NicoElNino

The bursting of the SaaS bubble is starting to present the opportunity to buy fantastic businesses at reasonable prices. Having fallen over 50% since the beginning of the year, I’ve added SaaS ERP leader Workday (NASDAQ:WDAY) to my portfolio.

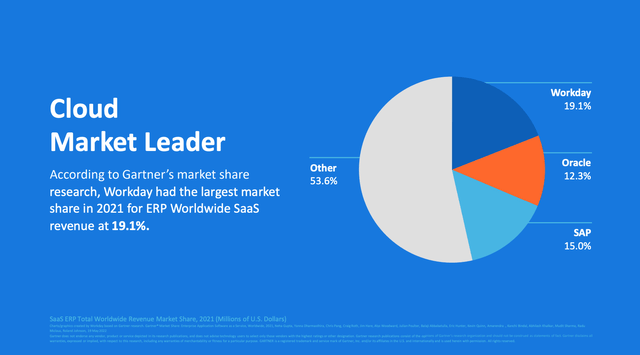

SaaS ERP Market Share (Workday Investor Relations)

Workday is a long-term SaaS winner, which boasts an impressive client roster (over 50% of Fortune 500 as shown below) and a very broad product offering. As Workday continues to add new clients and sell new products to its existing client base, the company should continue to grow revenue and free cash flow at a rapid clip.

I see the drop in the share price as creating a rare opportunity for value-oriented investors like myself to purchase a leading company in an important industry at a very reasonable price.

Growth Machine

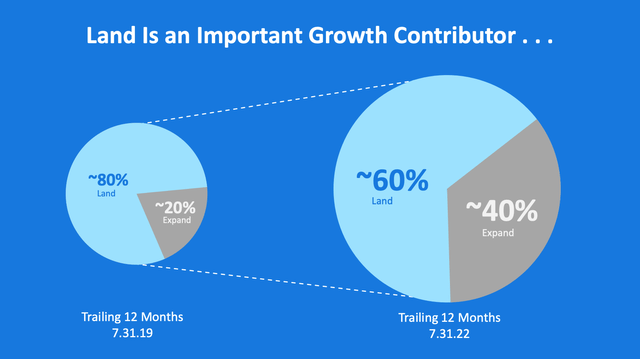

Workday has grown revenue at a 38% CAGR since 2012, mainly organically. Workday grows revenue in three ways: 1/ new customers (‘Land’ in the graphic below) 2/ selling more products per customer (‘Expand’ in the graphic below) and 3/ increasing price.

Sources of Growth: Land / Expand (Workday Investor Presentation )

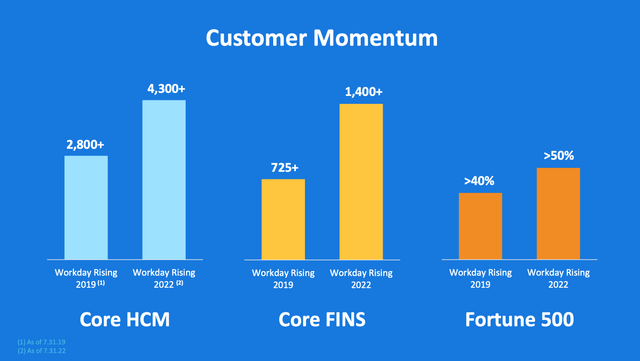

As you can see below, Workday has rapidly grown customer counts in just the past 3 years – one of the ways it has done this is by tailoring its products to serve new vertical markets. Workday has expanded its offering to serve the technology & media industry, retail & hospitality, and transportation sectors in recent years. While the company already counts over 50% of the Fortune 500 as customers, there remains plenty of whitespace for Workday to grow as it continues to serve new markets.

Beyond expanding in new verticals, Workday plans to grow its customer count by serving medium sized enterprises. Thus far, Workday has focused primarily on large customers. While there remains plenty of opportunity here (Workday still has another ~200 companies to penetrate in the Fortune 500), moving downmarket to serve smaller companies expands the total size of the market (which Workday estimates to be $125 billion).

