PeskyMonkey/iStock Editorial via Getty Images

Introduction

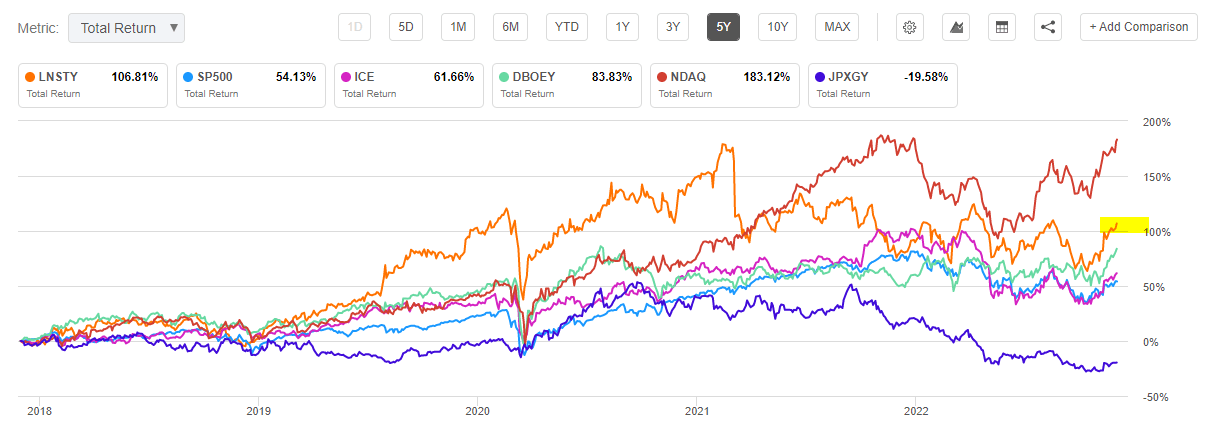

The London Stock Exchange Group (OTCPK:LNSTY) is the holding company of the various UK stock exchanges and trading companies, with a recent purchase of Refinitiv significantly increasing their data and analytics exposure. Thanks to post-Brexit trading and the increase in higher margin services, the LSE has performed quite well over the past five years. This is even despite the fact that PM Johnson’s tenure and subsequent volatility in 2021 and 2022 has led to a significant decline over the past year or so.

Seeking Alpha

Now that PM Sunak – a seasoned financial industry player- is in power, the UK markets are expected to stabilize thanks to an economy-focused administration. While still in the early stages with full budget and macro policies yet to be released, the LSE has already started to rebound over the past three months. This even includes bucking the forex headwinds that are currently facing European currencies as the dollar remains at decade highs. As reported by the BBC two weeks ago:

Speaking to reporters on a plane to the G20 summit in Indonesia – his second foreign trip as PM – Mr Sunak said “financial conditions in the UK have stabilised, clearly”.

He said to maintain that stability, “delivering on the expectations of international markets” and making sure “our fiscal position is on a more sustainable trajectory” were crucial.

“And that’s what we will do,” in the autumn statement, he said.

Speaking in Indonesia, Mr Sunak said the “decisions we make will have fairness and compassion at their heart”, and reiterated that “stability has returned” to the UK.

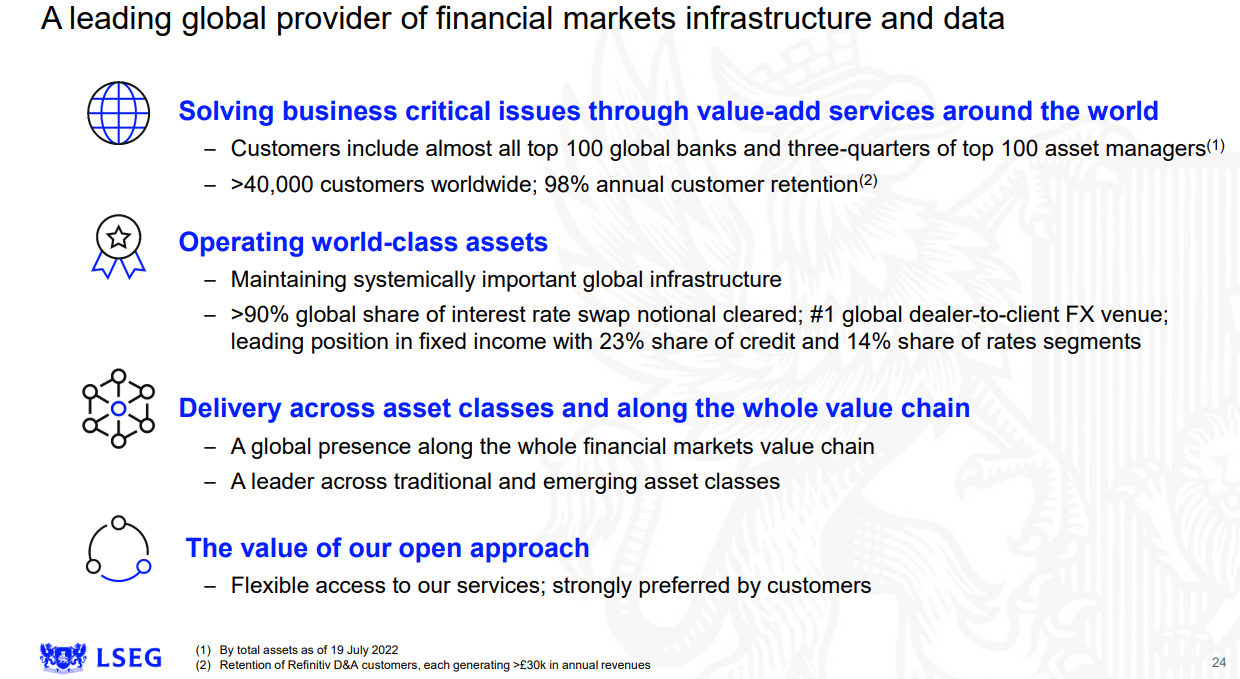

So, with the markets set to stabilize and with a more reasonable leader in charge, I expect that London Exchange will be seeing steady trading volume, and rising payments for services over time. This includes subscription-based payment systems, and according to the group, “almost all top 100 global banks and three-quarters of top 100 asset managers” access value-added data and infrastructure.

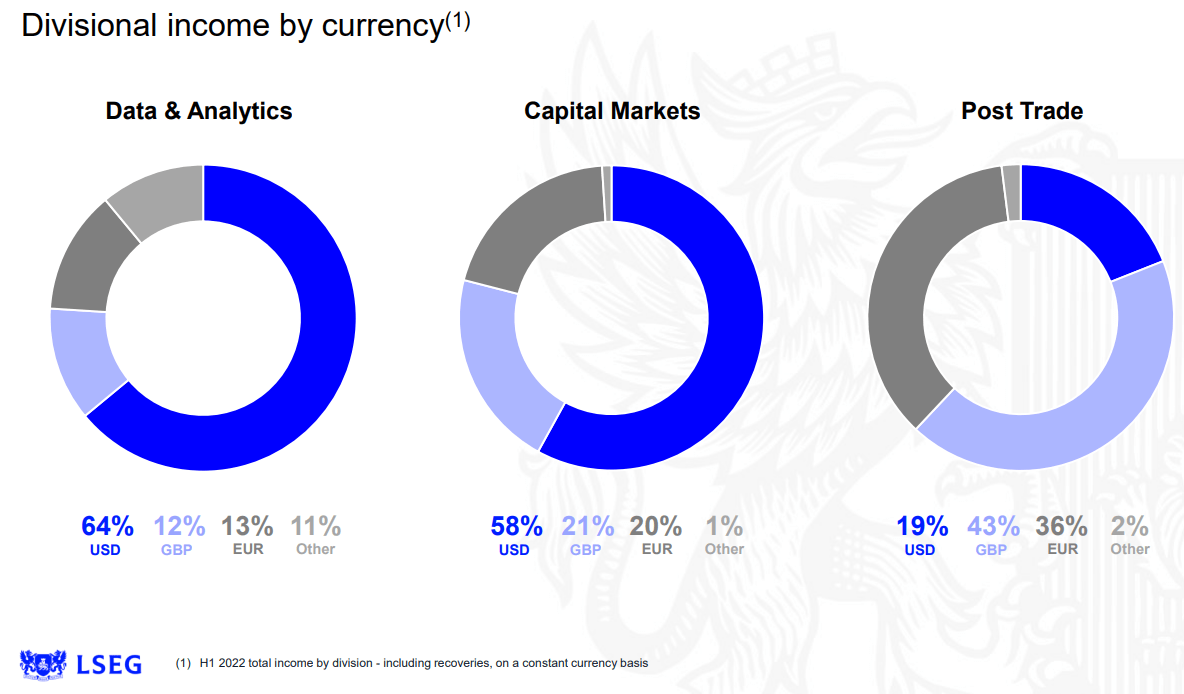

Resources are also not limited to just stock market listings, and the firm has a gamut of assets around the entire global financial market allowing for plenty of diversification and risk reduction. Investors can also rely on tailwinds such as volatile markets, rising interest rates, and positive foreign exchanges rates as factors to boost performance above expectations over the coming quarters.

LSEG Presentation LSEG Presentation

Financials

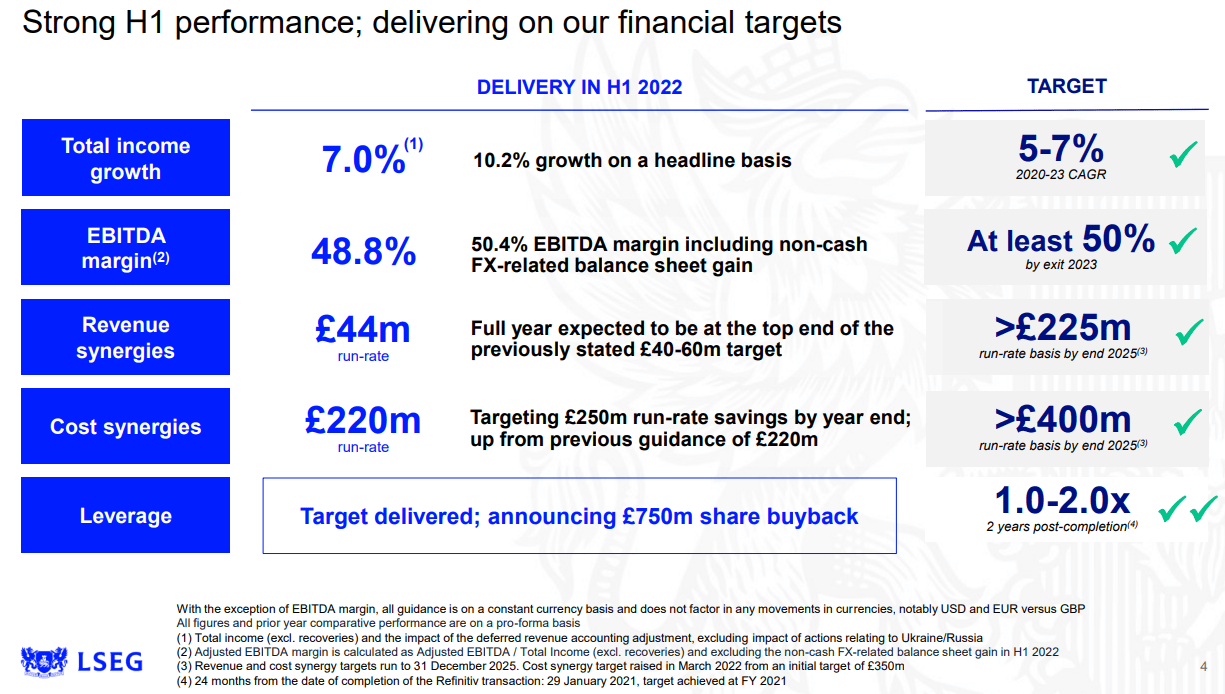

Despite the macroeconomic volatility due to the frequent change of leadership in the UK over the past year, LSE’s underlying financial performance has remained strong. In fact, financial targets set out in 2020 for 2023 have already been met, as shown in the image below. With their success, investors can look forward to good things to come and I will discuss the main catalysts throughout the article.

LSEG Presentation

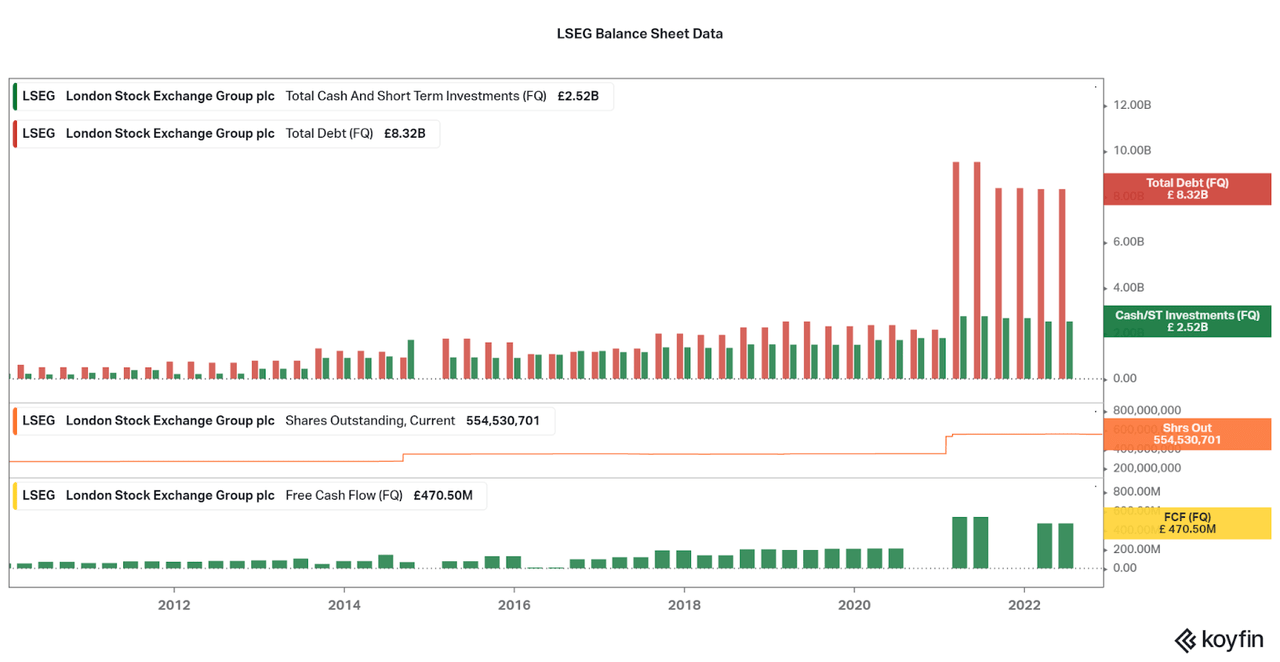

With the Refinitiv acquisition back in 2021 already providing some synergies, it is clear that LSEG will see strong profitability in the coming years at a fairly steady clip. I expect that earnings will grow at about double the rate of revenues, so approximately 12-14% annualized. This expectation is important for the purpose of reducing the current debt load that resulted from the acquisition.

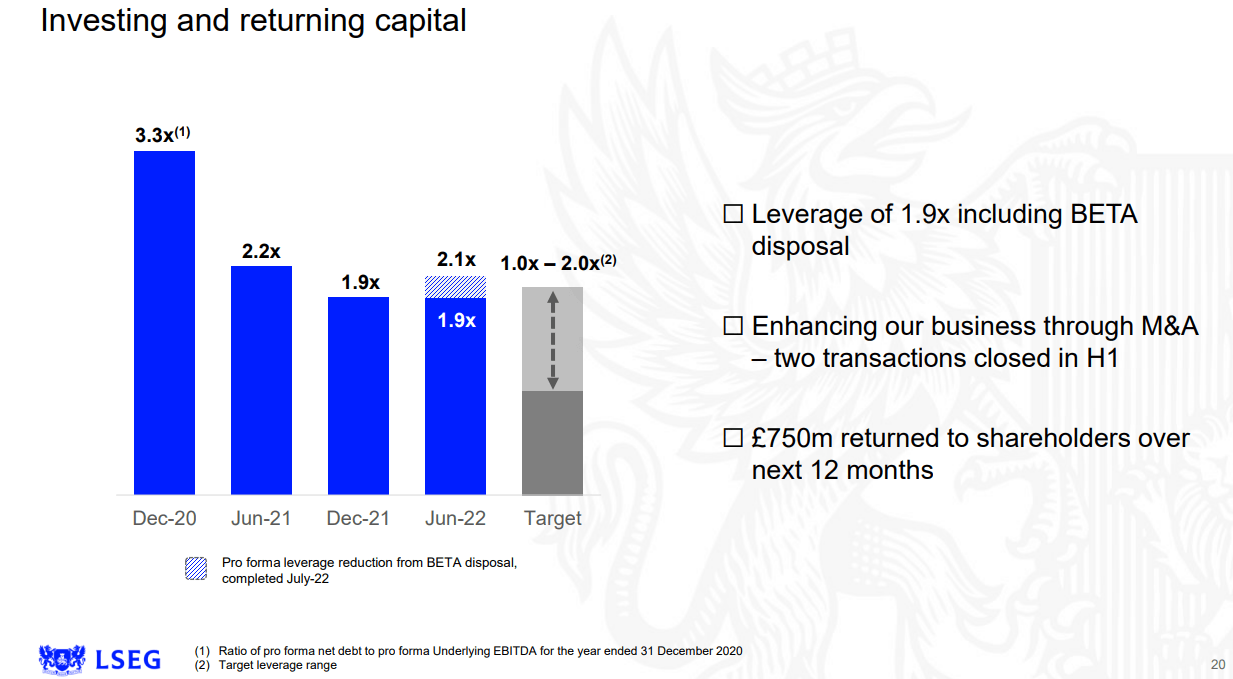

While leverage remains low at 1.9x (on a net debt to EBITDA basis), the company is aiming for a 1.0x level that would be more favorable to a low-risk investment. Considering the transformative nature of the Refinitiv acquisition, I do not expect additional major M&A in the future (there have been some bolt-on acquisitions), and instead, investments will go into improving services on the new joint platform. Then, the resulting earnings growth will provide cash flows to reduce both the large amounts of shares outstanding, and increase the paltry sub-1% dividend.

Koyfin LSEG Presentation

Valuation

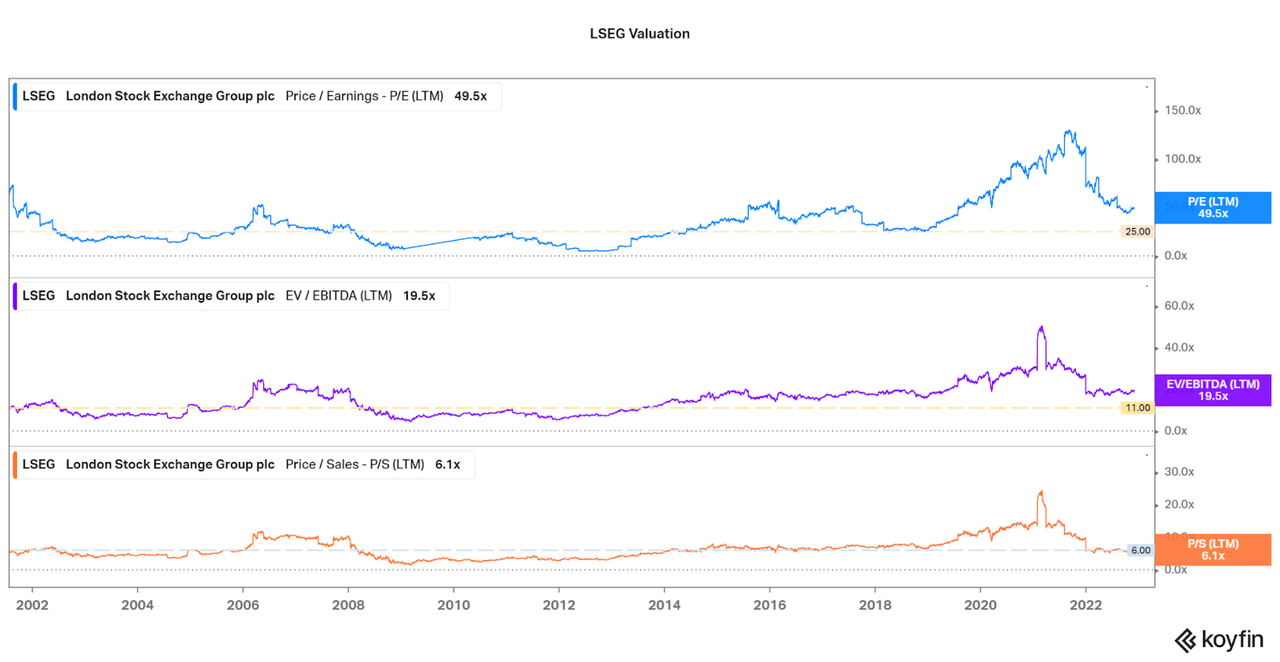

As a result of the prior few years of volatility, LSEG has fallen from overvalued levels. Now, the valuation has seemed to bottom out to a new area of support that remains above historical levels across the P/E, EV/EBITDA, and P/S. However, when considering the new high margin services, inherent rise in profitability, and economic outlook that supports continued high volumes of trading and research, I find that I believe the market support of the current valuation to be worthwhile.

