gorodenkoff

In June 2019, I wrote an article about Greenlight Re (NASDAQ:GLRE) and reanalyzed the company’s performance in June 2021. I considered Greenlight Re was a reinsurer with a meager operating margin wholly dependent on investment income to offset recurring underwriting losses.

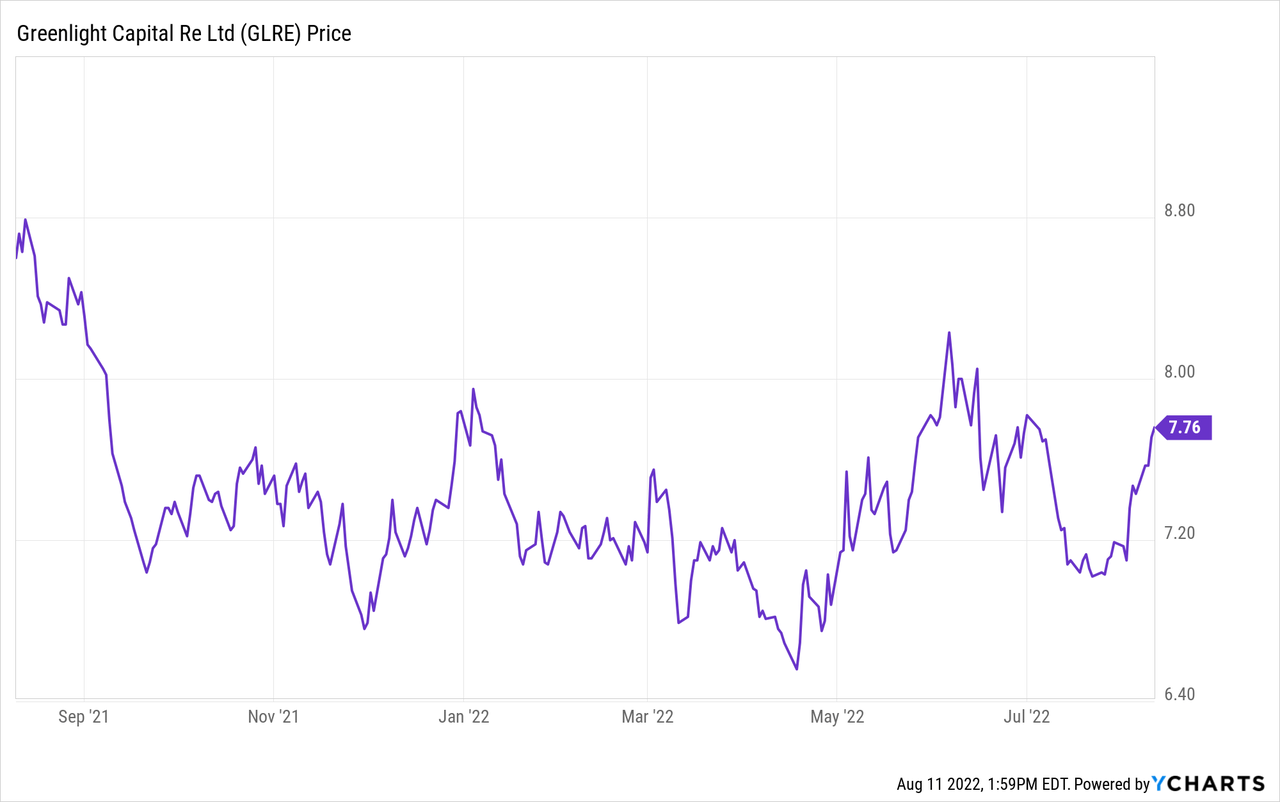

Between June 2021 and now, Greenlight Re’s share price has hardly moved.

Like Greenlight Re’s share price, my opinion about David Einhorn’s investment vehicle did not fluctuate so much.

No Underwriting Margin Improvement

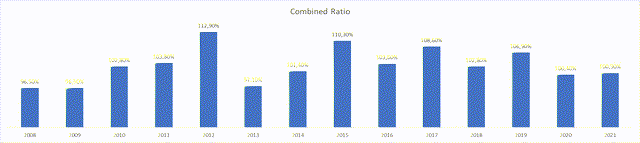

My previous articles indicated that the reinsurance portfolio was consistently loss-making since 2014, with a reported combined ratio above 100%.

