pabradyphoto

By Kevin Flanagan

If you look back over the first eight months of this year, it is truly amazing to see how the money and bond markets’ monetary policy outlook continues to change. Quantitative tightening (QT) was the “easy” part, as most market participants correctly saw this coming as part of the policy shift.

It’s the rate hike aspect of the equation that continues to undergo what seems like ongoing transformations. Now, as we enter the final third of the 2022 calendar year, investors are being presented with yet another new “twist.” Could Powell & Co. raise the terminal rate for Fed Funds to the 4% threshold?

After pricing in a very hawkish Fed in mid-June, Fed Funds Futures reversed course quickly only about a month or so later. Indeed, multiple rate cuts began to dominate the narrative for the second half of 2023 as signs of economic weakness became prevalent. Over the course of the last few weeks, a “funny” thing began to happen; the economic data was pointing toward activity not “rolling over.”

Obviously, there are two sets of data the Fed and, by extension, the markets have been closely following. The first one is inflation; the second is the labor market. Although recently released numbers on inflation suggested a crest may have occurred, price pressures remained elevated.

On the employment front, the August jobs report shows that the U.S. labor market continues to be on solid footing. Take these two factors together, and you get a hawkish Jackson Hole speech like Powell delivered a little more than a week ago.

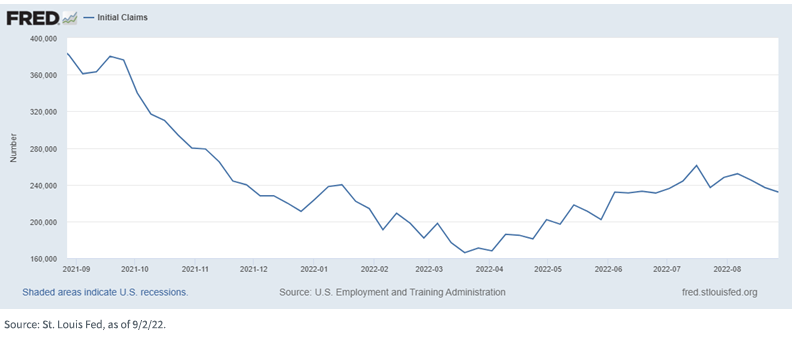

Initial Weekly Jobless Claims

Let’s look at the aforementioned jobs data a little more closely. Once again, total nonfarm payrolls visibly rose more than expected, and the job gains were widespread.

The unemployment rate did rise 0.2 pp to 3.7%, but this uptick was the direct result of a surge of +786,000 in the civilian labor force – typically a sign of strength, not weakness. In addition, the alternate civilian employment measure increased by a hefty +442,000.

What about future labor market trends? This is where initial weekly jobless claims can be a useful guide, given its characteristic of being considered a leading economic indicator. A great deal of attention was given to the increase in claims from its nadir in March of this year to the recent “peak” in mid-July.

Since then, claims have actually been falling. As the above graph illustrates, the level is essentially unchanged from when we began 2022 and is considerably below the readings of a year ago.

This brings us back to the Fed. There is no doubt the policy maker’s number one goal is to bring down inflation, but in order to get there, Powell reiterated at Jackson Hole that some softening in labor conditions will be required. Based on recent jobs-related data, we’re not close to being there at this point.

Conclusion

For the September 21 FOMC meeting, the upcoming CPI report could very well tip the balance for either a 50- or 75-basis-point (BP) rate hike. From my perspective, don’t get caught up in that debate, but rather focus on the point that the voting members will take the Fed Funds target visibly higher than where it currently stands. If you believe some recent comments from Fed officials, “4%” could be in play during early next year, with no rate cuts on the table. Stay tuned…

Kevin Flanagan, Head of Fixed Income Strategy

As part of WisdomTree’s Investment Strategy group, Kevin serves as Head of Fixed Income Strategy. In this role, he contributes to the asset allocation team, writes fixed income-related content and travels with the sales team, conducting client-facing meetings and providing expertise on WisdomTree’s existing and future bond ETFs. In addition, Kevin works closely with the fixed income team. Prior to joining WisdomTree, Kevin spent 30 years at Morgan Stanley, where he was most recently a Managing Director. He was responsible for tactical and strategic recommendations and created asset allocation models for fixed income securities. He was a contributor to the Morgan Stanley Wealth Management Global Investment Committee, primary author of Morgan Stanley Wealth Management’s monthly and weekly fixed income publications, and collaborated with the firm’s Research and Consulting Group Divisions to build ETF and fund manager asset allocation models. Kevin has an MBA from Pace University’s Lubin Graduate School of Business, and a B.S in Finance from Fairfield University.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment