Scharfsinn86/iStock via Getty Images

Workhorse Group Inc. (NASDAQ:WKHS) recently announced an agreement with the USDA. The company also appears to be exploring projects with the federal government and a large retailer. If we add up new production of vehicles in 2023 and 2024 as well as the implementation of LEAN systems, the glimpse gets even better. In my view, even considering the risks, in the best case scenario, the company could be worth $8.5.

Workhorse

Workhorse is a tech company offering sustainable and cost-effective solutions to the commercial transportation sector.

Management claims to be designing and building high performance battery-electric vehicles along with cloud-based real-time telematics performance monitoring systems.

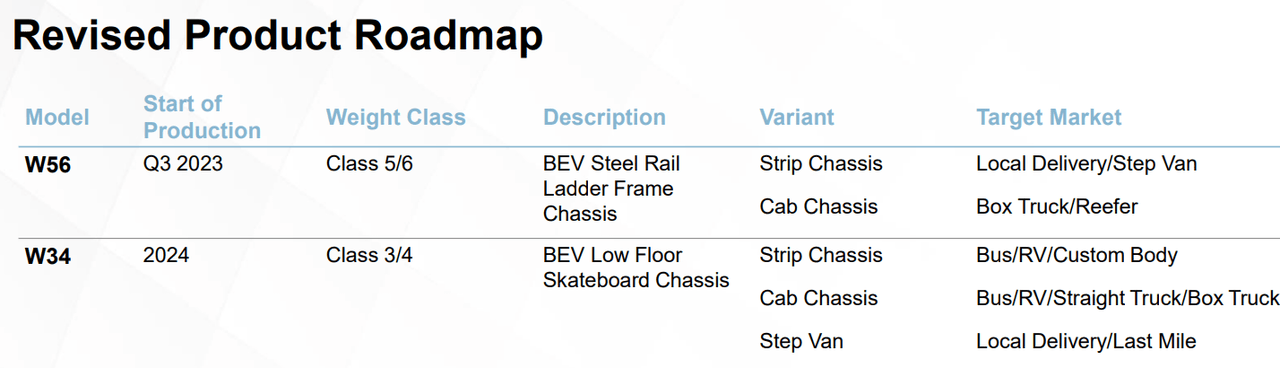

In my view, with the information released in the last quarterly report, it is a great moment to review Workhorse’s future prospects. Keep in mind that the company expects to start producing models W56 and W34 in Q3 2023 and 2024. With this in mind, I expect sales growth to trend north from 2023.

Q4 2021 Earnings Presentation

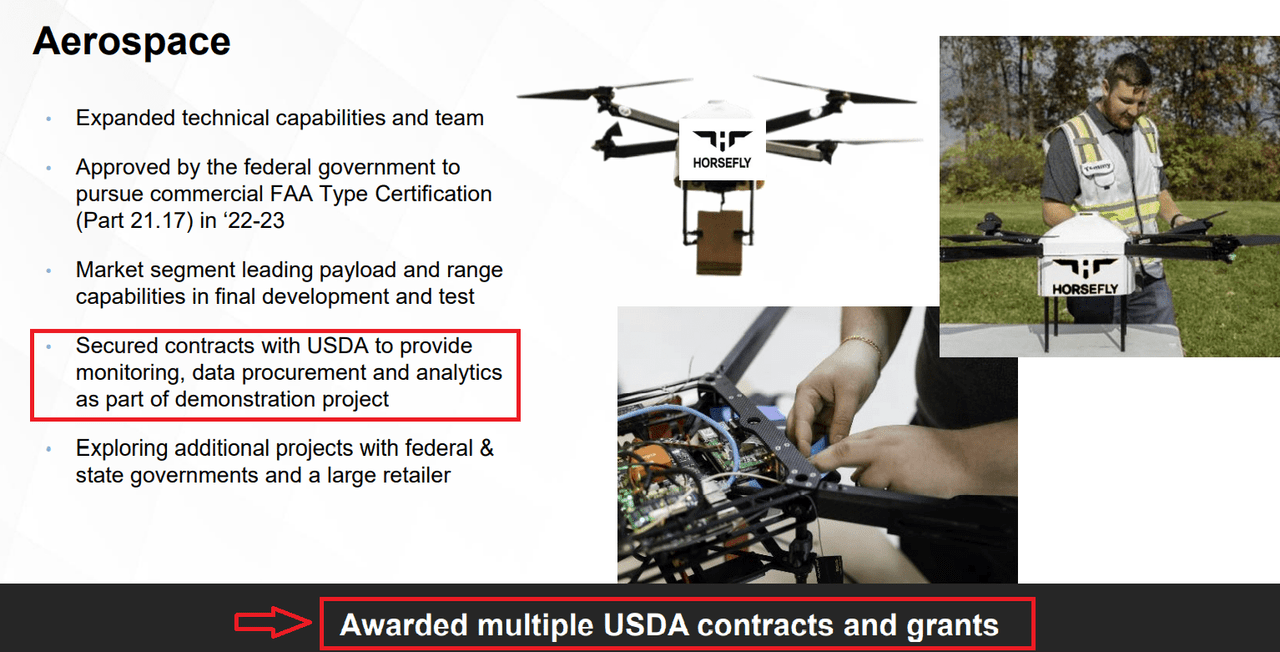

The company’s aerospace technology successfully received the attention of the USDA for a project. Besides, management appears to be exploring other projects with the federal and state government as well as a large retailer. In my view, if new announcements are made about new agreements, the stock price could trend north:

Q4 2021 Earnings Presentation

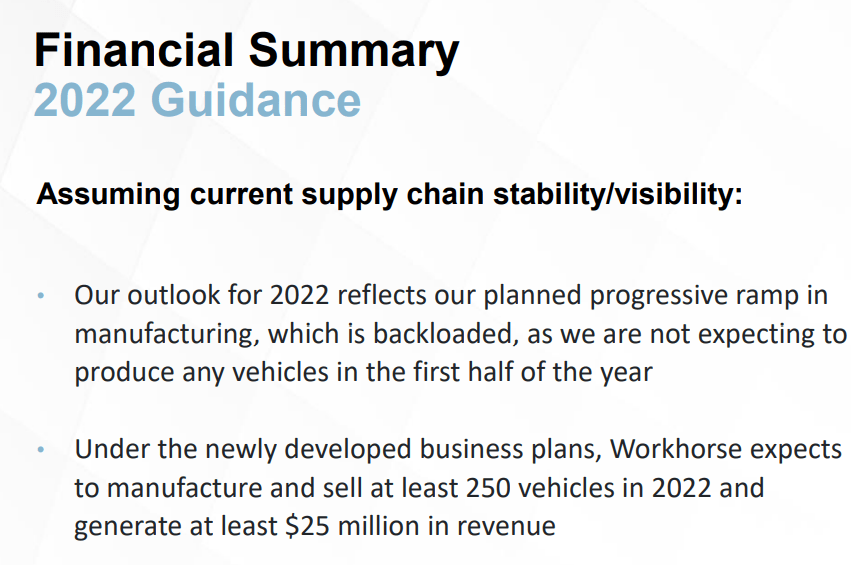

Management also gave some information about the year 2022 that investors may like. Under normal conditions, Workhorse expects to manufacture and sell vehicles in the second part of 2022. The management also promised progressive ramp in manufacturing.