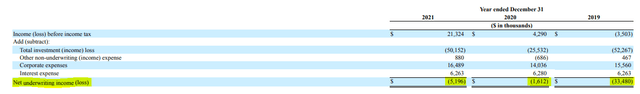

Annual Reports (Greenlight Re)

Unfortunately, there was no significant improvement in terms of underwriting margins, as the company recorded a combined ratio of 100.9% in 2021, resulting in an underwriting loss of $5.2 million.

For the first six months of 2022, the company was adversely affected by the Russian-Ukrainian conflict, contributing 5.8 percentage points to the combined ratio.

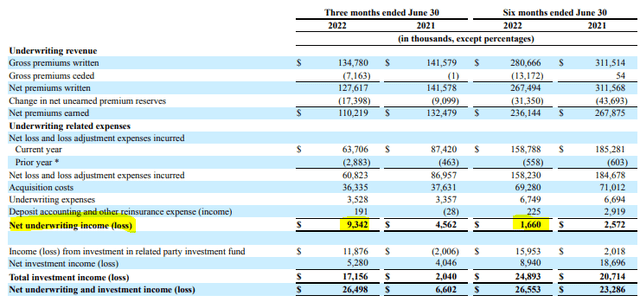

Nonetheless, the reinsurance company generated an underwriting income of $1.7 million for the year’s first six months. The 6M2022 underwriting gains were fueled by better-than-expected Q2 2022 results, with a quarterly underwriting income of $9.3 million.

The improved underwriting result was driven primarily by a change in the business mix. The company reduced its exposure to low-margin motor and workers’ compensation business; therefore, the higher-margin lines of business have elevated the underwriting income.

Given 2019, 2020, and 2021 results, I still consider that Greenlight Re has no pricing power or comparative advantage over other reinsurers, which have also suffered from pricing competition over the past years.

As Greenlight Re is smaller and less diversified than its peers, the Bermuda-based reinsurer is less well-equipped to generate steady underwriting gains.

However, this is not David Einhorn’s strategy. Greenlight Re is simply a reinsurance vehicle, serving to invest the premiums it collects.

The question is, therefore, still the same: Is David Einhorn investing reinsurance premiums wisely?

