Sergei Dolgov/iStock via Getty Images

Post the release of 2023 production guidance and the holding of its investor day, we wanted to refine our investment outlook for Woodside Energy Group Ltd (NYSE:WDS). Previously, we wondered how the company would manage its capex commitments while maintaining its dividend payouts. Those concerns have not abated, but we feel we have more clarity on the investment horizon and the right mindset for the stock.

Revisiting Fundamentals

Since our last update, Woodside Energy Group Ltd share prices rallied and approached A$40 but have since retreated closer to A$36. At these prices, and projected annualized earnings of $5.7bn assuming 12-month contribution of legacy BHP assets and continued elevated energy prices, optimistically we’re still looking at a P/E ratio around 8x, which is fair value for the industry.

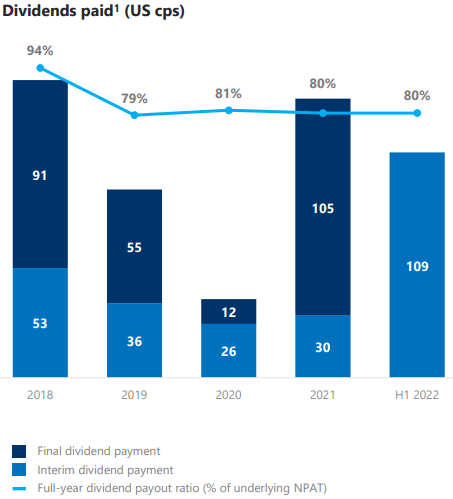

Woodside’s history of 80% dividend payouts appears a clear attraction for many investors (company presentation)

Forward-looking, we like Woodside for the general future prospects for natural gas/LNG, the global footprint of Woodside post-merger, and its project pipeline. We see its recent track record of paying 80% of profits as dividends as a nice perk valued by many investors, but at the 8x multiple it currently trades at, its effective dividend yield of 10% is not unique in the Natural Resources investment universe. Conversely, as long-term investors, we’re comfortable to forego some of this dividend if the capital can be better utilized when retained by the company.

Funding Capex Spend

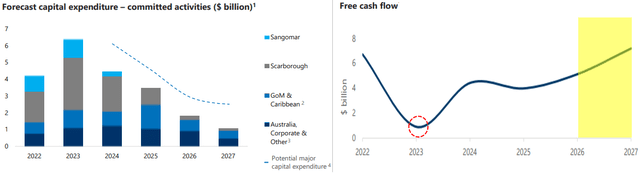

In the recent releases, Woodside management have affirmed 2023 full-year capital expenditure guidance in the range of US$6.0-6.5bn. The bulk of the spend is allocated to the Sangomar project (~20%) slated to go-live late 2023, and Scarborough (~50%), scheduled for first delivery in 2027.

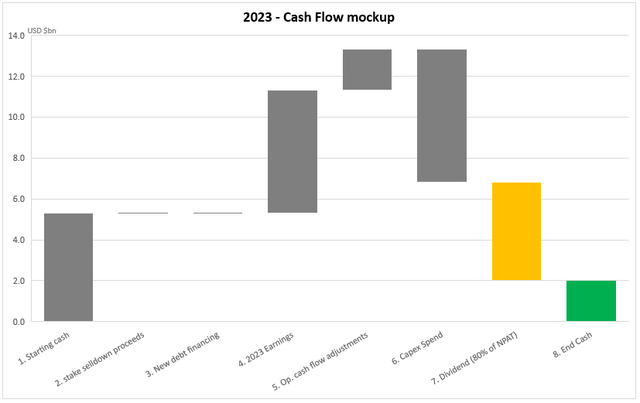

The dilemma we see is the source of funding of next year’s capex. Currently, (October 2021) the company has $5.3bn in cash on hand. We forecast the company generating around $8bn of operating cash flow (and $6bn earnings) next year. If we assumed that management maintains 80% dividend payout ratio, we calculate that the cash position at year-end to more than halve to $2.0bn. We can illustrate this through the waterfall diagram below:

Based on the latest released information, assuming no additional cash inflows aside from existing operations, a dividend payout ratio of 80% would leave an uncomfortable amount of cash left for Woodside. (Woodforde Investments)

$2.0bn in cash is not immaterial, but we note that relative to the other (capital and shareholder return) expenditure incurred, it doesn’t leave a lot of wiggle room for contingencies. We see 3 avenues to free up additional capital if required, and we assess their merits and likelihood below:

Sell down of stake: We noted last time that Woodside were soliciting offers for part-ownership of Scarborough, after aborting plans for Sangomar. We interpret the relative silence from management during recent communications that a deal is not imminent, and therefore, we don’t imminently expect proceeds from a sale to contribute to cash flow.

Debt Financing: The company has $4.1bn in undrawn loan facilities if required. However, management have repetitively stated its preference to protect its investment grade credit rating through a healthy balance sheet. We, therefore, see it unlikely that a significant amount from this facility will be tapped, especially at this juncture in the rate tightening cycle when interest rates are higher.

