zimmytws

As a cis gendered, heterosexual married man I know almost nothing about the world of LGBTQ focused dating apps, so why am I writing about Grindr (NYSE:GRND)? Well, I do know some things about SPACs and it is the SPAC component that makes this otherwise decent company a dangerous investment. In particular, there are 3 problems that result in the fair value per share of GRND being about 1/4th the current market price ($27.90 at time of writing).

- Dilution from warrants

- Extreme dilution from sponsor gifted shares

- Minimal float induced pop to market price

Further, there are 2 catalysts which I believe will swiftly bring the price down to where it belongs.

- Expiration date on insider share/warrant lockup

- In-the-money public warrants lockup expiring

I will begin with a quick business overview and then follow with the SPAC problems that result in extreme overvaluation.

Overview

As a company, Grindr seems fine. It has a decent growth rate and has achieved marginal profitability.

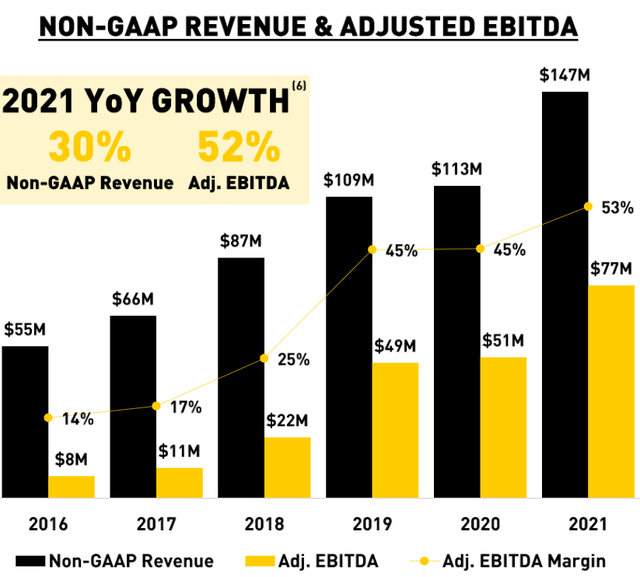

GRND

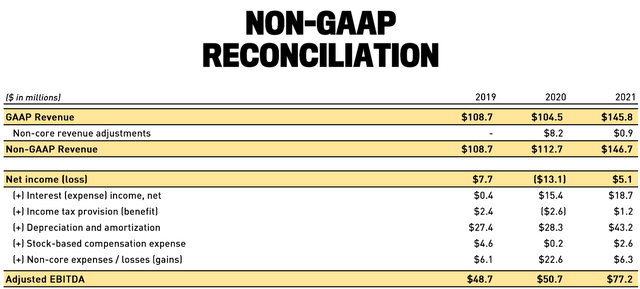

Adjusted EBITDA includes a few items like stock comp and depreciation which I think are real expenses, so I would lean more toward looking at the GAAP net income figure of $5.1 million for 2021.

GRND

Thus, the magnitude of profits is not yet significant, but simply being positive is fairly good for a freshly IPOed company that is early in its growth

Grindr claims to have a large total addressable market and even within their existing user base they have only monetized a small portion of users. Together, these attributes provide the potential for growth.

I don’t believe I have any sort of advantage in analyzing the plausibility or magnitude of said growth, so I will leave that to analysts who are more familiar with the dating app space. Instead, this article will focus primarily on valuation.

What sort of price is reasonable to pay for this growth potential?

Valuation

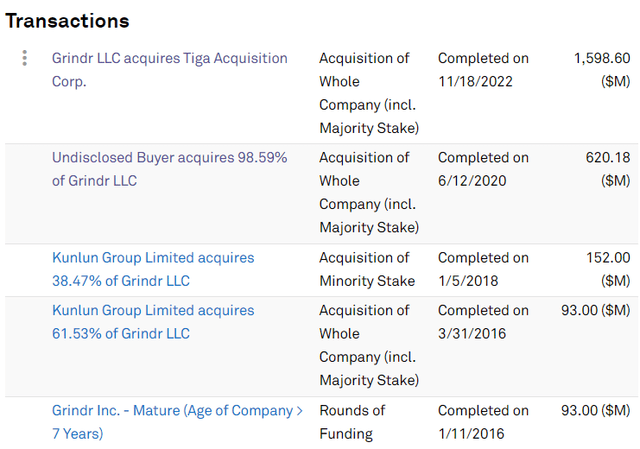

While freshly public, this is not the first time Grindr has been valued. It actually has a rather extensive history of being bought and sold.

