brightstars

Introduction

Over the past few months, I’ve increasingly focused on articles covering more than one stock. The benefit is that it makes it easier to cover multiple companies while also incorporating my view on cyclical macro or secular trends. In this article, we will discuss two dividend stocks that should do very well when (or if) the gold price takes its longer-term uptrend to the next level. This means we’ll discuss reasons why gold may take off and what stocks I’m looking at to benefit from that on a long-term basis. In this case, the focus will be on both income and capital gains, as I believe that investments in miners need to be rewarded with steady (and high) cash flows. We’ll also talk about risks and the reason why I don’t have a single gold miner in my dividend portfolio. At least until now.

So, let’s dive into it!

Yuck! Miners Can Be Terrible Investments. Unless…

Generally speaking, I’m not a fan of mining stocks. By buying mining stocks, I’m breaking a lot of rules that I apply when buying dividend stocks. Mining stocks are volatile, prone to commodity prices, and exposed to above-average geopolitical risks (i.e., mining locations). Moreover, margins are often highly impacted by volatile operating expenses.

Usually, I like low-volatility investments with steadily growing income, dividends, and stock prices.

Mining stocks are different. Very different.

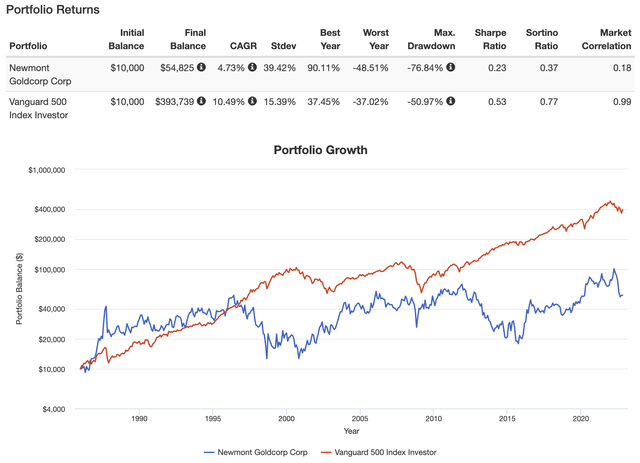

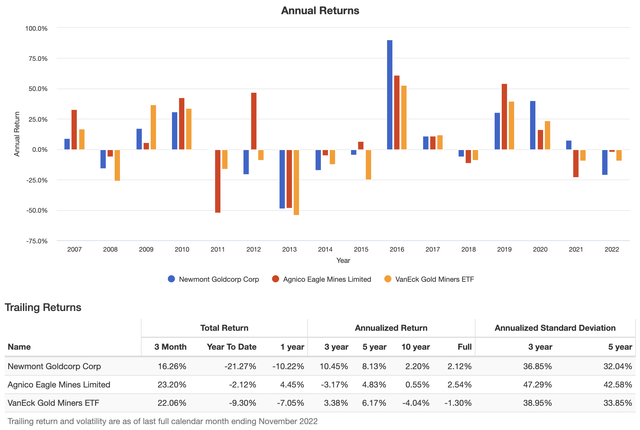

For example, shares of Newmont Corporation (NEM), the world’s largest gold miner, have returned just 4.7% per year since 1986. That’s a poor performance. The standard deviation during this period was 39.4%, which gives the stock an abysmal Sharpe ratio of 0.23 (volatility-adjusted return). In this case, I went with NEM because of its size and the fact that its long stock price history incorporates multiple gold price cycles. Using a mining ETF would usually be more appropriate to judge the performance of an entire sector.

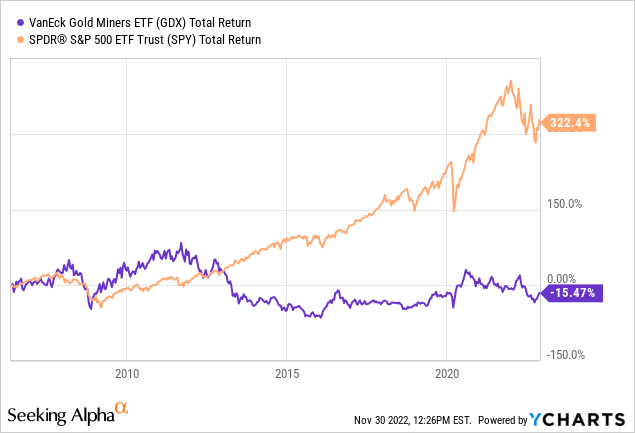

Speaking of ETFs, the VanEck Gold Miners ETF (GDX) hasn’t made its investors a single penny since its inception.

