kynny/iStock via Getty Images

Introduction

A lot is going on right now in the semiconductor space (SEMI) (SMH) (SOXX) (XSD) (PSI) (USD) (FTXL) (KFVG) (SSG). There’s uncertainty about a possible bust of the semiconductor cycle.

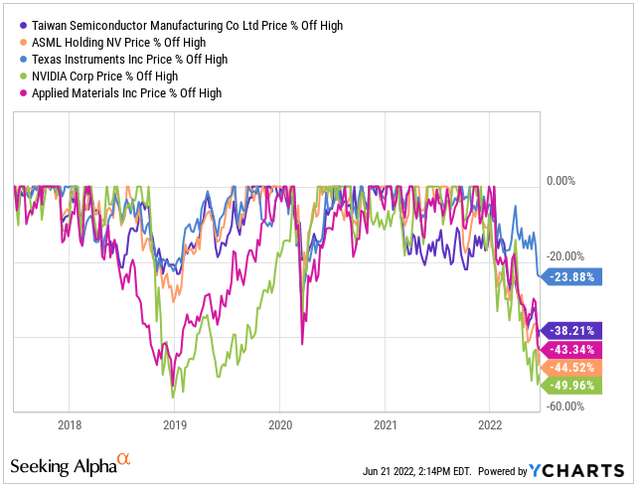

Humans have an innate need to try and predict exactly when an event will occur, and here we see this need, too. Semiconductor sales have historically been cyclical, and so have the stock prices of semiconductor companies. Many investors are already predicting that the next cycle is around the corner, and stock prices are starting to reflect this:

But…why have semiconductors been historically cyclical?

The cyclical nature of semiconductors

The semiconductor industry has a history of overbuilding supply, which directly results from the high costs incurred in chip manufacturing and the time it takes to build new capacity.

