JHVEPhoto

Thesis

Following my previous article on Shopify Inc. (NYSE:SHOP), shares have recently seen a 23% rally after the e-commerce SaaS (software as a service) company posted above-consensus revenue for Q3. Though GMV missed consensus by 1%, revenue increased 22% to $1.37 billion, 3% above consensus. This was the first quarter in 2022 that Shopify surprised the Street to the upside, and investors likely viewed the top-line beat as a major relief. While a 2.14% record high Merchant Solutions attach rate was something worth celebrating, Shopify’s bottom line remained deeply in the red despite it having become a $5-billion-dollar business.

As a result, I believe investors should treat the stock’s bounce as an opportunity to reduce exposure, as SHOP stock is unlikely to find any valuation support given slowing revenue growth and non-existent profits.

Shopify continues to grow expenses

In spite of a record total revenue take rate of 2.96% thanks to things like higher Shopify Payments penetration and Deliverr, Shopify continued its heavy spending in Q3, where a 64% YoY increase in OPEX quickly dampened the enthusiasm for a 22% growth on the top line. Sales & marketing increased 27% while R&D and G&A increased 87% and 98% YoY, respectively. In Q1 and Q2, S&M increased by 63% and 62%, respectively.

In the years leading to the pandemic, Shopify relied on heavy sales & marketing to drive revenue. In 2018 and 2019, Shopify’s S&M spend increased 55% and 35% on revenue growth of 59% and 47%, respectively. 2020 benefited from Covid tailwinds, so S&M increased only 27% while revenue grew 86% as businesses flocked to e-commerce. In 2021, however, the heavy S&M expense returned and saw a 50% increase vs. 57% top-line growth. Overall, it’s clear that Shopify will have to continue its heavy spending on sales and marketing to attract new merchants to generate online sales via the Shopify platform.

The question now is when will Shopify be able to grow its top line without having to incur such high sales and marketing expenses? The answer is probably never. This is because e-commerce is an extremely cutthroat business, where most startups or small businesses don’t survive over a slightly longer horizon. According to research by The Globe and Mail, ~66% of Shopify stores do not survive beyond one year. During the pandemic, many would-be entrepreneurs tried their luck in opening an online business, but the majority of them didn’t get very far.

This means going forward, Shopify will have to keep S&M going in order to convince as many new businesses to come on board as possible. On top of a multi-year investment in SFN (Shopify Fulfillment Network) and regular loan losses from Shopify Capital, Shopify’s expenses are likely to remain high, causing serious pressure on the bottom line.

But Shopify is not supposed to be making money now!

The conventional wisdom amongst Shopify bulls is that Shopify is still at an early stage where revenue growth is more important than profitability. While I agree that e-commerce, in general, remains a structural story post-Covid and Shopify should continue to win new merchants, revenue growth is unlikely to return to the good old days of 50%+ considering GMV will likely moderate to low to double digits going forward.

In Q3, GMV grew just 11% vs. 11% in Q2 and 16% in Q1. 2022 GMV growth is expected to be just 11% following a highly unusual 2021 and 2020 where GMV grew 47% and 96%, respectively. Given an economic recession is the base case for 2023, another 10% GMV growth would be considered very optimistic. Under these circumstances, investors are likely to question whether Shopify is still a growth company. Street consensus still sees Shopify delivering a 22% top-line growth in 2023, but this number looks increasingly at risk of downward revisions in the current macro backdrop. Should top-line growth come in below expectations, Shopify needs to make money for investors to stay on board.

Valuation

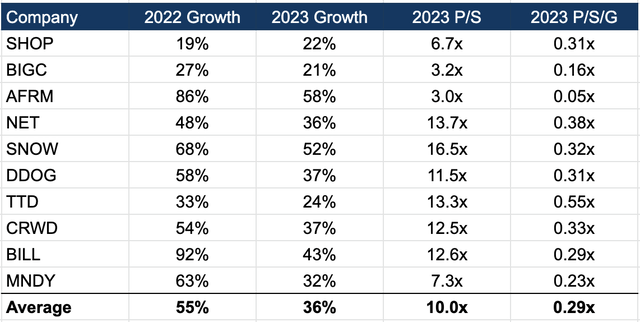

If we were to compare Shopify’s relative valuation against other high-flying (or once high-flying) tech peers, we can see that Shopify is cheaper on a forward price-to-sales basis, as 2023 revenue growth of 22% is below the average of 36%. On a growth-adjusted basis, however, Shopify scores right at the average of 0.3x. This also shows that despite Shopify’s below-average growth profile, markets are willing to value the company on a similar level as higher-growth names like Datadog, Inc. (DDOG), Snowflake Inc. (SNOW), and CrowdStrike Holdings, Inc. (CRWD), which are expected to grow revenue by 37%, 52%, and 37%, respectively, in 2023. In my view, this is quite concerning, as the headwinds that Shopify is facing are nowhere near the same as a cybersecurity name like CrowdStrike.

Consensus estimates, Albert Lin

Conclusion

I didn’t see much fundamental improvement in Shopify’s business prospects following the Q3 print besides that markets were probably relieved to finally see an above-consensus quarter. In a normalized environment, Shopify is unlikely to generate the explosive growth seen in the past few years, and markets are unlikely to find the stock’s P/S multiple helpful if revenue again slows more than expected due to macro headwinds.

Following the recent rally, Shopify’s stock valuation seems troubling given the company’s below-average growth profile. Consequently, I see the recent price action as nothing but short-covering or traders simply trying to make a quick buck, and would remain bearish on Shopify.

Be the first to comment