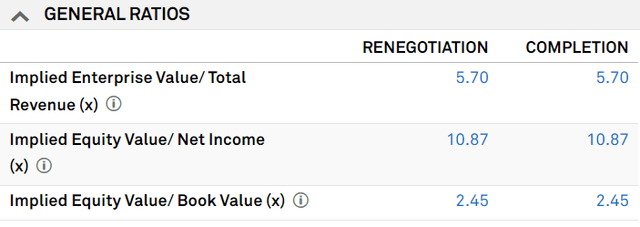

S&P Global Market Intelligence

Beyond the initial rounds of funding, Chinese online game publisher Kunlun Group bought 61.53% of Grindr at a valuation of $93 million in 2016. They then bought the other 38.47% in 2018 at a price implying a valuation of $152 million.

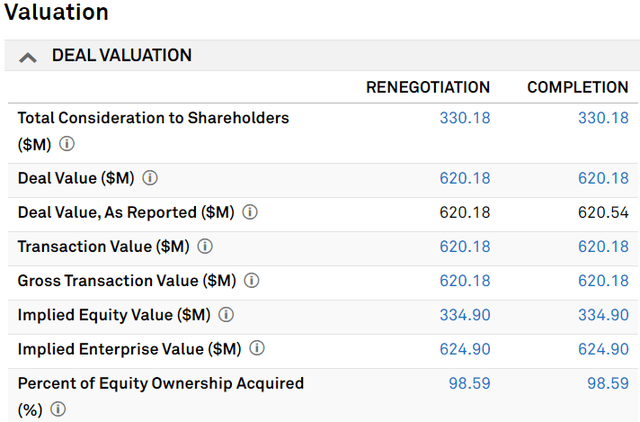

Kunlun then sold it in 2020 to a group of private investors at an enterprise value of $620 million, $330 million of which was equity with the rest being debt assumption.

S&P Global Market Intelligence

At that price the valuation was a little bit high but not outrageous.

S&P Global Market Intelligence

One would typically see a lower multiple on revenues and/or earnings in the start-up space, but since Grindr was a bit more established and therefore less risky that may have justified the slightly higher multiple.

I consider this $620 million dollar enterprise value to be the most recent vetted pricing of Grindr.

The buyer paid that much for it in cash and debt assumption, and they would have only done that if they believed it was worth that much. It is a large transaction so they clearly would have done due diligence.

All the valuation changes that have happened since then were not real cash buys and thus were not vetted to the same degree. As such, I will be using the $620 million as the base level of fair value.

The 2020 purchase price of $620 million was looking at 2019 full year numbers and the recent SPAC IPO used full year 2021 numbers.

Between 2019 and 2021, Grindr grew revenues by 35%. If we apply a similar increase to enterprise value, it implies a valuation of $806 million.

