drnadig/E+ via Getty Images

The Williams Companies (NYSE:WMB) is a midstream company that gathers, processes, stores, and transports natural gas and NGLs. Williams differs from other midstream partnerships because it is structured as a C-corporation.

At the July 11, 2022, stock price, dividend yield is a 5.4%. However, as is standard for asset-heavy pipelines, the company’s liability-to-asset ratio is steep at 70%.

In the first quarter, cash flow nonetheless covered the dividend at 2.3 times and is projected to do so similarly for all of 2022.

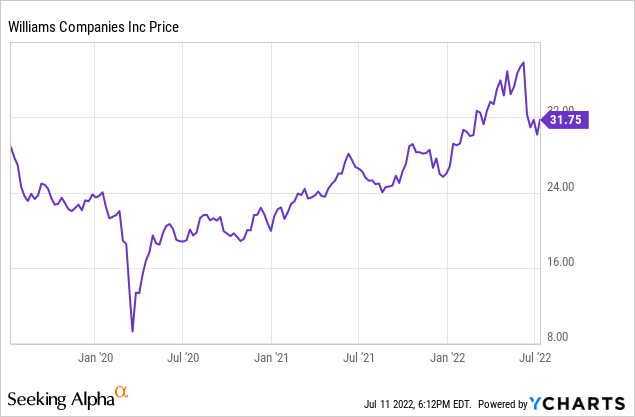

In the last fifteen months, the company’s stock price has increased 34% but it still appears to have room to run, especially given both the diverse geography of its assets and its ability to serve the large and growing LNG export market.

I recommend The Williams Companies to dividend and growth investors.

US LNG Export Market

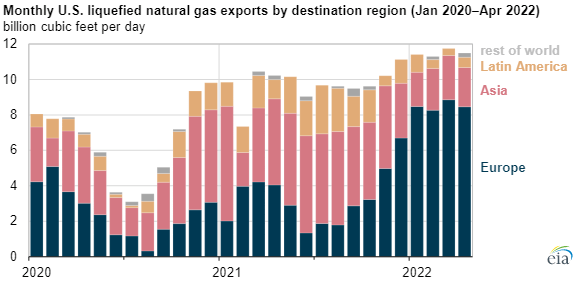

The importance of the US LNG export market can be seen in:

- Europe’s desperate need for gas to replace Russian imports and back up renewables driving LNG prices there to over $50/MMBTU – many times historical levels;

- the statistic that (relatively new) LNG demand represented more than 12% of US gas supply in the first four months of the year, coupled with

- the loss of the Freeport LNG export facility dropped natural gas prices from over $8/MMBTU to $6/MMBTU.

The graph below shows how the European natural gas shortage – already occurring and much exacerbated by reactions to the Russian invasion of Ukraine – has pulled US LNG exports away from Asia and toward Europe since the middle of last year.

