mgstudyo

A few months ago, I wrote an initial cautious article on the Reaves Utility Income Fund (NYSE:UTG), arguing for caution as rising interest rates are a headwind for utilities.

Since my article, the UTG fund fell by over 20% at the October lows. In recent weeks, the UTG fund has recovered a little more than halfway to $29 / share. Has my thesis changed on UTG?

If long-term interest rates have indeed peaked, as markets are currently pricing in, then UTG’s relative underperformance to the Utilities Select Sector SPDR ETF (XLU) may have ended. However, I remain cautious on UTG’s absolute return outlook given high sector valuations.

Brief Fund Overview

First, a brief overview of UTG for those that are not familiar. UTG is a close-end fund (“CEF”) that primarily invests in equities and bonds of companies in the Utilities sector. The fund also uses ~20% leverage to enhance returns.

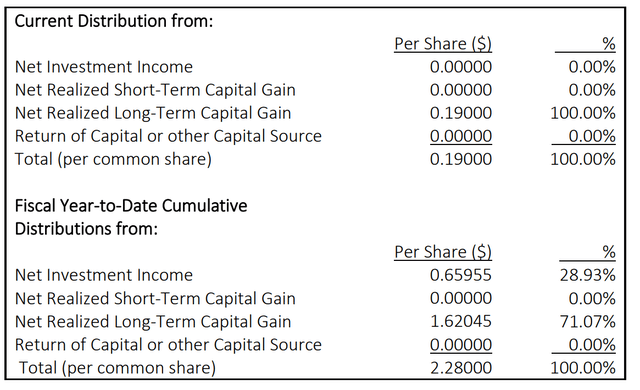

The main attraction of the UTG fund is its high distribution yield, currently set at $0.19 / month for a 7.9% current yield. The distribution is funded by a combination of investment income and capital gains (Figure 1).

Figure 1 – 71% of UTG’s YTD distribution has been funded from capital gains (UTG section 19.a report)

In the last few years, UTG’s average annual total returns have not been sufficient to cover the monthly distribution (3Yr average annual total returns of -4.0% to September 30, 2022), so it’s NAV has declined, i.e. investors were paid back their own capital in the form of distributions (Figure 2).

Figure 2 – UTG’s NAV has declined from poor investment returns and distributions (cefconect.com)

For a thorough overview of the fund, readers are encouraged to take a look at my prior article.

Rising Interest Rates Was A Headwind To UTG

Recall in my prior article, I warned that rising interest rates would be a headwind for utilities:

Utilities, as long duration assets, typically react negatively to rising interest rates. As UTG also employs modest amounts of leverage from a floating rate credit facility (OBFR+0.8%), the fund is therefore negatively impacted by rising interest rates on both its assets and liabilities. In fact, this could be the reason why UTG performed poorly in 2021 as interest rates came off their lows.

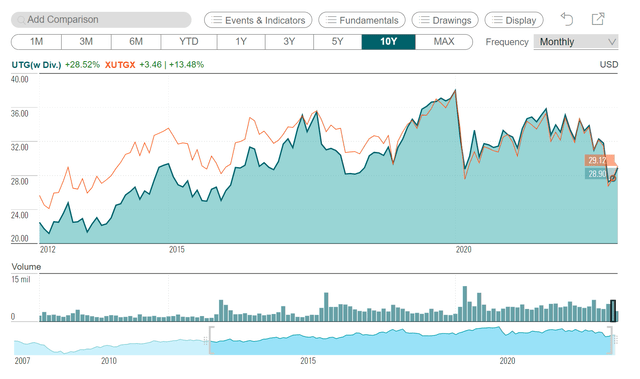

Sure enough, as the Federal Reserve continued increasing short-term interest rates by 75 bps at the September FOMC meeting, long-duration assets like the UTG fund experienced a sharp decline to mid-October (Figure 3).

Figure 3 – UTG declined by over 20% as the Fed increased interest rates (Seeking Alpha)

Rate Curve Now Expecting A Recession

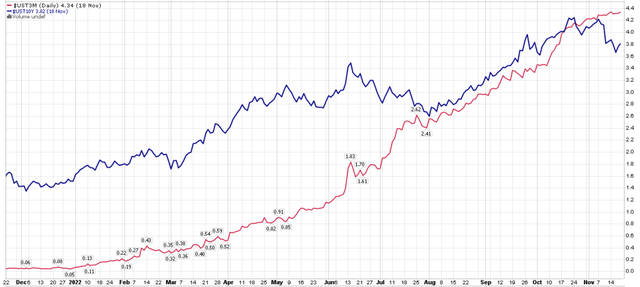

While the Fed is expected to continue raising short-term interest rates in the next few FOMC meetings, long-term interest rate expectations have actually started to come down, as investors begin to price in a pause in rate hikes and a potential recession in 2023.

Since mid-October, long-term interest rates as represented by 10Yr treasury yields have declined by over 40 bps from 4.25% to 3.80%, while short-term interest rates represented by 3M treasury yields have continued to increase, rising from 4.09% to 4.34% (Figure 4).

Figure 4 – Long-term yields decline while short-term and short-term yields diverging (Author created with price charts from stockcharts.com)

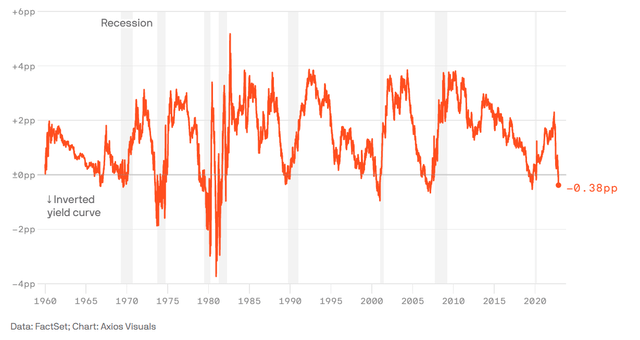

The inversion of the 3M-10Yr yield curve is now at the widest level in years. Historically, an inversion of this magnitude has been a strong predictor of recessions (Figure 5).

Figure 5 – Yield curve now inverted, signalling potential recession (Axios)

Decline In 10Yr Yield Improves UTG’s Relative Outlook

With declines in long-term interest rates, the relative outlook for defensive long-duration assets like utilities and the UTG fund improves.

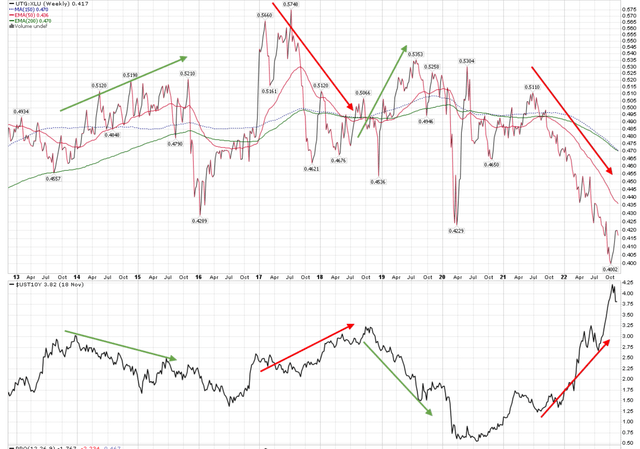

Recall in my prior article, I overlaid a chart of the UTG/XLU total return ratio vs. the US 10 Yr treasury yield, showing that UTG underperforms XLU in rising long-term interest rate environments. We are now seeing early signs that this underperformance has reached an inflection point (Figure 6).

Figure 6 – Early signs that UTG’s underperformance to XLU has ended (Author created with price chart from stockcharts.com)

However, UTG will need to maintain its relative outperformance on any upcoming market pullbacks, to confirm this inflection. It is also important that 10 Yr treasury yields do not resume rising, as that has been the key driver for UTG’s underperformance.

A changing relative performance profile means that defensive-minded investors should own UTG over XLU, all else equal.

Unfortunately Utility Valuations Still Expensive

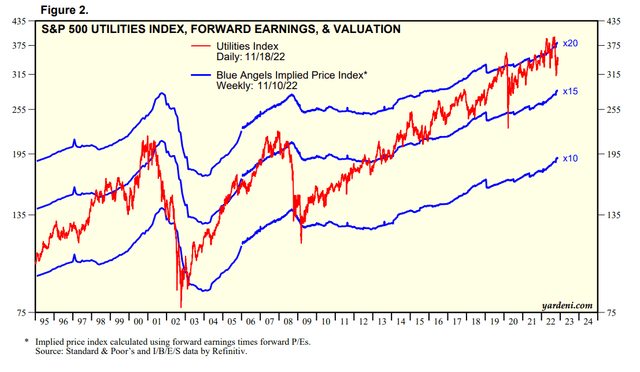

Another reason I have been cautious on utilities and funds like UTG have been sector valuations which were trading at multi-year highs. With the sharp pullback in recent months, utility sector valuations have improved a bit, now trading at ~18x Fwd P/E from over 20x previously (Figure 7). However, they are still not yet at attractive levels.

Figure 7 – Utility sector valuations (yardeni.com)

Conclusion

While I remain cautious on UTG’s absolute returns given high sector valuations, I believe we are beginning to see early signs that UTG’s relative underperformance to XLU has ended, if long-term interest rates have peaked.

Be the first to comment