JHVEPhoto/iStock Editorial via Getty Images

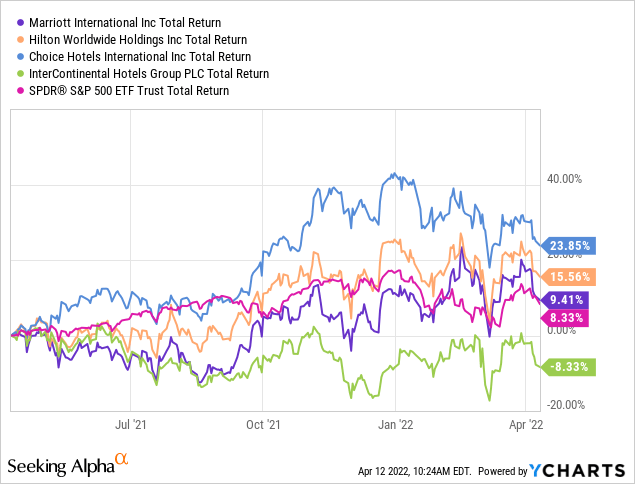

Over the last twelve months, Marriott International (NASDAQ:MAR) has been a laggard among its peer group that have recovered during the pandemic. It generated a total return of ~9%, roughly in-line with the S&P 500 but below Choice Hotels’ (CHH) 24% and Hilton’s (HLT) 16% return. In general, the hotel industry has suffered from the emergence of AirBNB and other alternative rental options. The latest generation of travelers are finding that they can get much more attractive stays if they all pitch in to rent a luxury house, whether it be in the Hamptons or Southern California. Although the pandemic was an immediate pullback in the hotel industry, there’s still some ongoing concern whether hotels lost the allure they once had for travelers in light of AirBNB. Marriott currently has 59% of its 2021 units under franchise, making it highly dependent on brand recognition to continue to attract third party owners. With that said, Marriott is the market leader in managed properties, so it carries a compelling economic moat.

According to Seeking Alpha data, the Street is currently mixed on the stock. Nearly 75% of the 22 analysts with a recorded rating rate the stock only a “hold” (or equivalent), a sentiment that has generally remained surprisingly consistent across the past three years. Although it’s nice to have the wind in your sails, it is my belief that there is no true “know it all” in the market. Fundamentally, stock returns are hard to predict over the short-term; I thus recommend investors focus on the long run history of stocks, identify undervalued to reasonably priced opportunities, and bet on strong fundamentals that could support returns over, well, the long haul. In this vein, I think Marriott could do well given its flagship status in the industry and broad footprint, notwithstanding the current noise around the pandemic and alternative rentals.

At 23.2x forward earnings, the stock looks reasonably priced, at first blush, relative to the broader market. Operating margins of 11.4% are tight though, especially combined with Debt/Equity at 7.2. By contrast, Hilton trades at 25.8x forward earnings but has operating margins of 16.3% and a relatively healthy balance sheet, as reflected in the quick ratio of 1.0. Choice Hotels trades at 25.0x with much stronger operating margins of 40.1% and Debt/equity of 4.0.

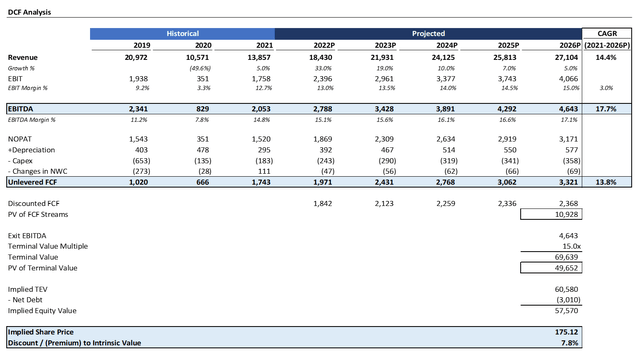

DCF Analysis Indicates Fair Valuation

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. Bear in mind that Marriott saw its revenue crater by half during the pandemic, and it was only up 5% in 2021 from that low at $13.9 billion versus $21.0 billion back in 2019. Accordingly, I forecast revenue recovering to slightly below pre-pandemic levels to $18.4 billion 2022, fully recovering in 2023, and then growing by 10%, tapering to 5% going into 2026. I assumed margins expanding by 250 bps into 2026 to 15.0%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at a little over $4.6 billion.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 15x and a discount rate of 7%, the stock is 8% below intrinsic value. In light of the market’s overvaluation, I thus find Marriott an attractive value play. From a historical standpoint, Marriott’s EBITDA multiple has generally traded in the 14-18x range, so my assumption assumes a permanent decrease in the valuation expectations on the Street.

