Adam Bettcher/Getty Images Entertainment

Build-A-Bear Workshop (NYSE:BBW) is a global retailer of customizable stuffed toys. It was founded in 1997 and operates as a small mall-based specialty retailer. Its total managed retail stores grew exponentially and in 2019, reached its peak at 373. However, over time, we’ve seen a continuous decline in this figure and the company is currently managing a total number of 345 stores globally.

However, it shows strength in its improving brand recognition and successfully translates it to its growing top line, amounting to $437.5 million, the highest revenue figure since 2013. On top of its growing top line, BBW is getting attractive with its highest record operating margin of 12.65%.

In my opinion, the risk from an aging America and a slowing children’s population forecast seems contained as the company is strategically positioned to cater to the changing consumer demographic, where adults and teens are now more knowledgeable about how stuffed toys help with mental health.

BBW is currently down from this year’s high of $23.5 and is approaching its significant support around $13. I believe it is trading cheaply and provides investors with meaningful upside in today’s bearish market.

Company Overview

BBW’s growing top line is a fruit of its diversification and its investment in digitalization, which positioned the company well in the growing global stuffed animal plush toy market. According to the management, their e-commerce operation outpaced their 2017 performance. This is thanks to its effective and efficient marketing strategy, as quoted below.

Impressions from our paid digital media initiatives are up over 20% compared to the prior year and we believe this is contributing to higher net retail sales in both brick-and-mortar and digital channels. We also believe our efficient and primary digital marketing activities are driving traffic to our stores and to our website. We saw a significant increase in store footfall compared to the prior year’s quarter, which outpaced national trends and fueled our net retail sales while also advancing digital commerce to record setting levels. Source: Q1 2022 Earnings Call Transcript

BBW is reaching more audiences in social media and is currently hungry for more as it seeks innovative ways to improve its digital capabilities.

We have engaged with Deloitte Digital to guide and elevate this process. Deloitte Digital is one of the leading agencies specializing and merging strategy, experience, and technology to drive digital growth and innovation. And we expect to enhance our analytical capabilities to further refine our digital campaigns and targeted personalized messages to our 14 million opted-in first party data contacts. As part of these efforts, we remain on track to launch the new loyalty module as the next step in our multi-faceted sales force implementation plan before the end of the year. Source: Q1 2022 Earnings Call Transcript

This resulted in a stronger brand presence and more followers than its private company peers. Another interesting catalyst is its partnerships with leading brands, as shown in the image below, which, in my opinion, helps the company target more customers and improve its consumer demographics.

BBW: Strong Partnership With Leading Brands (Source: 2022 ICR Conference Presentation)

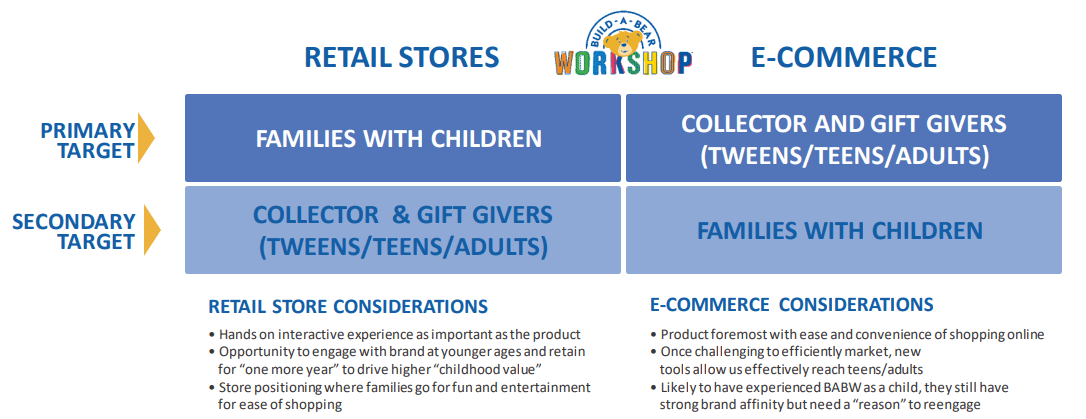

While BBW’s e-commerce operation targets more teens and older people, the management didn’t fail to update its investors about their retail operation where families can bond.

