Explora_2005/iStock via Getty Images

Simon Property Group, Inc. (NYSE:SPG) has continued to fall in the last few weeks and is now already trading 43% below the previous temporary high (and as the stock did not manage to come even close to the all-time highs set in 2016, it is also 59% below its all-time highs). Simon Property Group is on the list of stocks to avoid according to Wells Fargo (WFC), and according to Seeking Alpha Quant it is also at a high risk of performing badly. On the other hand, most Seeking Alpha contributors are rather bullish, and in the following article, I will also argue why Simon Property Group seems like a good investment at current prices.

Solid Quarterly Results

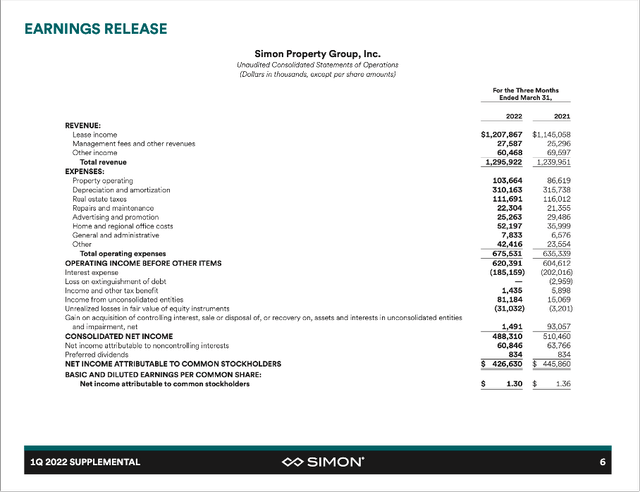

When looking at the last quarterly results – for the first quarter of fiscal 2022 – the stock price decline does not seem justified, as Simon Property Group is still reporting good results and growing with a solid pace. Revenue increased 4.5% year-over-year from $1,240 million in the same quarter last year to $1,296 million in this quarter. Operating income also increased from $605 million in Q1/21 to $620 million in Q1/22 – resulting in 2.5% YoY growth. Only net income per share declined a bit (4.4% YoY decline) from $1.36 last year to $1.30 this quarter.

Simon Property Group Q1/22 Supplemental Material

However, in case of Simon Property Group, we should not focus so much on net income but rather on funds from operations and FFO per share increased from $2.48 in Q1/21 to $2.78 in Q1/22 – resulting in 12.1% YoY growth.

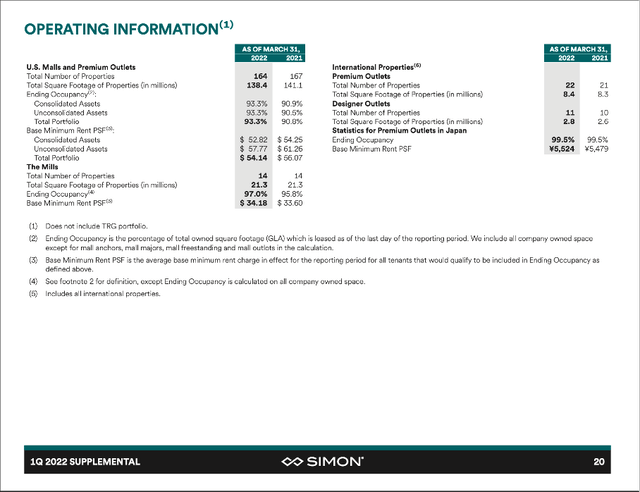

When looking at U.S. Malls and Premium Outlets, the base minimum rent per square foot declined from $56.07 on March 31, 2021, to $54.14 on March 31, 2022, but the occupancy rate increased from 90.8% to 93.3% in the same timeframe. Occupancy rate for “The Mills” also increased from 95.8% to 97.0% with the base minimum rent per square foot increasing from $33.60 to $34.18.