Q4 2021 Earnings Presentation

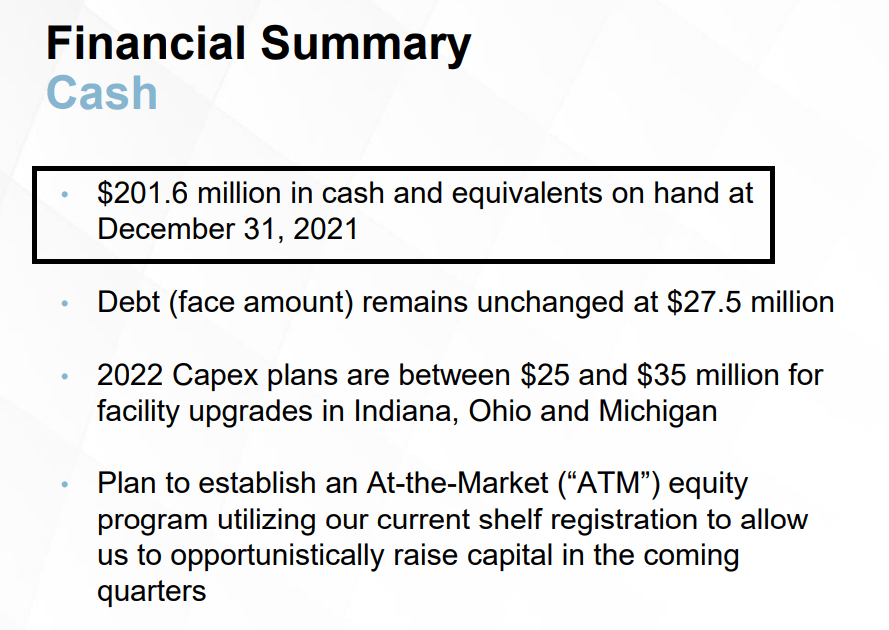

Finally, I believe that Workhorse has sufficient liquidity to finance further development, design, and manufacturing of products. Keep in mind that management reported $201 million in cash, and expects to report 2022 capital expenditures between $25 million and $35 million.

Q4 2021 Earnings Presentation

Base Case Scenario With Successful Implementation of The Company’s Customer Centric Strategy And New LEAN Systems

Under normal circumstances, I believe that Workhorse will successfully execute its business plan, which will likely lead to sales growth and free cash flow generation. Keep in mind that management expects to improve its cost structure and develop LEAN systems so that free cash flow margins increase. Besides, I am also optimistic about Workhorse’s customer centric strategy and the company’s leading tech capabilities promised in the last quarterly presentation:

Q4 2021 Earnings Presentation

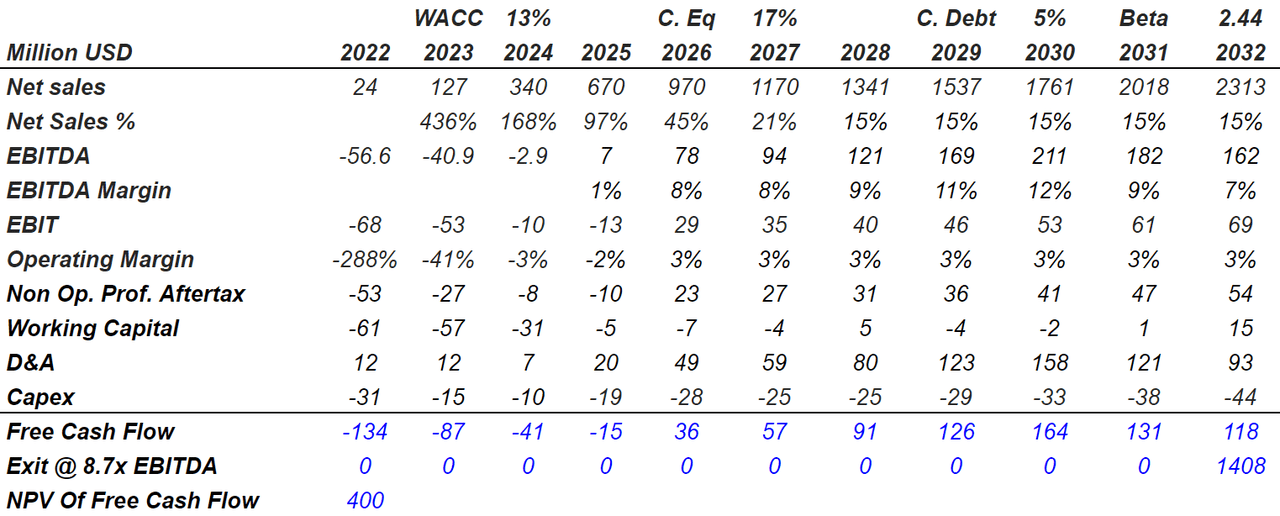

With experts noting that the global electric trucks market could grow at a CAGR of 14.6% from 2021 to 2028, I believe that Workhorse’s revenue growth will be close to this figure:

A recent study conducted by the strategic consulting and market research firm BlueWeave Consulting revealed that the global electric trucks market was worth USD 21.4 billion in 2021 and is estimated to grow at a CAGR of 14.6%, earning revenue of around USD 52.3 billion by the end of 2028. The growth of the global electric trucks market is attributable to the growing adoption of battery vehicles to promote zero-emission and sustainability. Source: Global Electric Trucks Market Getting Set for a Roaring

With the company claiming that it will likely sell vehicles in 2022, I assumed 2025 net sales close to $25 million. The target is also expected to grow at a CAGR of 14.6%, so I assumed sales growth of 15% from 2028 to 2032. Finally, with an EBITDA margin of around 10%, operating margin close to 3.5%, and growing capital expenditures, I obtained 2032 free cash flow close to $120 million. If we sum everything, with an exit multiple of 8.7x, the implied net present value stands at around $400 million:

Author’s Compilations

Now, by summing the cash in hand reported in the last quarterly report, and subtracting the debt of $25 million, I obtained an implied price between $3.5 and $4.0:

Author’s Compilations

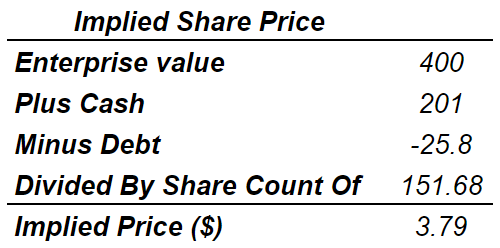

If Workhorse Has Difficulties In Accessing Financing In The Future, Sales Growth Could Be Lower Than Expected

In the last annual report, Workhorse reported that the company has sufficient liquidity to continue its operations. However, it also claimed that in 2022, management may also try to raise more capital At-the-Market offerings. In my view, if the share count increases, the intrinsic valuation of each share will likely decrease. If equity researchers notice the share count increase, the stock price will most likely trend down:

We believe our existing capital resources, including proceeds received in connection with the $200.0 million senior secured convertible note issued in October 2020, will be sufficient to support our current and projected funding requirements through 2022. If the opportunity arises, we may elect to raise additional financing in 2022, including through an At-the-Market offering. Source: 10-K

The company also reported that it will need to raise additional capital in the near future as the cash flow may not be enough to finance future operations. If Workhorse does not find a sufficient number of investors to finance future development of products and marketing efforts, future sales growth may be lower than expected. In the worst case scenario, the cost of equity may increase leading to a decrease in the company’s valuation:

However, unless and until we are able to generate a sufficient amount of revenue, reduce our costs and/or enter into a strategic relationship, we expect to finance future cash needs through our cash on hand. If we elect to or need to raise additional capital, we cannot be certain that additional financing will be available to us on favorable terms when required, or at all. In such circumstances, if we cannot raise additional capital, our financial condition, results of operations, business and prospects could be materially and adversely affected. Source: 10-K

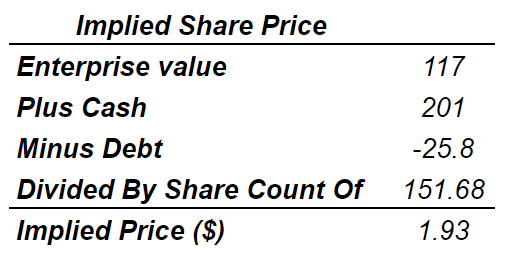

Under the worst case scenario, I assumed sales growth of around 21% and 11% from 2027 to 2032. The EBITDA margin would also stand at 7%, and the operating margin will likely stay at 3%. Finally, with growing working capital, increasing depreciation and amortization, and growing capital expenditures, 2032 free cash flow would stay at $91 million. The sum of free cash flows and the exit at around $1 billion in 2032 would imply a net present value of $117 million:

Author’s Compilations

Assuming a share count of 151 million shares, in this case, the fair price should be close to $1.93. Let’s note that management may increase the share count in the near future, which may push down Workhorse’s fair valuation:

Author’s Compilations

With Sufficient Acquisition, Divestiture Of Businesses, And Technology, I Believe That The Fair Price Could Lead To $8.5

Notice that Workhorse expects to grow not only organically, but also through M&A. In my opinion, if management continues to report beneficial acquisitions and divestitures at convenient prices for shareholders, Workhorse’s fair valuation will likely trend north. Also, note that successful integration of new teams, acquisition of innovative technology, and intellectual property could bring sales growth. I can’t offer full disclosure of all the companies acquired and sold in the past, but I would say that Workhorse does have a lot of expertise in the M&A markets. Some of its M&A operations are given below:

On November 27, 2019, the Company completed the sale of SureFly for $4.0 million.

On October 31, 2019, the Company and ST Engineering Hackney, Inc. entered into an Asset Purchase Agreement to purchase certain assets of Seller and assume certain liabilities of Seller.

On November 7, 2019, the Company entered into a transaction with LMC pursuant to which the Company agreed to grant LMC a perpetual and worldwide license to certain intellectual property relating to the Company’s W-15 electric pickup truck platform and its related technology. Source: Prospectus

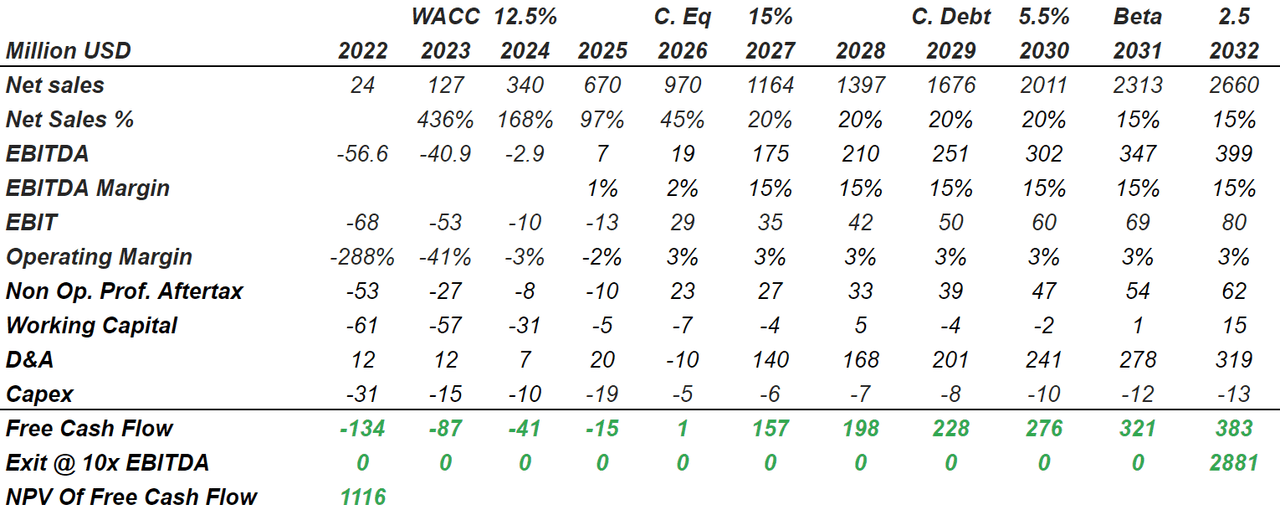

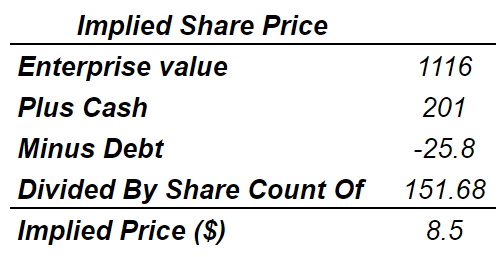

Under this case, I used sales growth close to 20% y/y in 2027, 2028, 2029, and 2030, and 15% in 2031 and 2032. The EBITDA margin should also stay close to 15%, so that the free cash flow grows from around $155 million in 2027 to almost $385 million in 2032. With a weighted average cost of capital of 12.5%, cost of equity around 15%, cost of debt of 5.5%, and an exit multiple of 10x 2032 EBITDA, the implied enterprise value should stand at almost $1.115 billion.

Author’s Compilations

If we adjust the enterprise value with the debt and the cash in hand reported in the last quarterly report, the implied price could stay at $8.5.

