You Stuck With The Shares Now, Brother Joe Raedle/Getty Images News

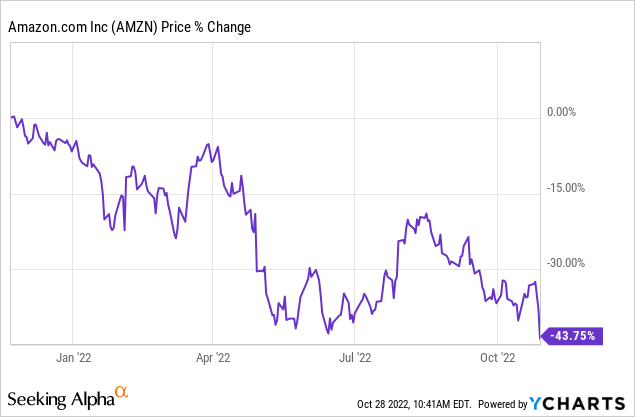

When we last gave our opinion on Amazon (NASDAQ:AMZN) it was poorly received by the cheerleaders. We did not like the valuation and felt the stock would drop at least 50% from the top.

Last time when AMZN’s super bubble burst, the Federal Reserve had eased aggressively. We don’t see any prospects for that this time and certainly there is far less room to ease compared to what was done there. So if AMZN dropped 92%, then don’t be surprised if we get at least a 50% drop this time.

Source: Ama-Gone, Why The Fed Is Not Bailing Your Poor Investments, Including Amazon

And we are almost there…

We actually hit the down 50% mark in the post-market action after the results. So where do we go from here for this once vaunted high flyer?

Q3-2022

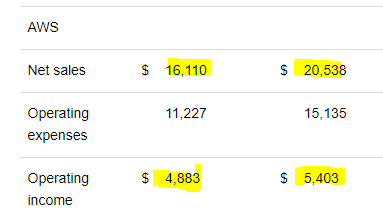

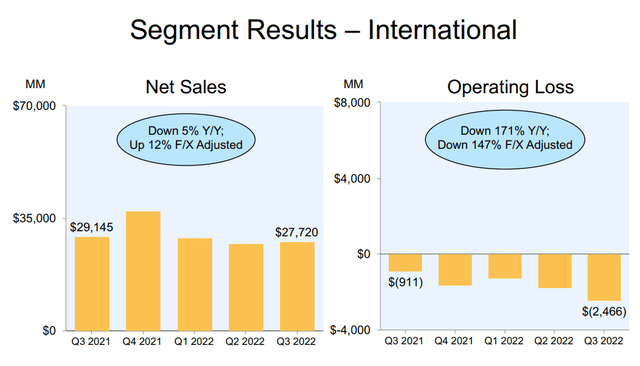

Net sales were lower than expected and came in with an increase of 15%. AMZN made sure everyone knew that exchange rates were making them take a bath and without the strong dollar, their sales would be up 19%. The big hit was in international where their sales were down 5% year over year. The much-vaunted AWS segment had sales move up by 28%, and this was a bit lower than the cloud growth from Microsoft Corporation (MSFT) or Alphabet Inc. (GOOG) (GOOGL). Both those names reported 30% plus growth rates in constant currency.

Of course, sales tell a small part of the story. Nobody has been worried about Amazon to sell you things. Making money on the other hand is a very different story. North America reported a $400 million operating loss, compared to almost $1 billion in profit in 2021. International had a $2.5 billion operating loss, worsening 171% year over year.

If there is one thing consistent about AMZN, it is that it likely has no idea how to get the international segment to even come close to an operating profit. At least you don’t get whiplash modeling those numbers.

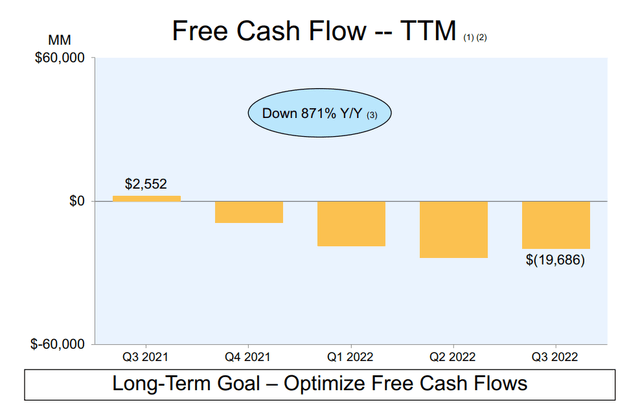

Cash burn was stunning across all levels. Free cash flow was an outflow of about $20 billion. AMZN’s presentation actually led off with the slide below.

The 871% drop is one that should send shivers down even the most optimistic spines. Free cash flow less principal repayments on finance leases was an outflow of $28.5 billion.

Outlook

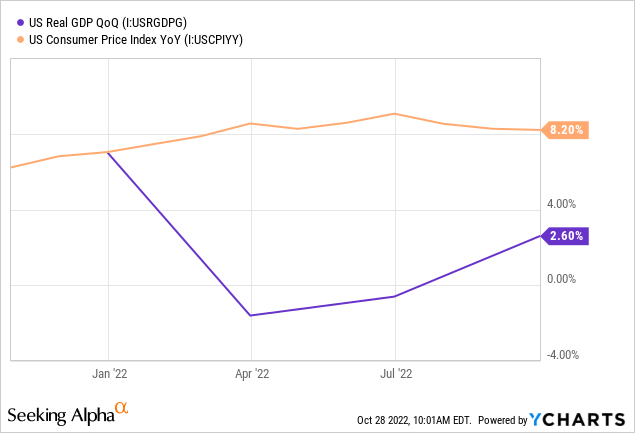

Guidance was for $144 billion in sales (midpoint) in Q4, implying a sales growth rate of 5% year over year. With real GDP at 2.6% and inflation over 8%, AMZN is badly trailing nominal GDP in sales growth, and it is not even a close call.