EIA

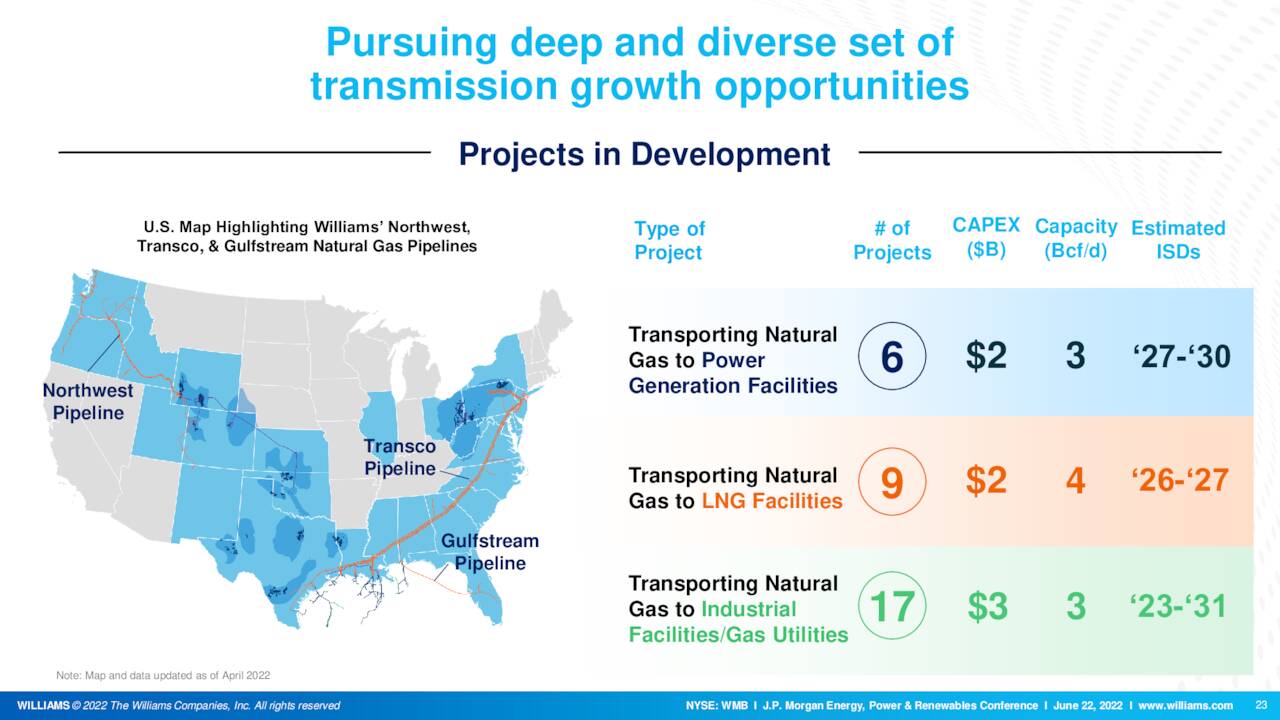

Williams has several additional projects under development:

- Six for power generation

- Nine for transport to LNG facilities, notably Texas-to-Louisiana Energy Pathway project, due online in late 2025

- Seventeen for transport to industrial users and gas utilities.

More immediate to serving both the LNG export and the Transco markets is Williams’ acquisition of Trace Midstream assets. This acquisition expanded Williams’ gas gathering in the region from 1.8 BCF/D to over 4 BCF/D. Indeed, Williams just recently announced a final investment decision (FID) or go-ahead for the completion of LEG, the Louisiana Energy Gateway gas gathering pipeline. This is shown in the diagram below as a dashed line extending from the north Louisiana Haynesville gas field south toward the Transco trunkline and numerous coastal LNG facilities.

williams.com and Seeking Alpha

First Quarter 2022 Results, Strategy, and Guidance

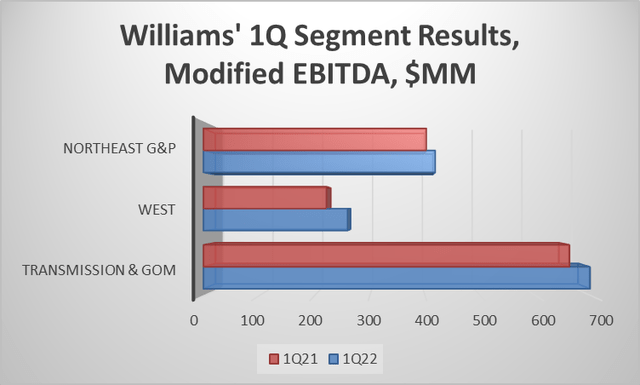

For the first quarter of 2022, Williams’ net income was $379 million, or $0.31/diluted share. Adjusted net income was $499 million or $0.41/diluted share. Adjusted EBITDA was $1.511 billion, 7% higher than in 1Q21. Available funds from operations (AFFO) were $1.19 billion, and dividend coverage was 2.3x.

