How some tenants may feel when they see rent going up 60% in a month. Also, how it feels trying to find a useful image in Getty Images. dundanim/iStock via Getty Images

Rexford (NYSE:REXR) is one of my favorite REITs. We’ve been increasing our position and bought more shares as recently as 10/20/2022. We bought 230 shares at $51.40 that day, which brings us up to 670 shares.

Allow me to take you back in time just a few weeks. When I was reviewing the industrial REITs in our October Portfolio Update, I wrote:

Removing the outliers of (STAG) (down 7.7%) and (ILPT) (down 26.6%), the rest were down 11.6% to 18.4%. Great bargains. An update from Prologis (PLD) indicated that rental rate growth remained very hot in Q3 2022.

We spent a bit over $41,000 buying the dip. This is the opportunity we wanted to see in industrial REITs. It’s been so long waiting for the entry opportunity, and it finally came. We don’t know when the industrial REITs will pop higher, but the fundamentals are outstanding in both the short-term and long-term. Growth in AFFO per share should be extremely strong for at least a few years. It’s hard to make predictions further out, but there’s a high chance rental growth remains hot and continues to drive strong AFFO per share growth. Since debts are relatively low, higher interest rates should only have a very minor impact on interest expense as small amounts of debt are rolled over.

ILPT is the exception. In my opinion, they have an absolutely insane amount of debt and lower-quality management. Those two things often go together. I covered ILPT a bit more in the prior update.

We’re not going to dive deeper into ILPT here, because this is about one of my favorite REITs. However, investors should be aware that massive leverage is a critical factor in ILPT’s performance and one of the reasons we exclude it from a typical discussion of industrial REITs.

We went on to say:

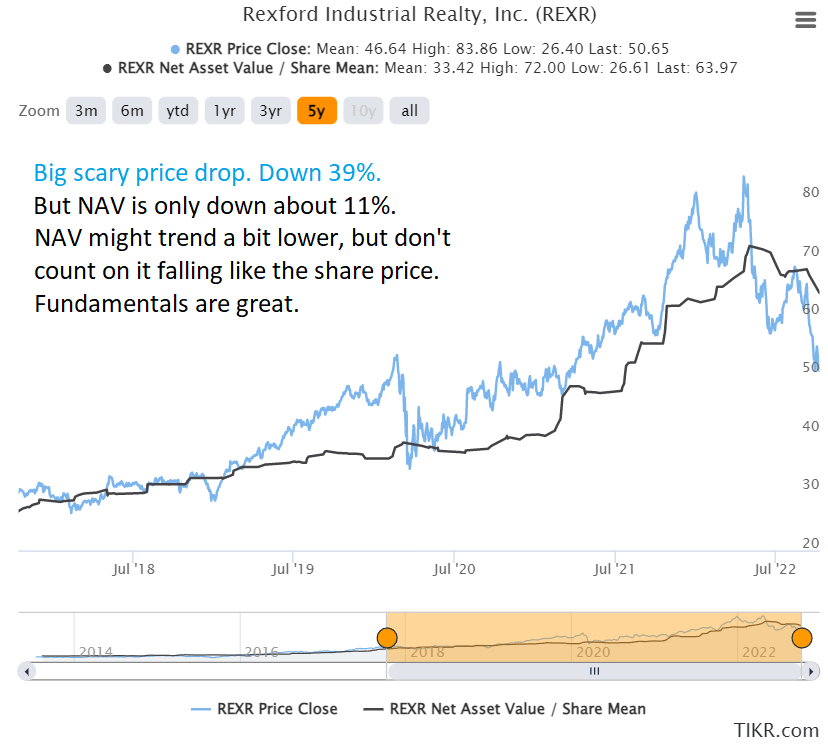

The huge swing in industrial REIT prices will have some investors in a panic. I understand. REXR trades at only 61% of their record high. A drop of 39% is going to create panic. Yet the consensus NAV (Net Asset Value) was only down 11% from the record high:

TIKR

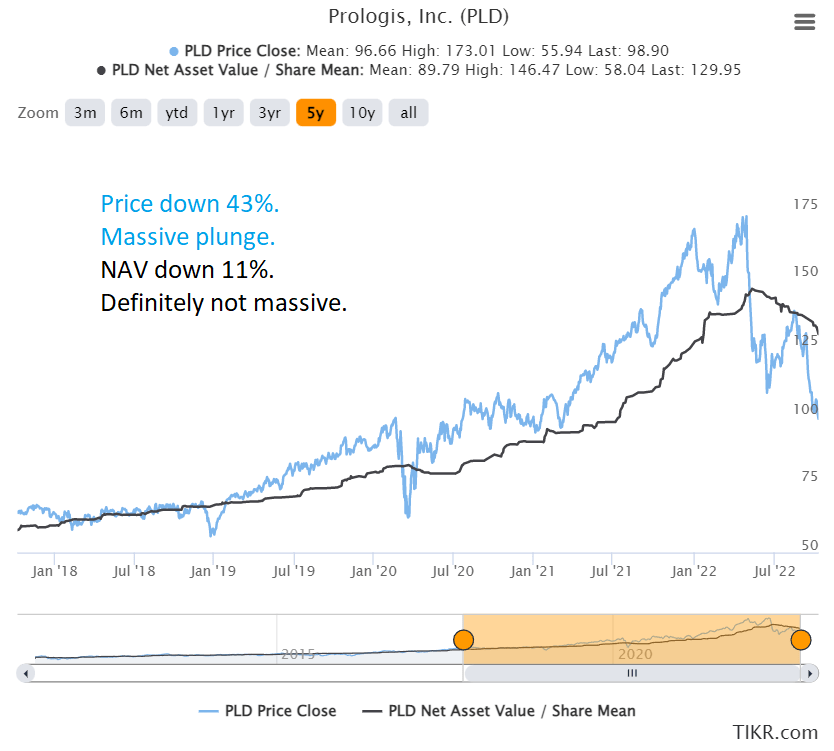

It isn’t just REXR, this is the case for many REITs with great assets:

TIKR

With that in mind, I want to move on to the results from REXR’s Q3 2022 earnings release and our latest report.

Latest on Rexford

We provided a huge updated report on REXR to subscribers shortly after the REIT reported Q3 2022 results. We’re sharing part of that report here.

We were doing a complete review of the REIT, but we also included the Q3 results from earlier that day.

Here are the main points:

- REXR’s Q3 2022 was great. I rate it 10/10. However, this article is way bigger than a quarterly update. We’re diving deep into REXR again.

- REXR’s fundamentals continue to strengthen. Massive leasing spreads driving management to raise guidance yet again.

- Upon a deep review of the portfolio and expectations for growth in FFO and AFFO per share, we’ve determined that consensus estimates for 2023, 2024, and 2025 appear too low.

- Even adjusting for the negative impact of higher interest rates, embedded growth should drive values higher.

- REXR was actively issuing shares, but they did it at $65.43. That’s 27% higher than today’s price. Issuing at $65.43 was a good idea.

Note: The reference to “today’s price” comes from the original subscriber report with shares of REXR at $51.32.

Now we can dive a bit deeper in.

Rexford is absolutely dominating on fundamentals. Shares appear to have found support right above $50.00. The 52-week low comes in at precisely $50.00. In our view, shares of REXR should be worth significantly more. What’s holding REXR back? Obviously, all REITs (and most stocks) have been pounded this year. Industrial REITs were hit harder than most. However, REXR’s fundamentals are smashing analyst estimates.

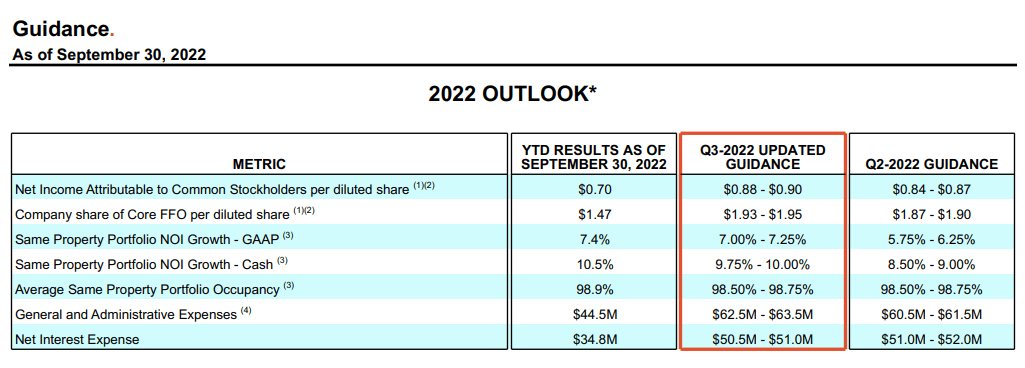

Besides beating estimates, they are also raising guidance:

Rexford

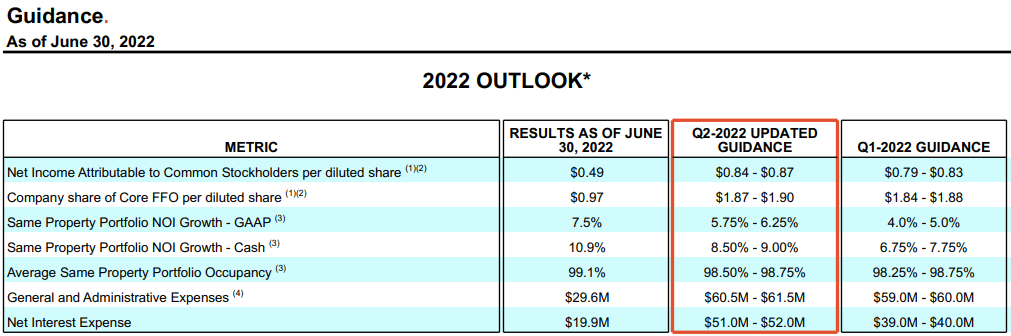

Seem familiar? After Q2 2022, they also had to raise guidance:

Rexford

Yes, there is a pattern here.

They are having an outstanding year on fundamentals, despite the weakness in the share price. However, this article isn’t meant to be a Q3 2022 update. It was designed to provide a look at FFO and AFFO per share growth over the next few years. We will include some figures from Q3 2022 though.

You can completely disregard headlines about missing on GAAP EPS. No one cares. REXR delivered Q3 2022 Core FFO per share of $0.50. That beat the latest consensus estimate of $0.48, and it beat the estimate of $0.49 from a few weeks ago. This is the typical “beat and raise”. Well, if a typical beat and raise can include 63% cash leasing spreads, then this is a typical beat and raise.

Some readers ask me to provide a simplified earnings assessment. I rate the quarterly results as a 10/10.

Other Picks

It isn’t just REXR delivering massive growth. We’re also very bullish on Prologis and Terreno (TRNO). These three REITs combine to represent about 14.1% of my portfolio. Since share prices change, and we have a real portfolio rather than a hypothetical portfolio with arbitrary allocations, that allocation will change over time because share prices change.

Conclusion

We foresee dramatic growth in AFFO per share continuing for the industrial REITs. Except for ILPT. We’re not getting into ILPT. For the rest of them, we foresee dramatic growth in AFFO per share. That growth should be largely driven by a strong performance in same-property NOI. That same-property NOI should be driven by strong leasing spreads. Those leasing spreads are a result of existing leases at low rates and a dramatic increase in market rents occurring over the last few years.

Limited development of new supply combines with a shift towards e-commerce (which requires dramatically more industrial space and virtually zero retail space) to create a structural imbalance of supply and demand. It could be possible to develop more industrial real estate, but in most cases, there would be huge opportunity costs. These opportunity costs (and zoning challenges) are large enough to create a dramatic barrier to new supply in the most desirable areas.

Industrial real estate still has fairly cheap rents per square foot. That gives landlords room to raise rents. Tenants can pay the new rent or they can leave. They could sign a competitor instead, but they would still be facing huge increases in rental rates. That leaves us in a great environment for seeing AFFO per share and dividends continue to grow at a rapid pace.

Ratings: Strong Buy on REXR, TRNO, and PLD

Be the first to comment