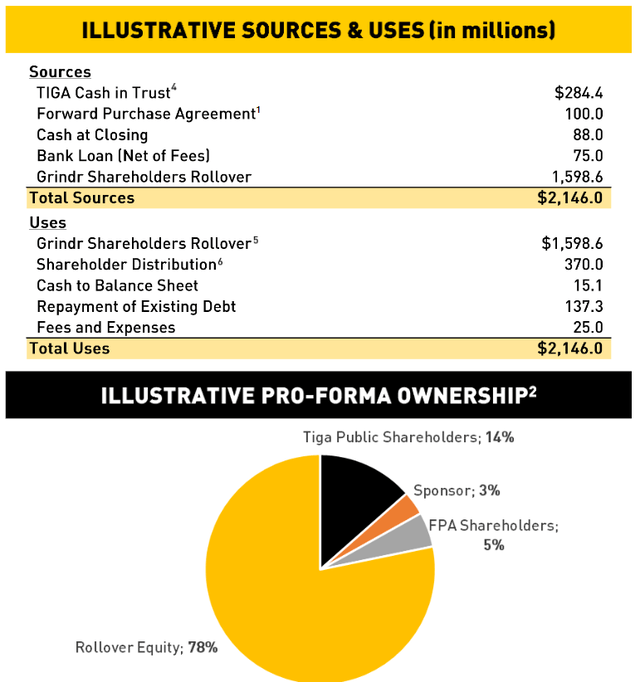

Yet, the SPAC buyout valued it at $1.6B on existing shares or $2.15B all in.

GRND

So why is the Kunlun sale to private groups a real valuation and the SPAC deal is not?

Well, the private group paid with cash whereas the SPAC did not contribute a meaningful amount of cash. It absorbed the company at an arbitrary valuation and paid a non-meaningful amount of cash at that valuation for some extra shares.

How did this happen?

Well, a SPAC begins with a capital raise as a sort of blank check company. In this case, they raised $276 million selling 27.6 million $10 units.

“The registration statement for the Initial Public Offering was declared effective on November 23, 2020. On November 27, 2020, the Company consummated the Initial Public Offering of 27,600,000 units (the “Units” and, with respect to the Class A ordinary shares included in the Units sold, the “Public Shares”) which includes the full exercise by the underwriters of their over-allotment option in the amount of 3,600,000 Units, at $10.00 per Unit, generating gross proceeds of $276,000,000”

The managers of the SPAC then have a certain amount of time to find a company to acquire and then shareholders can vote to approve that merger. In this case, shareholders overwhelmingly voted to approve.

SPAC investors also have an option to redeem their shares for the initial $10 plus a bit of interest. As it turns out, investors redeemed 98% of shares.

Per the merger 8K:

“A total of 27,114,767 shares of common stock were presented for redemption in connection with the Extraordinary General Meeting.”

Inclusive of interest, these shares were redeemed at $10.50 each so the capital outflow was actually greater than the entire amount of money raised.

So, while the SPAC was supposed to contribute a few hundred million dollars at the merger valuation to the combined company, the extreme redemption resulted in the SPAC contributing almost no capital. Therefore, nobody bought the company at the proposed $2.14B level. It was just arbitrarily set at that level and now is a public entity.

In addition to contributing almost no capital, the SPAC diluted existing shareholders quite a bit by issuing a bunch of warrants to SPAC investors and millions of warrants to SPAC management.

Per the filing:

“Simultaneously with the closing of the Initial Public Offering, the Company consummated the sale of 10,280,000 warrants (the “Initial Private Placement Warrants”) at a price of $1.00 per Initial Private Placement Warrant in a private placement to Tiga Sponsor LLC (the “Sponsor”), generating gross proceeds of $10,280,000”

Also per the filing:

Founder Shares

In July 2020, the Sponsor paid $25,000 to cover certain offering and formation costs of the Company in consideration for 5,750,000 Class B ordinary shares (the “Founder Shares”). On November 23, 2020, the Sponsor transferred 20,000 Founder Shares to each of the three independent directors for approximately the same per-share price initially paid by the Sponsor. On November 23, 2020, the Company effected a 1,150,000-share dividend, resulting in 6,900,000 Founder Shares outstanding.

In total that is more than 17 million additional shares/warrants issued for minimal proceeds. In fact, the proceeds are less than underwriting costs.

“Transaction costs amounted to $15,736,649, consisting of $5,520,000 of underwriting fees, $9,660,000 of deferred underwriting fees and $556,649 of other offering costs.”

It was significant dilution without a meaningful cash contribution.

The dilution in combination with the arbitrary step up in value per share are 2 major contributors to GRND’s current overvaluation. The 3rd, and biggest by absolute dollars, is the tiny float.

Big size – tiny float

Since so many of the SPAC shares were redeemed, the number of shares floating at IPO was tiny. Many of the initial shares are locked up and the warrants are not yet liquid, so it was just a fraction of shares outstanding that were trading.

Buyer interest in a company is largely based on its size, so this IPO had the buyer interest of a multibillion dollar company. However, that buyer interest was only trading against sellers of a dramatically reduced float.

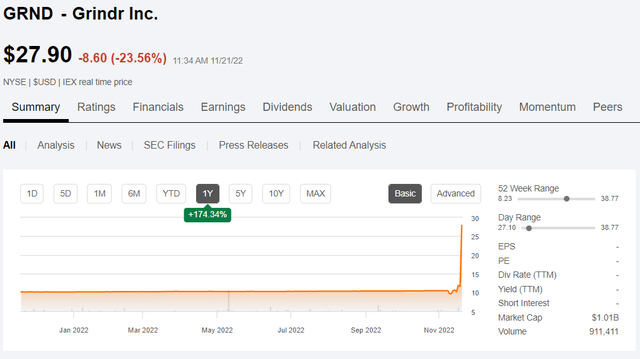

The imbalance caused GRND to pop as much as 400+% intraday on its $10 IPO and now sits at $27.90.

SA

Given the change to share count from redemptions it is hard to track down the exact number of shares outstanding, but CEO George Arison said on CNBC it is just over 120 million shares.

That represents a market cap of about $3.4 billion.

I view that as a rather extreme overvaluation against trailing year EBITDA of $77 million and trailing earnings of $5.1 million.

Beyond the bubble-like multiples, it also looks overvalued relative to the most recent cash purchase of the company. If it was bought for equity of $340 million in 2020, I highly doubt it is worth $3.4B market cap today.

10 fold in 2 years with almost no capital contribution?

This is also the time period in which interest rates have risen dramatically, putting a strain on growth company valuations.

I think a much more realistic valuation would be the aforementioned $806 million. This gives them full credit for the growth they have achieved since 2020 and still represents a fairly aggressive valuation against earnings and EBITDA.

Grindr is a legitimate company with a profitable business model. Its problem as an investment is related to the dilution and murkiness of the SPAC IPO process, which has led to a valuation that is out of touch with the way growth companies are priced today.

I think share price will fall to about $7 per share and there are some powerful catalysts that I think will get it there.

Catalysts for a falling price

I don’t believe the price is a reflection of what the market thinks GRND is worth, but rather a reflection of the supply/demand imbalance of the tiny float. The minimal float is soon to be corrected as various lockups expire.

Both the public warrants and the sponsor’s warrants are on their way to getting unlocked.

“The Public Warrants will become exercisable on the later of [A] 30 days after the completion of a Business Combination and [B] 12 months from the closing of the Initial Public Offering.”

“The Sponsor has agreed not to transfer, assign or sell any of the private placement warrants until 30 days after the consummation of the Business Combination.”

The exercise price for public warrants is $11.50, so presumably they would be exercised immediately upon being unlocked if the market price is anywhere near where it is today.

Additionally, the sponsor’s gifted shares get unlocked in about a year.

“After the consummation of the Business Combination, the Sponsor will be contractually restricted from selling or transferring any of its shares of New Grindr Common Stock (the “Lock-up Shares”), other than (i) any transfer to an affiliate of a holder, (ii) distribution to profit interest holders or other equity holders in such holder or (iii) as a pledge in a bona fide transaction to third parties as collateral to secure obligations under lending arrangements with third parties. Such restrictions begin at Closing and end on the date that is 12 months after the Closing.”

Once the float issue is fixed I think it will trade toward fair value.

Is GRND a short?

Given the fair value being about 25% of the current market price it is tempting to short GRND, but I think it is too risky. The tiny float presents the potential for explosive share price growth in a fashion similar to its pop on the IPO.

Perhaps later it will become a short opportunity if the price remains high after more shares float.

For now, I think it is just a don’t touch and those currently in it might be wise to consider taking profits.

Be the first to comment