Going back to NEM, the performance of NEM includes the massive rally in gold after the Dotcom crash. NEM outperformed the S&P 500 by a huge margin. Unfortunately, the bigger picture includes periods of weakening gold prices, operating cost headwinds, and other issues that make the long-term average performance so poor.

Hence, two things matter more than anything: timing and a rock-solid bull case.

Or three things, as I believe that cash flow from mining investment is extremely important. After all, it’s a sign that a mining company does well.

Also, I believe a decent yield is important when buying volatile miners.

But first, let’s discuss the bull case.

Why I’m Starting To Like Gold (Miners)

The other day, I wrote an article discussing what I believe could be a huge bull case for gold.

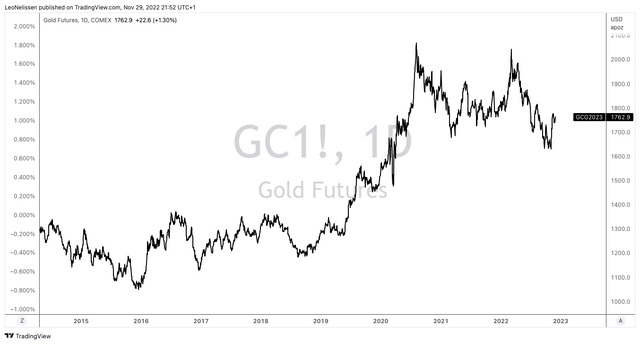

I believe that the biggest bull case for gold is a (forced) Fed policy pivot. A situation where the market expects the drainage of dollar liquidity to stop – or even reverse. After all, that’s what did a number on gold this year.

For the first time in the current cycle, market participants are starting to position themselves for a less hawkish Fed (that’s still far from dovish).

As I wrote in my prior gold article:

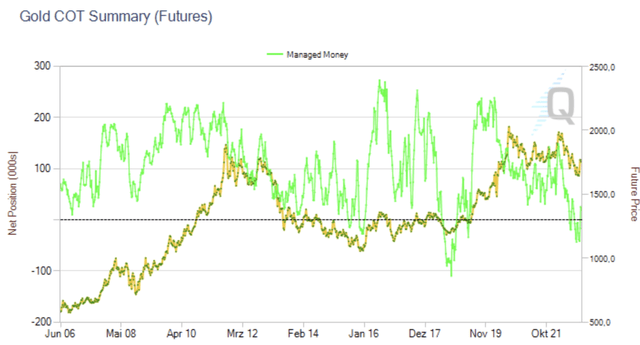

Even though this transition is very slow, investors are starting to go back into gold. In the past few weeks, money managers started to buy gold again after being net short this Fall. That was the third time since the Great Financial Crisis that smart money was net short gold.

As the chart above shows, a return of buyers could cause a steep increase in gold prices.

That may sound easier than it is. After all, buyers need a reason to return. If they don’t get a good reason, gold will just remain a shiny rock valued at less than $2,000 per ounce.

As I wrote in my prior article, the bull case is a fight between a (more than expected) hawkish Fed versus a (more than expected dovish Fed. The moment the market expects the Fed to drain dollars from the system at a slower pace, gold is likely at a bottom.

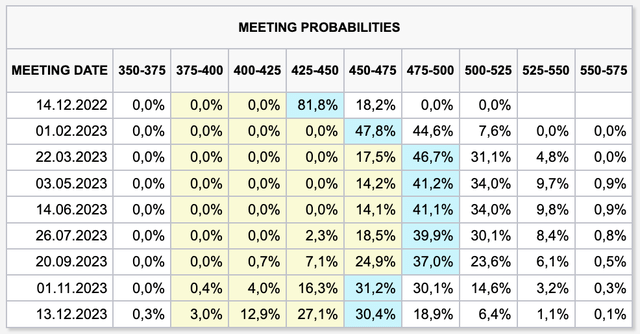

The market has currently priced in a terminal rate range of 500 to 550 basis points. This implies another 100 basis points worth of hikes until the end of the first quarter of 2023.

While I do not believe that the Fed is as dovish as the market believes, we’re certainly closer to the end of the hiking cycle than the start of it. One reason is the pressure on financial stability. At some point, the Fed will have to prioritize financial stability over fighting inflation.

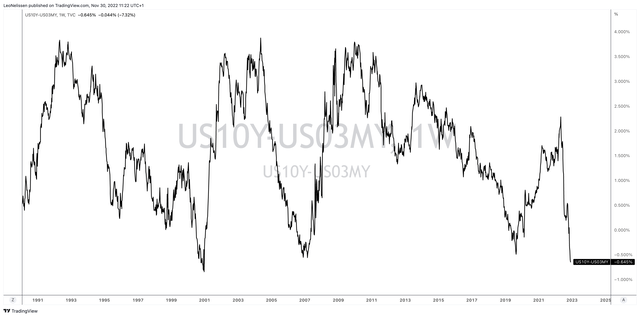

The Fed’s favorite recession indicator, the spread between the 10Y and the 3M government bond yields is now at negative 64 basis points. That’s the most inverted it has been since 2001.

TradingView (10Y/3M Yield Curve)

Before I started writing this, Powell came out dovish in a speech at the Brookings Institution in Washington.

As reported by Bloomberg:

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in the text of his speech. “Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

However, he also said that the path ahead for inflation remains highly uncertain. The Fed suddenly becoming dovish isn’t a done deal. That’s why I believe the gold uptrend won’t be a painless nonstop uptrend. It’s also the reason why gold isn’t at an all-time high yet. If the Fed becoming dovish was such a no-brainer trade among bigger funds, gold would be much higher.

Hence, there’s upside potential and I do like the risk/reward.

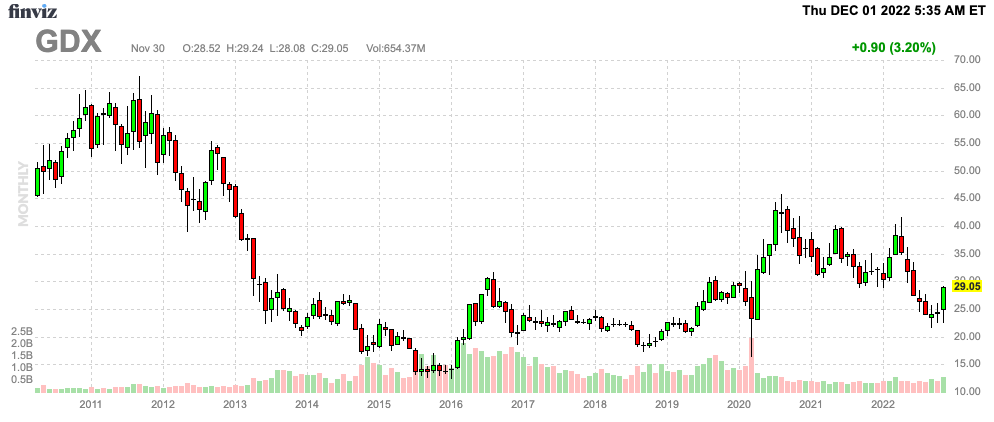

Now, gold miners are starting to gain upside momentum. The Gold Mining ETF (GDX) is likely to continue the uptrend it started in 4Q22 to new multi-year highs in 2023.

FINVIZ

With that said, I believe two specific gold mining stocks will do quite well in the scenario outlined in this article.

Golden Dividends With Two Solid Players

There are so many ways to play gold miners. Investors can buy gold streamers with steady, less cyclical yields, small gold miners that may or may not pay a huge dividend in the future, or companies with excellent operations, and an already high yield.

I went with the last category for several reasons. One of them is to reduce uncertainty. I want companies with a proven track record. Companies that can pay a high dividend as we speak.