Beaten By A Plain-Vanilla S&P 500 ETF

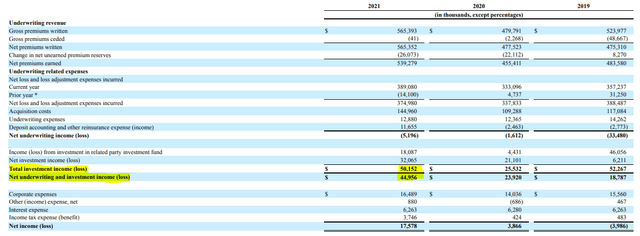

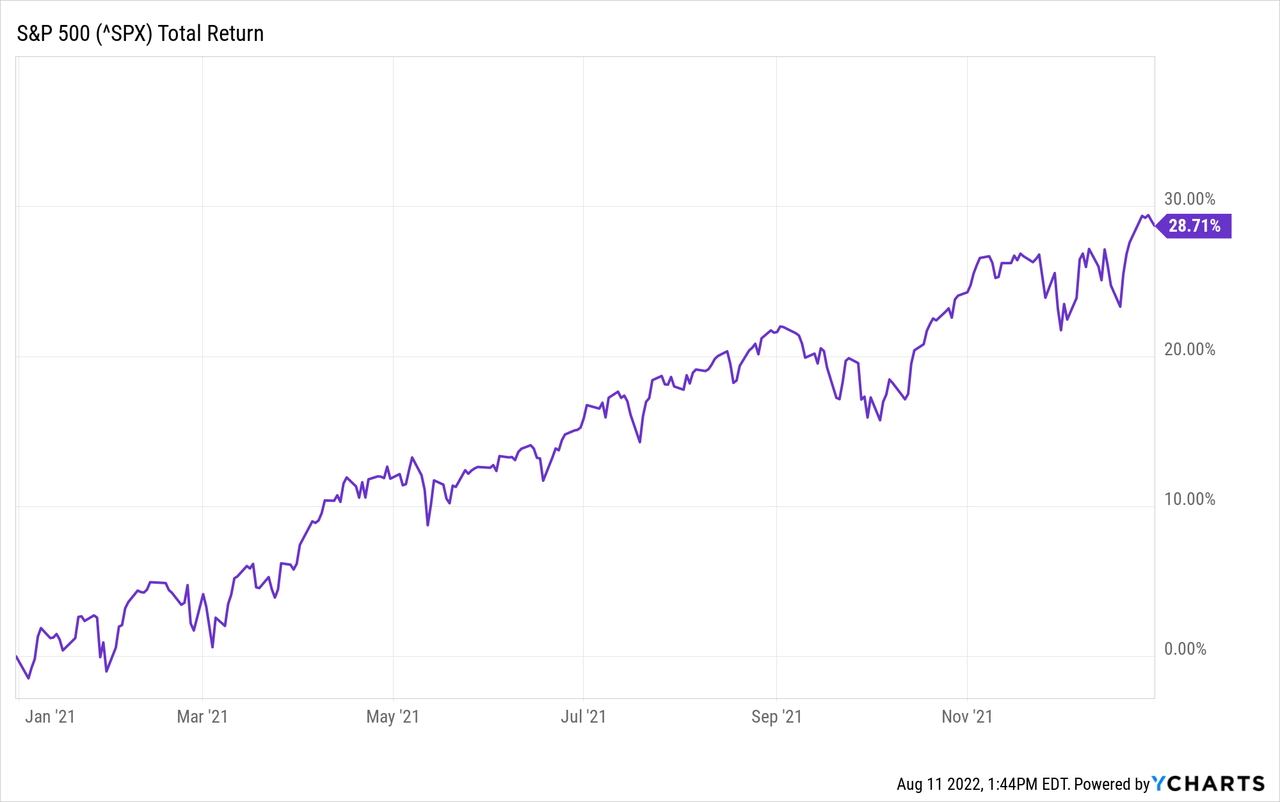

In 2021, Greenlight Re’s investment portfolio delivered a total return of 7.5% vs. 28.71% for the S&P 500.

The investment portfolio was the most significant contributor to the company’s earnings, as the total investment income amounted to $50.2 million for a total underwriting and investment income of around $45 million.

2021 Annual Report (Greenlight Re)

As the combined ratio has been above 100% every year since 2014, the company is entirely dependent on the investment portfolio performance to generate earnings.

To put it simply, Greenlight Re depends on David Einhorn’s investing mojo. In terms of performance, the return on investment seems mixed. After a 30% loss in 2018, performance was 9.3%, 1.4% and 7.5, respectively in 2019, 2020 and 2021.