Strategic developments include a) customer commitments for the Texas-to-Louisiana expansion project that will serve the LNG export market, b) transportation and processing agreement with Gulf of Mexico Salamanca producers, c) expanded Appalachian gas gathering, and d) acquisition of the Trace Midstream Haynesville (Louisiana) gathering assets.

For 2022, updated guidance is:

- adjusted net income of $1.8-$2.0 billion

- adjusted diluted EPS of $1.47-$1.64

- adjusted EBITDA of $5.9-$6.2 billion

- AFFO/share of $3.64-$3.89

- growth capex of $2.25-$2.35 billion

- maintenance capex of $650-$750 million.

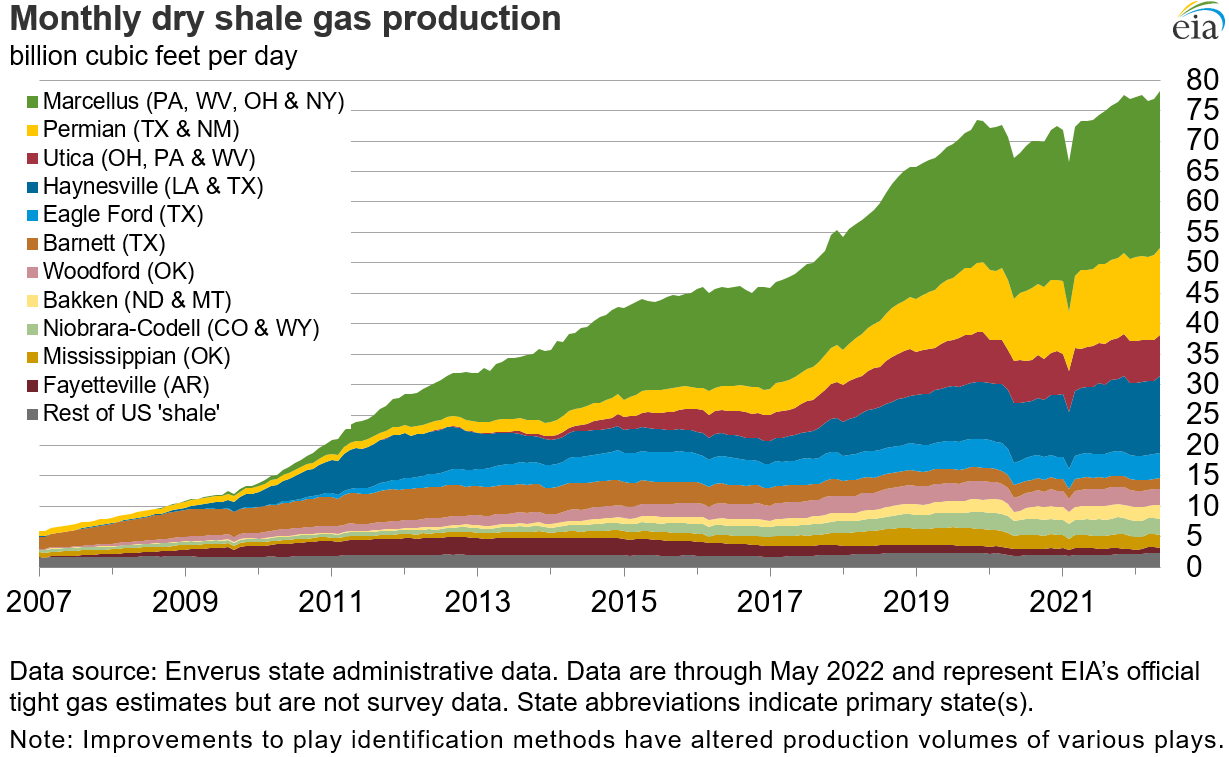

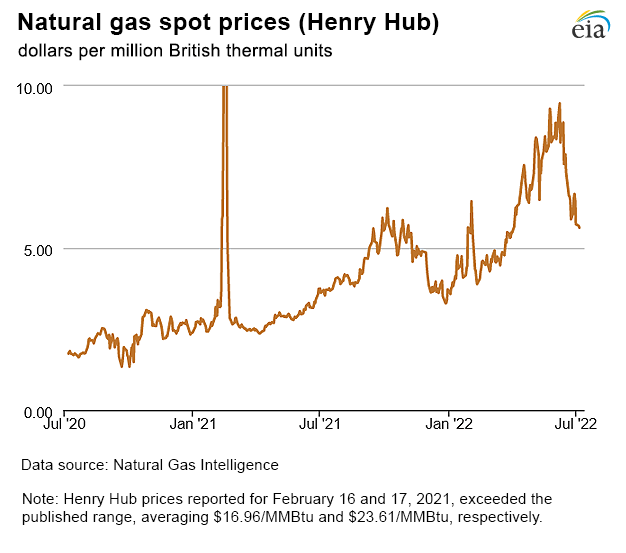

EIA

EIA

Natural Gas Production and Prices

The natural gas price at Henry Hub, Louisiana closed on July 11, 2022, at $6.53/MMBTU. The first chart above shows how much US shale gas production has increased. The second chart shows the national index price gas at Henry Hub, Louisiana.

US natural gas prices are seasonally affected by demand for heat (direct burning) in the winter and demand for cooling (natural gas as electricity generation fuel) in the summer.

What is not shown is the desperate shortage of natural gas in Europe due to the much-dwindled imports of Russian gas that formerly made up 40% of the continent’s gas supply. Thus, the price of liquefied natural gas – which began increasing in 2021 due to an unexpected dearth of wind energy – is now an extraordinary $52.41/MMBTU for August 2022 delivery at the Dutch Title Transfer Facility (TTF).