That’s where these two beauties come in:

- Agnico Eagle Mines Limited (AEM)

- Newmont Corporation

Agnico Eagle Mines Limited – 3.2% Yield

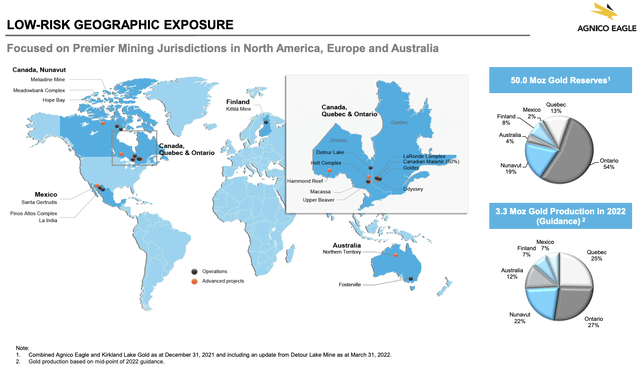

The first company may be my favorite long-term gold miner in general. Headquartered in Toronto, Canada, this gold miner with a $23.1 billion market cap combines high-quality assets with low geographic risks.

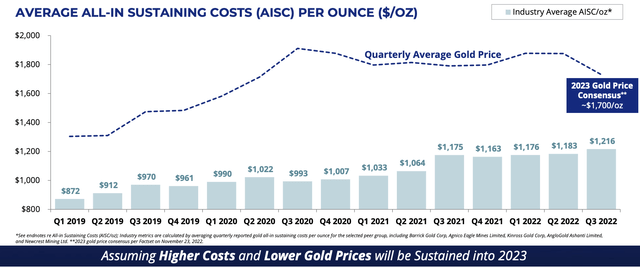

The company has very high margins as AISC (all-in-sustaining costs) is at just $1,106. This makes AEM one of the most efficient gold miners in the world.

Moreover, the company has a very strong BBB+-rated balance sheet with $2.0 billion in available liquidity and less than $300 million in debt maturities until 2026.

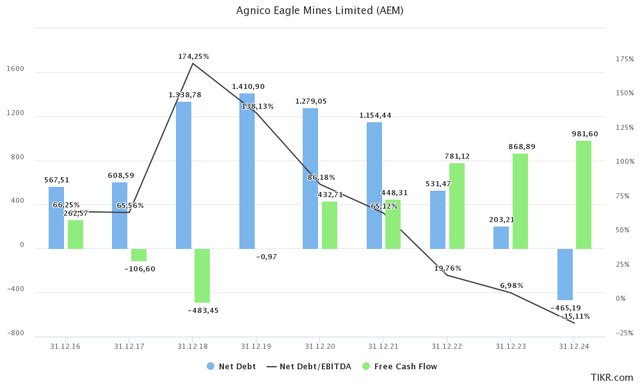

Its net debt ratio is expected to drop to a mere 0.07x EBITDA in 2023. After that, net debt might turn negative as the free cash flow generation is very high. Next year (and under current circumstances), AEM is in a good spot to do close to $900 million in FCF.

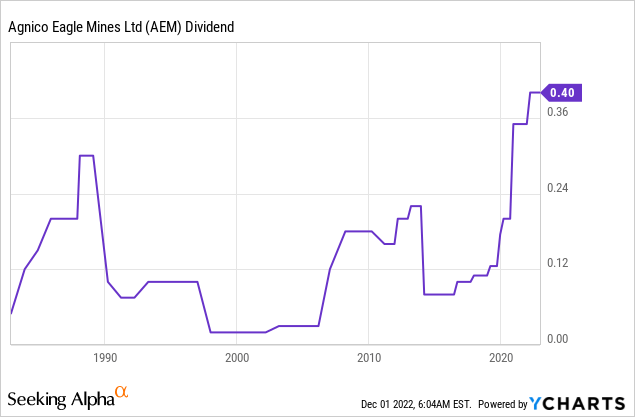

The company has 38 years of consecutive dividend payments.

