aydinmutlu/E+ via Getty Images

Investment Thesis

In a previous era, Woodside (NYSE:NYSE:WDS) management referred to its juggling of funding requirements for future ambitions as ‘financial gymnastics‘. In current times, as it progresses towards its next goals, the phrase is perhaps equally appropriate.

Whilst we like the company for its generous returns to shareholders, we recognize the company also has to balance this with the social expectations of eliminating carbon emissions.

We think that although a company with strong profit-generating prospects, the financial gymnastics required for Woodside to manage these two objectives (shareholder returns and social responsibility) will result in wobbles along the way and create attractive opportunities for a prepared investor to add Woodside to its portfolio.

The Company

Woodside Energy is an Australian-based energy company primarily focused on LNG production. In late 2021 it announced an agreement to acquire the petroleum business of BHP (BHP) in exchange for newly issued Woodside shares. It completed the merger in June 2022, and under the revised structure, 52% of the company is owned by existing Woodside shareholders and 48% by BHP shareholders.

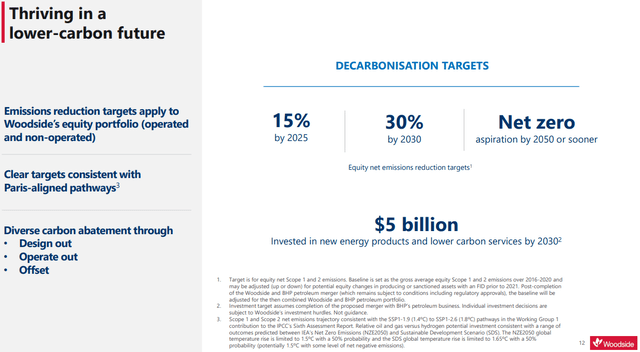

As a producer of hydrocarbon energy, it is understandably scrutinized for its role in a decarbonizing world. In addressing this issue, the company stands its ground on LNG’s medium-term importance in the energy transition, whilst committing to longer-term emissions aspirations. It has also promised $5 billion to fund investments in lower-carbon energy by 2030.

Woodside’s sustainability targets at a glance (Woodside Investor Update 2021)

Our stance is that its sustainability commitments appear light – we have an opinion that a perceived culprit of global warming should be more prominent and take stronger leadership in driving a carbon-free future. We sense that Woodside management understands the optics of their stance but has taken a pragmatic approach to ensure it doesn’t achieve this at the expense of both near-term and long-term profitability. However, we feel that management has little wiggle room to backtrack and will be expected to meet, if not exceed its stated investment guidance for green technologies.

The company has linked its ability to fund renewables initiatives and meet green objectives on the success of its Scarborough project, a significant new gas field with claimed low levels of CO2. With its touted reserves of 1,950MMboe, IRR of 13.5%, payback expectation of 6 years, and lifespan of at least 3 decades it is seen as having great earnings-generating ability. After the confirming of its intention to proceed with the investment, it is readying infrastructure works to get Scarborough operating by 2026.

Also imminent in the pipeline is Sangomar, an oil field development in Senegal scheduled for first oil in 2023. It is seen as a stepping stone project to Scarborough, as it will be an additional source of free cash flow and earnings from next year. Together with Scarborough, the capex spend required for these two projects makes up the majority of the $9bn budgeted for spend between H2 2022 and 2024.

Valuations

Woodside announced first-half 2022 earnings of $1.6bn, which included 1 month of earnings from legacy BHP assets. This equates to an EPS of $1.44 and P/E ratio of just over 8x. We think this is within an investable range, but compared with peers in the materials and energy sector would be considered middle-of-the-pack. Though, considering the low-cost/high-margin business, and the supply-demand dynamics of natural gas, we believe in the long-term prospects of the company.

