MF3d

I generally lean towards high yielding investments, as there’s nothing like a bird in hand versus two in the bush. However, to focus only high yield could mean missing out on outsized growth potential on beaten down high growth names.

Such was the case with UnitedHealth Group (UNH), when it traded down to the $200 level during 2020 at the height of concerns over the pandemic, before taking off and not looking back.

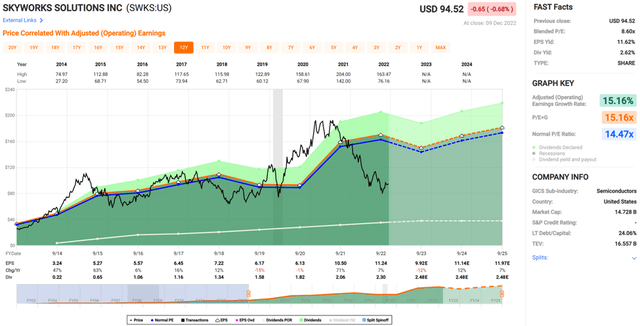

This brings me to Skyworks Solutions (NASDAQ:SWKS), which as seen below, as declined by 41% over the past 12 months, over market concerns around the tech industry and a potential recession. In this article, I highlight why SWKS stock is now unreasonably cheap for potentially market-beating returns going forward.

Why SWKS?

Skyworks Solutions is a leading provider of high-performance analog and mixed-signal semiconductors for mobile and wireless applications. The company’s products are used in a wide range of consumer and industrial devices, including smartphones, tablets, wearables, and connected cars.

As more and more people around the world adopt mobile and wireless technologies, the need for advanced semiconductors that can support these technologies will continue to increase. This presents a significant growth opportunity for Skyworks Solutions, as the company is well positioned to capitalize on this demand with its portfolio of high-performance products.

Skyworks’ recent fiscal fourth quarter results exemplify strong demand for its products, with revenue growing by 7% YoY and 14% sequentially, amidst a challenging macroeconomic backdrop. Notably, revenue also grew by 7% YoY for the full fiscal year, setting records for both the quarter and fiscal year.

Also encouraging, SWKS is partnering with large enterprises, including Vodafone (VOD) and Amazon (AMZN) to deliver Wi-Fi 6E broadband gateway and access points. It’s also covering its bases with mobile communications, by delivering integrated platforms to leading 5G smartphone makers Google (GOOG) (GOOGL) and Samsung (OTCPK:SSNLF), among others.

Risks and Outlook

One of the risks to SWKS include its customer concentration with Apple (AAPL), which represents around 59% of its fiscal 2022 revenues, and it would be a blow to SWKS should it miss out on an iPhone design cycle with its RF (radio frequency) chipset.

However, Skyworks’ competitive position is rather strong, as it has the capacity to delivery hundreds of millions of RF products per year, presenting a significant barrier to entry for new players. Moreover, its IP assets serve as a moat, with over 5,000 patents and applications worldwide, allowing it to differentiate its products and defend against competitors. Looking forward, 5G remains the medium term growth driver for the company, as noted by Morningstar in its recent analyst report:

Given the rise of advanced 5G-enabled smartphones, which use a wider variety of wireless spectrum and frequency bands than in prior generations of networks, RF content per phone has grown exponentially in recent years, lifting Skyworks and its RF competitors. 5G rollouts are in the early innings today and 5G-connected devices should be even more complex, making Skyworks’ expertise even more valuable to device makers.

Balance Sheet, Dividend, and Valuation

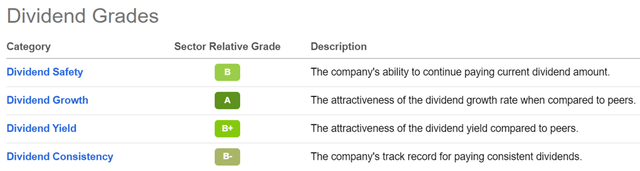

Meanwhile, SWKS carries a strong balance sheet, with a long-term debt to capital ratio of just 24%. While the 2.6% dividend yield isn’t high, it’s very well protected by a low 20% payout ratio, and comes with a robust 14.5% 5-year dividend CAGR. As shown below, SWKS scores A and B grades for dividend safety, growth, yield, and consistency.

SWKS Dividend Grades (Seeking Alpha)

Lastly, I see value in SWKS at the current price of $94.52, sitting far below its 52-week high of $163. It also carries a forward PE of just 9.6, sitting well under its normal PE of 14.5 over the past decade. I believe the current valuation is too cheap considering the Skyworks’ strong industry positioning and the long-term growth outlook. Plus, analysts estimate 13% EPS growth next year and have a consensus Buy rating with an average price target of $111, while Morningstar has a $155 fair value estimate.

Investor Takeaway

Skyworks Solutions is well positioned to continue benefiting from a strong multi-year growth outlook for 5G, with its strong industry positioning and IP assets protecting against competition. The company also carries a healthy balance sheet and strong dividend growth that should reward shareholders over the long run.

In addition, SWKS is seeing record revenues, but it’s now trading at less than 10x PE and sits well below its normal valuation. For these reasons, I believe SWKS could deliver outsized returns over the next year.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment