Ethan Miller

Many of us would have watched a show or two, or even try to execute some of the dangerous moves on our siblings when we were young. From the pioneering generation of wrestlers in WWE, Hulk Hogan and Stone Cold Steve Austin to some of the longest-tenured wrestlers, Kane and The Undertaker, the wrestling scene has been graced by many big names that adults and teenagers would be familiar with. Unbeknownst to young kids, the integrated media and entertainment company, World Wrestling Entertainment, Inc. (NYSE:WWE) has been a widely successful corporation in these few years. The most shocking revelation is that this stock has completely crushed the markets after recording a 26% return while the three major US indices tanked by 16-24% YTD. With that, we can safely say that most large-cap stocks have fallen even more than that percentage. We think that this medium-cap stock of $5 billion in market capitalization will continue to perform in a bearish market as it continues to effectively execute its strategy through its live events and increase the monetization of its consumer products.

Company Analysis

WWE engages in the sports entertainment industry on a global scale. Its origins could be traced back to the McMahon family as early as the 1950s, but it was the younger McMahon (Vincent K. McMahon) that bought out the company from his father (Vincent J. McMahon) before taking the company public in 1999, valuing the enterprise at $172.5 million.

However, the younger McMahon’s forty-year reign would finally end in a series of scandals involving nondisclosure agreements signed by many women in the company as a result of misconduct by McMahon. As a result, the Board decided to promote Stephanie McMahon, daughter of Vincent K. McMahon, to Chairwoman and Co-CEO after her father was forced to retire from all positions in 2022.

Nevertheless, the company was on the path to success after restructuring its brand with two separate rosters, Raw and SmackDown! after its initial public offering. Since then, both programs developed their own unique rosters, announcers, ring sets/ropes, and championships on Monday and Friday nights respectively. More recently in 2019, WWE has also increased its emphasis on newer talents, promoting NXT as its third primary developmental brand that features newer WWE wrestlers on Tuesday nights. This would provide an opportunity for them to perform before being promoted to the main roster. In 2021, the company launched the “Next in Line” program that seeks to recruit and develop potential Superstars by providing a fast track for collegiate athletics into WWE full-time. This completes the pipeline for WWE to continuously grow its talents and brand while providing collaborative partnerships with college athletes from diverse athletic backgrounds. As of 2022, WWE is into its second class of “Next in Line” and has signed a total of thirty-one full-time college athletes. Twenty-five of the athletes remain active after the graduation of six inaugural members, which could see them debut on NXT or the two main rosters soon.

Industry Analysis

Despite the rise of MMA and other forms of combat sports in this decade, wrestling still has not lost its shine. A combination of lackluster storylines and a secular shift away from TV programming resulted in the decline of interest in WWE.

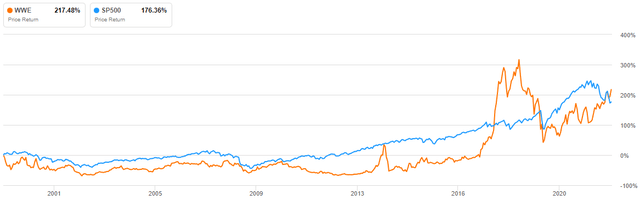

WWE v SP500 Performance Comparison (Seeking Alpha)

Indeed, this has been consistently reflected in its stock price for almost one and a half decades, as WWE’s stock price went nowhere and diverged from the performance of the US economy.

However, with the digitalization of many businesses these few years, WWE is one of the few that strategically shifted its business from a traditional pay-per-view TV and live event business model to on-demand live streaming of events and wrestling-related content on internet platforms. As such, WWE has significantly benefited as seen from the drastic price appreciation of the stock as it continues to attract a diverse audience that spans across generations.

Currently, WWE has 18.6 million followers on TikTok, larger than any official sports leagues or combat sports promotional companies (NBA, NFL, MLB or UFC, One Championship, Bellator MMA, Rizin Fight Federation). This proves that WWE is still widely popular amongst the younger generation, who are the majority of the users of online social media platforms. And this seems to be the direction of the WWE management after the former Chairman decided to shift WWE’s content from TV-14 to TV-PG in 2008, which was subsequently doubled down by his son-in-law, Paul “Triple H” Levesque. With him being the current Chief Content Officer and his wife, the Chairwoman and co-CEO, we should expect the continuation of such family-oriented programs that caters to a wider audience.

Such a move has its benefits; less grotesque scenes, lesser profanities, reduced violence (such as chair shots to the head), and even eliminating the sexualization of female wrestlers. This benefits a wider movement of progressive and inclusive society while keeping the gist of the entertainment business alive.

Fans looking to enjoy more realistic and mature violent content have gravitated towards rising names like UFC and One Championship, companies that promote mixed-martial arts (MMA), throughout the years.

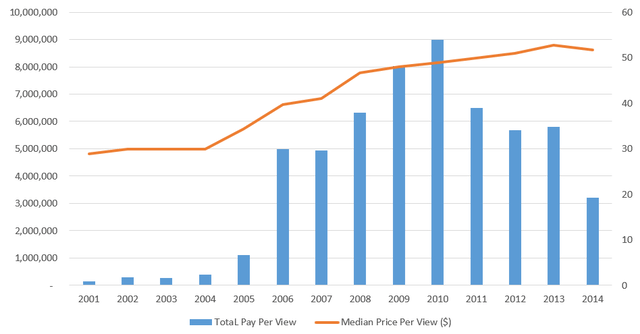

UFC Historical Pay Per Views (MMAHive, Statista)

From UFC’s historical data, we can clearly see that it has been gaining traction over the past decade, thus taking away market share for entertainment that involves an element of grievous body contact. Since it is a private company, there should be not much to worry about having WWE benchmarked to this fast-growing company with an almost parallel business model. However, the core of WWE’s business surprisingly remains largely unaffected in the same time frame.

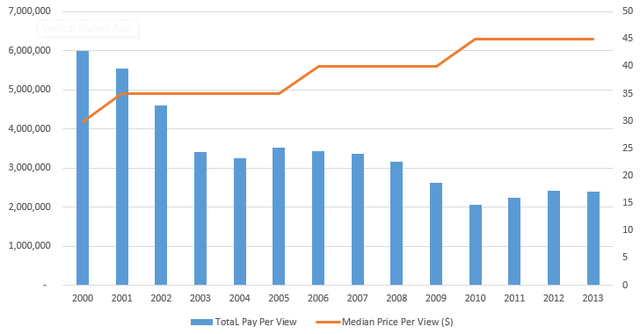

WWE Historical Pay Per Views (Wrestlenomics)

Since its public offering, WWE has been able to keep its total revenue generated from pay-per-views consistently high by raising the prices of its fight package, despite declining purchases. Thus, this proves that the wrestling business has remained strong historically despite a divergence in its stock price against the markets.

Investment Theses

Global Expansion of the WWE Brand

When it comes to expansion, WWE’s brilliant execution should earn praise from investors looking into their strategy. In 2014, the company launched its direct-to-consumer network in the US, Canada, Asia Pacific, and selected European countries. In the following year, it expanded to the Middle East, parts of Africa and India, before launching in additional European and Asian countries in 2016. The shift from a traditional TV broadcasting pay-per-view to a completely new platform took less than two years, which is no mean feat for a public company like WWE.

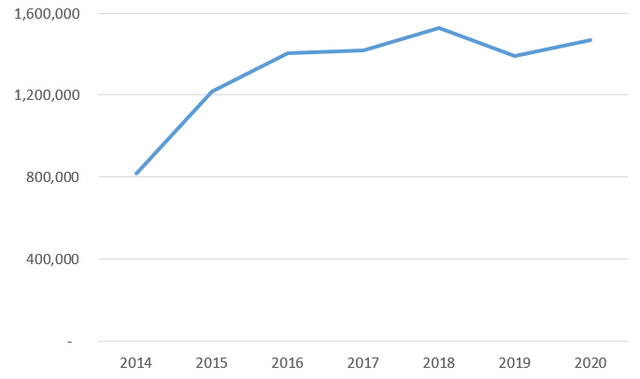

Total Number of Paid Subscriptions for WWE Network (Company’s Annual Report)

The data above show the growth in the total number of paid subscriptions for WWE Networks since its inception. As soon as the growth in subscriptions began to fall and turn negative, WWE decided to bring the wrestling scene to a wider audience by signing with Peacock a deal that would give the streaming platform exclusive rights for live WWE events and a library of wrestling content in the US. This move has been lauded by experts and we think that at the current price of a Peacock subscription ($4.99/month), it is a significant cost reduction compared to its direct-to-consumer streaming platform ($10/month) that helped the company transition away from the traditional pay per view. Considering at the time of its transition, WWE Networks had 1.1 million subscribers and since has seen a 42% increase in live viewership of WWE’s live events. This proves that the company’s shift away from competing for the market share in the streaming space is widely successful as the company could focus on doing what it is good at – creating more content for its huge fan base in WWE.

