tomeng

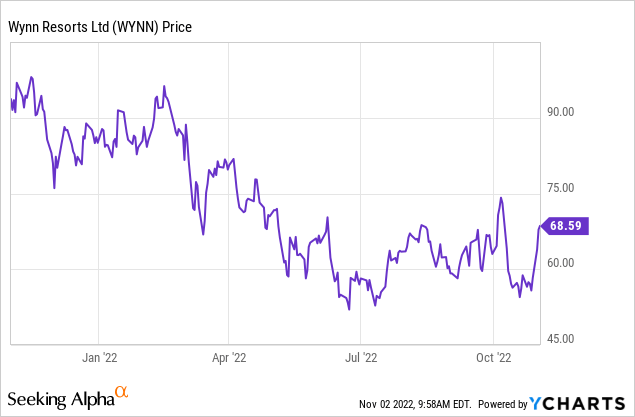

As we have long guided on SA, we believe the shares of Wynn Resorts Ltd. (NASDAQ:WYNN) have been vastly undervalued, just awaiting someone to discover that fact and act. The low valuation was of course, a consequence of the disastrous zero covid policies of China which has held recovery in Macau in check for nearly two years. It also sprang from the consensus of analyst reports that continued to use the same, pre-covid data points to value the shares.

That was understandable, but in the end, wrong. We have been living in an all bets are off world in the sector for nearly three years. Even before the pandemic, Wynn shares lost much of their allure to long-time fans of the stock when in 2018 founder Steve Wynn was ushered out the door due to allegations of sexual misconduct.

Since then, successor management, faced with a spate of crises, did make an effort to “de-Steve” the company. It quickly resolved core issues. The ongoing Macau lawsuit was settled. The Wynn name was removed from the Boston property. Beyond that we had stewardship, not the normal bold, often brilliant, strokes of imagination that investors had come to expect from the eponymous founder. But clearly there has been a missing ingredient here.

This also produced a late, but essentially lame entry into sports betting with WynnBet, still lingering on the lot, like a used car. To be fair, the late start was in part attributable to early hesitancy about online sports betting by Steve Wynn. Yet, it was also clear that had Wynn been at the helm, the entry, though late, might well have arrived with a far better shot at a strong market share than as a third tier fringe operator.

The powerful recovery in Las Vegas which continues into its 19 th straight money was among the view bright spots for the stock in terms of giving investors a glimmer of hope that the company could hang on through the worst in Macau. Overall though, the stock was hammered along with peers in Asia to the extent that its Vegas numbers only produced meh shrugs as far as the price of the shares indicated.

Mr. Market has also been worried about potential liquidity problems given its $12b in long term debt and continuing losses in Macau thinning its reserves. Yet the company now sits of $2b in cash (mrq) with a current ratio of 1.47-two indicators of reasonable liquidity. The company does not have a liquidity threat for at least a year assuming no change in China policy.

But longer term, it would face refinancing of maturities at a much higher price of money. That implies on the surface at least, that it won’t be in a position to begin reducing debt until Macau starts firing again. But for now, it should not be a factor in valuing the stock. Also Wynn has readily salable assets if push came to shove. Among them its successful Boston Encore property. It cost $2.6b to build. It could go to a REIT sale, or outright buy out which could yield proceeds that could be applied to much liquidation of debt.

Then there is the possibility of selling the Macau properties and Boston to massively reduce debt and expand in Las Vegas, where Fertitta apparently has a strong belief in a future there. (He has petitioned to build a mega property on the strip).

Along comes billionaire Tilman Fertitta now, buying 6.1% of the stock that he, as a visionary, gut level operator, has seen as being way undervalued, made his move. The fact that Wynn remains imprisoned with its peers in Macau did not stop what he clearly sees as the simple math of Wynn that showed $58 a share as a real value, sans Macau. And he acted, his move spiking the shares now inching its way to near $70.

Below: Tilman has shown tough love during the pandemic in hunkering down on the NBA team and restaurants but his net worth rose to near $5b.

At the same time it appears that Beijing may well be in the early stages of a steady as she goes re-opening of the country, province by province to the eVisa scheme and group travel. That news comes as a bonus. Within weeks, the original four provinces opened will be accepting arrivals to Macau again.

That will result in a significant rise in average daily footfall from a weak 20,000 to possibly double according to our sources there. The news flow from Macau could begin to look more positive. And that would show up quickly in the trading range for Wynn. But the hard truth of what possibly motivated Fertitta we believe, is a shot at taking over the company with a market cap of $7.7b-way below its value even if you count the replacement value of its properties in Vegas and Macau.