Simon Property Group Q1/22 Supplemental Material

During the first quarter earnings call, CEO David Simon also mentioned the low tenant terminations and the high amounts of leases that were either signed recently or are about to be signed:

The number of tenant terminations in the first quarter was the lowest recorded in the last five years. (…) Leasing momentum continued across the portfolio. We signed more than 900 leases for more than 3 million square feet in the quarter and had a significant number of leases in our pipeline. In fact, at our recent leasing deal committee, we approved the most deals since 2016 and overall, we recently have approved approximately 500 new deals representing 2 million square feet.

And finally, Simon Property Group also increased full year 2022 guidance and is now expecting funds from operations to be in a range between $11.60 to $11.75 (instead of $11.50 to $11.70 according to the previous guidance).

Recession

First quarter results for fiscal 2022 as well as the full-year guidance are solid and no reason to worry. However, the stock price is not just reflecting past results – it is also reflecting investors’ sentiment and expectations about what might come. And the fear that a recession might hit the United States (and many other countries around the world) could be one of the reasons for the steep stock price decline in the last few months.

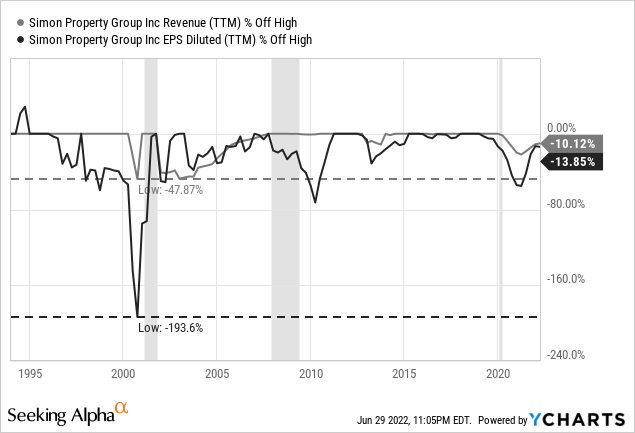

When looking at past recessions, we can’t call Simon Property Group recession-proof. Each one of the last three recessions is clearly visible in the chart. And while Simon Property Group did not have to report declining revenue during the Great Financial Crisis, earnings per share declined pretty steep during the last two recessions. And when looking at the early 2000s recession, earnings per share already started declining before the recession began.

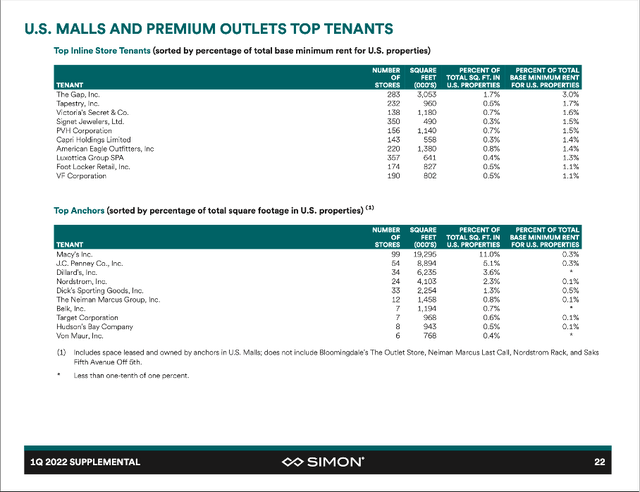

We also must assume that the next recession will have a similar effect on Simon Property Group as it seems difficult for the business to withstand a recession. People need disposable income to spend it in the different shops located in the malls. And the retailers which are typically located in Simon Property Group’s malls are rather consumer discretionary than consumer staples and therefore selling cyclical and non-essential items, which are usually not bought during a recession. The list of Simon Property Group’s top 10 inline store tenants is also including companies selling jewelry or (rather expensive) clothes and these are businesses most likely being hit by a recession. And when the top tenants will suffer, they might not renew leases and SPG will be hit as well.

Simon Property Group Q1/22 Supplemental Material

While the effects of a recession will certainly have an impact on Simon Property Group, it is good to know that no single retailer is responsible for a huge part of the total rent the company is collecting. The Gap, Inc. (GPS) is responsible for about 3% of the total rent, but even a bankruptcy (and that is a real possibility in a recession) of some major tenants should not create an existential threat for Simon Property Group.

