imaginima

Woodside Energy Group (NYSE:WDS) is a growing energy player. While a lot of its recent growth was inorganic from the acquisition of BHP’s (BHP) crude business, which basically doubled them up in terms of assets, there are major developments on the horizon that will entirely change their profile. Energy prices have tumbled a fair bit since the highs after the invasion, but they are way ahead of pre-war prices. We think dislocations will be more or less permanent and put a premium on oil and gas prices. While other companies pay out dividends, Woodside is going to grow its capacity into this structurally improved market. Dividend is sustainable and we’re staying bullish here.

Capacity Growth

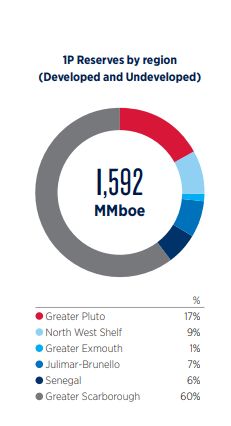

Woodside is doing a fair bit of developing. First oil for the Sangomar field is coming in 2023, and that field should add about 5% to its capacity and volumes of crude once the installations are fully ramped up. The other big development is on the Scarborough field, which accounts for more than half of the company’s current 1P reserves, or proven reserves both developed and undeveloped.

1P Reserves (WDS Annual Report)

The Scarborough field is still pretty far from completion at about 21%, but these sorts of projects usually don’t take too long to get developed. Phase 1 oil production should begin in 2026, which is a conservative and easily achievable timeline. The key message on Scarborough is that the breakeven thresholds are a fraction of the current levels. Breakeven prices are more or less 15-20% of current gas prices, as indeed Scarborough will be substantially growing Woodside’s capacity in gas production. On current gas prices, these investment economics should be pretty phenomenal, and IRRs rather high. For a lot of shareholder value to be generated, it is however key that the markets for these products remain somewhat dislocated as a consequence of the invasion, and that some premium remains in the prices of these commodities.

Bottom Line

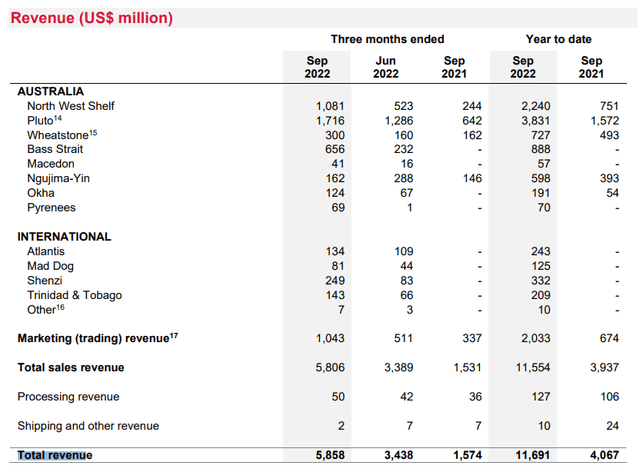

WDS is way ahead of its results from last year thanks primarily to rising prices of both oil and gas, but especially gas which represented 70% of the company’s revenue a few quarters ago prior to the BHP merger. Gas prices have had a more aggressive evolution compared to oil prices, which have appreciated around 50% compared to the 100% for gas.

Revenues (Q3 2022 PR)

About 40% of current revenues are from BHP’s crude business, which were consolidated into results in the meantime through the merger.

Ultimately, we are going to see a 5% increase from Sangomar next year, and a much bigger increase after that with the coming online of Scarborough. CAPEX guidance is at around $4 billion, and EBITDA is more than twice that expected for the full-year, therefore even with the very substantial capital burden coming from the development of Scarborough and the soon-to-be developed Sangomar, the current dividend which yields about 8% is well covered. Moreover, the fact that CPI is peaking is going to be a reversal of the speculation that was happening over reducing demand for oil. Oil demand should decrease at this point too much, or at least not undergo the same demand destruction that was expected by markets up to that point, including economic pressures already evident in China and Europe. With structural dislocations in the energy markets, even if unforeseen supply increases happen, prices should stay high and profitable for Woodside and their ilk. With plenty of development and reinvestment opportunities and a dividend to pay you in the meantime, Woodside continues to look attractive.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment