marchmeena29/iStock via Getty Images

There are few sectors more in need of disruption than banks, with their expensive fees, slow operations, unfriendly customer experience, and opaque costs. Fortunately, there are a few startups working hard to fix that, such as Wise plc (OTCPK:WPLCF).

Wise started by specializing on improving international money transfers, but is increasingly adding more banking functionality at very low costs, and with a great user experience. International money transfers by itself is a huge market, with more than 280 million immigrants, and businesses that export ~$18 trillion globally, there are a lot of potential customers for the company.

Technology And Product

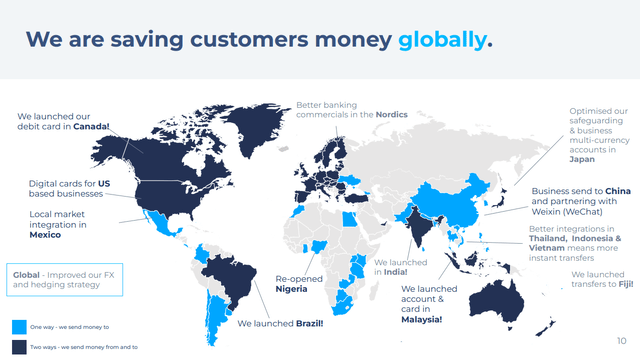

Wise is working hard to create the world’s most international bank account for people and businesses. Currently customers can transfer money to a large and increasing number of countries, including most of Europe and North America, for very low fees.

Some interesting facts about Wise are that it has more than 13 million customers around the world, it sports a Net Promoter Score of 71, which is remarkably high, and ~66% of its customers join through word of mouth. Its three main businesses are the Personal Wise account, the Business Wise account, and the Wise Platform that allows other businesses to operate within the Wise network and gain some of its functionality.

Financials

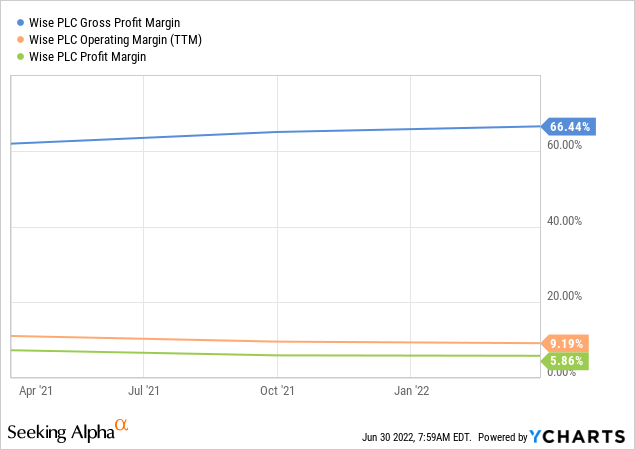

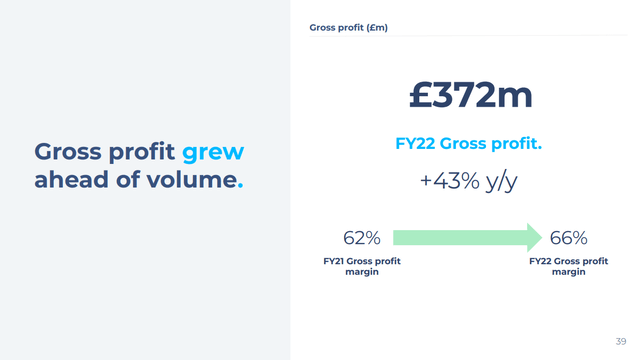

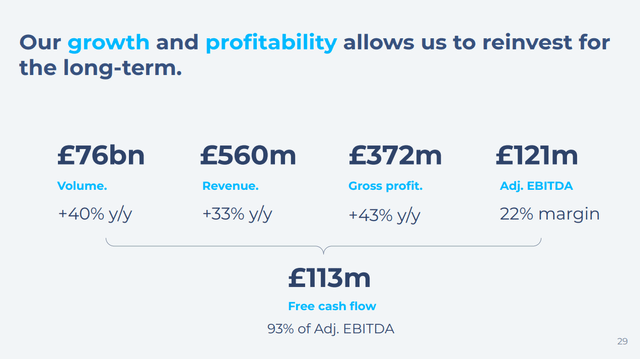

As we write this article, Wise is valued in the market at ~£3 billion, which is roughly $3.65 billion dollars. This is an elevated market cap, but as we’ll see, it is supported by a very promising and fast growing business. Wise’s gross profit margins are high and growing, currently ~66%, and it is already profitable, with an operating margin of ~9%, and a net profit margin of ~5.8%. It is remarkable that the company has already attained real profitability while still managing to grow at an incredible speed.

The company is demonstrating operating leverage, with gross profit growing faster than volume, at a remarkable 43% year over year. Gross profit for FY22 was £372m, which puts the market cap to gross profit ratio at ~8x.

Growth

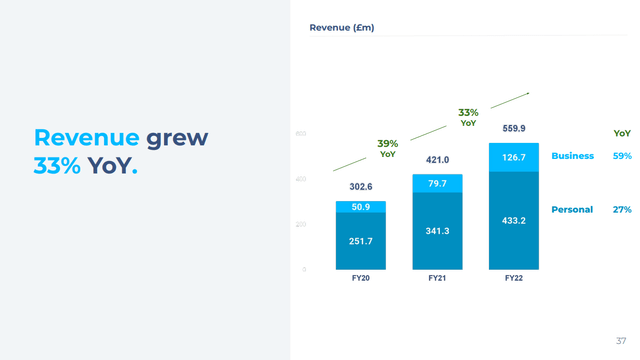

As we mentioned, the company is growing very quickly. Revenue grew 33% year over year. The more mature personal business grew at 27%, while the newer business segment grew at a spectacular 59%.

Revenue growth was well distributed geographically, with the UK still growing a 30% year over year, North America at 30% as well, Europe at 36%, Asia Pacific at 40%, and the rest of the world at 18%.

Wise’s Valuation

Valuing a young fast-growing company is usually more difficult compared to valuing more established corporations, so we’ll have to make some assumptions to estimate an intrinsic value per share. Fortunately the company is already profitable, and its growth rate appears sustainable, at least for a few more years, given the enormous size of the opportunity it is going after. Below are some of its key financial metrics. This is a business that is currently being valued by the market at around £3 billion, it is therefore trading at less than 30x free cash flow, which some might find cheap given how fast it’s growing.

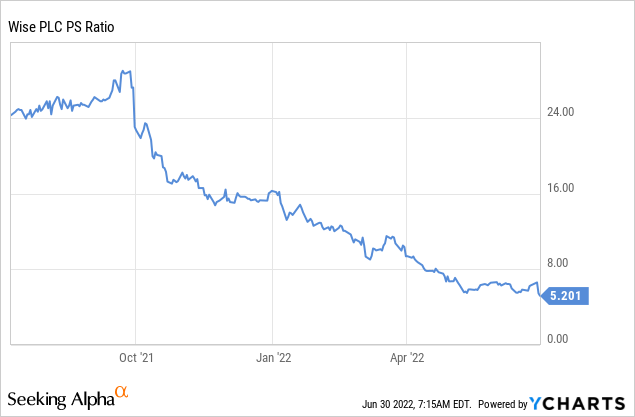

Wise is trading at ~5.2x revenue, after having started at more than 24x. A combination of revenue growth, and share price decline have brought the multiple down significantly.

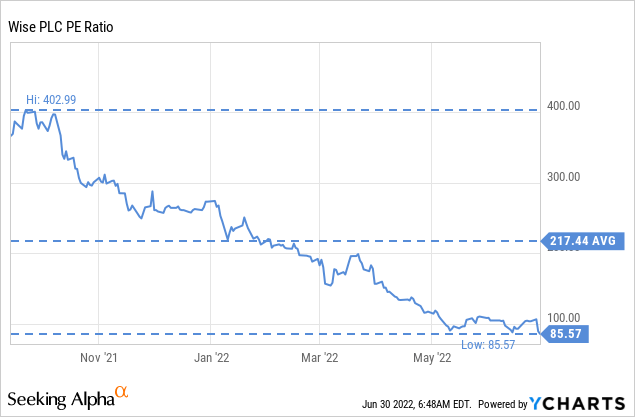

Shares are trading at a price/earnings ratio of ~85x, which might seem incredibly high, but the company is expected to grow earnings at a very fast rate for many years.

To estimate the net present value of the future earnings we created a simple model that assumes earnings will grow at 30% per year for the next decade (in line with its current revenue growth rate, and not assuming any operating leverage), and that the company then grows at a GDP-like growth rate of 3.5%. We discount everything using a 10% rate, and the NPV per share that we get is $4.04. That is a little higher than where shares are currently trading by about 15%, so we therefore believe shares are somewhat undervalued. If the company can grow at 30%+ for more than a decade, then shares could be significantly undervalued. The big question when valuing Wise is for how long can it sustain ~30% growth. Given the size of the opportunity, we believe it can do so for many years.

| EPS | Discounted @ 10% | |

| FY 22E | 0.04 | 0.04 |

| FY 23E | 0.06 | 0.05 |

| FY 24E | 0.07 | 0.05 |

| FY 25E | 0.09 | 0.06 |

| FY 26E | 0.12 | 0.08 |

| FY 27E | 0.16 | 0.09 |

| FY 28E | 0.21 | 0.11 |

| FY 29E | 0.27 | 0.13 |

| FY 30E | 0.35 | 0.15 |

| FY 31E | 0.46 | 0.18 |

| FY 32 E | 0.59 | 0.21 |

| Terminal Value @ 3.5% terminal growth | 9.12 | 2.91 |

| NPV | $4.04 |

Risks

The most important risk with an investment in Wise, we believe, is if the company’s growth decelerates. There is currently a good amount of growth assumed in the share price, and if growth goes down significantly shares could decline by a large amount. While the opportunity to disrupt traditional banks is very large, there are a number of competitors trying to do the same thing, and this could result in lower growth rates for all of them especially if the number of competitors increases.

Conclusion

Wise is going after the massive opportunity of disrupting traditional banking. It started with international transfers, but is now going after other banking products. Wise has managed to grow at an impressive speed, with revenue currently growing at a ~30% rate. We believe that given the quality of its products, the high level of customer satisfaction, and the size of the opportunity it is going after, that it can maintain a high rate of growth for several more years. We believe shares are currently somewhere between fairly valued to somewhat undervalued, if the company can grow earnings at ~30% per year for a decade.

Be the first to comment