JHVEPhoto/iStock Editorial via Getty Images

It’s been a rough start to the year for the major market averages, and while a few names have managed to hold up well, like World Wrestling Entertainment (WWE), several growth stocks have been crushed. Despite solid execution, Wingstop (NASDAQ:WING) has not been immune from the market-wide turbulence, given that it entered this correction at a very lofty valuation, hovering near 90x forward earnings. However, after a near 60% correction, the stock is becoming more interesting. Given its industry-leading growth and solid unit economics, I believe it’s a name to keep a close eye on if we see further weakness.

Wingstop UK Menu (Company Presentation)

Just over six months ago, I wrote on Wingstop, noting that while the company had phenomenal growth, meaningful whitespace, and consistently growing AUVs, the stock was priced for near perfection at more than 90x forward earnings. Since then, the stock has slid over 56%, massively underperforming the restaurant sector and even the more volatile Nasdaq Composite (QQQ). Fortunately, for investors who were patient and didn’t chase the stock while it flew too close to the sun, the stock is now approaching a low-risk buy zone. Let’s take a closer look below:

Q1 Results

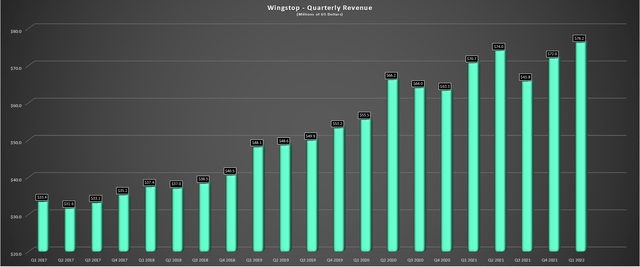

Wingstop released its Q1 results last month, reporting quarterly revenue of $76.2 million, an 8% increase from the year-ago period. This was driven by double-digit growth in its store count and domestic same-store sales growth of 1.2%. On a system-wide basis, sales increased by 12.7% to ~$630 million, and digital sales continue to remain elevated, coming in just above 62% of sales. Finally, the company’s average unit volumes continue to perform well, with AUVs of ~$1.60 million in Q1 2022, up from ~$1.55 million last year.

Wingstop – Quarterly Revenue (Company Filings, Author’s Chart)

While the system-wide AUV performance was impressive, the AUVs for new units also are noteworthy. This is evidenced by the current class of new units enjoying AUVs of ~$1.3 million vs. ~$900,000 for the class of 2019, a substantial increase. Meanwhile, in the United Kingdom, one of Wingstop’s newest markets, AUVs are sitting at $2.0 million, 25% above its domestic store base, despite only opening in late 2018. These results are phenomenal, suggesting that international is an opportunity for significant growth, and there’s the potential for over 200 stores in the UK alone.

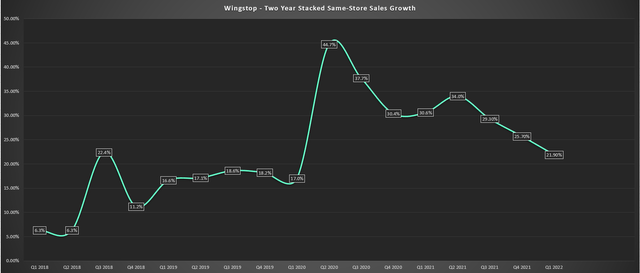

Wingstop – Two-Year Stacked Same-Store Sales Growth (Company Filings, Author’s Chart)

If we look above at domestic same-store sales growth, the results might discourage some investors, given that we’ve seen two-year stacked same-store sales growth continue decelerating. However, it’s important to note that this deceleration trend is occurring from above the 20% level, and most restaurant brands don’t even make it up to these altitudes on a two-year stacked basis. Hence, while Wingstop’s 1.2% domestic same-store sales growth in Q1 was its weakest in years, it’s essential to put it in context. From a big picture standpoint, 18 consecutive quarters of same-store sales growth is nothing to sneeze at, and any growth after lapping difficult comps (Q1 2021 20.7%) due to government stimulus is solid.