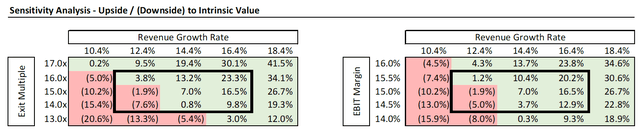

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, you can see that there are considerably more pathways to upside than downside. If the multiple were to expand to the high-end of the range at 17x, there would be 19% upside. It would take the multiple contracting to the low end of its historical range to get the stock to be fairly valued. At that point, you can ride the 7% returns implicit in my discount rate. Even if revenue were to grow by a CAGR of 10.5% and the multiples fall below the low end of the historical range at 13x, there is “only” 20% downside here—not bad, given where the broader market is priced. Accordingly, by and large, I think the stock is reasonably priced and represents favorable risk/reward.

Upside Catalysts

Admittedly, it’s not easy investing in such a has-been sector. With all the excitement from hot tech stocks, Marriott is never going to garner the attention on the Street. Thus, it will take several catalysts for the stock to really outperform. As much of a threat as AirBNB is, Marriott does actually have some aces in its hand that are being underappreciated. Marriott is seeing strong performance in the luxury tier resorts with packages that offer a full complement of services and amenities, which is a favorable differentiator against some of the short-term rental options. AirBNB’s often just don’t come with that “resort” feel of additional added services and support staff.

I am also excited about the company’s focus on lifestyle and select-service that I believe will stymie the threat of AirBNB. Marriott’s Bonvoy members booked 58% of room nights in the US and Canada, reflecting a cultivated loyalty. Marriott’s investment in its digital platform represents a massive upside opportunity. Bonvoy escapes are able to identify attractive availabilities within a four hour drive of your home, offer co-brand credit cards, and use points from Uber. So, even if consumers haven’t booked a stay in their hotel, they’ve accumulated points towards a stay that will provide inroads into developing a customer relationship.

It also is worthwhile to note that, with inflation hitting record levels, Marriott provides somewhat of a hedge. Hotels set prices daily, so they account for changes in the value of currency. At the same time, Marriott has stronger exposure to higher-end consumers and thus have a better ability to pass on input increases onto its customers than some of its competitors do. In general, there is potential here for inflation-averse investors to more into more hard asset businesses like Marriott. In addition, internationally, the company is more a manager of hotels than a franchiser.

Risks

There are several reasons to be hesitant about Marriott. Aside from the AirBNB threat, the company also suffers from a labor shortage and corresponding wage inflation. Management has tried to roll out productivity enhancements, and thus far profitability metrics have materially improved. However, there’s no guarantee in continued margin expansion. My model is highly sensitive to changes in margins: a 1% change in margins yields a 7% change in the return on value. Management is heavily trying to focus on cost reductions, but cost reduction is easy to talk about yet elusive to continue to achieve.

I am also concerned about the company’s high debt load of $11.4 billion, which puts the Debt/EBITDA multiple at 5x. This inherently limits the company’s ability to pursue accretive acquisitions, return cash to shareholders, and invest in additional growth catalysts. With a bet of 1.7, the stock is also highly sensitive to swings in the broader market, which makes the high leverage even more of a concern, especially when you factor in narrow operating margins of 11.4%. Lastly, it’s also important to note that Marriott is growing net rooms at a slower pace than Hilton.

Conclusion

Yes, the pandemic demonstrated the unique challenges of the hotel industry. However, I believe this has obfuscated Marriott’s otherwise strong fundamentals. Although slower growth relative to Hilton, high leverage, the rise of AirBNB are serious threats to Marriott; in my view, they are offset by otherwise strong fundamentals, execution, and growth catalysts. Bonvoy and full service options provide a strong answer to the changing hospitality preferences of next generation travelers. So, although the hotel sector is definitely changing, Marriott is more than capable of not only adapting to it, but to also continue to innovate within it. As a leading managed hotel property owner, the company simply has the established footprint and brand image to continue to thrive. Accordingly, I strongly recommend investing in Marriott.

Be the first to comment