GoodLifeStudio

It’s time for growth stocks to step back into the limelight again. As fears of an overly hawkish Fed subside and turbocharge a recovery rally, it’s a great time for investors to examine the tech stocks that have been beaten down this year despite continued strong fundamentals.

Upwork (NASDAQ:UPWK), in particular, is one interesting company to watch. This stock has been rebounding earlier than most other names, hitting its low point of the year in May and rising sharply since. A series of consecutive earnings beats have helped restore sentiment on the name, and I think there’s far more upside left.

Year to date, shares of Upwork have lost 30% of their value – a bigger loss than the S&P 500, but more benign than most other tech stocks. There’s still a great opportunity, in my view, for investors to buy Upwork now and capture additional upside.

I remain bullish on Upwork. Since I last wrote on the stock in early June, shares have jumped an additional ~20%, but I also think the strong results in Q2, plus the fact that Upwork still trades at a reasonable valuation, leaves plenty of room for upside.

For investors who are newer to this name, Upwork is essentially a freelance work site that lets buyers hire gig workers for various jobs. Though it initially started out as a P2P marketplace for simpler jobs such as copywriting and logo design, Upwork spent the last few years (specifically during the pandemic) pivoting into a more robust enterprise offering. Still today, enterprise represents less than 10% of Upwork’s revenue and is a vast market for expansion, especially with the company’s established partnerships with giants like Microsoft (MSFT).

Here is a full rundown of the reasons to be bullish on Upwork:

- Workers have the upper hand and remote work is winning out. There’s a global shortage of everything right now, including and especially talent. In the drive to keep up with massive consumer demand and heightened business activity, more and more employers are rethinking their traditional workforce and replacing permanent, in-office positions with a number of non-standard arrangements, including remote work, contract positions, gig-based work, and the like. This is Upwork’s bread and butter and the space it’s excelled in since its founding. Upwork estimates its long-term market opportunity at $1.3 trillion in gross services volume (GSV).

- Backdrop for freelancers has never been more optimal. Upwork notes that 10 million Americans are currently considering leaving their jobs while half of “Generation Z” is also choosing to start off their careers as independent freelancers.

- Enterprise push. Before the pandemic, Upwork was largely a “retail” site. Gig seekers would use the site to find small, one-time jobs. But more and more, Upwork is evolving into an enterprise platform. Companies as large as Microsoft (NASDAQ:MSFT) have used the platform to drive their contract hires.

- Sales expansion. Following alongside this newfound enterprise orientation, Upwork aggressively expanded its sales team in the third and fourth quarters of FY21, while also boosting its marketing budget to increase unaided brand awareness, which should start bringing us tangible revenue benefits in FY22. Again, Upwork is a late bloomer here, but it’s fully capitalizing on heightened demand for its services to chase growth in a very intentional way.

Even after running higher in June and July, I continue to believe Upwork trades at a very attractive valuation. At current share prices near $23, Upwork trades at a market cap of $3.0 billion. After we net off the $667.6 million of cash and $562.8 million of debt on Upwork’s most recent balance sheet, the company’s resulting enterprise value is $2.89 billion.

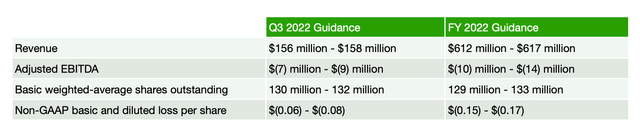

Meanwhile, for the current fiscal year, Upwork has guided to $612-$617 million in revenue, representing 22-23% y/y growth.

Upwork guidance (Upwork Q2 shareholder letter)

Against this revenue estimate, Upwork trades at just 4.7x EV/FY22 revenue – which is quite a reasonable multiple for a company currently growing revenue in the mid/high-20s.

The bottom line here: Upwork is a fantastic company with secular growth drivers as well as name-brand recognition in the freelance work segment. With fears of a Russia-driven slowdown behind us and proof that Upwork can continue to expand its business in the post-pandemic environment, investors should take the chance to buy the stock and continue to ride the upward rebound.

Q2 download

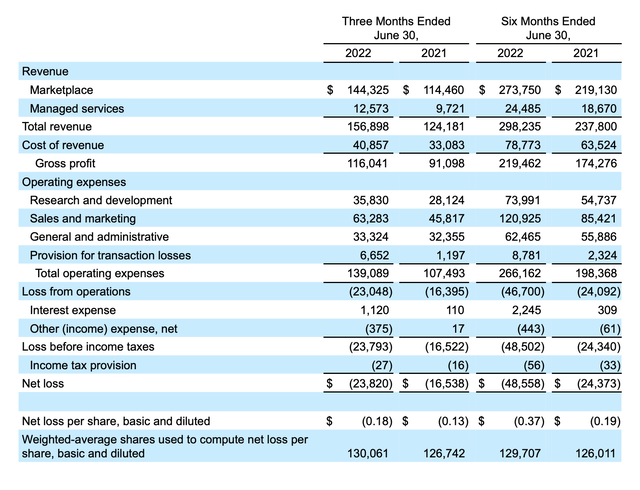

Let’s now go through Upwork’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Upwork Q2 results (Upwork Q2 shareholder letter)

Upwork’s Q2 revenue grew 26% y/y to $156.9 million, handily beating Wall Street’s expectations of $147.8 million (+19% y/y) by a massive seven-point margin. Revenue growth also accelerated two points versus 24% y/y growth in Q1.

The company has made a lot of tweaks and additions to its platform in recent quarters to fuel growth. Starting in April, the company rolled out its new Client Marketplace Plan, which simplified and combined the Basic and Plus subscription plans into a single offering and has seen strong traction with customers. It also updated its pricing structure to make more features available to more customers at all price points. It also doubled down on a new offering called Consultations that it added in Q1, which helps clients engage with an expert before beginning a large project (the company reported that customers using this feature have a time-to-hire of just 1.5 days from the initial consultation, 50% lower than other Marketplace transactions).

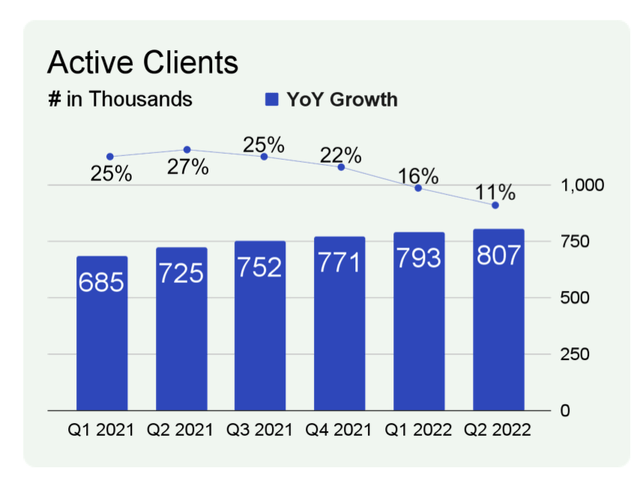

The number of active clients on the platform rose 11% y/y to 807k. Upwork noted that client growth will slow in the back half of 2022, but we do have to remember as well that the company’s focus as of late is enterprise, and so while overall customer growth is slowing, enterprise revenue and clients are growing 45% y/y and 24% y/y, respectively.

Upwork client count (Upwork Q2 shareholder letter)

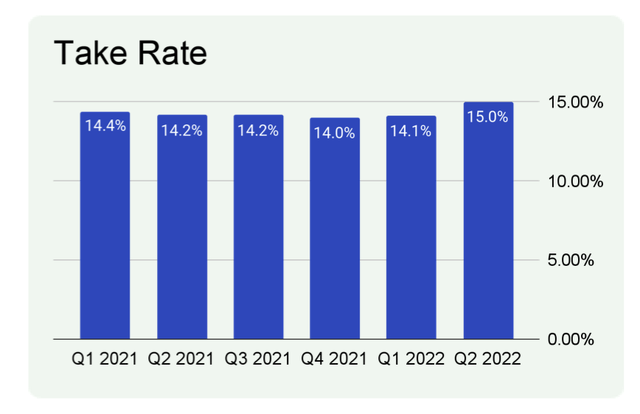

Another big highlight: as shown in the chart below, Upwork’s take rate (a measure of how much revenue it earns as a proportion of marketplace transaction value) rose to a record high of 15.0%, up 80bps y/y and driven by the higher-value new Client Marketplace Plan.

Upwork take rate (Upwork Q2 shareholder letter)

Here’s some qualitative commentary from CEO Hayden Brown on the company’s sales productivity and hiring progress, made during her prepared remarks on the Q2 earnings call:

Our sales team achieved their deals per rep productivity targets. And we’ve maintained our hiring pace to stay on track to double the land team by the end of this year. We continue to focus on building Upwork into the household name in our space, investing with discipline, and a focus on measurability and brand awareness. Many large recognizable companies, such as Asurion, Fanatics, Newsweek, Payoneer, Pearson and ServiceNow signed on as new enterprise plan customers in the second quarter turning to Upwork as a high trust, high quality destination for remote work and specialized talent at scale.”

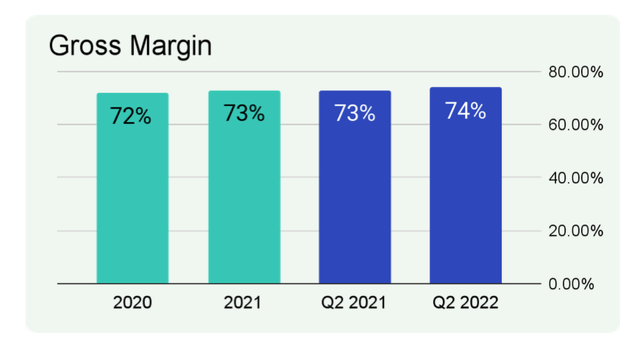

One final highlight: we note that pro forma gross margins ticked up one point to 74%, driven by the improvement in take rates. Though increases in sales and marketing to drive growth have pushed Upwork’s adjusted EBITDA margins slightly negative, I remain confident that Upwork’s high gross margins give it plenty of flexibility to scale as it grows larger.

Upwork margin trends (Upwork Q2 shareholder letter)

Key takeaways

Though not a very well-known small/mid-cap tech stock, I’d encourage investors not to ignore Upwork as it continues to lean into its recent rebound rally. Upwork is a great example of a “growth at a reasonable price” stock, which will be a successful trade as we head into a recovery.

Be the first to comment