the_guitar_mann/iStock Editorial via Getty Images

The Boeing Company (NYSE:BA) restarted deliveries of the Boeing 737 MAX in Q4 2020. With approximately 450 aircraft built shortly before and during the grounding of the Boeing 737 MAX, expectations were that Boeing could ramp up deliveries rather quickly. Reality, however, has been that the delivery ramp up has been rather slow-driven by reduced demand due to the pandemic. While certain pressure on the delivery ramp up remains, Boeing 737 MAX deliveries reached a new high in the delivery ramp up which I will have a look at in this report.

Boeing 737 MAX Deliveries Trend Up

In February, Boeing hit a multi-month low in commercial aircraft deliveries and that was rather disappointing. With an inventory of several hundreds of jets awaiting delivery and an improving demand profile for aircraft, it was rather unsettling that Boeing was not being able to set new highs for MAX deliveries and instead was hitting a multi-month low.

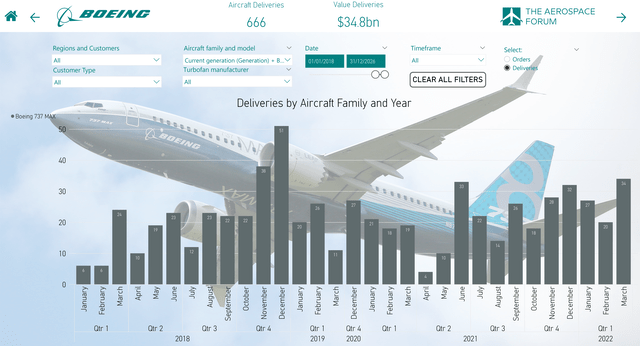

Boeing 737 MAX deliveries per month (The Aerospace Forum)

March, however, was different as Boeing 737 MAX deliveries hit a multi-month high as shown by our data analytics tool, the TAF Boeing Orders and Deliveries Monitor. In fact, deliveries have not been this high since December 2018. This means that deliveries are not just at the highest level since the Boeing 737 MAX ungrounding, but even before that, before the grounding of the Boeing 737 MAX.

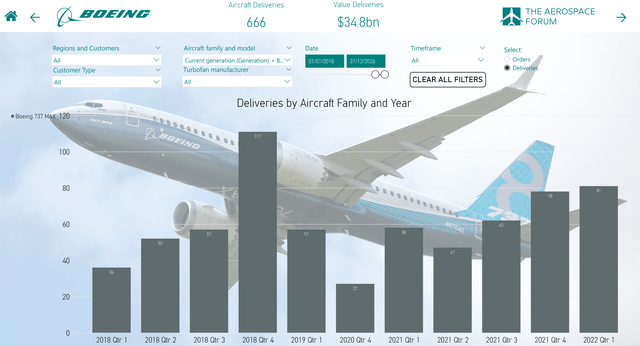

Boeing 737 MAX deliveries per quarter (The Aerospace Forum)

When looking at the quarterly development, we also see Boeing 737 MAX deliveries hit a multi-quarter high. Just like with the monthly deliveries for the MAX, the quarterly deliveries were at the highest level since the end of 2018.

Generally, I consider it a good sign that deliveries are at fresh multi-quarter highs, and deliveries have been trending up for several quarters, which also is a good sign. At the same time, I am also seeing that increases are declining sequentially. What that means is that the growth rate in deliveries is declining. Since Q2 2021, the growth rate of deliveries declined from 32% in Q3 2021, 26% in Q4 2021 to 4% in Q1 2022. So, that is something that will be a focal point in the coming quarters.

Boeing is step-by-step reaching milestones, but we want the delivery ramp up to be a sustained one. Currently, there seems to be some signs of exhaustion in the ramp up. It is clear that Boeing needs another step up or two in deliveries. I expected that having at least 90-110 quarterly deliveries should be achievable for Boeing. That would put the jet maker at 340-380 deliveries for the MAX, more focused toward the higher side of the range, but well short of the 500 aircraft it is aiming for to deliver this year. It should be noted that China currently is a wildcard. Either way, at 380 deliveries, year-over-year delivery volumes for the MAX would still grow by 55%, which is strong.

Conclusion

Boeing has reached some new milestones in March, and I consider these to be good signs. If you are a patient investor, I believe that the Boeing 737 MAX delivery ramp up provides some base to accumulate shares. At the same time, it should be noted that current delivery profiles and production rates are not aligned with the delivery target with China taken out of the equation. So, there is some pressure on Boeing’s delivery target for 2022 but I believe Boeing is positioned for various years of double-digit growth. So, if you like Boeing now even with delivery targets slipping in the near term, you will like it even more in the future.

Be the first to comment