Therefore, I believe now is a good time to begin loading up on shares on a recurring basis. In fact, I believe LSEG is non-volatile enough to support long-term accumulation on a regular basis without regard to the current valuation. With earnings growth expected to remain above 10%, total returns moving forward should continue to beat the broader market. If the bear cycle does continue, I would believe that a worthy turnaround point would be at the valuations listed on the chart below and large buys could be made then. In fact, with the next semi-annual reporting due early next year, strong results may lead to these valuation goals being met.

Koyfin

Conclusion

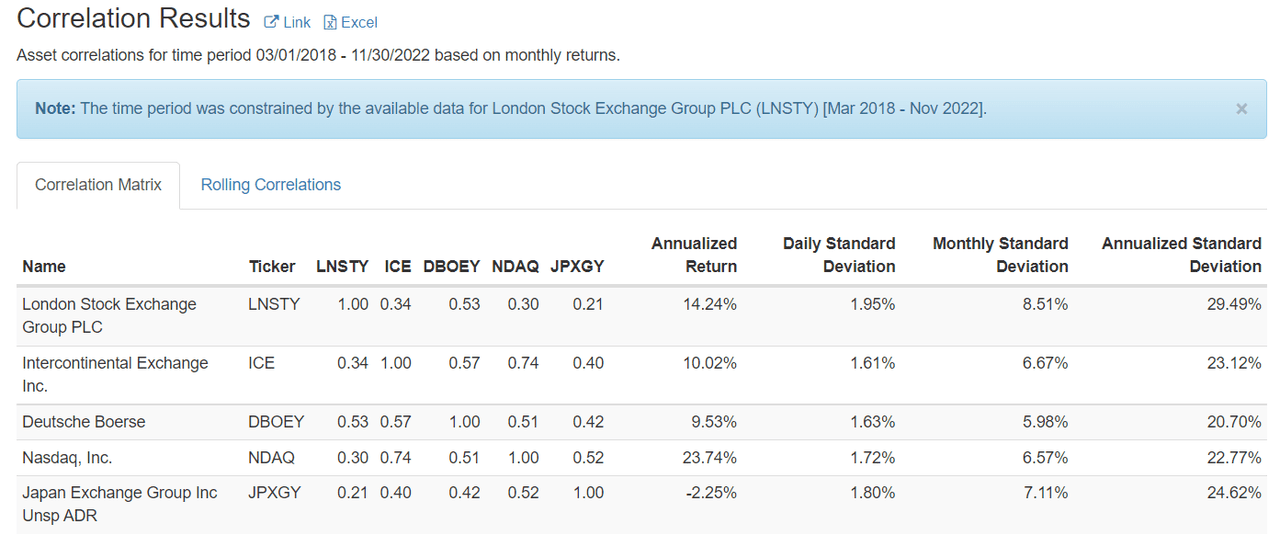

I believe that the London Stock Exchange Group looks to be the most exciting and profitable long-term capital markets play for investors. The multiple tailwinds of a successful Refinitiv acquisition, rising high margin services, and economic outlook under Sunakonomics all allow LSEG to have slight advantages over peers, especially European ones such as the Deutsche Borse (OTCPK:DBOEY). If anything, I believe the investment can be paired with another non-European exchange such as the Nasdaq (NDAQ), Intercontinental Exchange (ICE), or Japan Exchange Group (OTCPK:JPXGY), all of which offer limited correlation due to the different exposures.

Portfolio Visualizer

All-in-all, the entire sector offers fairly solid returns compared to the broader financial industry, and I believe nearly all investors would benefit from a holding. As long as you or your fellow populations continue to invest, exchanges will continue to see rising earnings and growth. Then LSEG also has the additional benefit of significant exposure to high value-added services to gain profitable subscription revenues. I hope this article summarizes the opportunity well, but please feel free to share your thoughts below.

Thanks for reading.

Be the first to comment