eyesfoto/E+ via Getty Images

Despite The Rapid Increase in Interest Rates, the Financial Sector Has Not developed As Expected

The rate hike to combat runaway inflation should draw the market’s attention to financial services stocks as the profitability of their operations should improve after monetary tightening.

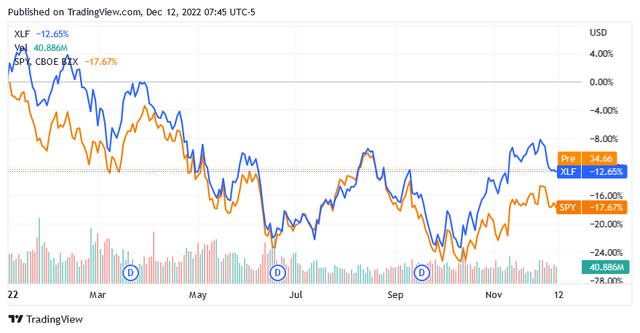

However, judging by the performance of the financial sector over the past year, represented by the benchmark Financial Select Sector SPDR Fund (XLF), things have not gone as expected following the aggressive rate hike by the US Federal Reserve. The index, which was very volatile among other things, lost 12.7% of its value after last year’s slide.

Source: Seeking Alpha

Essentially, many financial stocks suffered from the same known headwinds that weighed on the broader U.S. stock market, whose benchmark index, the SPDR S&P 500 ETF Trust (SPY), reflected a 17.7% decline over the past year.

In addition to what appears to be rather persistent headwinds, there is a risk of a build-up of non-performing loans and uncertainty about the evolution of the interest margin in the banking system.

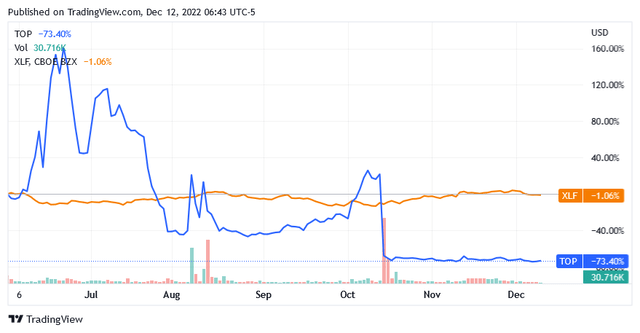

Given this situation, investors may be better off reducing their positions or not buying shares in “the most vulnerable financial stocks”. One of these underperforming stocks is TOP Financial Group Limited (NASDAQ:TOP), a Hong Kong-based online brokerage firm. Business is not going well and the future holds significant challenges.

Source: Seeking Alpha

TOP Financial Group Limited shares have lost 73.4% over the past year, significantly underperforming the financial sector as shown in the chart above.

Consistent with fiscal 2022, TOP Financial Group Limited’s contract futures trading business is likely to continue to suffer from the presence of social, political and economic factors that will impact traders’ incomes and their willingness to trade.

About TOP Financial Group Limited in the Financial Services Sector

Based in Hong Kong, TOP Financial Group Limited operates an online brokerage platform enabling trading in a range of local and overseas securities. These are essentially the three product groups equities, futures and options.

In addition to brokerage and value-added services, the platform offers trade placement and execution, and clients can also get account management and customer support.

The stock went public through a $25 million initial public offering on Wednesday, June 1 under Zhong Yang Financial Group (TOP) and thereafter changed its name to TOP Financial Group Limited in July 2022.

TOP Financial Group Limited in The Current and Near-Term Macroeconomic Environment

Elevated inflation weighing on households and businesses, fears of a sharp economic slowdown due to tighter interest rate policies, and lower present values of publicly traded equities due to higher discount rates being applied to future cash flows have created severe headwinds for TOP Financial Group Limited’s business so far.

These global headwinds created great uncertainty about the future for traders, who were significantly less inclined to invest in contract futures, stocks and other riskier assets. As such, the company’s total revenue for fiscal 2022 ended March 31, 2022, was $7.8 million, down nearly 53.8% year over year.

Futures brokerage commissions, which accounted for 55.1% of total revenue, fell 73.3% year-on-year, while trading solution fees accounted for 42.3% of total revenue. The company began offering trading solutions in May 2021.

The above headwinds, which are likely to persist given the severity of their causes, could be exacerbated by the accumulation of non-performing loans on banks’ balance sheets due to runaway inflation and the expected contraction in the global gross domestic product. A generally less stable banking system worldwide will certainly not help restore tolerance for riskier investments among TOP Financial Group Limited’s customers.

The increased volatility of the financial markets also makes traders less willing to invest in futures, stocks, options and other risky assets.

The decline in trading volume, which pushed up commission expenses, resulted in a net profit for fiscal 2022 of $3.5 million, or $0.12 per share, versus $5 million, or $0.17 per share in the 2021 fiscal year.

In addition, the shares of TOP Financial Group Limited will not be spared from the following negative factors that may affect the financial services industry. These will be the uncertainty about the development of interest rate margins in the banking sector, as interest rate hikes have also spurred the cost of deposits and savings, while revenues from asset management should decline because of the recession.

The significant year-on-year improvement in the company’s 12-month net margin to 44.9% as of March 31, 2022, and the existence of $5.96 million in net cash position has proven insufficient to trigger a recovery in TOP Financial Group Limited shares.

The Stock Valuation

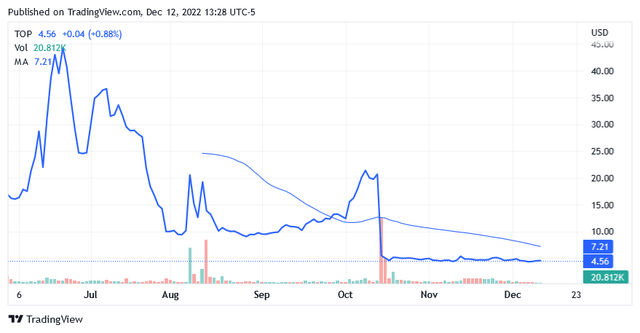

TOP Financial Group Limited shares are trading at $4.56 per unit at the time of this writing, giving a market capitalization of $158.43 million.

The 52-week range is $3.60 to $50.97.

Source: Seeking Alpha

Shares are trading below the $27.285 midpoint of the 52-week range and below the long-term trend of the 200-day simple moving average, but that doesn’t suggest a cheap stock.

Based on the likely trajectory of the global economy in 2023, TOP Financial Group Limited shares carry a high risk of falling further from current levels.

The 14-day relative strength indicator for TOP Financial Group stands at 39.21, meaning the stock is not yet oversold despite last year’s plunge. So there’s ample room for shares to experience more downsides.

At the moment, it looks like this stock’s shares will have a very difficult time recovering as the severe economic slowdown expected in 2023 and persistently high inflation will further fuel traders’ risk aversion in financial markets.

In addition, there are social and political risks in Hong Kong that could have a more direct impact on the business results of TOP Financial Group. These are the restrictions against the COVID-19 virus that limit opportunities for GDP expansion in China and Hong Kong, and the social tensions that arise from time to time due to the Chinese regime’s repressive activities towards pro-democracy activists.

Conclusion

After the shares of TOP Financial Group Limited were listed on the US stock exchange in June 2022, the shares have plummeted under strong downward pressure from global issues and other local issues of a social and political nature.

These issues have negatively impacted traders’ willingness to trade risky assets in the financial markets, resulting in lower volumes, turnover and profits for TOP Financial Group Limited.

As these problems are likely to persist in the coming months, this stock does not seem to have a realistic chance of recovery for the time being.

Be the first to comment