Kwarkot

Publicly traded real estate investment trusts (“REITs”) remain a popular investment vehicle for all classes of investors.

According to the National Association of Real Estate Investment Trusts (“NAREIT”), a Washington, D.C.-based association representing the industry, 83% of registered investment advisors currently recommend REITs to their clients. And over the next 1 to 3 years, 92% of surveyed advisors anticipate increasing or maintaining their use of publicly traded REITs.

Given the current pullback in the sector, this increased level of exposure makes sense, given their competitive long-term performance and stable dividend yields, which are currently more than double that offered by other components within the S&P 500 (SPY).

While the sector, overall, appears attractive, more defensive components, such as Healthcare and Self-Storage, as well as those with enormous pricing power, for instance, Industrials, offer wary investors the best risk-adjusted prospects. And for those with a greater risk appetite, top-tier Sunbelt-focused Office components continue to offer some of the most compelling risk/reward propositions.

Current State Of REITs

YTD through November 30, 2022, the FTSE NAREIT All Equity REIT index (“FTSE-A.E.R”) is down 21%. This compares unfavorably to every major index, with the exception of the Nasdaq, which is down 26% over the same period.

While the underperformance may cause some hesitancy to investors, it’s worth noting that the FTSE-A.E.R index has outperformed the S&P 500 in 15 of the last 25 years, while also providing a dividend yield more than double that of the S&P 500.

In the present, however, most sectors are down over 20% YTD. Bellwether sectors, such as Industrials, which includes REIT giant, Prologis (PLD), is down 26% YTD and Infrastructure, which counts American Tower (AMT) and Crown Castle (CCI) as core constituents, is also down 26%.

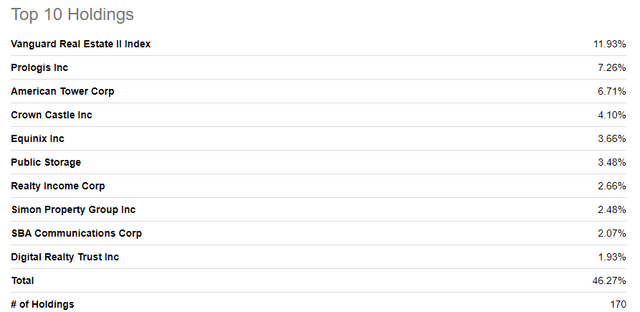

The underperformance of these two sectors is a primary driver of overall REIT YTD underperformance, as the previously mentioned three stocks are often core holdings in the various real estate funds. In the Vanguard Real Estate Fund (VGSLX), for example, the three, themselves, represent nearly 20% of the fund’s holdings.

Seeking Alpha – VGSLX Top 10 Holdings

Among the worst performing sectors are Offices, which is the biggest laggard, down over 30% YTD. Investor flight from the sector due to the rise of hybrid working arrangements is one prime culprit, as is the general glut of lower quality buildings, which are beginning to weigh on property values.

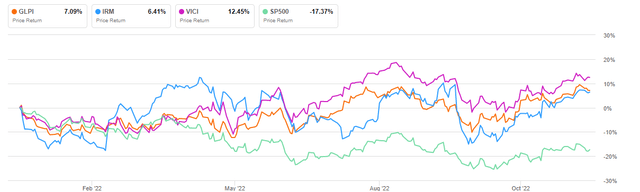

One sector bucking the YTD losses experienced by others is the Specialty space, which is the sole sector with a positive return, at about 3.5%. Among the components included within this sector are VICI Properties (VICI), Iron Mountain (IRM), and Gaming and Leisure Properties (GLPI), all of which have posted positive returns YTD and have handily outperformed the broader markets.

Seeking Alpha – YTD Performance Of Specialty REITs Compared To S&P 500

Opportunities Embedded In REITs

The recent underperformance in the sector has presented an attractive entry point on many names for new and existing shareholders alike. And for income investors, this is especially so, given the steady dividend income associated with most of the top names included within the FTSE-A.R.E index.

In addition to the income stream, REITs offer investors the ability to better diversify their portfolios. This is important due to the increased correlation to the total stock market of various indexes over the past 25 years.

According to NAREIT, the correlation of REITs to the total stock market from 1997-2021 was just over 0.60. This is compared to a near 1/1 correlation of large cap indexes and a correlation of above 0.90 for the value, mid cap, and growth indexes.

REITs also have one of the simplest models among all investment options. For most REITs, their primary business is leasing space and collecting rent on the real estate. At least 90% of their taxable income is then paid out to shareholders annually in the form of dividends. This simple business enables investors to easily follow and compare sector performance.

The Current Risk Associated With REITs

Though long-term outperformance, stable dividends, and their easy-to-understand business model with inherently low volatility are a few opportunities embedded within a REIT investment, prospective investors must also be cognizant of their risks.

One risk is relatively higher debt loads in relation to the broader markets. Currently, the average debt ratio of the FTSE-A.R.E. is just 34.5%. In addition, the debt servicing coverage ratio stands at a strong 6.0x. While these are healthy figures, leverage as a multiple of EBITDA still generally tracks higher than broader market indexes.