NXT UK Attendance by Events (WWE News, Profightdb, Wikipedia)

Outside of the US, the company also sought to develop its foothold in regions with huge growth potential. Starting with Europe, WWE brought the wrestling scene into the UK by leveraging its NXT branding. After revealing its first NXT event NXT TakeOver – London in the UK, WWE announced a 16-man tournament a year shortly after, looking to crown its first WWE United Kingdom Champion in 2017. The tournament returned for another year in 2018 before cementing its spot as WWE rebranded its UK division as NXT UK. Subsequently from 2018 to 2020, the company ran four of such tournaments, which were widely successful considering the attendance for those live events.

Even in regions like the Middle East and North Africa (MENA), WWE has outsourced its streaming to other influential parties, by partnering with MBC Group – the largest and leading group in the MENA region – to distribute its content in the region. MBC’s video-on-demand streaming service, Shahid, will provide unlimited access to all WWE premium live events, as well as WWE Network’s vast library of original programming and archived content. Additionally, a free-to-air television channel by WWE’s partner will broadcast highlights of Raw® and SmackDown® weekly and its magazine shows, Afterburn and Main Event. This brilliant move to leverage the region’s strongest broadcasting network widens the company’s outreach without having to invest in any additional infrastructure and technological capabilities, reducing operating costs.

We think that WWE would not aggressively expand into Asia, for the audience here derives more satisfaction from watching MMA, especially One Championship, UFC, and Rizin Fight Federation. Possible value creation would be expanding into Oceania and India, in which the latter has seen considerable success from WWE Live Tour India 2016 and WWE Live India Supershow 2017. The event in 2016 saw an attendance of 12,500+ in the Indira Gandhi Indoor Stadium which houses a maximum of 14,348 fans, while the event a year later at the same place saw a 70% attendance. In 2019, Triple H announced that WWE would eventually open a performance center in India, of which 80 wrestlers were shortlisted.

As such, we believe that WWE’s expansion plan would continue to incorporate elements of scouting and nurturing talents from all around the globe while partnering with industry giants in various geographic regions to distribute WWE’s content at the lowest cost to both the consumers and the company.

Increasing Monetization Across Business Segments

WWE generates revenue through these three segments: Media, Live Events, and Consumer Products. The Media segment involves generating revenue from the licensing of video content, advertising, and sponsorship across various platforms, including WWE Network, broadcast and pay television, and digital and social media. The Live Events segment involves the sale of tickets to WWE live events. In contrast, the Consumer Products segment includes the merchandising of WWE branded products (video games, toys, apparel, NFTs, and books) through licensing arrangements, direct-to-consumer sales at WWE venues, and e-commerce platforms. In our previous thesis, we barely scratched the surface of its first business segment.

Broadcasting Partners for WWE Core Content (Company Announcements)

On top of its flagship direct-to-consumer WWE Networks and partnership with Peacock, WWE has also sought to tap into its partnership with strong broadcasting and streaming services around the world for a wider audience for live streaming of its live events, documentaries, and series related to wrestling. The list is set to grow even further in 2022 as WWE continues to announce more partnership deals such as with Foxtel Group in Australia, giving the company access to 4.5 million of Foxtel’s subscribers access to unlimited WWE content. We believe that as WWE continues to commit to multi-year agreements and arrange more partnerships in different countries, its core content rights fees will increase, translating to higher revenues for the media segment.

