Torsten Asmus

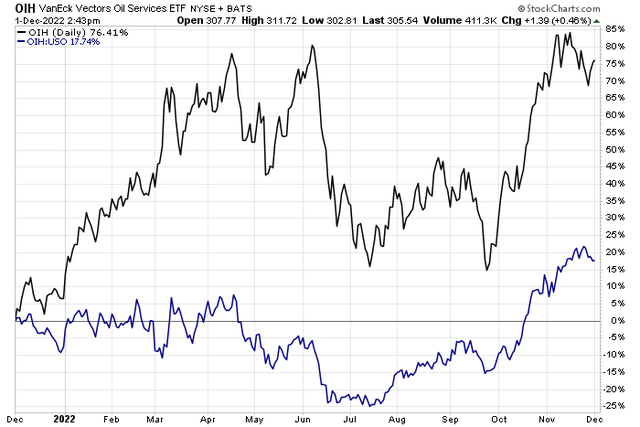

Oil services stocks have crushed the S&P 500 this year. A chart making the rounds lately has been the Energy sector’s big outperformance against the underlying commodity – oil. While giving back some relative gains in the last several days, I see the trend generally continuing as energy equities remain cheap, but the risk is recessionary fears could bring down oil and gas names with high operating leverage.

Let’s weigh the situation with one domestic oil equipment name that is having a great year.

Oil Services Stocks Pulling Back Within An Uptrend, Outpacing Oil ETF

Stockcharts.com

According to Bank of America Global Research, NexTier Oilfield Solutions (NYSE:NEX) is the third largest provider of U.S. land completion services, including 2.5 million hydraulic horsepower and other services. Founded in 1973 as Keane Group Inc., the company was renamed NexTier Oilfield Solutions through the merger with C&J Energy Services, Inc. in October 2019.

The Texas-based $2.5 billion market cap Energy Equipment & Services industry company within the Energy sector trades at a somewhat low 13.0 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

The oil services name reported a Q3 earnings beat back on October 25, but the firm missed on top-line estimates. Earlier this year, the management team was on the hunt for an acquisition and bought Continental Intermodal in a cash and stock deal. With a stock buyback plan in place after the October report, shareholder accretive activities may be on the way through 2023. On the earnings call, the company said it expects to have at least $225 million of free cash flow this year, but high capex partially offsets that strong cash generation.

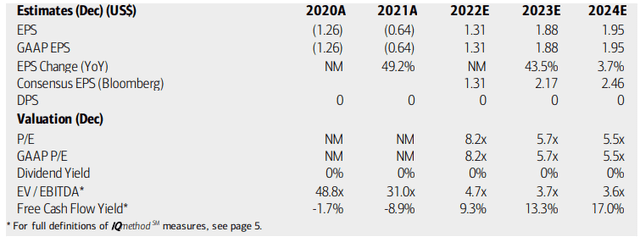

On valuation, analysts at BofA see NEX earnings turning sharply into the black for FY 2022. Per-share profits are then expected to rise big next year with moderation in 2024. The Bloomberg consensus forecast is even more optimistic than what BofA expects.

So, using forward numbers, both NexTier’s operating and GAAP P/E retreat to very attractive levels in the single digits. Moreover, its EV/EBITDA multiple is exceptionally low while NEX’s free cash flow yield grows big. Overall, the earnings and free cash flow situations make me like the valuation despite Seeking Alpha’s soft C+ rating.

NexTier: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

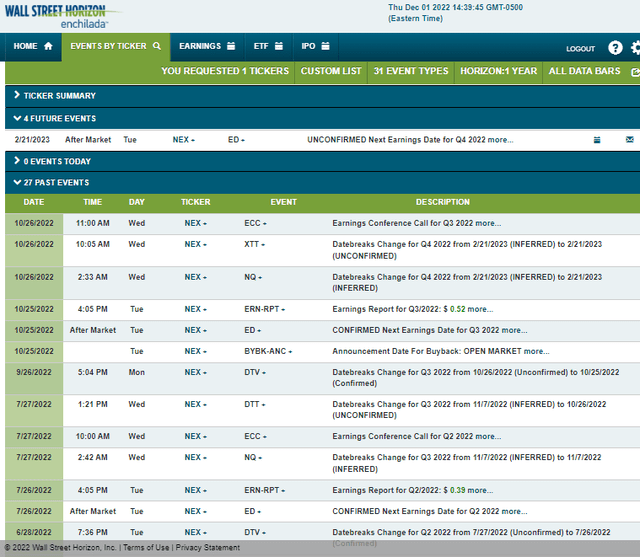

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Tuesday, February 21. The calendar is light of volatility catalysts until then, however.

Corporate Event Calendar

Wall Street Horizon

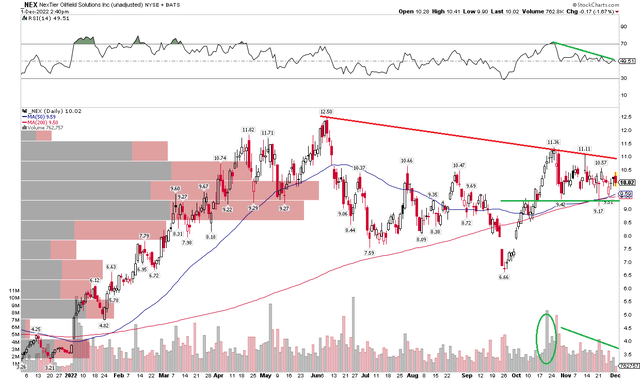

The Technical Take

NEX is consolidating in a modified and extended bull flag or simple coil pattern. Notice in the chart below how there’s a downtrend resistance line that has met with selling pressure in the last month and a half. There’s downside support, though at NEX’s rising 50-day and 200-day moving averages in the $9 to $9.50 zone.

As we wait for a bullish breakout above the $11 to $12 resistance range, notice how the RSI at the top of the chart is gradually trending lower while volume beneath the price chart is moving lower in the current share price consolidation. These are hallmarks of a bullish continuation/corrective pattern. Before this trend, volume surged in an upward share price thrust.

Putting it all together, I see a bullish setup in the making, but shares look vulnerable under $9 with an old gap under $7.50.

NEX: Bullish Consolidation – Watch $11 to $12 For A Breakout

Wall Street Horizon

The Bottom Line

NexTier’s free cash flow generation, new share repurchase program, and growing bottom line make me fundamentally bullish from a value standpoint. The chart has some work to do in order to prove a resumption in the stock’s uptrend. Tactical traders should monitor the $11 to $12 range.

Be the first to comment