BBW: Strong Product Diversification (Source: 2022 ICR Conference Presentation)

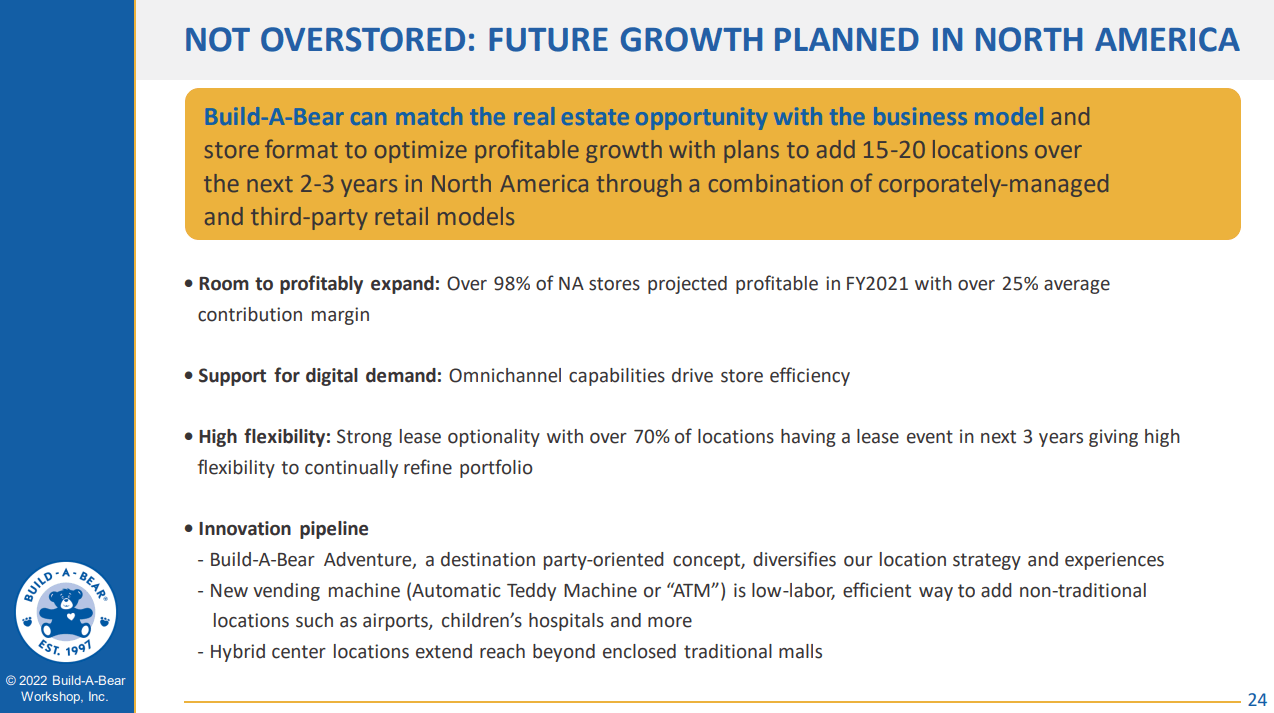

This FY2022 will solidify its sustainable top line growth as the company continues to have plans in its core business, which is its retail operation. According to the management, they are planning to open more stores in the North American region, which contributed 87.7% of its total revenue in Q1 2022.

More to Like About BBW’s Operation: Growing Margin and Strong Innovation Pipeline

BBW: Improving Stores Count Outlook (Source: 2022 ICR Conference Presentation)

On top of this improving store count, another value adding catalyst to mention is its current outlook for 98% of its stores located in the North American region to generate over 25% contribution margin. This outlook may help the company to expand its trailing operating margin of 12.65%, which has been its highest over the past 10 years.

Additionally, BBW has a solid innovation pipeline to consider where the management expects to have at least 10 out of 20-25 target Build-A-Bear vending machines (ATM) operating this year, which is half the amount to be put in airports. The company is also leveraging the continued recovery from the pandemic with its new store concept called Build-A-Bear Adventure, making it more attractive during the summer months.

On top Of Its Growing Store Count Catalyst

After dealing with the risks of the pandemic, BBW’s Q1 2022 exhibited a robust buyback activity, with its $8.1 million share repurchase as of April 2022, bringing a total $14.1 million utilized out of $25 million shares authorization. This leaves the company of roughly $10.9 million remaining shares authorization in place.