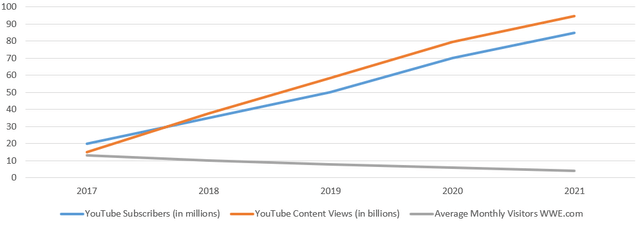

WWE’s Ad Revenue Performance (Company’s Annual Report, Seventeen)

On social media platforms, WWE continues to effectively monetize its outreach on YouTube and Facebook based on the audience viewership of its short-form content, almost reaching the elusive 100 million subscriber mark as of writing this article (91.3 million). Such strong growth rates are likely to continue to benefit the advertisement revenue for WWE from these social media platforms, despite the fall in average monthly unique visitors to WWE.com.

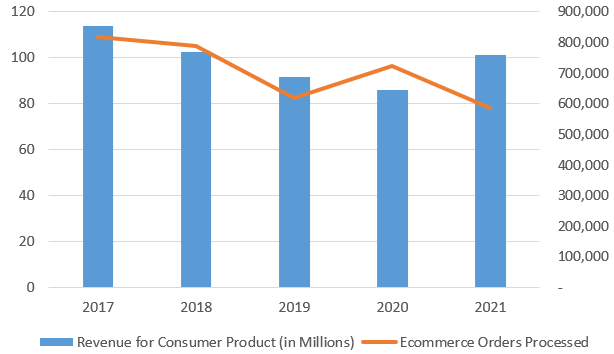

Consumer Product Segment (Company Annual Report)

For the Consumer Products segment, revenue has been relatively stable in the past five years, despite revenues from e-commerce declining significantly due to COVID-19 and lesser discretionary spending habits in the current macroeconomic environment. We think that there is enormous potential in consumer product licensing as a huge growth driver for this business segment.

This would be largely driven by two licensing agreements that began this year in 2022; the first one is an exclusive deal with Blockchain Creative Labs to launch an NFT marketplace for licensed digital WWE tokens and collectibles, while the second one is an agreement with the Panini Group to produce trading cards and collectible stickers. This allows WWE to leverage the existing hobby of physical collectibles into the Web3 space, a new technological frontier for this hobby as well. On top of that, WWE has also partnered with the sports retailing industry giant, Fanatics, which would not only provide fans access to its apparel and merchandise but also develop and distribute both physical and digital trading cards for WWE.

As such, from broadcasting networks to social media platforms and consumer products, WWE’s increasing efforts in value creation strategies would continue to increase the monetization of all of these business segments.

Valuation

We find it difficult to benchmark WWE to any industry. Not only is WWE disconnecting itself from being a streaming company, but it is also not a sports group. The closest that company we can classify WWE with would be the entertainment companies, and thus we decide to approach the valuation using a DCF method.

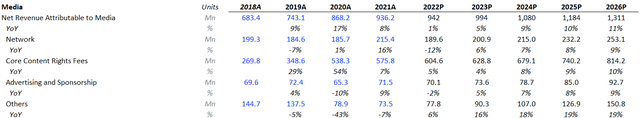

Revenues from Media Segment (Author’s Spreadsheet)

For net revenue for Media, we think that all sub-segments are expected to rise in revenue, considering the establishment of a new NXT Europe campaign in 2023 following its success in the UK. On the conservative side, we project its effects to kick in from 2024 onwards. For 2022-2023, we believe that WWE will continue to grow its distribution partners and see a slight drawdown in advertisement and sponsorships, given the current macroeconomic headwinds.

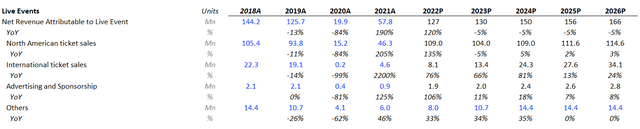

Revenue from Live Events Segment (Author’s Spreadsheet)

For net revenue for Live Events, we assumed that operations will resume back to 2019 levels by 2023, and think projected growth steadily beyond 2018 levels by 2026. We kept average ticket prices high taking into consideration WWE’s loyal fan base with an increasing number of eyeballs on its content year-on-year.

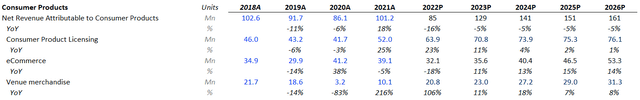

Revenue from Consumer Products (Author’s Spreadsheet)

For net revenue for Consumer Products, we think that revenue for consumer product licensing will continue to remain high with the launch of WWE NFTs and long-term hobbyists collecting trading cards, playing WWE games, or purchase of memorabilia/toys. We took into consideration the current situation with discretionary spending and tuned down our forecast for 2022-2023 before projecting steady growth till 2026. Revenue for e-commerce would largely depend on the partnership with Fanatic, which we remain bullish about in the next 5 years to come, and the discretionary spending habits of its fans. We think that this headwind will change soon and boost spending habits from 2024 onwards. Lastly, revenue from merchandise would be projected against the growth in live event attendance.

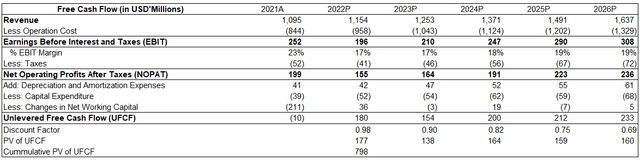

PV of FCF (Author’s Spreadsheet)

After balancing our model, we derived our present value of future free cash flows. For net changes in working capital, we think that WWE’s management is going to pay down its lease liabilities and long-term debt using its free cash flow as per its ongoing trend. For capital expenditure, we projected according to its expansion plans for NXT Europe and doubling down on content creation.

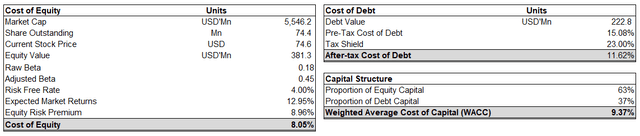

COE and COD Calculations for DCF (Author’s Spreadsheet)

After calculating the cost of equity and debt, WWE has a healthy capital structure with a third of its capital supported by debt and the remaining from equity. We think that WWE’s equity risk premium could be reaching its peak and thus, there could still be some slight increases in its WACC in the short run.

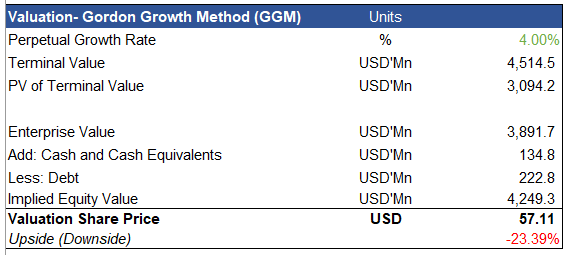

Perpetuity Growth Method DCF Valuation (Author’s Spreadsheet)

Finally, we decided to use the perpetuity growth model for a mature and constantly growing company like WWE. After taking into account its free cash flow growth in our projection, we think that WWE’s FCF could conservatively grow at 4% forever as they experience major booms and busts in its content production cycle, sometimes recording double-digit growth or decline within a span of few years. Hence, we arrived at a valuation that is significantly lower than the current price it is trading at.

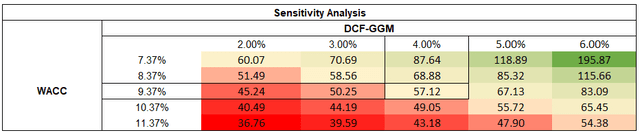

Sensitivity Analysis Table (Author’s Spreadsheet)

Does that mean that the company is trading at unfavorable prices? We constructed a sensitivity analysis table to answer that question. As the table coloring suggests, there could be more downside to the price if the current macroeconomic situation persists. However, we think that this stock is definitely a buy-and-hold for long-term value investors, who believe in the corporation’s strategy and are patient enough to wait for macroeconomic headwinds to subside.

Conclusion

WWE is synonymous with the wrestling culture, and the company has been leveraging its branding to continuously provide entertainment to generations of children and adults. Although its story plots and scenes were not as exciting as in the past, there is still value in the entertainment aspect of wrestling for adults and children. Nevertheless, WWE’s execution of its strategy continues to bring the company to greater heights and we think that its ability to increase the monetization of its consumer products will allow the company to keep up with the current trends in society. As such, we recommend long-term investors consider WWE to be included as part of their portfolio once the macroeconomic headwinds have subsided, for a better margin of safety.

Be the first to comment