Finally, on the development front, Wingstop opened a record 60 net new restaurants in Q1 and grew its store count by 13% year-over-year. This strong start out of the gate and impressive AUV performance has prompted the company to raise its guidance to 220 stores this year, which would place the company just shy of 2,000 restaurants to finish 2022. Among its growth plans, Wingstop expects to continue its growth domestically, it recently announced an expansion of its agreement in Indonesia, and it has Canada coming online this summer. If Canada can perform at even 85% of UK levels ($2.0 million AUVs), which would not be surprising, this could represent another key market.

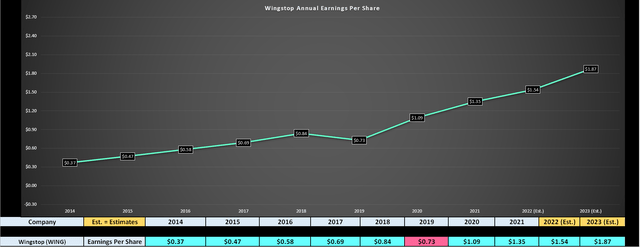

Wingstop – Annual Earnings Per Share (YCharts.com, Author’s Chart)

Unfortunately, while this was all good news, Wingstop saw a slight decline in quarterly earnings per share, impacted by higher cost of sales due to higher wages and increased hiring/training costs due to the tight labor market. However, despite the 23% decline in quarterly earnings per share ($0.34 vs. $0.44), the company is on track to grow annual EPS on a year-over-year basis, with annual EPS estimates currently sitting at $1.54. This would translate to 14% growth and allow the company to maintain its high double-digit compound annual EPS growth rate looking back to FY2014 ($1.54 vs. $0.37).

Long-Term Potential and Current Headwinds

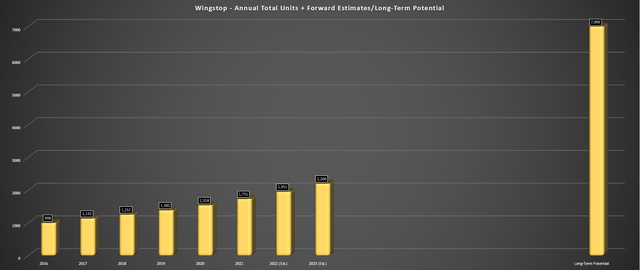

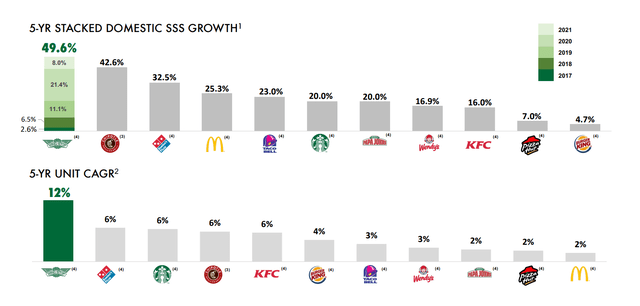

While the short-term might be noisy due to a tight labor market and worries about consumers’ health as gas prices pinch discretionary budgets, it’s worth stepping back to look at the big picture and Wingstop’s unique position. As shown below, Wingstop continues to enjoy industry-leading unit growth. It also has exceptional unit economics with a sub two-year payback on the initial investment to build out a Wingstop at sub $1.70/lb bone-in wing prices. This makes it very attractive for existing and new franchisees, and we haven’t seen any pullback in the development outlook, with another agreement signed in South Korea last month for 60 restaurants.

Wingstop – Total Units + Forward Estimates/Long-Term Potential (Company Filings/Estimates, Author’s Chart & Estimates)

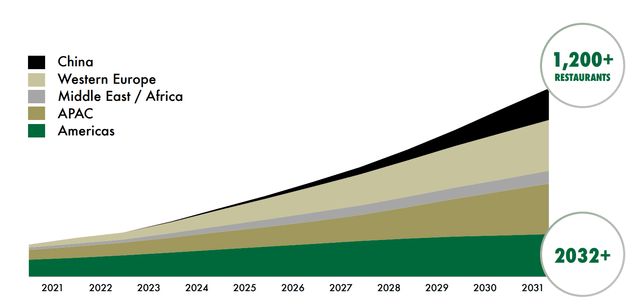

In the long term, Wingstop is confident that it can reach 7,000 restaurants globally, translating to nearly 300% growth from current levels (~1,800 restaurants), giving it a significant runway left to grow. This is a key attribute that makes Wingstop special, given that several other iconic brands like McDonald’s (MCD) may have some growth, but their best years of growth are behind them. As the image below shows, Wingstop sees the potential for 1,200 new restaurants over the next decade internationally, and with the performance of the UK so far, it’s hard not to be encouraged by Wingstop’s potential as it enters and builds up its footprint in new markets.