While some view Verizon’s (VZ) net debt/EBITDA multiple of 2.7x with caution, it’s not uncommon for REITs to have multiples in the 4-6x range. PLD’s multiple when excluding development gains, for example, is 4.3x. And Simon Property Group (SPG), another top holding in many REIT ETFs, sports a multiple of 5.7x.

Over the years, the industry has significantly de-levered and is currently in a much stronger financial position than it was in the Great Financial Crisis of 2007-2008. But the higher relative debt loads could, nevertheless, create strain, especially if the underlying real estate were to significantly decline in value, causing acute refinancing risk.

Competitors To REITs

Historically, REITs have provided a solid hedge against inflationary pressures. Rents, for example, are often tied to CPI-related data. So, one would naturally expect the sector to outperform during a period of rising inflation.

This, however, has not been the case. One prime reason is because there are attractive alternatives. The average dividend yield of the FTSE-A.R.E. index, for example, is 3.68%. While that is more than double the rate provided by the S&P 500, it is lower than what many risk-free alternatives offer.

The average rate on a high-yield savings account is above 3% in many cases. In addition, Treasuries are offering coupon rates in excess of 4%. And until recently, investors could have received interest of nearly 10% on an I-Bond. In fact, they could still obtain 6.89% at current rates.

Since the dividend payout is often one of the prime reasons why investors allocate capital to the sector, any decline in yields relative to other options presents a formidable hurdle for new investment dollars.

Recent News

At the beginning of the month, Blackstone’s (BX) real estate fund, BREIT, notified investors that it was limiting redemptions after the amount of withdrawals requested in October exceeded its monthly limit of 2% of its net asset value (“NAV”) and its quarterly threshold of 5%.

This sent shares tumbling and caused a stir among investors in the real estate arena. Though the fund is a non-traded REIT, which is distinctly different than a public REIT in that they raise money directly from individuals through financial advisors as opposed to selling shares on the stock market, they still buy the same type of commercial properties bought by public REITs.

BX CEO and Co-Founder, Stephen Schwarzman, brushed aside the news and explained that the redemptions originated primarily in Asia from investors seeking to shore up liquidity.

But shortly afterwards, Starwood Capital Group, another non-traded REIT, also notified investors that it was restricting withdrawals in their real estate fund.

In addition, U.S. public pension funds have also cut back on new investments in commercial real estate, according to a recent report in The Wall Street Journal, citing statistics from data firm, Preqin.

These statistics noted that real estate funds managed by private-equity firms have raised 30% less than they did last year, which has consequently pressured commercial property sales and values, leaving pensions and other institutional investors reluctant to deploy capital for fear of even steeper declines in the event of recession.

And if investors keep pulling money from the market, it would likely turn into an issue for the broader real estate market. This is because funds would likely have few alternatives other than outright building sales to pay back their investors, which would then place additional pressure on prices.

Top Industry Pick #1: Healthcare

Heading into 2023, REITs with more defensive, needs-based business models continue to be safe bets for wary investors. One such sector is Healthcare REITs.

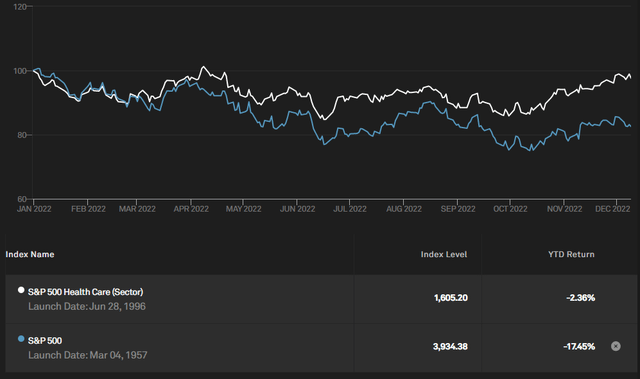

YTD, the S&P 500 Health Care index is down just over 2% compared to a YTD decline of nearly 18% in the broader index. Healthcare REITs, on the other hand, are down an average of 17% YTD.

SP Global – Comparative YTD Chart Of S&P Healthcare Index Compared To Broader S&P 500

The sector, however, has favorable long-term demand drivers for both medical office buildings and skilled nursing facilities resulting from an aging population. Among the pertinent names, Medical Properties Trust (MPW) and Omega Healthcare Investors (OHI) are two within the sector that offer investors significant upside potential and attractive dividend yields.

Top Industry Pick #2: Self-Storage

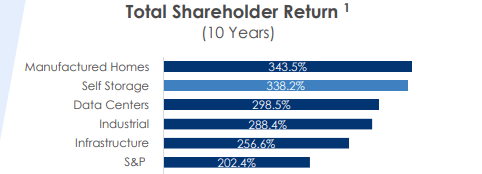

Self-storage is another needs-based industry that is worthy of investors’ attention heading into 2023. Over the past 10 years, the sector has been among the best performing, behind just Manufactured Housing. But YTD, they are down 22%.

