vchal/iStock via Getty Images

Introduction

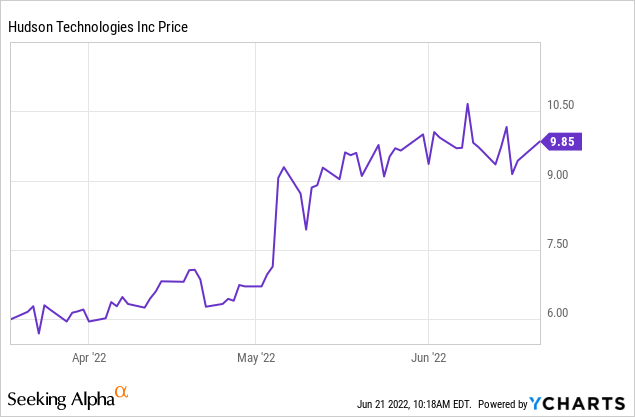

While markets are bleeding, there are some stocks that are witnessing huge gains. It’s the case of Hudson Technologies (NASDAQ:HDSN), a company that will join the Russel 2000 on June 27th, creating a lot of renewed interest for this company.

The Company

Hudson Technologies operates in the HVACR industry (Heating, Ventilation, Air Conditioning and Refrigeration). It focuses on supplying and/or reclaiming refrigerants. It is also a developer of solutions to capture and recycle refrigerants and other ozone depleting and global warming gases. The company operates mainly in the U.S., where it is the largest refrigerant reclaimer with a 35% market share, but it also has exposure to other countries. The Company sells virgin (i.e. new) and, most importantly, reclaimed refrigerants. In fact, Hudson Technologies owns a chemical know-how that makes it one of the few companies able to remove the moisture, oils and other contaminants frequently found in refrigeration circuits. Thus, the company is able to reclaim old refrigerants, clean and recycle them to then resell them. For example, Hudson Technologies continues to sell reclaimed CFC based refrigerants, which are no longer manufactured. The Company regularly purchases used or contaminated refrigerants, from many different sources, these refrigerants are then reclaimed using the Company’s proprietary Zugibeast system, and then are resold by the Company. The Zugibeast is protected by a patent and offers the company a moat that protects it from other competitors and from new companies that may think about entering into this market. Refrigerant reclamation can be performed even onsite at large buildings or facilities. The company explains that it is similar to kidney dialysis in that the building chillers can continue operating while the refrigerant is diverted to the Zugibeast cleaning process.

The reclamation process is important and lucrative because it allows to re-use refrigerants thereby eliminating the costs linked to their destruction or to the manufacturing of additional refrigerant. Clearly, this has also a positive impact on the environment.

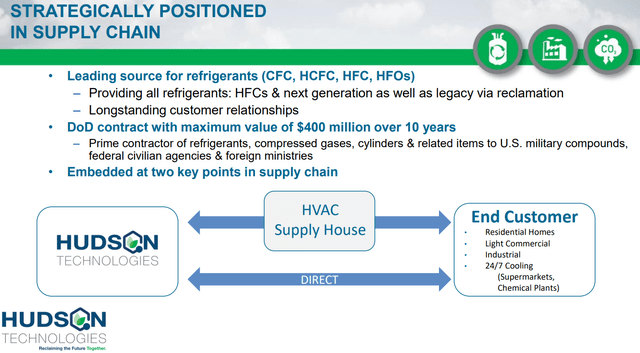

Hudson Technologies has thus a double role in the refrigerant supply chain: on one side it is a supplier, on the other it is a reclaimer. In this way it is both at the beginning and at the end of the cycle. Actually, Hudson Technologies is able to convert every end cycle into the start of a new supply.

Hudson Technologies 2022 Investor Presentation

One last note, Hudson owns multiple reclamation facilities through the US in order to make refrigerant reclamation as easy as possible.

The environmental trend

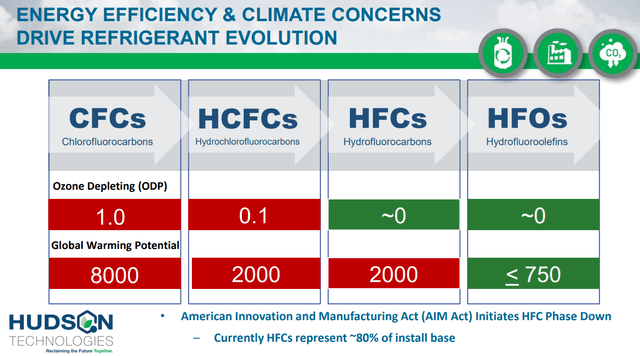

Refrigerants have given and are still giving some environmental problems because the chlorine used has a harmful impact on the ozone layer. This is why governments around the worlds ruled different steps to phase out of chlorine based refrigerants.

Here is a slide that shows the four different steps of refrigerant evolution, a path that Hudson knows well and that investors should be aware of.

Hudson Technologies 2022 Investor Presentation

CFCs have already been dismissed and substituted by other technologies (HCFCs and HFCs), and in particular HCFC-22, also known as R-22.

Hudson became able to reclaim R-22 and reuse it, since all air conditioners built before 2010 run on it. By 2020 R-22 production had to be ceased, thus creating a supply limit for the owners of R-22 air conditioning systems that are functioning and that are not to be replaced in the short term. The supply limit did boost prices up, offering Hudson Technologies a great opportunity with its reclaiming, recycling and reselling business, through its refrigerant buyback program.

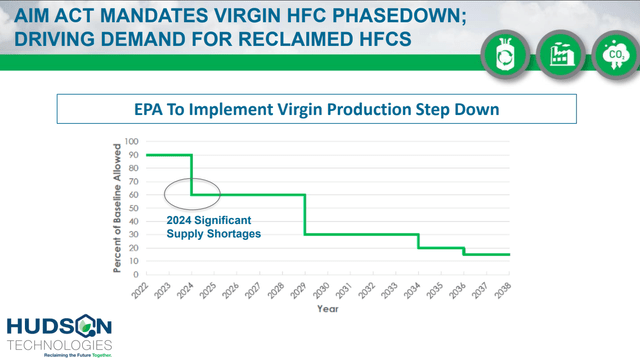

The AIM act

In December 2020 Congress passed the AIM act, requiring a further step toward zero impact refrigerants. The act ruled the phasedown of virgin HFC production in the next 15 years.

Brian Coleman, President and CEO of Hudson Technologies, explained the good consequences of this act during the Q1 2022 earnings call:

The start of 2022 marks the beginning of our industry’s compliance with the AIM Act regulations, which mandate a 10% step down in the production and consumption allowances for HFCs for 2022 and ’23 with a 40% reduction in the baseline scheduled to take place in 2024. HFCs are currently the most commonly used refrigerants and as a leading reclaimer, we are uniquely positioned to fill the anticipated HSC supply gap as virgin production is phased out. It’s important to note that the AIM Act mandates a much more aggressive and faster phased out than what we previously saw with the R-22 phase-out and promotes the use of reclaimed refrigerants to meet demand as Virgin production steps down. As a leading reclaimer, with the reclamation technology capabilities and established distribution network in place, we believe this presents us with a tremendous market opportunity to expand our leadership role in the industry’s transition to cleaner, more efficient next generation cooling equipment and refrigerants.

In 10% stepdown in production for virgin HFCs that has to take place already in 2022 will provide Hudson an opportunity because to fill the gap in supply, the reclamation business will accelerate. However, tailwinds will not end with 2022, as in 2024 we will have significant supply shortages, as shown in the graph below.

Hudson Technologies 2022 Investor Presentation

With one of the hottest summers starting, we may also imagine that refrigerant supply will be under pressure at a faster than anticipated pace, which could boost Hudson’s profits.

A little history

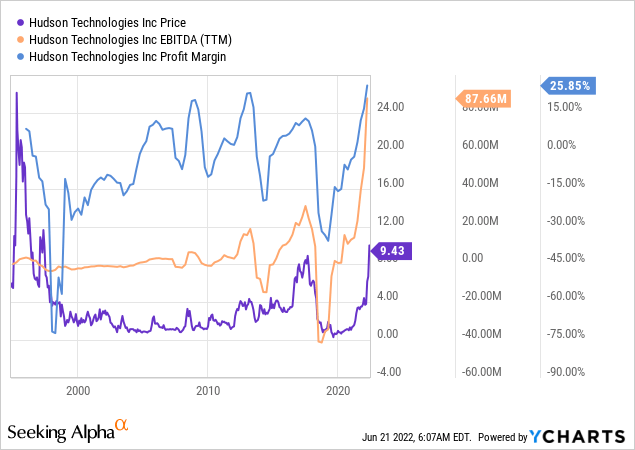

Let’s take a look at the stock price since its IPO in 1994 alongside with its EBITDA and the profit margin.