Wingstop International Opportunity (Company Presentation)

From a commodity inflation standpoint which cannot be ignored, Wingstop appears to be in a better position than some of its peers during a critical period from a value standpoint. This is because it’s seeing meaningful deflation in bone-in wings as of its May Q1 2022 Conference Call, with prices dipping from $3.21/lb last year to $1.64/lb. The dip in this key input cost should allow the company to flex its value proposition and be much less aggressive on pricing when its peers are raising prices to hold the line on margins.

In addition to this, Wingstop’s operating model is very simple and highly digital, suggesting that it should be able to lean into technology and automation and also look at smaller boxes for some new locations. This could allow the company to maintain high AUVs with a slightly lower up-front investment, and it’s also in solid shape from a labor standpoint with as few as three team members in the restaurant with a sub-20 team member roster.

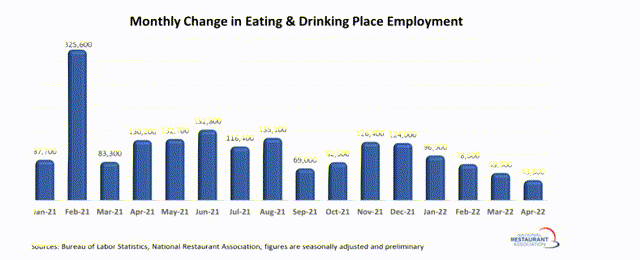

Obviously, no brand is immune from the labor tightness in the industry, and I would expect continued upward pressure on wages. The exception would be if we magically see workers return to the industry in droves, which has yet to happen (6% below pre-pandemic employment levels). Having said that, it doesn’t hurt to be an ultra-lean quick-service brand vs. the full-service model in terms of the number of people that must be continuously hired to support growth in an industry where jobs have yet to come back.

Monthly Change in Restaurant Employment (National Restaurant Association, BLS)

Last but not least, Wingstop has ~28 million users in its digital database and while some restaurants are paring back their marketing/advertising expenses to show higher EBITDA margins, this is not the case for Wingstop. In fact, it has doubled the size of its national ad fund since pre-COVID 19 levels (~$120 million vs. $60 million), allowing it to raise brand awareness as it enters and infills new markets. Plus, the data and ability to target this large footprint of first-party digital users cannot be understated, especially as the company works on menu innovation, which could help drive an additional visit and offset the slight dip in transactions we saw in Q1. New menu items are shown below, which include the Wingstop Chicken Sandwich.

Wingstop Menu Innovation (Company Presentation)

Valuation

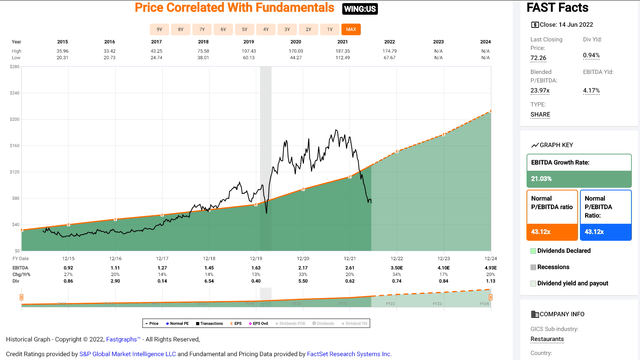

Wingstop has historically traded at ~43.1 EBITDA since its IPO debut, which is a very lofty valuation and a massive premium to its restaurant peers. The valuation can be partially explained by an accommodative Federal Reserve that pushed up multiples on growth stocks, but also Wingstop’s solid execution and industry-leading unit growth with phenomenal same-store sales growth. Since the stock hit peak valuations last year (~70x EBITDA), we’ve seen no degradation in the fundamental thesis. Instead, the macro backdrop has become much worse, with increased recession risk, elevated gas prices weighing on discretionary budgets, and higher rates leading to a contraction in multiples for growth stocks.