LifeStorage November 2022 Investor Presentation – Snapshot Of Self-Storage Industry Performance Compared To Peer Sectors

While self-storage isn’t intuitively seen as recession-resistant, the sector has a record of holding up strongly through previous downturns. During the 2007-2008 Great Financial Crisis, for example, most businesses lost 40-50% in revenue. This is in stark contrast to self-storage, which experienced just a 2.5% decrease.

This is due to their “all-weather” demand drivers. That is, when times are good, consumers typically increase their purchases of household items, which ultimately creates demand for extra storage.

In a similar sense, when times are bad, the need for storage still exists, but the need is even more so since individuals are likely to be less mobile due to the affordability constraints of moving out of their current living arrangements. Self-storage offers one solution via comparably lower monthly rates.

In individual names, National Storage Affiliates (NSA) is a top name within the sector due to their modestly priced valuation of just 13.7x forward funds from operations (“FFO”) and strong dividend track record with a five-year compound growth rate of over 15%.

Top Industry Pick #3: Industrials

Sectors with enormous pricing power, such as Industrials, where vacancy rates continue to hold at record low levels, should also experience a rebound in valuations in the coming periods. Arguably, the sector has already experienced a run up over the past two years, leading some to shy away from the sector.

Still, there is significant potential within key names in the sector. Plymouth Industrial (PLYM) is one such name. Down over 30% YTD, shares trade at just 10.9x forward FFO, which is well below the sector median, despite posting operating results that are largely in-line with the sector.

Top Overall Industry Pick: Offices

And finally, of all the sectors, Offices, particularly those concentrated in the Sunbelt region of the U.S., is one sector that can experience the most significant rebound in 2023.

YTD, the overall sector is down over 30%, with some names down well over that 30% average. Secular risks certainly are present and that does warrant a markdown in valuations.

In addition, several notable names have already sliced their dividend payouts. Among them are SL Green (SLG) and Douglas Emmett (DEI). Vornado Realty Trust (VNO) is also expected to reduce their payout in 2023 as well.

While the dividend cuts certainly are frustrating, the current share price declines across the sector appear overdone.

Despite the current market environment, most of the major office components continue to post strong leasing figures marked with long weighted average lease terms. If offices were truly at risk of obsolescence, companies wouldn’t be committing themselves to extended lease terms.

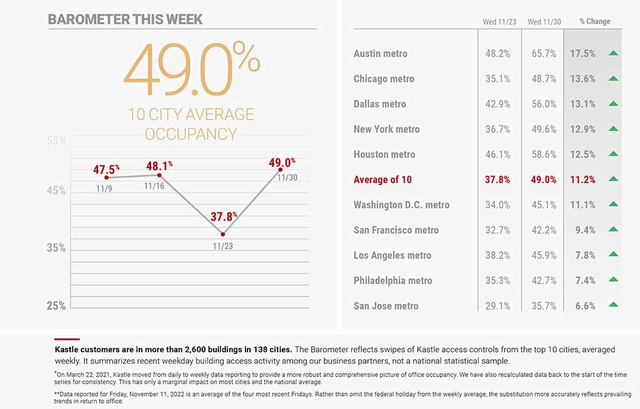

In addition, according to data provided by Kastle, occupancy levels continue to increase on a week/week basis, particularly in the Texas market.

Kastle Occupancy Statistics Used To Measure Return-To-Office Trends

While opportunities abound in the sector, Piedmont Office Realty Trust (PDM) and Highwoods Properties (HIW), are two names to keep an eye on in 2023. PDM trades at just 4.6x forward FFO and provides a dividend yield of over 9%, while HIW trades higher but at still historically low levels, despite its strong financial position and solid track record of dividend growth.

Takeaways

REITs have underperformed broader markets, with most major components down over 20% YTD. More specialty-focused sectors have fared better, but they are the rare exception.

Rising interest rates have presented a two-fold problem for the sector. One, it increases refinancing-related risks, especially if property values were to experience a sustained decline. Second, the higher rates have presented an attractive alternative to income-focused investors.

Though REITs are down, they aren’t out. Recent surveys of investment advisors continue to show greater exposure to the sector in the years ahead, driven in part by favorable fundamentals.

For more cautious investors, the Healthcare and Self-Storage industries are two defensive sectors that can buffet portfolios in the event of a downturn. Many Healthcare names, in particular, also present material upside potential due to their uncharacteristic YTD underperformance.

For those seeking even more lucrative upside, Offices are one asset class that has seen significant investor flight. Despite the hesitancy among investors, most REITs in the sector are still posting solid leasing results and are providing generally positive commentary.

A few Office-focused names have slashed their dividend payouts, which is especially frowned upon by REIT investors, but this should not distract from the embedded upside within several Office-related names.

All considered, despite facing a setback in 2022, the future prospects of REITs as a whole looks promising.

Be the first to comment