curraheeshutter/iStock via Getty Images

Investment Thesis

APA Corporation (NASDAQ:APA) is an oil and gas company. APA runs an unhedged upstream oil and gas portfolio.

For investors that are bullish on oil and gas prices, investing in an unhedged energy company makes sense.

I lay out my estimate for how APA could return 13.8% annualized returns to shareholders.

This uses current strip prices of approximately $105 WTI.

While future oil prices are unknown, I believe that paying 5x free cash flow is attractive enough.

Here’s why I rate APA a buy.

APA Corporation’s Near-Term Prospects and Financial Position

APA explores and produces oil and gas properties.

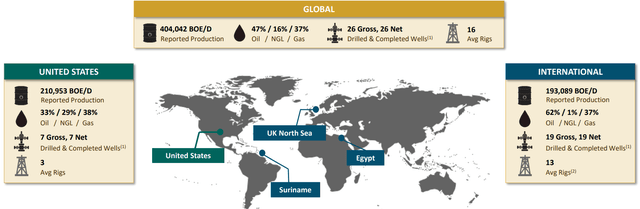

As you can see in the graphic above, APA has its oil production roughly evenly split between the US and international operations. Being able to participate in the UK North Sea could be a meaningful contributor to its near-term operations.

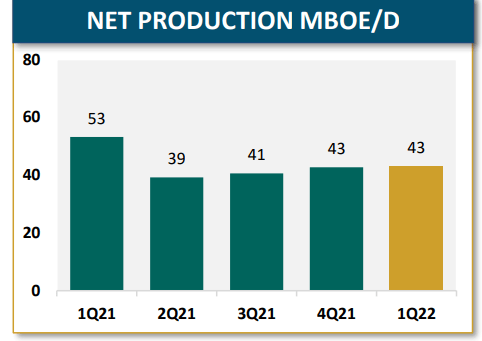

Incidentally, APA believes that after some repair and maintenance work took place at local North Sea rigs. However, APA guides that its exit rate production in Q4 in the North Sea could exceed 50 Mboe/d.

APA investor presentation

This would obviously be a welcome boost, at a time when oil prices are still strong.

Moving on, let’s turn our focus to APA’s balance sheet:

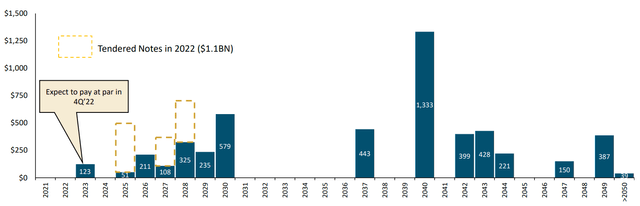

APA has no significant debt maturity. And its average interest rate on its notes is 5.3%.

That being said, APA does carry approximately $5 billion of net debt. Thus, even if there are no near-term material debt maturities, the debt still has to be repaid alongside APA’s shareholder returns.

On a positive note, Fitch recently upgraded Apache to investment grade with a BBB- rating and a stable outlook. While this is clearly good news, keep in mind that Fitch is normally recognized as the smallest of the credit houses, making this recognition of small practical significance.

All in all, its balance sheet is solid, but still requires some paring down over time.

With all that in mind, let’s now turn our focus to APA’s capital return program.

APA Corporation’s Capital Return Program

APA’s dividend yield was recently increased. It now offers shareholders a 1.25% yield. Clearly, this is nothing too exciting. Not when we keep in mind the volatility of energy prices.

The one aspect where shareholders could build a bull case is its share repurchase program.

During the APA’s earnings call, management said,

Based on our capital return framework, this would imply a minimum of $1.8 billion of return to shareholders. Thus, if commodity prices sustain at these levels, you should expect an acceleration in the pace of share buybacks through the rest of the year.

Indeed, during Q1 2022, APA returned to shareholders $261 million in share repurchases.

If we were to annualize this repurchase program we would get to approximately $1 billion. Given that this figure, plus circa $200 million for dividends, only amounts to approximately $1.2 billion, this would mean that APA will indeed rapidly increase its share repurchase program in Q2 and beyond.

Thus, this could mean that APA will increase its capital repurchase program from $261 million in Q1, to somewhere as high as $400 million per quarter.

The $400 million in buybacks, plus approximately $45 million in dividends would equal around $450 million per quarter or the $1.8 billion guided for in management’s quote above.

In that event, APA’s total shareholder return would reach 3.5% per quarter, or 13.8% annualized. Needless to say, getting a 13.8% annualized dividend is seriously attractive.

APA Stock Valuation – Priced at 5x Free Cash Flow

Back in May, when APA guided the market for its full-year 2022 free cash flows of $2.9 billion, oil prices were approximately $107 WTI. Prices then proceeded to move higher, before sharply returning lower.

However, for now, prices remain not too dissimilar to when APA guided for $2.9 billion of free cash flow in 2022.

This leaves the stock still priced at approximately 5x free cash flow.

Any energy stock that is still being priced at 5x free cash flow or less is clearly very attractively priced.

I contend that the bigger and more widely followed oil and gas companies, for example, Exxon Mobil (XOM) or Chevron (CVX) are more expensively priced at 7x and 9x free cash flow respectively. Whereas the smaller companies, that are perceived to be at higher risk, are being priced at significantly lower multiples, several turns lower, as in the case with APA.

The Bottom Line

APA has a line of sight to $2.9 billion of free cash flow. This strong free cash flow is leading to a massive $1.8 billion potential shareholder return program.

I estimate that this could amount to somewhere close to 13.8% total shareholder return over the next twelve months.

Consequently, I rate this stock a buy.

Be the first to comment