Development Activity

Simon Property Group is also continuing its development activity. Construction continues on several redevelopment projects (including The Falls in Miami, or the Stanford Shopping Center in Palo Alto). Construction also continues on two new international development projects – the Fukaya-Hanazono Premium Outlets in Japan (projected to open in October 2022) as well as the Paris-Giverny Designer Outlet in France (projected to open in the first quarter of 2023).

We must assume development activity will slow down in case of a recession and it might take longer to finish the projects. But I am not particularly worried about Simon Property Group investing too heavily and running into problems if the economy should slow down and we are heading towards a recession.

Dividend

When talking about reasons to invest in Simon Property Group, we can’t ignore the dividend as it is a huge part of the total return for investors. During the last earnings call, David Simon pointed out that the company has paid out more than $37 billion in dividends since the IPO in 1993.

Right now, SPG is paying a quarterly dividend of $1.70, which is resulting in an annual dividend of $6.80 and a dividend yield close to 7% at the time of writing. And while the annual dividend is exceeding the expected net income per share of around $6.00 in fiscal 2020, the dividend is more than covered by the funds from operations and we actually get a payout ratio of 58% when using the midpoint of fiscal 2022 guidance.

Without much doubt, Simon Property Group is a stable dividend payer, but the company is not a dividend aristocrat, and we should neither expect an increasing nor stable dividend. The company had to cut the dividend during the Great Financial Crisis in 2009 from $0.85 to $0.56. However, it took only until the end of 2011 for the dividend to reach previous levels again. And because of the COVID-19 crisis, Simon Property Group had to eliminate the dividend entirely in 2020. It was reinstated after only two quarters and constantly increased in the following quarters, but we have not reached pre-crisis levels so far ($1.70 right now vs. $2.10 before COVID-19). And in case of another recession, I expect a dividend cut once again.

Share Buybacks

During the last earnings call, David Simon also announced a new share buyback program as the stock is rather cheap in his opinion:

We also announced today that our Board of Directors has authorized a new common stock repurchase program for up to $2 billion that will become effective on May 16. When we look at the valuation of our stock today at an FFO multiple of approximately 10 times relative to the historical valuations closer to 15 times, and an applied cap rate of around 7% for our real estate assets, we see substantial value in our stock, particularly given our belief and conviction in our future growth opportunities.

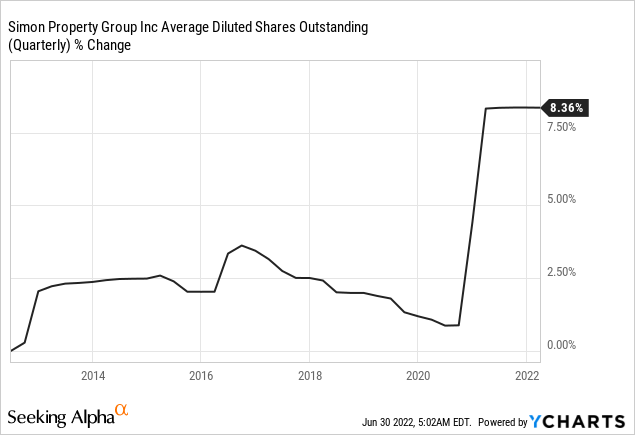

In the last ten years, Simon Property Group increased the number of outstanding shares by about 8%, and therefore, share buybacks are a good idea. Of course, we need to mention that the increasing number of shares was mostly a result of the Taubman acquisition.

And I agree with David Simon that Simon Property Group seems to be trading below its intrinsic value right now.