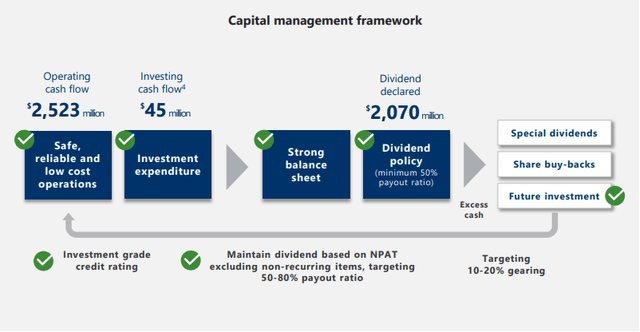

Arguably the most attractive trait of the stock is its recent track record of returning 80% of operating profits to shareholders, which are the highest levels seen of the stocks we’ve been tracking. Official communication states that the dividend paid will be between 50-80% of operating income, however, the precedence of continued payments at 80% has likely embedded future expectations of payouts at this level.

Woodside HY 2022 Results Presentation

With legacy BHP assets contributing fully going forwards, H2 2022 aggregate earnings will be expected to exceed H1’s, although on a per share basis it will probably appear weaker due to earnings linked to energy prices which have faded in recent months. To this point, we think this tilts a negative bias to stock price potential at current levels. However, we are keenly watching for an alternative scenario where stock prices push lower if a sense prevails that future dividend payouts of 80% earnings are at risk – an event we think is more likely than that is being priced in.

We feel that a drop in stock prices could occur as investors may mistakenly view dividend cuts as weakness in the company’s overall earning potential. In our opinion, a dividend cut is more likely to be due to short-term cash flow bottlenecks and offset by probable returns at a later date. A negative drop in sentiment without a change to fundamentals (in our opinion), could result in stock prices lower than $20 (A$29) and would represent an enticing entry point.

Financial Gymnastics

To flip the question as to whether 80% payout will be maintained is to ask whether the 20% earnings retained by the company is sufficient to cover future capex spending requirements. To tie it back to the long-term goals of the company, Woodside needs to ensure sufficient funds for:

- Sangomar first oil in 2023

- Scarborough first cargo in 2026

- Green initiatives by 2030

- Other development projects

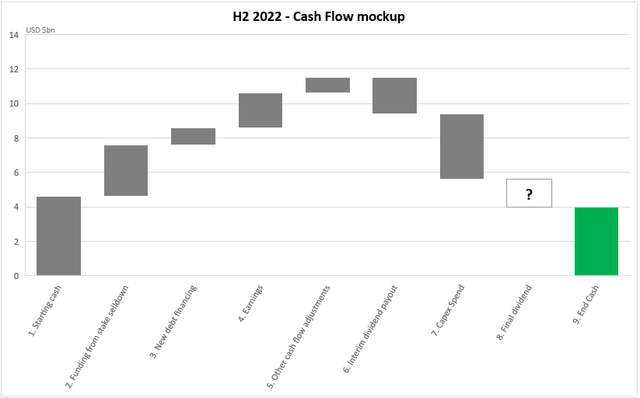

To help us better visualize, we mocked up an illustration of the next 6 month’s cash flow.

A mockup of H2 2022 cash flows. Note that end cash balance (9) needs to be positive. We question whether cash flows are healthy enough for final dividends (8) to remain as 80% of operating earnings. (own analysis)

- Starting cash: Cash as of July 1

- Funding from stake sell-down: Proceeds from the sales (either fully or partially) of Woodside’s portfolio

- New debt financing: Additional borrowings from available undrawn facilities

- Earnings: P&L for the H2 2022

- Other cash flow adjustments: Stripping items such as depreciation from earnings

- Interim dividend payout: Confirmed to cost $2.1bn

- Capex spend: Budgeted amount of $3.8bn for H2 2022

- Final dividend: Technically a 2023 event. Between 50-80% of H2 2022 earnings (4)

- End cash: Remaining cash on December 31

What we’ve drawn out for H2 2022 will need to be repeated for all subsequent periods until 2030, and for each of these periods, the end cash amount must be adequately positive. In turn, to ensure adequately positive cash amounts after a final dividend paid of 80% earnings depends on the status of the critical items preceding it.