As Seeking Alpha author Capital Research explained in a 2017 article, Hudson at first began as an importer and exporter of R-12, that was to banned in 1996. Then, Hudson chose to move towards being a national distributer, increasing a lot its costs. This led the stock to reverse and lose all its massive gains. It was during this time that the company became focused on developing a network of distribution and reclamation centers, ceasing its importing activity. As the company developed its new core business, the stock price bottomed and traded flat for almost a decade, to start then recovering. However, we see a sudden drop during 2017 and 2018 due to poor results linked to refrigerant prices dropping and a cool weather.

As Kevin Zugibe, the former Hudson Technology founder and CEO, explained during the Q3 2017 earnings call,

There was a severe although temporary supply and demand imbalance. This disruption began to subside in the third quarter of 2017 with a flood of Chinese suppliers refrigerants which in turn create a rapid reduction in HFC pricing that returned levels similar to the beginning of the year.

Hudson is historically focused more on the legacy R-22 business while ARI brings a very strong HFC business. As our industry continues to evolve, we expect our combined expertise and capabilities will increase our access to legacy as well as next generation gases allowing us to expand and diversify our product offerings, application capabilities and our customer base. The strength and depth of our combined operations position Hudson for continued growth and profitability as the industry transitions to new technologies and gases.

During 2017 Hudson also completed the acquisition of Airgas-Refrigerants, Inc. for $220 million. This enabled Hudson, that was mostly focused on R-22, to expand and strengthen its HFC business. However, as refrigerant prices kept on correcting through 2018, the company found itself in turmoiled waters because of a leverage ratio violation. During the Q2 2018 earnings call, Zugibe explained that the company was

working closely with our term loan lenders to secure a waiver and amendment of our term loan that would waive compliance with the existing total leverage ratio covenant and provide new total leverage ratio covenants for the period ended June 30, 2018 through September 30, 2019. It should be noted that we had a leverage ratio violation as a result of the price correction and inventory write-ups.

Zugibe, however, was confident the company would weather the storm because it had already seen that during previous phaseouts, refrigerant prices had high volatility at the beginning due to some producers that flooded the market with already produced refrigerants before they were banned.

Hudson did reach in August 2018 an interim waiver to its term loan credit and security agreement. From that point onwards, Hudson has worked on increasing its efficiency and its margins. Last March, Hudson managed to refinance its debt, entering into a new $85 million term loan agreement with TCW Asset Management Company LLC. In addition, Hudson amended its existing revolving credit facility to increase the overall facility to $90 million. This lowered Hudson’s cost of capital as the interest expense will be almost 3% lower than the prior loan.

If we compare these important moments to the stock price, we see them reflected in the chart. However, I see, as a whole, a long-trajectory path that Hudson has undertaken to improve its efficiency while learning how to get through different market conditions. For example, as refrigerant prices went down during 2017 and 2018, the company was keen on replacing its old inventory with refrigerants bought at lower prices, preparing the ground for the margin explosion that happened over the past 12 months, a time during which many companies saw their margins shrink due to inflationary pressure.

Financials

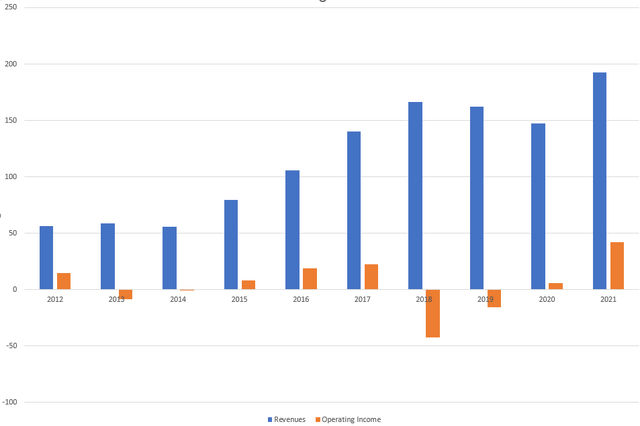

Hudson Technologies rallied after it reported Q1 2022 revenues of $84.3 million, which was an increase of 149% YoY.