The growth story is done and AMZN’s best case is to track nominal GDP sales growth. As inflation and real GDP slow down, we think these numbers will prove extremely optimistic.

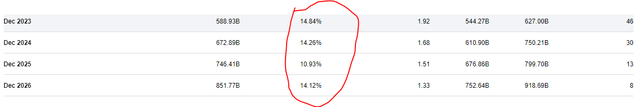

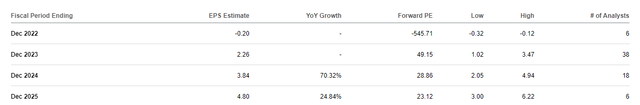

The bigger question is when will this company actually make money consistently. It is already reached a sales level that is tracking nominal GDP. At that point you are more of a “value company” and not a “growth idea”. Analysts obviously see things with green colored glasses and expect the best of outcomes. But even those numbers make AMZN ridiculously expensive.

50X next year’s earnings that are based on sales numbers that now look impossible, is a recipe for more downgrades. A business breakdown also reveals some big holes in giving this a buy rating. AWS sales are slowing and will likely hit a brick wall in 2 years. AWS margins were down from 30% in 2021 (left) to 26% in 2022 (right)

AMZN Q3-2022 Press Release

We see cloud and web services become a commodity service within 2-3 years and expect margins to drop by 40% from these levels (sub 15% operating margin). If you buy that story, then you need to sell AMZN.

Verdict

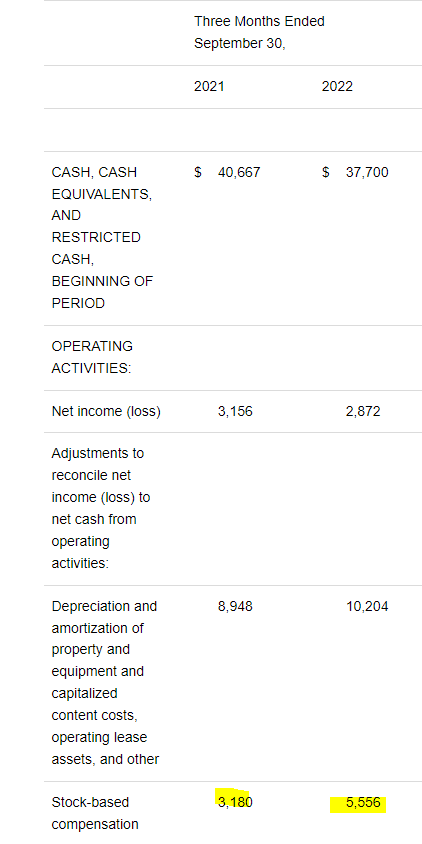

Let’s talk about that big increase. We are talking about that $5.55 billion in stock-based compensation, annualizing to $22 billion.

AMZN Q3-2022 Press Release

That alone knocks out the entire AWS operating income. Retail has of course not found a way to be profitable but valuing only the AWS at some crazy sales multiple will work out as well as valuing NVIDIA (NVDA) based on some arguably fictional addressable market numbers.

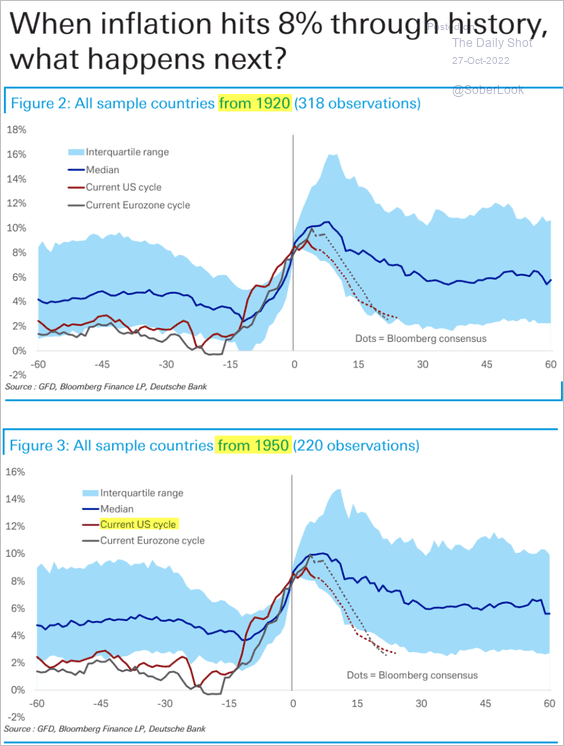

The Federal Reserve has shown a big reluctance to ignore the heavy inflation numbers. Yes, we might be at a peak inflation rate, but historical data shows that inflation takes about two years to trend below 6% once we peak above 8%.

Jesse Felder-Twitter

Good luck getting interest rate cuts to support these insane valuations. We rate the shares a Strong Sell with a 1-year rice target of $70.00

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment