Lemon_tm/iStock via Getty Images

Anchoring bias is one hell of a bias. But being fully aware of this bias, I can discard the fact that we recommended MEG Energy as our 2nd largest position back in March 2020 following the CRC debacle.

And yes, we did recommend this name when it was at C$1.22. It is not a typo.

While the analysis in March 2020 was about how the company will survive the oil price crash, the analysis we are offering today is the exact opposite.

MEG Energy is one of the few energy producers in the market today with no hedging exposure. Yes, zero hedges. Unlike Baytex Energy Corp. (OTCPK:BTEGF), which loves to hedge itself out of upside risk, MEG is literally taking it like the champ it is. And based on our estimates of free cash flow, the risk-taking will pay off big time for MEG.

At $105/bbl WTI, MEG could produce as much as C$1.7 to C$1.9 billion in free cash flow. The wide range is dependent on the differential it receives for its oil.

At a market cap of C$5.442 billion, MEG trades at ~3x FCF or ~33% FCF yield.

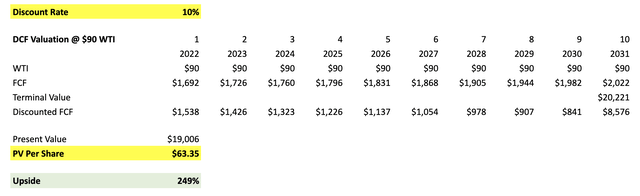

On a DCF basis at a price of $90/bbl WTI, MEG is worth 3.5x what it is trading at today.

Now, of course, much of this analysis is dependent on the price of oil doing well, but the fundamental analysis aspect of oil could be viewed in pretty much every other OMF.

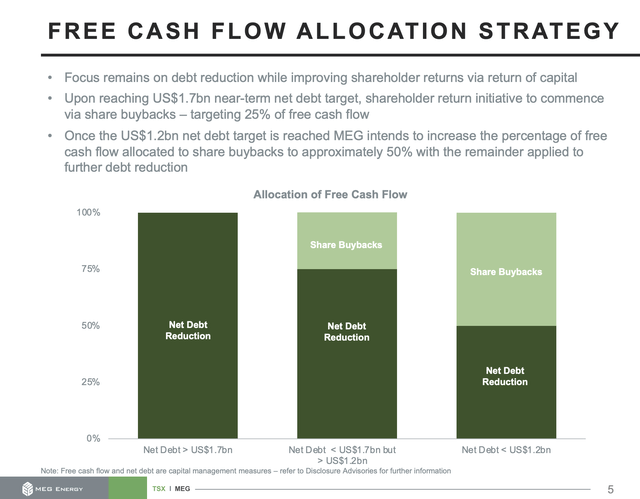

In MEG’s year-end result reporting, it updated this slide on what it plans to do with free cash flow.

The crazy thing about this chart is that in today’s oil price environment, MEG will be sub ~C$1.7 billion by its May reporting time. This means that MEG will likely announce NCIB in its Q1 reporting, which should be very favorable for the stock. By year-end, MEG will have less than C$1 billion of debt, and more cash will be returned to shareholders. We could possibly even see a dividend get paid down the road.

Identity Crisis

All of this will result in a major 1st world problem for MEG. What’s also particularly interesting about MEG is that it also has somewhat of an identity crisis.

Back in 2018, when we were first long MEG, Husky had made an offer to acquire it for around C$10 per share. The company turned it down and the oil market went into a downturn. Husky, itself, got bought out by CVE.

The reason why MEG is an attractive acquisition target is that it is too small to be considered a scalable oil sands producer, while it is not big enough to buy others.

MEG has tier 1.5 to 2 assets, which makes it very attractive for a large oil sands producer with scale to digest. The only real suitable buyers would be CVE or SU. Neither of them is looking for acquisition targets at the moment but never say never. Then there is Imperial Oil (IMO), owned in large part by Exxon (XOM), which won’t be doing any deals anytime soon.

All of this leaves us with the great Goldilocks scenario in the next 2-3 years. MEG will earn a lot of money, shareholders will get their fair share, and MEG will eventually get bought out some time in the future.

A great win-win-win scenario for shareholders.

Conclusion

Why did we buy MEG today? Because it’s trading at ~33% free cash flow yield and, with no hedges in place, MEG is fully torqued to the upside. The debt that bogged down MEG’s valuation in the past will no longer be an issue by year-end. Buy MEG, it’s our 2nd largest position.

Be the first to comment