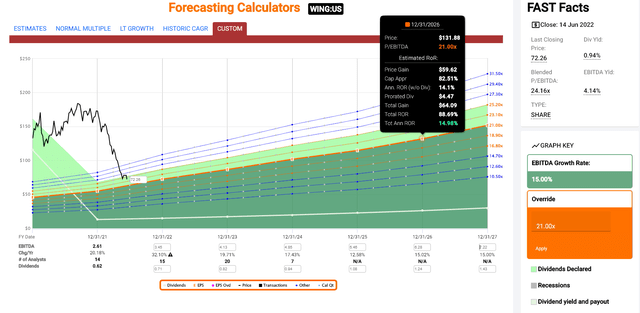

Wingstop – Historical EBITDA Multiple (FASTGraphs.com)

Wingstop Growth Relative to Peers (Company Presentation)

In addition to these negative developments, we continue to see a tight labor market which should put upward pressure on wages for companies like Wingstop, and commodity inflation continues to be an issue. Given this backdrop, I believe a more conservative EBITDA multiple for the stock is 21, which is a premium to the industry average but justified by Wingstop’s solid execution and industry-leading growth. Based on this multiple and FY2023 EBITDA estimates of $124 million ($4.13), I see a fair value for Wingstop of $86.75.

While this represents a meaningful upside from current levels (20%), the goal is to buy at a deep discount to fair value, especially in a cyclical bear market where things often get stretched to the downside (as we saw in Q4 2018, Q1 2020). When trading mid-cap stocks, I prefer to wait for a 30% discount to fair value to justify starting new positions to bake in an adequate margin of safety. Applying this discount to Wingstop’s conservative fair value of $86.75 translates to a low-risk buy zone of $60.75 or lower. So, while we are getting closer to a low-risk buy area after this 55% correction in the stock, we’re not quite there yet. Let’s take a look at the technical picture:

Wingstop – Potential Returns at Different EBITDA Multiples (FASTGraphs.com)

Technical Picture

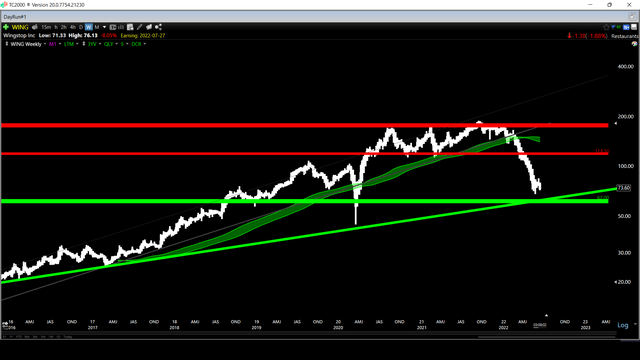

Moving to the technical picture below, we can see that Wingstop now has two strong resistance levels overhead, sitting at $169.50 and $118.50. In addition, momentum is to the downside, with the stock breaking below its key support band (green shaded area) after several years spent trading above this level (excluding a brief below this area in 2020). While these are negative developments, given that any rally towards the $118.50 level is likely to run into strong selling pressure, the stock is now 38% below this level and approaching a strong support zone at $62.00.

WING Weekly Chart (TC2000.com)

This support level represents the pre-COVID-19 support for the stock and an area where it found weekly support during the Q1 2020 COVID-19 Crash. It also represents the stock’s long-term trend line, connecting the November 2015 and March 2017 lows. Obviously, there’s no guarantee that support holds, and in a cyclical bear market for the S&P-500 (SPY), position sizing is critical. Having said that, the best time to buy is when stocks are out of favor and sliding into multi-year support zones (assuming their story remains intact), and for Wingstop, the investment thesis remains solid.

Wingstop Logo (Company Website)

The time to be cautious on Wingstop was when it traded at more than 40x forward EBITDA with record bone-in wing prices and coming up against extremely difficult comps as it lapped government stimulus from Q1/Q2 2021. However, the stock now trades at barely 17x forward EBITDA estimates, can lean into value due to bone-in wing deflation, and continues to see industry-leading growth, with its FY2022 outlook raised to 220 restaurants. Therefore, while I’m not long the stock yet, given that it’s still above its low-risk buy zone, I see this as a name to keep on one’s watchlist if it can pull back closer to $60.00.

Be the first to comment