Cheap BBW

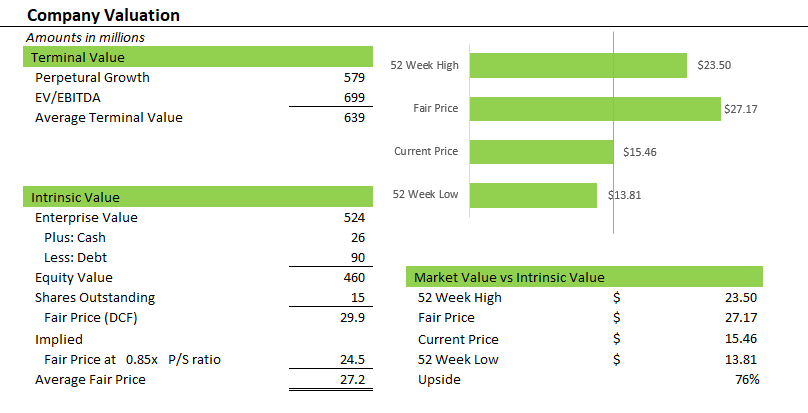

BBW: Company Valuation (Source: Prepared by InvestOhTrader)

Build-A-Bear Workshop is cheaply trading below my average fair price target. I used the discounted cash flow model and simple relative valuation to arrive at the said figure. At a conservative growth assumption and implied PS of 0.85x, I believe BBW should trade near $27.

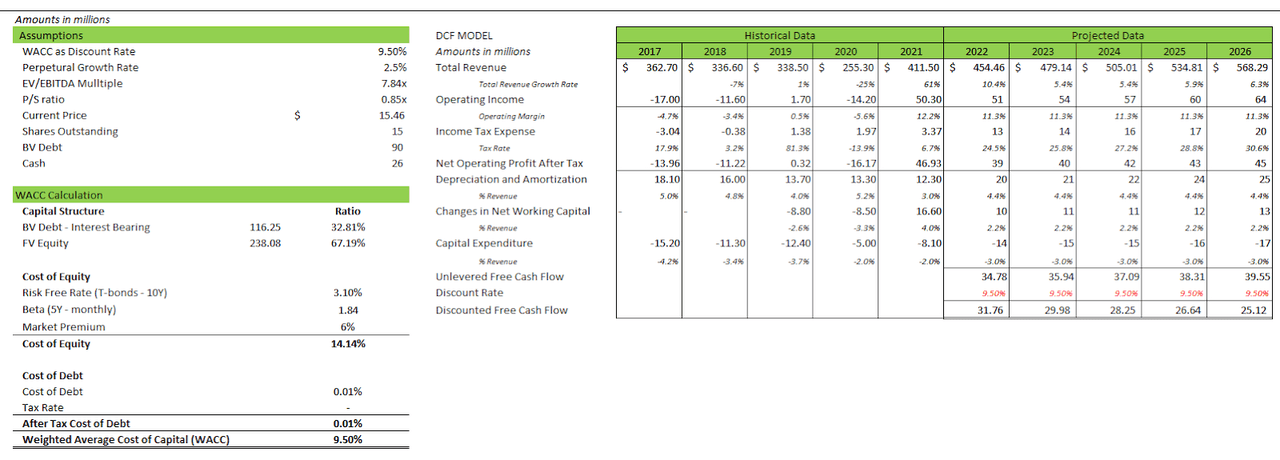

BBW: DCF Model (Source: Data from Seeking Alpha and Yahoo! Finance)

I used the analysts’ estimate to arrive at my FY2022 and FY2023 figure and then projected at a conservative growth as shown in the image above. I used a conservative 11.3% below last year’s operating margin, as the company faces inflated operating cost due to rising inflation. I believe this figure is still conservative, considering its outlook for pretax earnings to be around $52-$62 million in FY2022, up from $50.7 million recorded in FY2021. This is especially true with its target to reduce its current inventory level below its FY2021, which composed 26.96% of its total asset.

Risk Note

Aside from America’s aging population, one important risk for BBW is its enormous inventory accumulation. Currently, its total inventory represents 30.17% of its total assets of $256.4 million, which is vulnerable to impairment losses. This may result in a bottom line disruption in light of the slowing global economy.

Another Push?