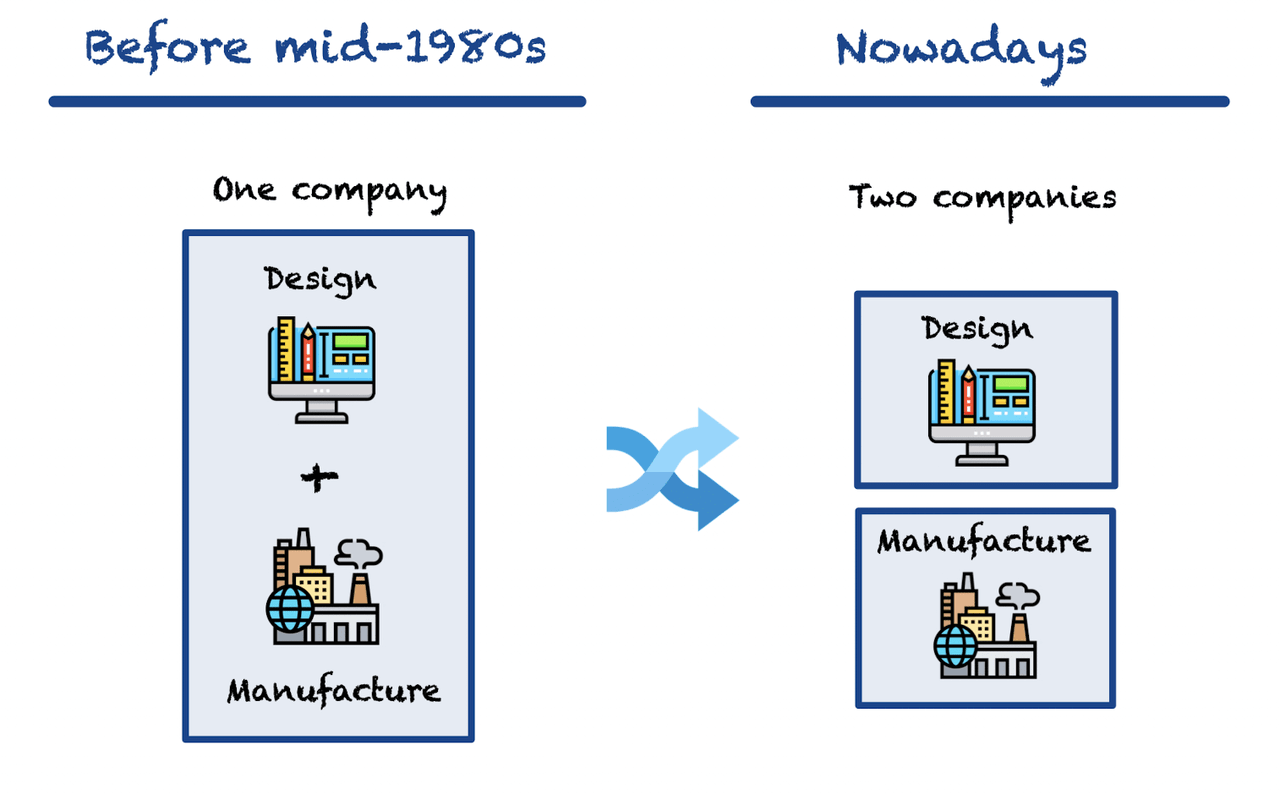

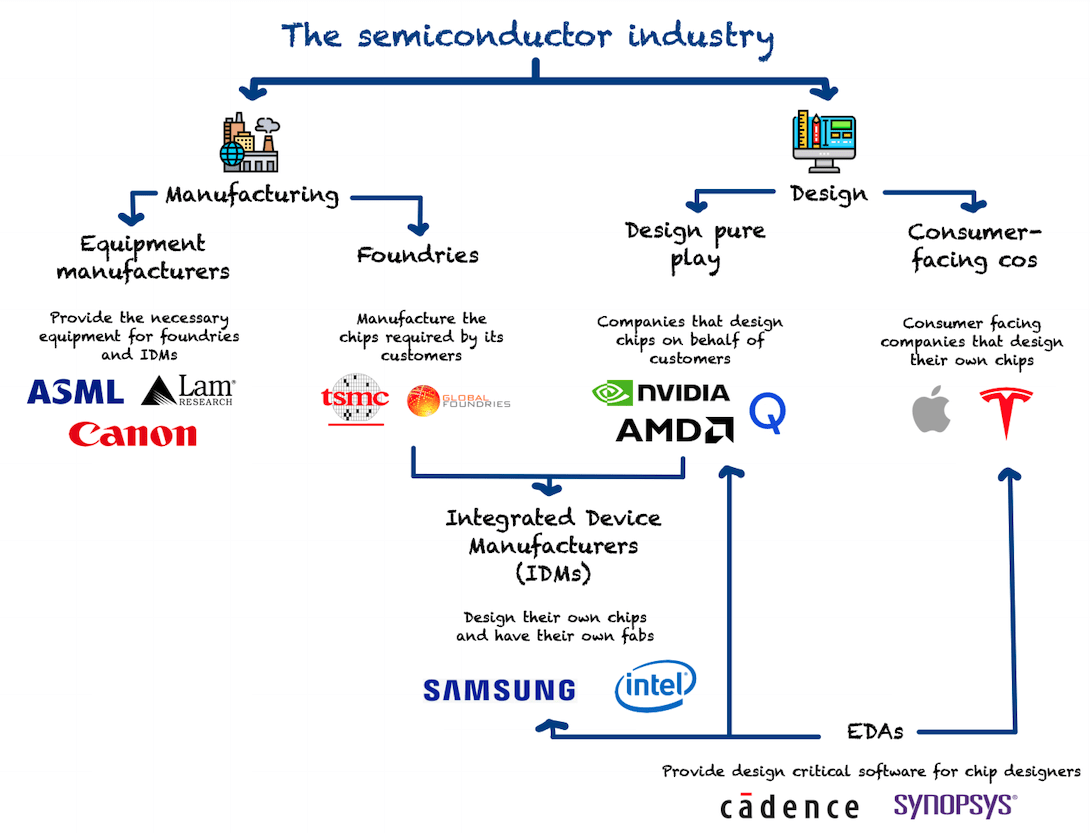

The industry’s first change to mitigate these problems was to separate design from manufacturing, making IDMs (Integrated Device Manufacturers) a rare species:

Made by Best Anchor Stocks

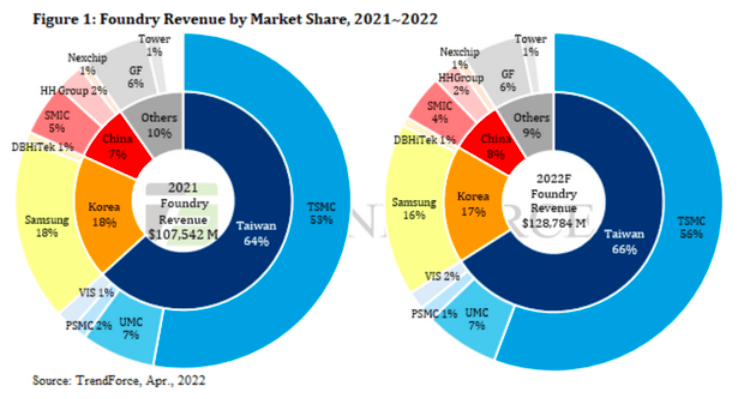

Companies that specialized in manufacturing are referred to as “foundries,” and they subsequently concentrated so they could enjoy economies of scale and thus reduce cost per unit. The first change (the separation of design and manufacturing) happened around the 1980s decade, and concentration has been a progressive path to where we stand today, with a handful of foundries that are responsible for the majority of chip manufacturing:

TrendForce

Even after this industry concentration, running a foundry profitably is a challenge. Moore’s law states that the number of transistors that fit in a chip doubles every two years while the price is roughly cut in half. This is why technology is deflationary by nature. This continuous price reduction forces foundries to run at max capacity to cover costs. There’s no incentive to run at less than full capacity because most of the expenses incurred in a fab (equipment, land, workforce…) are “fixed” costs, so more output means less cost per unit and thus higher margins. Simply put, most of the costs of running a fab will be incurred regardless of fab utilization, so it makes sense to run at high utilization.

The problem comes when this max capacity is not enough to meet demand. When this happens, foundries start to plan capacity expansions, which is logical considering that any business’s goal is to grow.

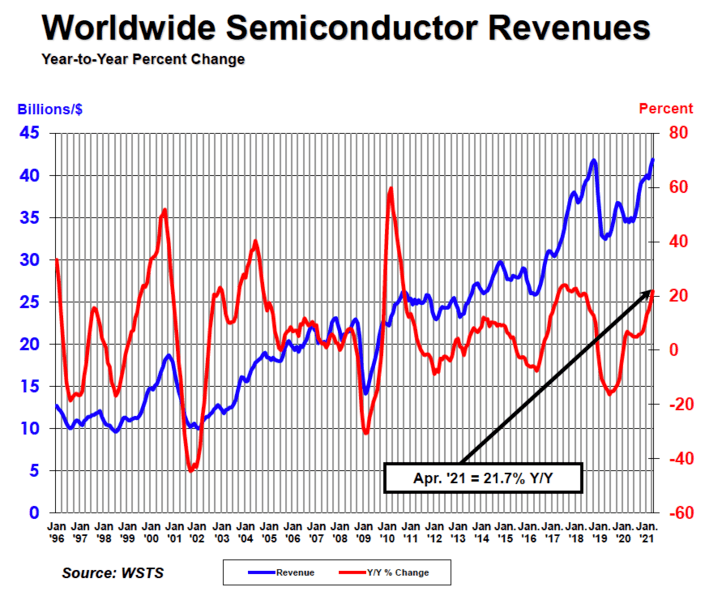

There’s a catch, though. Building this capacity takes time. Building a new fab, filing it up with the necessary equipment, and hiring the right people can take up to two years. During these two years, the demand landscape might change, creating an imbalance of supply and demand again. This time, it’s not good for foundries because they are left with capacity they don’t need. Despite this overcapacity, foundries typically continue operating at a “high” utilization to reduce fixed costs per unit, making prices collapse. Utilization rates can also come down, but not so much as the price. The end result is illustrated by the chart below:

WSTS

As you can see, despite the ebbs and flows of semiconductor sales, the long-term revenue growth has been strong, with sales multiplying by a factor of 4 since 2001. As the developed world continues digitizing and the emerging world hops on the digitization train, we see no reason the long-term trend will change going forward.

Will the cyclicality continue?

The million-dollar question is if semiconductors will continue to be cyclical in the future.

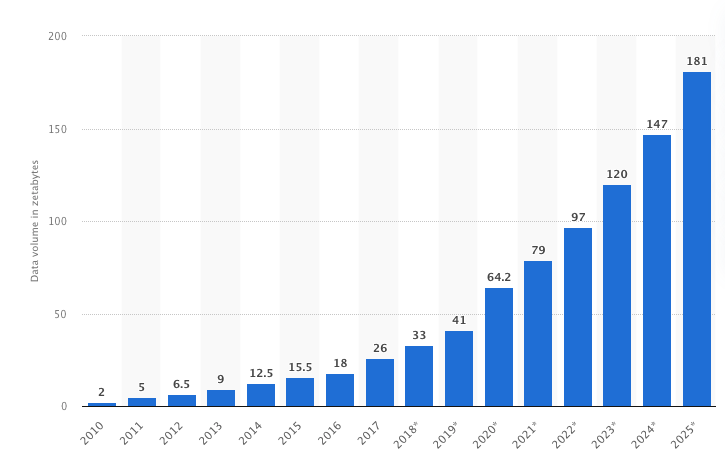

We have reasons to believe that cyclicality might be more muted or cycles might be shorter in the future. As more of the world goes online, increasing amounts of data are generated daily, creating exponential expectations for data generation. This chart shows the data volume projections in zettabytes, which is about 1 trillion gigabytes.