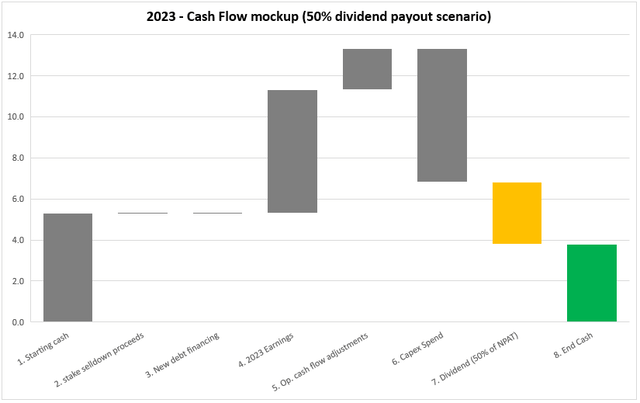

Dividend Payout: Woodside officially states its dividend policy is to pay out 50-80% of net profits as dividends, but its recent record of consistently return closer to 80% has seemingly embedded expectations of payouts at the higher end as the norm. However, if we modelled our cash flow waterfall with 50% earnings returned as dividends, we see that Woodside’s balance sheet would end up in a much healthier position, with end cash balance around $3.8bn.

Woodside’s cash position would look much healthier if it decreased dividend payouts to the bottom of its guidance, however, this may prove unpopular with some shareholders. (Woodforde Investments)

Much Ado About Nothing?

The potential bottleneck regarding sufficient cash to achieve all the company’s goal appears to be strictly a 2023 item. In presentation resources, management indicated that the capex for 2024 and beyond is expected to incrementally decrease, meaning that if Woodside can seamlessly navigate 2023, then things should be much smoother on the other side. The company modelled such an outcome when projecting the free cash flow for the next 5 years.

Management indicates any cash flow crunch to be isolated to 2023 (although they forecast positive free cash flow for the year). As long-term investors we’re more excited about what lies ahead in 2026 and beyond. (company presentation)

If the modelling is to be believed, then the “worst-case scenario” of only $2bn in cash at year-end 2023 may not be as perilous as we make it out to be. Alternatively, management could elect to adopt a hybrid approach, for example slightly decreasing dividends (say to 70-75% payout) and borrowing a small amount, sufficient just to make ends meet.

What it Means for Investors

Ultimately, we think that current investors should be excited about the potential cash flow and profit generation once Scarborough goes into production in 2027. In the meantime, it would be highly desirable for investors to continue to reap the benefits of 80% of profits returned as dividends. This upside-bias explains the seemingly high P/E multiple at which Woodside stock trades at.

However, we sense that for some of the current investor base, the current high dividend payout is the primary reason for their investment. We heard persistent questioning from analysts about management’s commitment to maintaining dividends, which were repeatedly stubbornly responded to with the “minimum payout ratio of 50% NPAT” rhetoric. We also note that, subsequent to the recent investor releases, the perception that perhaps shareholder returns were at risk resulted in the share price dropping by a couple of percentage points of separate occasions, and downgrades from a handful of analysts. We stand by our initial intuition that a move away from 80% earnings as dividends, however transient or substantial it could be, may trigger further tremors downwards in the stock price.

The recent downturn (orange circled) at first glance does not feel substantial, however, noticeably bucked the trend when the market rallied on stronger energy prices and positive sentiment. We attribute this to investor concerns regarding 2023 cash flows. (Interactive Brokers)

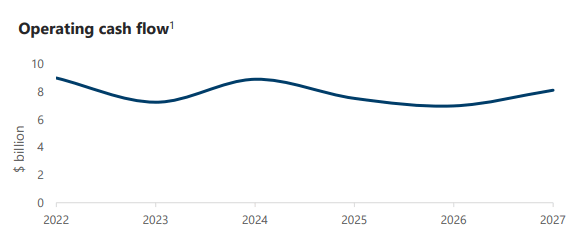

We also wish to highlight management’s projection of operating cash flow for the next 5 years, which perhaps bizarrely shows it to be broadly flat. This can be rationalized when we see that this is modelled using a downward sloping Brent oil forward curve, which prices in 2027 delivery at $70/barrel. Our main takeaway from this depiction though is that without a significant uplift in oil prices at current elevated levels, net profit as it relates to operating cash flow looks range-bound between US$5-7bn/year. Reverse-engineering this leads us to continued dividends of US$2.40-3.00/share (assuming 80% payout), and if the stock maintains its yield of 10% then we don’t see the stock price exceeding US$30 or A$45 in the next few years.

Management’s modelling of the next 5 years’ operating cash flows. Whilst we disagree with the energy price assumptions used, broadly speaking flattish operating cash flows means flattish P&L, and flattish P&L means flattish dividends at best. (company presentation)

In summary, we see stock price appreciation limited to approximately 25% higher than current levels. Conversely, we think that it’s more likely the uncertainty around the future of dividend payouts could drag the stock price down.

Final Thoughts

With the above in mind, in addition to the associated volatility of investing in a company operating in energy markets, we are confident that drops in the stock prices from current levels will occur.

We like the fundamentals of Woodside and think it has great potential, specifically once Scarborough commences production in 2027. Therefore, we see the current situation as an opportunity, happy to bide our time in hope of the stock falling below a 6x multiple. We’d definitely be interested to add to our portfolio should the stock drop to A$25 and fundamentals remain in tack.

As an existing Woodside investor, and overweight on the energy sector, we’ve looked to reinvest dividends into other hydrocarbon producers. Despite high energy prices being a tide that rises all energy stocks, we have found vast disparity in the shareholder return propositions, valuations and operating geographies for many of them, and have settled on a “diversification” approach which works for us. Admittedly, we would rotate into more Woodside stock if the price was more appealing, but for now we think this approach allows us to hedge any capital gains we may have foregone by not adding Woodside exposure.

We look to re-assess our stance again when full year results are announced and dividends declared in the new year.

(AUDUSD=0.68 assumed in analysis)

(Reporting currency of Woodside is USD, however, we reference ASX-listed WDS in our analysis which is quoted in AUD.)

Be the first to comment