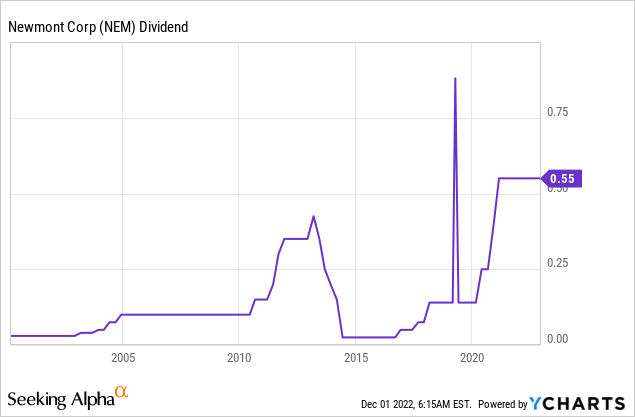

As the chart below shows, the dividend is highly dependent on the price of gold. If gold goes up, the dividend will likely follow. Currently, the dividend is $0.40 per share per quarter. That’s a yield of 3.2%.

The current dividend payout ratio of roughly 70% is high. Yet, that makes sense as dividends move with the price of gold. If my bull case is correct, a higher gold price will free up much more cash to boost the dividend.

Before I show you other benefits that come with holding AEM, let’s look at the second stock.

Newmont Corporation – 4.6% Yield

Newmont is larger. With a market cap of $37.7 billion, Newmont is the largest gold miner in the world. Headquartered in Denver, Colorado, the company is also the highest-yielding gold miner with a current yield of 4.6%.

Newmont has an annual gold production target of roughly six million ounces of gold. This includes managed and non-managed operations. The FY2022 AISC is also quite low at $1,150, freeing up a lot of cash for other purposes like financial stability, investments, and dividends. On a side note, that’s exactly the hierarchy of the company’s capital priorities.

With that said, the company is an S&P 500 member, it has close to 100 million ounces of gold reserves, and 12 global operations in eight countries. It has no debt maturities until 2029 and close to $7 billion in liquidity.

Hence, the company remains in a good spot to reward investors – in light of its dividend framework.

According to the company (on November 1, 2022):

With $6.7 billion in total liquidity, we have maintained an investment-grade balance sheet with the financial flexibility to balance steady investment into our most profitable growth projects with strong shareholder returns. Last week, we declared a third quarter dividend of $0.55, set within our established dividend framework, which is calibrated at an $1,800 gold price. This dividend demonstrates our confidence in our diverse global portfolio and our commitment to providing leading returns to shareholders.

The company remains committed to a dividend framework, which will continue to consist of a base and a variable component, depending on costs and gold prices.

So for argument sake, if we went to a reserve price of $1,300, then we would continue to move in $300 increments to $1,600 and $1,900 and then determine our payout at those levels. So you’re going to see a framework that looks very similar to the one that we’re operating under today.

Another Benefit & A Word Of Caution

At the start of this article, I highlighted the poor long-term performance of miners. While that is still true, both NEM and AEM consistently outperform the GDX ETF, meaning we can make the case that the fundamental qualities these stocks bring to the table end up in longer-term alpha.

But, needless to say, please be aware of the risks that come with investments in gold miners.

Gold mining dividends aren’t a must-have, but I believe the risk/reward is good. Especially if we continue to be stuck in a prolonged period of interest rate hikes and cuts, as we saw in the 1980s.

Takeaway

I have to admit that this is somewhat of an unusual article. I usually cover dividend stocks that are great throughout multiple cycles.

Gold miners are different. They are volatile and prone to steep declines and rallies, depending on macro factors like rate expectations, liquidity, and related.

Right now, I believe that we’re in the early innings of a long-term bull market for gold companies. The Fed is close to a point where it needs to prioritize financial stability over fighting inflation. Economic growth is deteriorating rapidly, giving Powell reasons to become (more) dovish.

While I do believe that it will be a bumpy ride for gold, I see a great risk/reward for a long-term uptrend.

Newmont and Agnico Eagle Mines offer investors high-quality gold exposure thanks to top-tier operations, high margins, and a focus on shareholder distributions (dividends).

I rate both stocks a buy and expect both outperforming capital gains and longer-term dividend hikes.

(Dis)agree? Let me know in the comments!

Be the first to comment