Statista

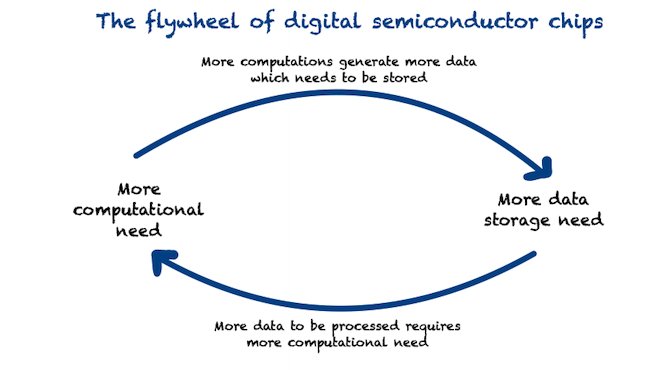

More data means more demand for memory chips, but it also means more demand for logic chips as this data requires more computational power. More computational power also produces more data, powering a two-sided flywheel in the semiconductor industry:

Made by Best Anchor Stocks

We are pretty sure that this flywheel will power the long-term secular tailwind for semiconductors, but we can’t predict with certainty if the industry will suffer its historical ebbs and flows. We’ll only know in hindsight.

Why are investors worried right now?

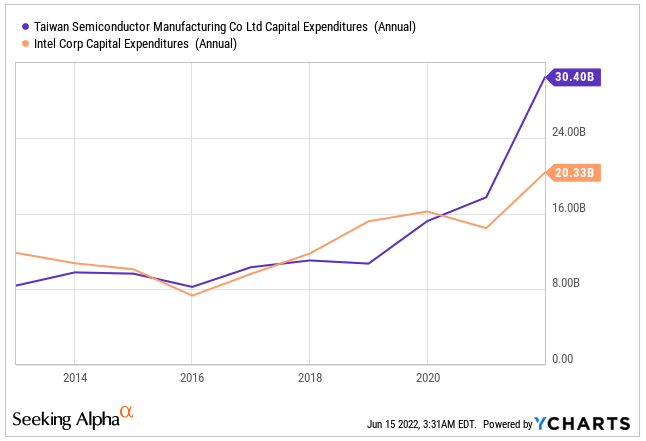

Investors are worried because several foundries have been ramping up CapEx to build extra capacity amidst the current chip shortage the world has been under for almost two years now:

YCharts

Experts and managers of some of the most important companies in the industry think that the chip shortage will last well into 2023 and might go into 2024, indicating that demand is currently very strong. However, many of these expansion plans will end once the chip shortage is supposedly over, which might create overcapacity and the feared semiconductor bust.

TSMC (Taiwan Semiconductor Manufacturing Company Limited (TSM), the biggest chip foundry in the world), recently announced that on top of the $40 billion in CapEx it will spend in 2022, it plans on spending $44 billion in CapEx in 2023. Intel (INTC) and Samsung (OTC:SSNLF, OTC:SSNNF) are also aggressively expanding supply, aided by government programs that aim to incentivize domestic manufacturing. We don’t know if governments worldwide will be successful with their “domestic” venture (we don’t think it’ll be easy), but subsidies will undoubtedly increase capacity in the industry.

What parts of the industry might a semiconductor bust affect the most?

Some months ago, we shared the following explanatory graph of the components of the semiconductor industry with members of Best Anchor Stocks:

The semiconductor industry (Made by the author)

So, the question is: what sections of the semiconductor industry would be most impacted by a bust? We can give a very precise answer: it depends. We could say that manufacturing might be affected quite a bit by a bust, and this would evidently be true, but there are some companies like ASML Holding (ASML) that we think offer more protection against a bust inside that specific group. The same might apply to other parts of the industry, we just can’t put all companies in the same bucket and a lot of company-specific analysis that is outside of the scope of this article is needed there. We plan on doing this analysis for ASML soon, so stay tuned.

As a general rule, though, exposure to personal electronics puts companies in a tougher position than exposure to enterprise demand. The cycles in personal electronics are shorter than the investment cycles in the industry.

Conclusion

The semiconductor industry has historically been cyclical. While we don’t know what will happen in the future, we think there are reasons to believe that cycles might be more muted going forward as capacity catches up with demand. Even if the cycles would continue, the long-term trend seems to be favorable for semiconductors.

Do you think there will be a semiconductor bust soon? Let us know in the comments section!

In the meantime, keep growing!

Be the first to comment