Tatiana Foxy

About a month ago, I detailed how new lows seemed possible for shares of cryptocurrency platform Coinbase (NASDAQ:COIN). With peer in the space FTX (FTT-USD) seeing its main token crash eventually resulting in FTX filing for bankruptcy, Bitcoin (BTC-USD) and other coins saw their prices drop considerably. While one might expect that bears might have taken a victory lap and cashed in their profits when it came to Coinbase, recent data shows that the naysayers are still looking for more downside.

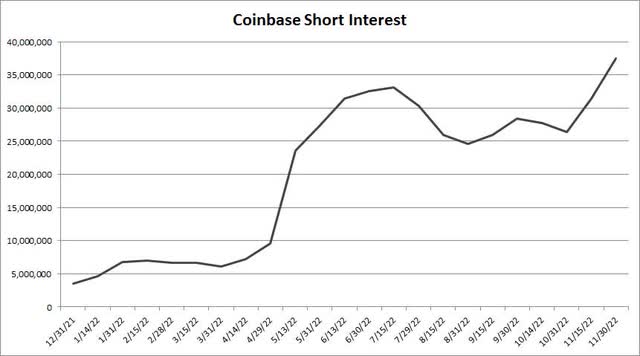

I covered the initial surge for short interest in Coinbase back in late June, as in just a month and half the number of shares short had surged from 9.5 million to over 31.4 million. 2022 started at just over 3.5 million shares short, but one might have expected to see some rise in short interest as the share price started to fall. Well, as we get ready to finish out the year, a new wave of bears joined the party, as the chart below shows the end of November update.

Coinbase Shares Short (NASDAQ)

At the end of last month, a little under 37.5 million shares were short, which itself is a new high, and is up about 969% for the year. Even though the stock’s float has risen in the low double digits percentage wise since late June, the percentage of float short has ticked up a couple of percentage points to over 25.3%. According to finviz data, of the 832 stocks with a market cap of at least $9 billion at the end of last week, Coinbase was in the top 10 names in terms of percentage of float short.

The interesting part here is that the dollar value of shares short hasn’t changed that much in the last month. At the end of October, that figure was $1.745 billion, but it was only down to $1.714 billion at the end of November. That’s despite a more than $20 decline in the stock, which if short interest had remained constant, would have meant a large drop in the dollar value of short bets. As a point of reference, there’s about $80 million more being bet against the stock now than at my June update on short interest, which tells you that investors are still looking for more downside despite the name being close to new lows at the end of last month.

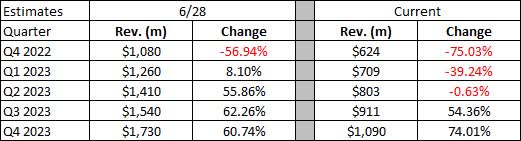

The drama at FTX certainly added a new chapter to the cryptocurrency story. Earlier this year, Coinbase revenue estimates were coming down as many coins dropped in price. This was because investors were trading less and were holding less assets on the platform. At that point, there was still a lot of faith in the crypto story overall, but recent events have shaken that confidence quite a bit. It will be interesting to see how Coinbase’s asset base finishes the year, and to see how much trading volumes fell after the FTX fiasco. In the table below, I’ve detailed how Coinbase revenue estimates have dropped since late June.

Coinbase Revenue Estimates (Seeking Alpha)

As we were set to finish Q2 this year, analysts thought that Q4 would be the last quarter to see revenues lower than they were in the prior year period. Now, analysts think we’ll see revenue declines through the first half of 2023. These Street averages may still have room to go down, as some of the high estimates seem pretty optimistic currently. That might just be a case of a certain analyst not yet updating their numbers, especially when it comes to the back half of next year.

In my previous article, I thought that new lows for Coinbase shares were possible, and we have definitely gotten to that point. Shares fell below $40 for the first time on Monday before rebounding a little. Still, I’ve kept talking about the street remaining quite positive, as the average price target is still over $72 a share. Of course, that average is down about $20 since the company’s Q3 report, and well off its spring 2021 all-time high of more than $500. This is certainly one of the names this year where analysts have been quite late, only cutting their targets after the stock takes another leg down.

With revenues dropping a bit in recent quarters, Coinbase has started to rack up some large net losses. This has resulted in quite a bit of cash burn, which has weakened the balance sheet. At the end of last year, the company had over $7.1 billion of cash, or more than $3.7 billion when excluding debt. When the September quarter came to a close, the cash balance was down to just $5 billion, or about $1.6 billion net of debt. A few more bad quarters like this could easily result in a capital raise to bring in some fresh funds to solidify the financial situation here.

In the end, Coinbase shares have fallen to lows, and short sellers as a whole are not exactly rushing to take large profits just yet. At the end of November, the number of shares short was at a new high for the stock, with the dollar value of these negative bets being close to its peak as well. With the FTX collapse hurting the entire crypto space, Coinbase revenue estimates are dropping considerably, and a capital raise might be needed if large losses and cash burn continue.

Be the first to comment