The big three: Ready to move

Fertitta’s 6.1% buy, added to the 8.9% held by Steve Wynn’s ex-Elaine, plus the 4.9% held by Asian gaming giant Galaxy Entertainment Group (HK007) brings their combined holding to ~20%. So the next question is this: Can Tilman buy Elaine’s shares at a sensible premium? We believe he can. At the very least, Elaine Wynn has considered herself far more than the boss’s wife over the decades while still married to Steve. Over time, her voice in management got a lot louder and was listened to as she was clearly a participant in the company’s growth. She may well decline an offer, but at the same time would want to stay involved and happily add her shares to Tilman’s to build a position to ignite the takeover.

Above: Tilman’s AC’s Golden Nugget. managing to hold share in tough market.

As to Galaxy: they bought in just after Steve left averaging at $180. It was a strategic entry for a company flush with cash (and still so) because of belief in the future of Macau pre-pandemic. Any reasonable offer that can shrink their presumed loss would seem attractive. But like Elaine, they could decide to throw in with Fertitta to create the 20% triumvirate as a starting point. After that a phone call to Uncle Carl Icahn for example would make a lot of sense to him. He has historically made so much money in gaming deals, that it is hard to see why he would not find joining the fun with a big buy as well.

Is Wynn in Play?

The playing field is now wide open. Sitting now at the sidelines are the likes of Las Vegas Sands (LVS) with a ton of cash. Lots of Vegas savvy complied over decades running the Venetian and a real contender who could line up an activist like Icahn to outbid many pretenders. Wynn is hot merchandise at the moment in our view. It is undervalued, its products are first rank, its prospects for some relief in Asia getting stronger. It is also a clear target for the likes of VICI Properties (VICI) or Gaming and Leisure (GLPI) to acquire the realty, thus providing a massive cash haul for Fertitta and/or a group of cohorts.

Whether the company is in play or whether Tilman moves fast to consolidate and increase his position by either buying more shares, or partnering with big holders is less important that the ultimate test of where the stock is and where it could be. That would happen if indeed we see a bidding war, or Tilman moves fast to accumulate and consolidate hoping to avoid a war.

A grasp on valuation

We have long expressed our opinion that Wynn shares have been woefully undervalued. But we also recognized the negative news flow out of Asia as the primary culprit for Mr. Market. So we did our own calculations and came up with a number that as it turns out, was close to estimates we found on alphaspread. Despite the dour news on earnings, heavy debt and overall chaos in Asia, they applied a valuation using three different criteria. The formulae, as all such constructs in these times, has its plusses and minuses, too long to mull in this limited space. However, we found that in all three constructs, alphaspread came up with valuations far higher than what the shares were trading for at the moment.

Intrinsic value: $95.56

Discounted cash flow value: $68.14. By this measure, the current spike has brought the shares to fully valued.

Relative value: $122.97

Current analyst PT: $83.73

Our PT: $97.50 assuming news flow out of Macau begins to look like gradual opening of more provinces continues.

The management bonus

As readers of this space know, I come at my guidance on gaming stocks from a management perspective. Having been on the inside of the c-suite for decades I think I have a grasp on evaluating management in terms of policies and operational skill sets I see filtered into their results. Some operators are simply better than others at running casinos. While they all use comprehensive analytics as the building blocks of decision making, there are some that are better than others at acting on their analytics by healthy dollops of operational know how. And yet there are still others who bring the always unique instincts of the entrepreneur to drive home superior performance.

In the case of Wynn as I noted, we have had several managements post Steve, which have provided stewardship through many difficult times. Yet most of the people, while efficient and responsible, have not exhibited the kind of creative drive for which that company has singly been noted for over the decades under founder Wynn. But he is gone and we can’t have management navel contemplating forever about “what would Steve do?” or “what wouldn’t Steve do?” or “who cares what Steve would do in these times?”

Inside we now have the possible prospect of an emerging situation that could bring Tilman Fertitta to the Chairman’s seat. He is a cat of a different stripe from those currently inhabiting the c-suite at Wynn. When he took a position in 2021 selling his online Golden Nugget site for $1.56b and also vowing not to dump DKNG shares, it appeared to me that an adult had entered the room to possible curtail some of the more dumb marketing moves by management.

But if Wynn is indeed in the crosshairs and does become a Tilman holding, his influence at the board level would be a big plus for the company. He is very much an independent, idea thinker who knows how to move the pieces around the corporate chessboard to result in a checkmate victory for himself and his associates.

He for now, we think one can still be a buyer of Wynn as it is in the early stages of a run based on the Fertitta move.

If you hold, it makes sense of accumulate and price average. If you don’t being in the stock between now at say $75 has BUY written all over it. If we are wrong and the stock does settle in not much above where it sits now, the downside risk we see is small relative to an upside, which alone may trigger more upside, if China appears to begin opening.

Be the first to comment