Inside Creative House

NETSTREIT Corp. (NYSE:NTST) is a real estate investment trust (“REIT”) that is focused on the rental of single-tenant, retail properties to a high-credit tenant base under long-term net lease arrangements.

Their portfolio is distinguished by their high share of investment grade (“IG”) credit or profile tenants, with the two groups representing approximately 80% of total annualized base rents (“ABR”). In addition, the company maintains 100% occupancy levels and cash collection rates.

YTD, shares are down about 18% and about 25% over the last year, though the trading range is tight, with less than $10 separating their 52-week highs and lows.

Seeking Alpha – Summary Of NTST’s Current Trading Metrics

For existing shareholders, NTST boasts of perfect portfolio metrics that generates stable and predictable cash flows. The perfect portfolio, however, is also one of the biggest limitations due to the heightened dependency on external growth. With the acquisition market noticeably slowing from prior periods, this can constrain the upside potential in the stock until there is further clarity. Though the stock is a solid long-term holding, there is not enough potential to warrant new initiation.

Portfolio Of Assets Continues To Grow

NTST’s portfolio continued to grow in the current quarter, increasing by a net 25 properties, including 26 acquisitions and one disposition. In total, this equated to +$130M in net investment activity.

On the acquisitions side, the properties were acquired at a weighted average cash capitalization rate of 6.6% at a weighted term (“WALT”) of 11.8 years. The average purchase price is up slightly from the 6.7% cash cap rate reported in Q2. Average terms, however, are almost a year longer.

The sole disposition during the quarter was a banking property that came in at a 5.5% cap rate, which is an improvement over the 6.0% the company received on the sale of a Kohl’s (KSS) in Q2.

Altogether, NTST has thus far increased their portfolio count by 81 units to a current total of 409 properties through three quarters of the fiscal year. Within this total are six development projects, one of which is a discount retailer that is expected to commence in the 4th quarter of this fiscal year, with four others expected to commence in the first quarter of 2023, and one with a still to be determined project schedule.

Though their current developments are expected to obtain continual funding, management expressed caution in committing to any new developments, given higher hurdle rates stemming from increased costs and interest rates.

Impeccable Portfolio Metrics Anchored By Necessity-Based Tenants

Overall, the company’s portfolio metrics at quarter end remained consistent with the prior quarter, with a total of 77 tenants in 24 industries, with a 100% occupancy rate and a WALT of 9.6 years. Exposure to necessity-based tenants, however, which predominantly include drug stores & pharmacies, home improvement retailers, and grocery stores, did tick up 320 basis points (“bps”) to 57.7% of the portfolio, with discount and service retailers representing the next largest share at 30.9%.

And of their portfolio total, about 80% of their portfolio was either IG rated or unrated but with an IG profile, which the company defines as tenants with IG credit metrics that include +$1.0B in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x but no published rating from the major credit agencies. This is down slightly from the second quarter due to a credit rating change in Big Lots (BIG), which resulted in the loss of their IG profile status as defined by the company.

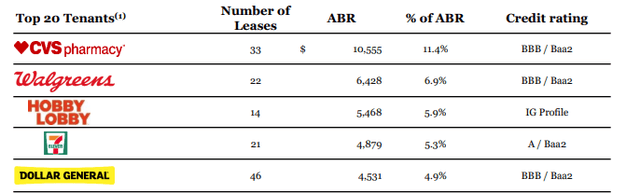

Their top twenty tenants remained consistent with prior quarters, with the collective total representing about 75% of their ABR, with CVS accounting for the largest share at 11.4% of ABR. Together with the other top four tenants, their top five represented approximately a third of total ABR.

Q3FY22 Investor Supplement – Summary Of Top 20 Tenants

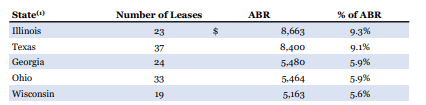

Geographically, their portfolio remains concentrated, with five states representing over 5% of total ABR, but the representation of each state has changed. In Q2, for example, Texas was their largest state at 10% of ABR. Exposure there has since declined to 9.1%, with Illinois taking the top spot, though its exposure ticked down 10bps. Additionally, exposure to Ohio and New York ticked down noticeably by 60bps each, with New York knocked off the top five states altogether, replaced by Wisconsin.

Q3FY22 Investor Supplement – Summary Of Geographic Concentration

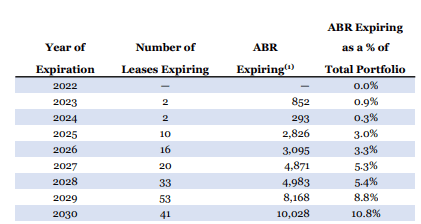

Given the extended WALTs of their current portfolio, it’s not surprising that the company has minimal expirations in the coming years, with no more than 3.5% of ABR expiring in any given year through the end of 2026.

Q3FY22 Investor Supplement – Lease Expiration Schedule

Earnings Remain Supported By Favorable Contributions Of Newly Acquired Properties

With minimal expirations and full occupancy levels, portfolio growth continues to be the primary driver of revenues. YOY, total revenues increased 60% from Q3FY21 due almost entirely to the increase in the number of properties in the reporting period from 264 operating properties as of July 1, 2021, to 401 operating properties as of September 30, 2022. Similarly, revenues are up nearly 70% YTD due to an increase in the portfolio to current levels from 203 operating properties as of January 1, 2021.

Revenue growth paired with adequate expense control is resulting in continued growth in earnings, with reported adjusted funds from operations (“FFO”) up 25% YOY and 30% YTD. This growth has ultimately improved the dividend payout ratio from 83% last year to 67% in the current year on a consistent quarterly dividend payment of $0.20/share.

Primarily financing their portfolio growth was the settlement of shares of their common stock through forward sale agreements, issuances through their ATM program, and net borrowings on their revolving credit facilities. While their leverage metrics remain strong at 2.5x post-consideration to their forward sales agreement, which is well below their targeted range of 4.5x-5.5x, increased share issuances can have a negative impact on future growth in AFFO.

An Uncertain Acquisition Environment Requires A Pause

Following a respectable earnings release, management narrowed their full-year AFFO guidance to a higher than initially expected midpoint. While this is a positive, their net investment target of +$500M was eliminated in favor of a more opportunistic approach to capital deployment. Based on YTD net activity levels, that leaves over +$100M in an uncertain status. With so much of their earnings growth dependent on the continued expansion of their portfolio, any setback in meeting initially set targets is cause for concern.

At 100% occupancy levels and cash collection rates, in addition to extended WALTs with limited near-term expirations, there is little opportunity aside from portfolio expansion. Sure, some active developments will commence rent in coming periods. Embedded escalators within existing leases will also provide a boost to contractual rents. But is that enough?

New portfolio acquisitions contributed to YOY revenue growth of 60% in the current period. And that was based on 137 more operating properties in the reporting period. Currently, the company has just six developments pending commencement with no commitments to any new projects in the current market environment. One would be hard-pressed, therefore, to make the case that these projects themselves will be able to sustain current growth rates.

Though the company didn’t rule out new net investment activity entirely, they did cite uncertain market conditions as one factor pulling participants to the sidelines. Until there is some stabilization in the interest rate environment, the pause is likely to continue.

At present, shares are valued at about a 6.5% implied cap rate. This is lower than their current acquisition rate of 6.7% and above their most recent disposition rate of 5.5%, which is more closely in-line with prior implicit valuations on the company’s stock. At a 6.0% implicit cap rate, shares would be valued at just above $19.50/share, which is not significantly higher than where shares are currently trading.

While the current dividend payout is safe and provides income investors with a steady cash stream, the yield of 4.3% is hardly enticing enough compared to not only alternatives in the overall REIT sector but also to risk-free Treasurys, which are presently yielding comparably to NTST’s current dividend.

Though NTST’s nearly impeccable portfolio provides stability and reliability to existing shareholders, there is limited opportunity in the current market environment to materially improve upon existing metrics. As such, prospective investors are best left on hold until there is further clarity in the acquisition environment.

Be the first to comment