Greenlight Re Investor Website

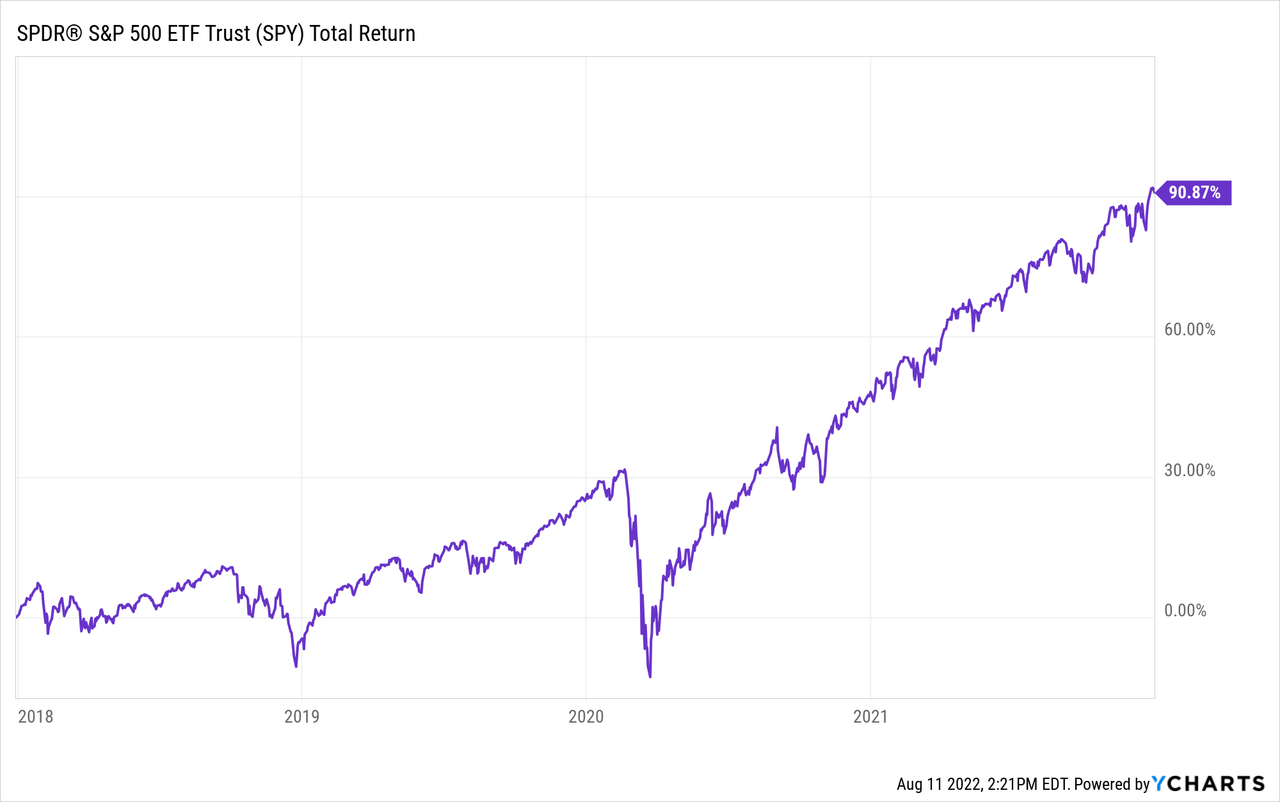

With a plain-vanilla S&P 500 ETF, Greenlight Re would have delivered a total return performance of almost 91% over the same period.

Unfortunately, David Einhorn’s investment convictions (e.g., his short investment in Tesla (TSLA) and his long investment in Brighthouse Financial (BHF)) did not pay off.

Nonetheless, I could also counter-argue that the Solasglas fund, which manages Greenlight Re’s investment portfolio, overperforms S&P 500 for the first seven months of the year, thanks to its short positions. Unfortunately, it is not sufficient for me to be interested in Greenlight Re.

Being Contrarian Might Be Cool. Being Realistic Is More Efficient.

When I was younger, I might have considered Greenlight Re as a potential investment, as the stock is traded below its book value, which amounts to $14.10 per share, vs. a current stock price of around $7.8.

Unfortunately, I consider that the book value discount is justified for at least three reasons:

(1) The underwriting performance is meager, with a combined ratio above 100%, although Q2 2022 results have shown significant improvements in terms of underwriting margins.

Nonetheless, it might be a one-time effect, offset by an increase in the claims trend during the year’s second half. The resilience of the reinsurance portfolio is weaker than larger competitors’ like Munich Re (OTCPK:MURGY), Everest Re (RE), or Swiss Re (OTCPK:SSREF), which have a more well-diversified reinsurance portfolio.

(2) Greenlight Re is undoubtedly seen by the market as David Einhorn’s investment vehicle. Hence, in my opinion, the stock performance is linked to David Einhorn’s investment decisions and performance. Unfortunately, the investment performance was weaker than a plain vanilla S&P 500 ETF for the last four years.

(3) Greenlight Re failed to create enough value for shareholders over the last three years, justifying an investment from my side. The company does not pay dividends (anyway, the earnings are too volatile to set up a reliable and recurring dividend distribution policy). Although the company repurchased shares in 2020 and 2021, I doubt it created value for shareholders. Last but not least, the book value did not grow rapidly (from $12.9 per share in 2019 to $14.1 per share in 2021 or 4.2% per year).

Like in 2019 and 2021, I’m sorry, David, but I’ll not jump on board, but I wish you (and your supporters and investors) all the best in your future investment choices.

Be the first to comment