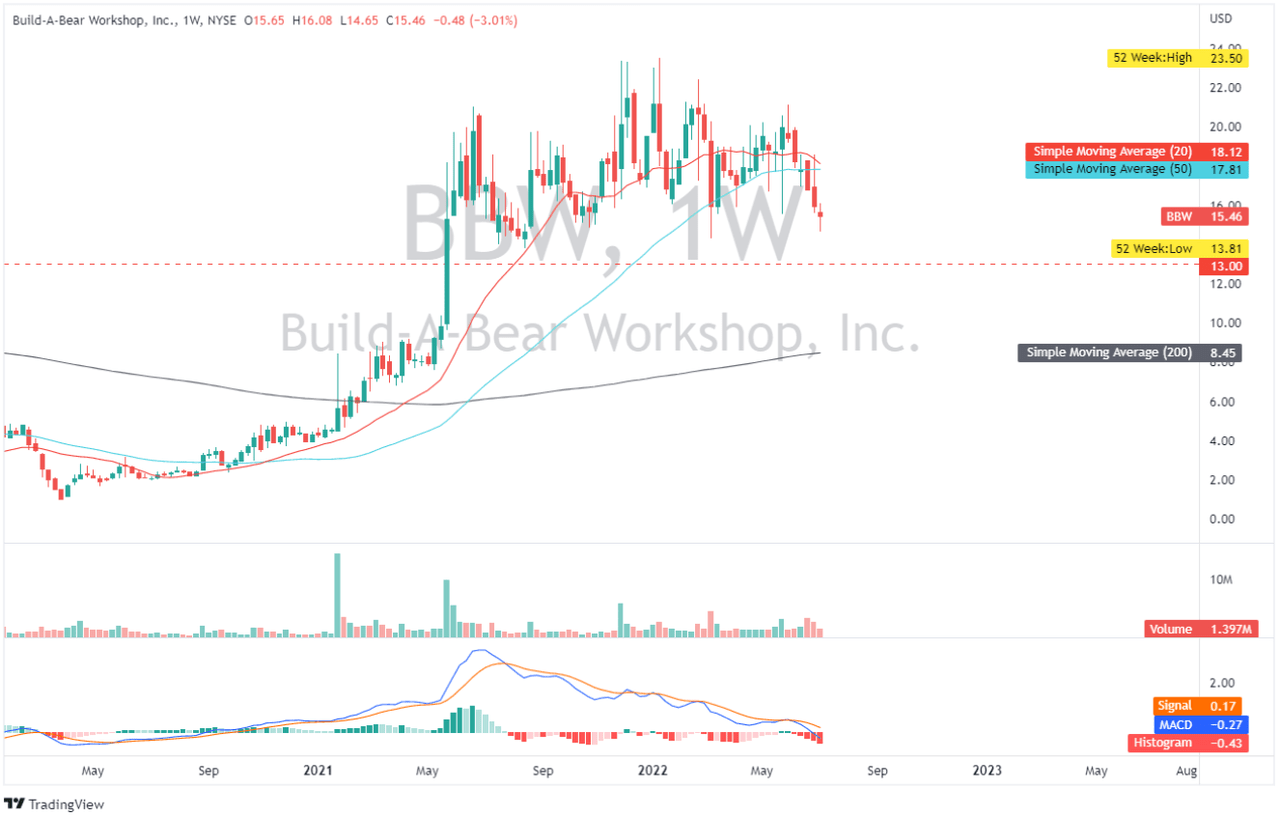

BBW: Weekly Chart (Source: TradingView.com)

Build-A-Bear Workshop recently broke its 20- and 50- day simple moving averages, as shown in the image above, indicating short term bearish price action. It is currently trading above its multi month support of $14 and if this level breaks, I believe $13 is the next strong support to monitor. Its MACD indicator is presently below zero, indicating bearish sentiment, but an improvement of this and a consolidation above $13 may assist in drawing bullish attention.

Final Key Takeaways

The recent abortion ruling in the US, which makes abortion illegal at the discretion of the states may be another value-adding catalyst for BBW. This decision, although quite revolting in my opinion, may help to ease pressure from America’s aging population, as it would reduce the number of abortions and therefore increase the number of people who are born. Financially speaking, BBW may benefit from this potential growth in the child population, which may support its growing top line.

BBW remains liquid at its improving current ratio of 1.43x, above its five-year average of 1.39x, with no long-term debt on its balance sheet and a declining lease obligation of $90.1 million.

The company remains attractive with its sustainable top line and growing EBITDA outlook. BBW possesses a considerable risk, but remains liquid and has strong buyback activities, making it a stock to buy in today’s bearish environment.

Thank you for reading and good luck!

Be the first to comment