Author’s Compilations

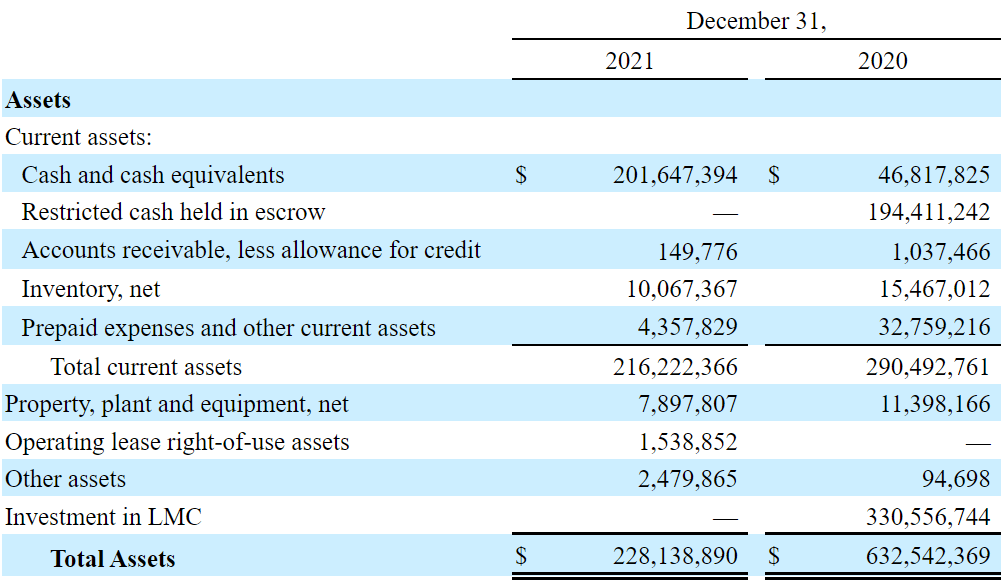

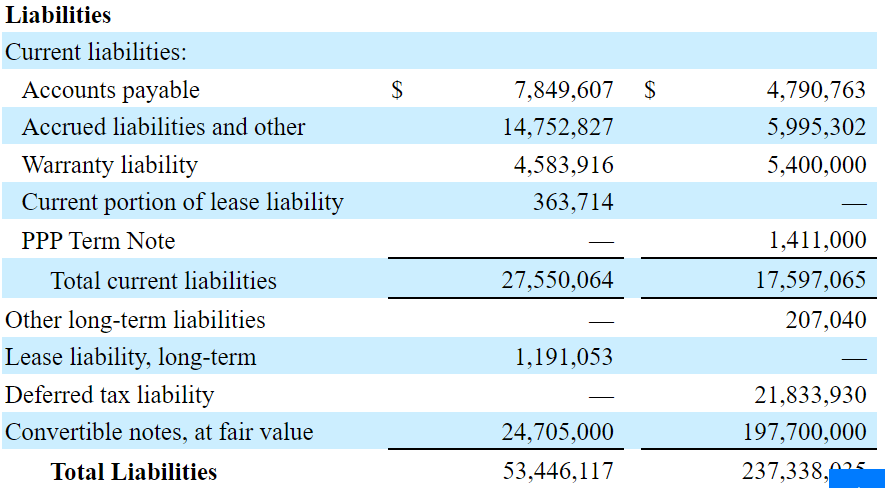

Balance Sheet: The Total Amount Of Debt Declined

As of December 31, 2021, the company reports an asset/liability ratio of more than 4.3x and a significant amount of liquidity. I believe that Workhorse will be able to acquire other businesses.

10-K

It is also quite beneficial that the convertible debt declined significantly from $197 million in 2020 to less than $24 million. In my view, if management needs more financing from banks to acquire other entities, financial institutions will likely offer more money.

10-K

Conclusion

With Workhorse announcing an agreement with the USDA and production of new vehicles in 2023 and 2024, in my view, the interest for Workhorse’s stock could increase. Besides, management does not only report a lot of cash in hand, it also announced new strategies including a customer centric strategy, new LEAN systems, which may push revenue growth up. Under the best conditions, the company’s M&A activities could also be successful, which could push the stock price up to $8.5.

Be the first to comment