US LNG exports to Europe have increased and more agreements are being made; however, LNG terminal construction is a multi-year, multi-billion-dollar process that requires significant volumes and long-term commitments; it cannot ramp up immediately. LNG exports nonetheless are an important and relatively new demand component for US natural gas.

By contrast, regional spot prices, particularly in the Northeast, tend to be lower due to the excess of supply over demand (compounded by a lack of pipeline takeaway capacity there for gas from the Marcellus and Utica fields). For example, on July 6, 2022, when the Henry Hub price was $5.63/MMBTU, the Tennessee Zone 4 Marcellus spot price was $4.85/MMBTU and the Eastern Gas South (southwest Pennsylvania) was $5.00/MMBTU.

williams.com and Seeking Alpha

Williams’ Operations

Williams has gas transmission of about 23.7 BCF/D (23.7 million dekatherms/day), gas gathering of 24.4 BCF/D, gas processing of 7.4 BCF/day, 23 million barrels of NGL storage and handles about 30% of the country’s natural gas volumes.

It divides into five reporting segments but only the three largest are shown: Northeast G&P (gathering and processing), West, and Transmission & Gulf of Mexico. The map above illustrates operational locations. Based on the split of modified EBITDA (a non-GAAP measure), the Transmission & Gulf of Mexico segment is the largest as it contains Transco.