Funding from Ownership Sale: Management has indicated an intention to sell a stake in the Scarborough project to an interested partner. With the go-ahead received and the project de-risked, there should be more clarity on the fair valuation of the asset and should allow Woodside to monetize the expected future returns at Scarborough in present value equivalent.

A stake sell-down has the likely additional benefit that the capex spend burden can be shared with the new partners in the project. Also, we note that any windfall gains from potential sale is technically non-operating profit, and therefore is not destined to form part of BAU dividends.

We believe this is management and shareholders’ most preferred method to ensure there is enough cash for future capex spend whilst leaving enough to continue returns to shareholders. However, there is recent precedence of a change of heart by management, when the company abandoned sale plans for Sangomar earlier this year. We think a repeat for Scarborough is a possibility, but with tighter financial conditions we feel this time it may result in an adjustment to dividends paid.

Whilst we are unsure of what course of action management takes, we feel there is a chance the market could perceive it negatively. Broadly speaking we don’t have a preferable scenario: an imminent sale should be done at fair value, and a non-deal would mean the company retains a larger share of the overall project and shareholders would benefit from the increased returns at a later date. We also think that sales of other assets, perhaps some taken on from BHP, may also be considered.

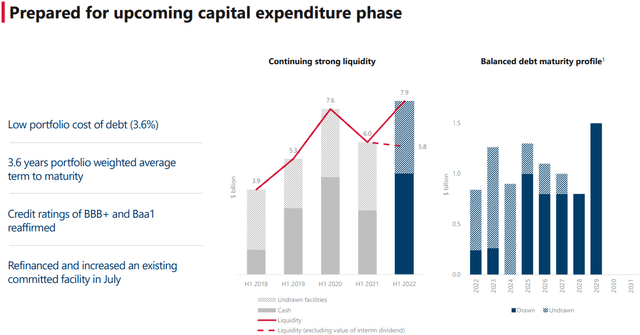

New debt financing: After the merger, Woodside’s debt leverage ratio fell into the lower end of its revised 10-20% target range, a metric which was touted as a key benefit as it provides resilience to the company’s credit rating. Presentation materials indicate that the company has up to $3.3bn in undrawn funding facilities available and is actively looking to tap into this to keep capex progress on schedule. Adding debt liabilities of $3.3bn of will bring it close to the top end of the 20% leverage target by our calculations.

Woodside is shaping up to tap into its debt facilities (HY 2022 Results Presentation)

We view additional debt financing as the back-up plan if a stake sell-down does not happen as planned. We see more borrowings influencing dividends in two conflicting ways: increased liquidity from debt financing would allow for more cash for the dividend payout. However, passed a certain point this will leave insufficient retained earnings in the company to remain within the targeted debt leverage range.

Earnings: We expect aggregate earnings to be immediately boosted by output from legacy BHP assets, and look for earnings to increase incrementally over time, in particular as Sangomar and Scarborough go online. Near-term concerns over energy price volatility will weigh on the stock, and in a severe case may result in worries that the retained 20% earnings by the company is insufficient.

Capex Spend: The guidance of $9bn by 2024, and $5bn for sustainability projects are at risk of overrunning, especially as supply-chain disruption, labor shortages and inflation remain headline macroeconomic news.

Conclusion

We think that Woodside’s reputation as a liberal payer of dividends may be at risk as it works to source the capital required to fund its green investment initiatives. We don’t doubt that Woodside will be able to generate sufficient earnings to cover these costs over time, but we think they may experience short-term liquidity crunches which decreased dividend payouts will help to alleviate.

We are anticipating imminent announcements of either a stake sale and/or additional debt raising, in addition to the regular investor updates, production guidance, and earnings reporting in the next six months. We are preparing for the developments of these topics to put pressure on sustained dividend returns, and are hoping for a misinterpretation of these announcements by the market will result in an unwarranted lowering of stock prices back to May 2022 lows at the very least. This would present an opportune time to add to an investment portfolio.

Be the first to comment