Intrinsic Value Calculation

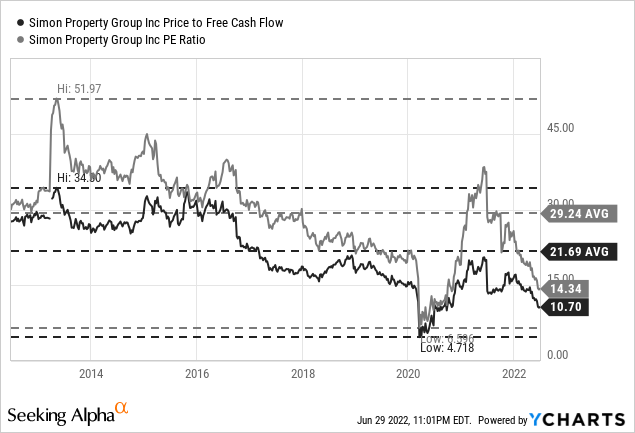

When looking at the price-earnings ratio, Simon Property Group is trading for 14 times earnings. And while this might already seem cheap, the P/E ratio is not a metric I would use in this case. Instead, we are looking at the price-to-free-cash-flow ratio, which is only 10.7 for SPG right now. Of course, this is almost double the P/FCF ratio the stock was trading for at the COVID-19 lows, but this should not be the benchmark. It makes more sense to look at the average P/FCF ratio of the last ten years, which was 21.69 and from that point of view, Simon Property Group seems to be extremely cheap right now.

One might point out, that Simon Property Group seems cheap when looking just at simple valuation multiples, but they have several shortcomings. For example, we can’t really account for the potential recession and much lower free cash flow in the coming years and therefore a discount cash flow calculation might offer us a more precise picture.

As a basis for such a calculation, we can use the free cash flow of the last four quarters, which was $2,989 million. Assuming a recession will hit the United States in fiscal 2023, we expect a drawdown of 30% followed by a recovery which might take till fiscal 2026 (reaching previous free cash flow levels again). For the years between 2027 and 2031, we assume 5% growth followed by 4% growth till perpetuity. This leads to an intrinsic value of $139.70 (assuming 10% discount rate).

We might call these assumptions already cautious, but let’s also include a bear case scenario with an even more severe recession. Once again, we take the free cash flow of the last four quarters as a basis but assume a 50% decline in 2023 (due to a severe recession, but also due to rather low capital expenditures in the last four quarters, which could be higher in the years to come resulting in a lower free cash flow). In this scenario we assume it takes until fiscal 2027 for Simon Property Group to recover again and while we assume 5% growth for the years until fiscal 2031, we assume only 3% growth till perpetuity. When using a 10% discount rate again, we get an intrinsic value of $111.27.

Technical Picture

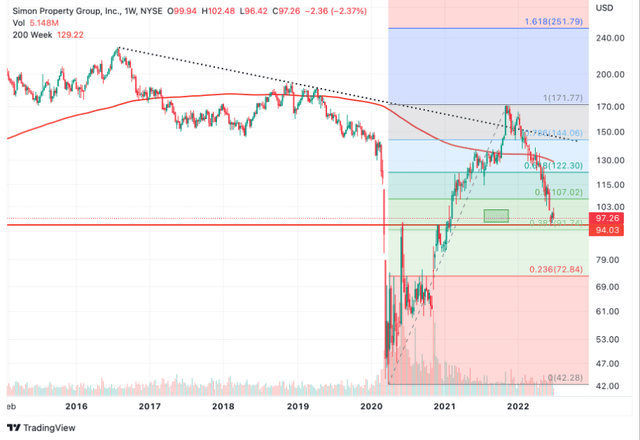

Simon Property Group seems not only undervalued (even when assuming a severe recession), but the stock also seems to be well supported from a technical point of view. Right now, the stock has not only retracted to the 38% Fibonacci retracement of the last upward wave but is also at a support level created by previous highs around $95.

In an article published about a year ago, I assumed that Simon Property Group might decline to $95 again. And I was right, but the stock increased to $170 before – a move I did not expect. Nevertheless, the stock is at a strong support level, which I already identified a year ago.

Conclusion

When writing this article, I realized that my past two articles more or less had the same title, and in both cases, I asked if to buy, sell or hold the stock. This time I don’t have to ask that question as the answer seems to be obvious. Despite the potential recession and downside risk, Simon Property Group is undervalued and a buy in my opinion. Retailers and malls could be hit hard in case of a recession (and the stock might drop lower), but Simon Property Group is probably the best in class among the retail REITs.

Be the first to comment