williams.com and Starks Energy Economics, LLC

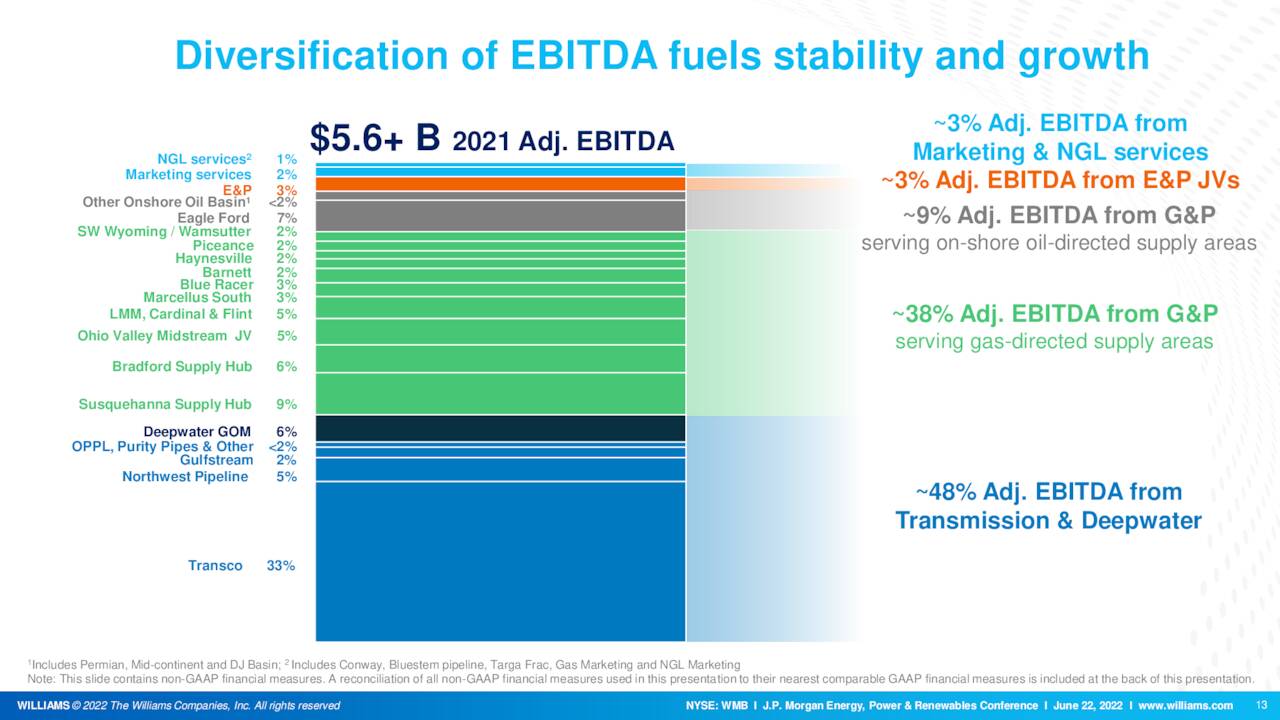

While a third of its 2021 adjusted EBITDA came from Transco, other sources are numerous and diversified.

williams.com and Seeking Alpha

Competitors and Regulation

The Williams Companies is headquartered in Tulsa, Oklahoma.

Pipeline companies do not exactly compete head-to-head: projects are not built until long-term volumes are committed. Still, in areas such as the Permian Basin or Appalachia different companies, or company consortia, may offer competitive potential (and actual) pipeline projects. Some of these companies and limited partnerships include Energy Transfer LP (ET), Enterprise Products Partners (EPD), Kinder Morgan (KMI), ONEOK (OKE), and Targa Resources (TRGP).

Williams also competes and cooperates with intrastate pipelines and gathering systems.

Williams is operationally regulated at the national or interstate level by the Federal Energy Regulatory Commission (FERC) and the Environmental Protection Agency (EPA) and at the state level by the local authorities of the states in which it operates.

Additionally, the company is subject to the Biden administration’s anti-fossil fuels policies, which have included canceling the permit for the Keystone XL oil pipeline and – notwithstanding the US Supreme Court’s recent decision in favor of West Virginia and against the EPA – using the above agencies and others to slow or halt construction of all interstate and federal lands’ hydrocarbon development and infrastructure.

Governance

At July 1, 2022, Institutional Shareholder Services ranked Williams’ overall governance as 3, with sub-scores of audit (6), board (3), shareholder rights (6), and compensation (2). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

At May 2022, Williams’ ESG ratings were above-average with a total risk score of 23 (36th percentile). Component parts are environmental risk 9.6, social 10.4, and governance 3.2. Controversy level is moderate at 2 on a scale of 0-5, with 5 as the worst.