Client growth since 2019 (Workday Investor Presentation)

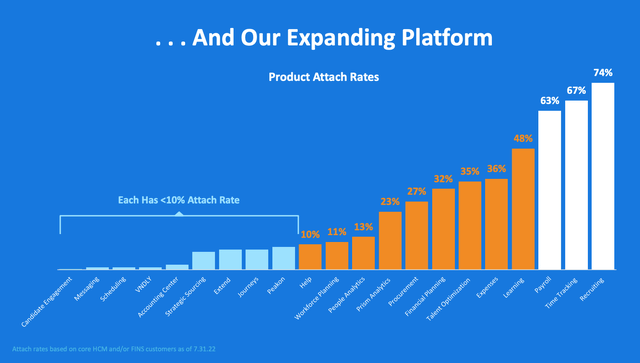

While Workday started as a provider of HR tools for recruiting and payroll, over time the company has developed a very broad offering of products spanning HR and finance/accounting applications. Workday is able to leverage its leading position in core HR products to cross sell additional functionality.

Penetration by Product (Workday Investor Presentation )

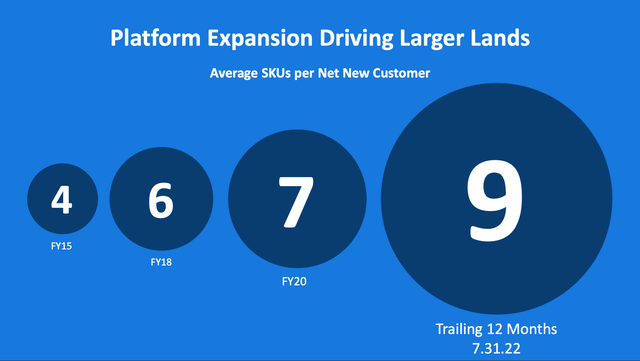

As Workday has broadened its offering over time, as shown below, customers are increasingly adopting a larger number of Workday products right from the get go which means the size of new deals is larger and significantly accretive to revenue from an early stage.

Number of Products taken per New Customer (Workday Investor Presentation)

Software is a beautiful business because it becomes embedded in customer business processes which makes it unlikely that customers will change (changing software is a disruptive process and requires retraining employees) which is evidenced by 95+% customer retention. Because of the mission critical nature of the product and high switching costs to the customer, software providers have strong pricing power and are easily able to charge 3-5% more per year.

Valuation & Conclusion

At $132 per share, after stripping out $10/share in net cash, Workday trades at 22x my 2023 estimate of free cash flow per share. Workday is targeting 20% annual revenue growth for the next several years while expanding cash flow margins from 29 to 35%. Should Workday achieve its goals, the company will generate $11/share in free cash flow in 2026.

Given what appears to be a looming recession and the likelihood of a slowdown in business investment into software, I forecast that the company will grow at 16-17% over the next several years with more modest expansion in free cash flow margins. I estimate that Workday will produce $8 per share in 2026 free cash flow per share. Additionally, between now and then, Workday will have generated another $8 billion ($25/share) in free cash flow which will pile up on its balance sheet (unless it is used to repurchase shares or make an acquisition).

I consider Workday to be a very high quality business given that it generates recurring revenue from a captive customer base (switching costs). Further, I expect that the company will still be able to grow its free cash flow per share at a 12-15% rate for several years beyond 2026. As such, I value the company at 25x free cash flow. This gets me to a total value per share (in 2026) of $235 which breaks down as follows:

-$10 per share in net cash on balance sheet today

-$25 per share in cash to be generated between now & 2026

-$8/share in Free cash flow * 25x multiple = $200/share

This implies that an investor who purchases shares in Workday today will earn a 20% annualized return by holding until 2026 which I consider to be attractive.

Note that if Workday is able to achieve its targets (which are more aggressive than mine), using the same 25x free cash flow multiple, the stock would be worth $310 per share in 2026.

Either way, the shares seem like a good deal to me here and I’ve added the stock to my portfolio.

Risks

-SAAS stocks have been heavily out of favor in 2022 and could decline further.

-A slowdown in business investment into software could make my projections too optimistic.

Be the first to comment