The big surprise came from gross margin, that increased to 54%, compared to 27% YoY. This was mainly due to an increase in selling prices that greatly outpaced the increase in refrigerant costs. In addition, total operating expenses actually decreased YoY by $150 million, providing an additional benefit to net income, that was of $29.6 million, which translated in $0.63 per diluted share. During the earnings call, Brian Coleman made it clear that these margins are not to be expected for the rest of the year, as its guidance sets them in the low 30s. However, this could be a little conservative, given the fact that we are in the first step of a new phase-out that will force a 10% decrease in the production of HFCs for 2022 and 2023 with a 40% reduction in 2024. Before these results, the company stated that it expected to reach a revenue of $350 million with an operating income of $72 million by 2024. However, Mr. Coleman said that now there are reasons to believe that these goals may be reached at a faster pace.

If we look at the trend shown from the graph below, we see that Hudson’s revenue has grown quite consistently and that the weak point was the operating income. Last year’s results were already promising, and the Q1 results brought up this trend even more.

Author with data from Seeking Alpha

Investors will also be pleased to see that the leverage ratio was 1.16x to 1x for the trailing 12 months ended March 31, 2022, with a major decline from the leverage ratio of 6.18x to 1x for the trailing 12 months ended March 31, 2021.

Last, Hudson runs a business that is well protected by inflation, since it controls key points of the supply chain and doesn’t have big capex (about $1-2 million every year).

Risks

Hudson has been a volatile stock as its market cap exposes it to big price swings that larger companies usually don’t see. However, it is often priced in by investors that to pick a small cap stock has these risks.

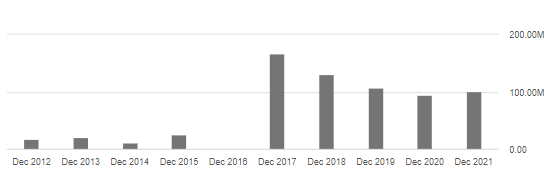

Based on its history, investors could be worried about its debt, that is, in any case, being reduced as shown from this graph.

Seeking Alpha

Another risk is provided by weather conditions (i.e. cool summers). In a general global warming context, I see this as a risk that, if it takes place, it will slow down the company for a season or two.

Valuation

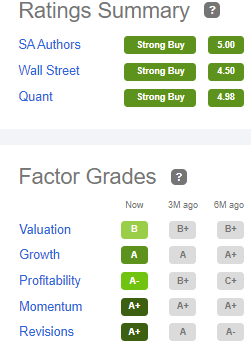

Worth to say, Hudson Technologies has really strong ratings from SA Authors, Wall Street analysts and Quant Ratings.

Seeking Alpha

In particular, even though the price has soared during the past two months, the valuation is still rated at a B, supported by very strong grades in growth and profitability. In addition to the huge beats during Q1 which gave the stock strong momentum, the news of Hudson being included in the Russel 2000 will strengthen this trend at least in the short term due to index funds buying the stock in order to rebalance their positions. This is why I see this one of the most interesting stocks both in the short-term and over the long-term.

But, how much is Hudson worth? If a discounted earnings model, if we consider the company to grow its earnings just at 10% for 5 years and then grow at a 5% pace for the next 5 years, with a discount rate of 10%, we have a fair value of $12.54, which is a 20% upside. Of course, these metrics are really conservative, as I expect the company to grow more especially in the next 5 years. For example, if we plug in an expected growth of 15%, we would have a fair value of $ 15.38, a 35% upside.

There are even higher estimates around, but as general market conditions do not lead to extremely bullish valuations, I prefer to stay conservative. In any case, it is clear that Hudson has still some room to catch up before the opportunity for investors weakens.

Conclusion

Hudson Technologies is a company that operates in a very interesting niche that sees also the favor of the environment protection trend. Its patented machine enables it to run a reclaiming activity that is difficult to replicate. With its financials growing and its debt under control, Hudson is now in good shape to perform well over the next decade, supported by political and economic tailwinds. I rate it as a buy.

Be the first to comment