As of June 15, 2022, shorts are 1.6% of floated shares. Insiders own a small 0.33% of shares.

Beta is 1.22; this heightened volatility reflects increased gas price and regulatory risk but is only moderately above the overall market’s volatility.

At March 30, 2022, the five largest institutional holders of The Williams Companies’ stock are Vanguard (10.1%), Blackrock (9.3%), State Street (7.2%), Dodge & Cox (5.8%), and Bank of America (2.95%). Some institutional fund holdings represent index fund investments that match the overall market.

Some investment companies have pursued non-financial ESG metrics. Their activism may not align with long-term profitability for other public shareholders. This includes the top three Williams shareholders. All three – Vanguard, BlackRock, and State Street – are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite Europe’s desperate need for energy – natural gas, oil, coal – due to reduced Russian exports) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Williams’ Financial and Stock Highlights

Williams Companies’ market capitalization is $38.7 billion at a July 11, 2022, stock closing price of $31.76 per share. Its enterprise value is $60.0 billion.

The company’s trailing twelve months’ earnings per share (EPS) is $1.20 for a current price-earnings ratio of 26.5. The average of analyst estimates for 2022 and 2023 EPS are $1.49 and $1.60, respectively, resulting in a forward price-earnings ratio range of 19.9-21.3.

Trailing twelve months’ operating cash flow was $4.1 billion and levered free cash flow was $1.7 billion.

Williams’ 52-week price range is $23.53-$37.97 per share, so its most recent closing price of $31.76 is 84% of the high. The company’s one-year average estimated target price is $37.86/share, so the target is 19% above the current price.

Trailing twelve-month return on assets is 3.5% and return on equity is 10.7%.

The dividend of $1.70/share yields 5.4% at the July 11, 2022, closing price.

At March 31, 2022, Williams had $32.1 billion in liabilities, including long-term debt of $20.8 billion, and $46.0 billion in assets giving a liability-to-asset ratio of 70%.

The company’s ratio of debt to market capitalization is 0.58. The debt-to-EBITDA ratio is 5.0.

Average analyst rating is 1.9, or “buy,” from 19 analysts.

Williams will report second quarter results in early August 2022.

Notes on Valuation

The company’s book value per share at $9.27 is less than a third of its market price, implying positive investor sentiment.

However, its ratio of enterprise value to EBITDA is 13.5 so does not imply a bargain since it is above the range of 10.0 or less.

Positive and Negative Risks

Due to its high level of debt and large capital expenditure program, Williams also has significant inflation risk in materials, labor, and capital cost.

Activist and regulatory resistance to building or even expanding pipelines is ever-present. This includes risk from environmental activists who advocate for no hydrocarbons whatsoever, groups that oppose pipeline rights of way, as well as anti-hydrocarbon federal and state policy makers and regulators.

However, as natural gas is more frequently acknowledged to be the available and lower-carbon energy solution it is – such as its inclusion in the European taxonomy for clean energy – resistance to making natural gas a bigger part of the energy mix may decrease.

Finally, additional to US growth, the huge demand for liquefied natural gas in Europe and Asia creates the need for companies like Williams to transport US natural gas to Gulf Coast and other liquefaction facilities.

Recommendations for The Williams Companies

Given Williams’ debt and large capital programs, it is exposed to inflation in interest costs (70% liability-to-asset ratio), labor, and materials, as well as supply chain shortages.

Still, the company’s revenues are predominantly fee-based rather than commodity-based.

It is geographically diversified, with operations in the southeast, Florida, Gulf Coast, Rockies, and northwest. In particular, it is serving and is well-positioned to grow with the significant, vital-to-the-world US LNG export market.

With its current 5.4% dividend yield and continued upside potential, I recommend The Williams Companies stock to dividend-seeking and growth-seeking investors.

williams.com

Be the first to comment