Bill Pugliano/Getty Images News

The stock price of BYD Auto (OTCPK:BYDDF) has been hit, like almost every stock, by the current market malaise. It has been further affected by recent sales made by early investor Warren Buffett. It has additionally been affected by virtue of the fact that it is involved in what are currently unpopular sectors of the market.

All these factors are temporary. They do not change the reality. BYD is a well-run company and a market leader in the sectors in which the company is involved. Furthermore these sectors are secular growth areas.

Timing the market is always difficult and there is no rush to pick up BYD stock. However at current levels the stock price is a bargain. A contrarian view from that of the market should be very profitable for investors.

Berkshire Hathaway Sale

Berkshire Hathaway (NYSE:BRK.B) (BRK.A) was an early investor in the company. They have done very well from their investment. A sharp stock price decline began this summer when observers noticed large blocks of stock being sold on the Hong Kong market. On 30th June Berkshire Hathaway had owned 225 million shares. As of 2nd September they had reduced their holding from 20.495% to 19.92%. It is thought that further disposals have been made. Since their initial buy in to the company their purchase price of $232 million had risen to $7.5 billion.

One cannot know what is the long-term plan and whether this will be a continuous drip feed of stock affecting the price over months or even years. It is thought their last sell point was at approximately $35. It is quite likely that next time the stock attains that number, they will sell some more again. However it seems a slightly strange policy to be selling in small proportions of the whole, which sends the stock price down on sentiment while Buffett keeps the bulk of his position.

This article here surveyed the general trend of Berkshire Hathaway’s stock disposals. It is hard to discern a pattern between slow sell-offs leading to the entire disposal of a stake, and bouts of profit-taking. The fact that Buffett and Berkshire has been investing in oil companies recently has led some to suppose he is shifting from the renewable “new economy” stocks to old fossil fuel stocks. That would seem to be a mistaken idea and is unlikely in my view.

It is more likely that Berkshire took the opportunity to take some profit as the general market began to fall. The scare stories that the price would crash as Buffett bailed out took on a life of their own of being the gospel truth on no solid basis at all.

The better course of action for an investor is to take this as a contrarian opportunity to buy. The worst that can happen from Berkshire sales is a temporary stock price reduction. Such sales affect sentiment but do not affect the intrinsic value of the company going forward.

China Nerves

It has become somewhat of a standard in the stock market that the Chinese economy is in trouble and investors should flee Chinese stocks. This has been seen in particular in the market for Chinese A-shares. These have fallen by 14.4 trillion yuan ($150 billion) in the first 9 months of the year. Institutional investors have made what has been a rather unsuccessful “flight to safety”. They have moved from blue-chip growth stocks to other falling stocks. This presents an opportunity for the contrarian personal investor to take advantage of reduced prices.

On the issue of Covid, the Chinese economy has been hit by the government’s drastic actions on closing down large swathes of the country whenever a Covid outbreak occurs. I believe this policy is likely to be changed by the end of this month. The Communist Party holds its National Congress on October 16th. During this example of participatory democracy Xi Jinping will likely be re-elected as leader, effectively in perpetuity. He will no longer need to worry about the effects on his leadership of any embarrassing Covid disaster or U-turn on Covid policy.

Once the draconian Covid policy is ramped down, this will greatly help economic growth in the country. Virtually all economic forecasters agree that the Chinese economy will in the long run continue to grow much more rapidly than those in North America and Europe. In the short term, problems over rising interest rates and a slumping real estate market may continue. These are hardly restricted to China though.

On the issue of politics the main threat is over the issue of Taiwan. However Xi is no Vladimir Putin. The Chinese threat to Taiwan is more gradual, though insidious, and more likely a long-term problem, not a short or medium term one. If I am mistaken, then investors will probably find all their stock holdings facing meltdown, not just BYD.

The company could however be hampered by political moves in its efforts to expand in the USA. This has already happened in a few instances in regards to its e-bus business and its rail transit division.

Concerns that investors express over increased regulation of Chinese stocks on U.S. exchanges do not feature in the case of BYD. It is investable for foreign investors as an OTC stock and in Hong Kong and not on main U.S. exchanges.

Chinese EV Market

It has become somewhat of a widespread view that the Chinese auto market is stationary at best, or even in decline. That view also says that the EV potential in China has been over-stated. In my view these ideas are very much mistaken. A strongly contrarian view to them is warranted.

Recent figures from the CADA (Chinese Automobile Dealers Association) show that new vehicle sales were up 23% year-on-year in September. This is despite the economy’s problems and Covid scares. It is forecast that Q4 will show an even faster pace of growth. In the month of September, EV sales were estimated to have been 580,000 units, up 74% year-on-year.

For BYD, their EV sales in September continued a rapid ascent, to number 201,259. This is the first time they have exceeded 200,000 sales in a month. They have now had seven consecutive months of record sales. They are targeting 280,000 monthly sales by the end of the year.

The September was up 184% year-on-year. In the period January-September they sold 1,180,054 cars. That was an increase of 249% on 2021.

The Chinese government recently extended the Purchase Tax exemption for EV’s. This was due to expire at the end of this year. It has now been extended until the end of 2023. This will guarantee that China remains by far the world’s largest EV market. Indeed its lead is growing rapidly, as sales figures this year indicate.

EV Market Too Competitive

This a strange idea, which has gained a lot of currency. It is propounded particularly by Tesla (NASDAQ:TSLA) bears. It is easy to be contrary to this idea. In fact the EV market is probably less competitive than the old ICE market. The old ICE manufacturers are not flourishing in the new auto world. Both Ford (NYSE:F) and Volkswagen (OTCPK:VWAGY) are way behind in their EV forecasts and their debts mount as they pour money into EV capex.

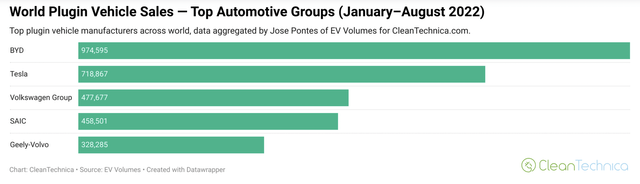

The best EV’s are, arguably, coming out of China. That is perhaps not surprising as China is the world’s largest auto market and largest EV market as well. Their EV market leaders are mostly manufacturing only EV’s now. BYD is the leading EV company in China. It is generally considered the world’s largest EV company, dependent on how you define the terminology. Figures produced recently by Cleantech bear this out:

Compared to BYD’s September sales of 201,259 cars, the much touted NIO (NASDAQ:NIO) had deliveries of 31,607 and Li Auto (NASDAQ:LI) had deliveries of 26,524.

Company Product Diversification

BYD is most well-known for its car business. In fact this is just one part of its diversified portfolio, albeit an extremely successful one.

It is a big player in battery manufacture, in e-buses, in e-trucks and has growing divisions in rail and semiconductors. It has an old-established electronic components business and even a substantial mask business.

I covered its range of product in detail in an article in March. Its “Blade” battery has received a very favorable reaction. This post here shows the latest award it has received in Europe. Initially developed for the company’s cars, it is now being adapted for the e-buses and e-trucks, and being supplied to rival car companies.

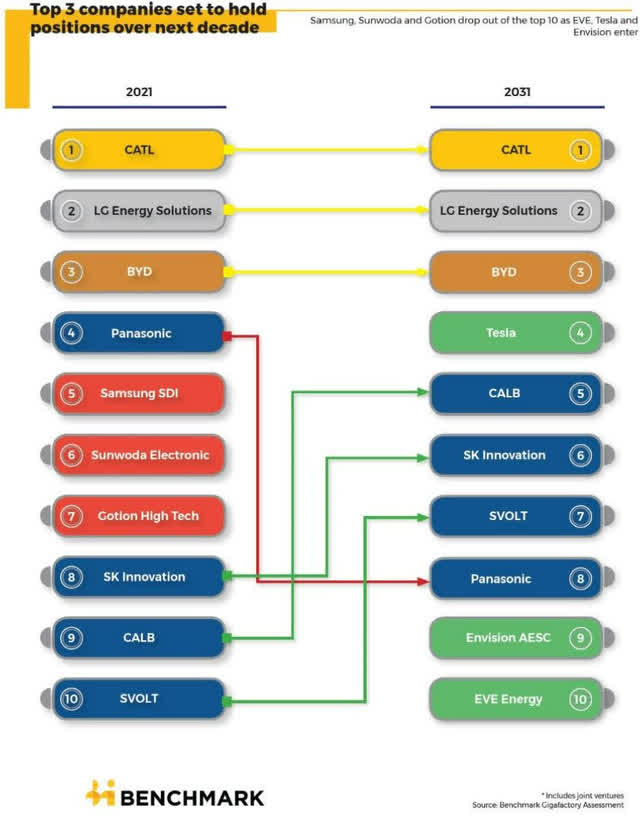

As quoted on Twitter, it is the world’s third largest battery manufacturer and is forecast to continue in that position:

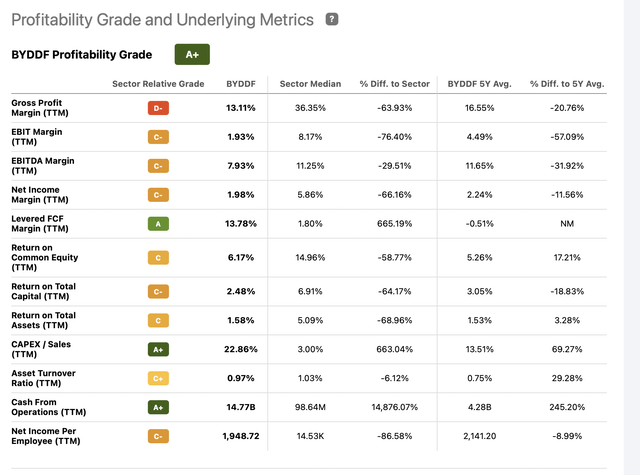

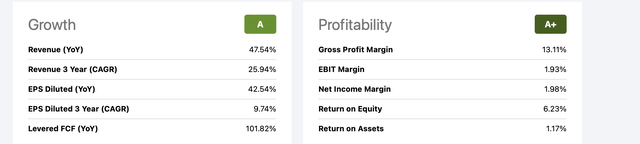

Conglomerates are somewhat out of favor these days. The mantra is more that companies should focus on a narrow specialized range of activity and out-source the rest. BYD’s strategy is to plough profits back into growing the business. This leads to a profitability and valuation picture that deters some short-term investors. This is illustrated below from SA Quant ratings:

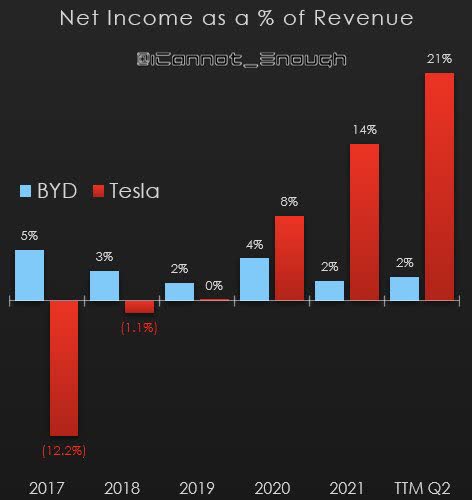

The company is definitely going in the right direction though, as the figures for the past 3 years below from SA Quant ratings show:

Figures cited vary somewhat for the auto industry. However the gross profit margin of 13.11% is satisfactory. The EBIT margin of 1.93% and Net Income margin of 1.98% probably need to double for BYD to match its peers better.

Looked at from another perspective, the company’s net income as a percentage of revenue is low compared to its main rival, Tesla, as illustrated below:

Twitter

A figure of 10% would be regarded as about an average number. This might deter valuation based investors but should encourage growth investors who wants a growth company on secure footing in terms of revenue and capital.

The debt position of BYD is very healthy, despite the huge sums poured into capex in recent years. The average debt to equity ratio for U.S. auto companies, for instance, is cited as 0.74. As of June this year, BYD’s debt to equity ratio was 0.311. That strongly suggests that the common concern for investors that growth companies would run out of finance for expansion does not apply to BYD.

The strategy of farming out specializations has been somewhat discredited by recent world events. These have led to product bottlenecks and serious logistical problems. An example of this is how in the EV world, rivals have often had to slow down production because of a lack of batteries and other parts. BYD makes its own. It even supplies to others as in its recent deals to supply Tesla with batteries. The company’s contrarian vertical integration conglomerate stance on this has been a major advantage.

Company Geographic Diversification

Obviously the company is centered on China but its geographic reach is growing rapidly. My article in August dealt with this in detail, focusing on the advantages of its vertical integration.

It has manufacturing plants for batteries, e-buses and e-trucks in North America, in South America and in Europe. Its sales, especially for e-buses, are spread around the world. In some cases this is done through local manufacturing partnerships, such as this example with ADL in the UK. This has been bringing in a slew of high value orders recently, as illustrated below:

According to SA Quant ratings, foreign sales have increased fifteen fold since 2014 but are still a tiny proportion of the whole. The greatest proportion of this comes from e-buses. By next year there is no doubt that the greatest proportion of it will be cars by far.

The geographic diversification will increase rapidly as it is now opening up its auto sales to Europe in a substantial way. My article in February previewed this expansion and it is now just starting to take off. In September the company exported 7,736 cars from China, still a small number. One can see here its current plans for its European expansion, and for take-off in the Japanese market. In the U.K. there will be 3 new right-hand drive models to be launched shortly on a new platform. This month the company announced a major new development in a tie-up with German car rental company Sixt. The first few thousand cars are due to be delivered by BYD in Q4. The new partners are aiming to bring in 100,000 cars over the next few years.

The Future of EVs

For some observers, the future and potential of EV’s has been over-stated. In fact, all the signs point to this idea having no basis in fact. BYD itself was a major ICE manufacturer in China but is closing down this business entirely. They have seen the writing on the wall.

Other observers see hybrids as the future, not pure electric cars. BYD has its feet in both camps here as it is a major supplier of both. It has its own very successful new “DM” hybrid technology. Hybrid sales continue to soar in China but in most areas of the world the really rapid growth is in pure electric cars.

The future of e-buses and e-trucks is, for me, even more secure and certain than that for passenger cars. This has been under-rated by analysts. My article in December last year illustrates this.

Growth Companies

Growth companies are generally out of favor with stock analysts, including BYD. This is another reason to take a contrarian view right now.

Growth companies have been the hardest hit in the stock market meltdown. There has been a counterpoint argument in favor of “safe” dividend paying companies. Neither approach is the right one in all cases. Both have their place in a well-balanced portfolio. Recent market moves do not however negate the case to be made for growth companies in principal.

Market timing is a dangerous game but long-term investment in financially sound companies following a substantial price decline is a good strategy.

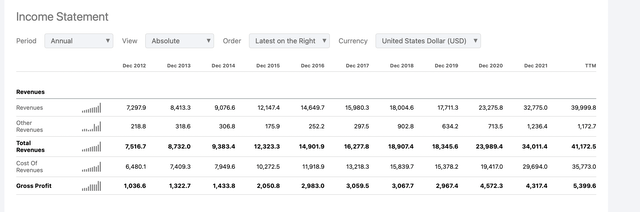

The company’s revenue growth history is shown below, from SA Quant ratings:

Earnings from Continuing Operations rose from $624 million in 2020 to $908 last year.

BYD has the added advantage of being a profitable and well-financed company. When people refer to “growth companies” they tend to think of smallish growing companies which do not make a profit and which have huge debts. This is not true of BYD. Its debt ratios are sound.

Risks

In many ways, all stock investments have increasingly been seen recently as risky. That is a self-evident fact that many investors had forgotten in the long bull market.

Some risks specific to BYD include:

* The China risk.

This pertains to both the political risk and the risk that Chinese companies have less clarity in their financial reporting. This was shown recently with BYD when the Shenzen Stock Exchange delayed the company’s planned semiconductor IPO because it had not yet produced its up-to-date financial reports. Its internal political risks seem quite limited.

* The Management risk.

It could be perceived that BYD rely too much on their far-sighted founder and chairman, Wang Chuanfu. This is a problem of success really. Charlie Munger had referred to him in the past as a combination of Thomas Edison and Jack Welch.

* Lack of high Net Profitability.

The company’s continuing policy of re-investing gross profits in capital expenditure for growth is, in my eyes, a healthy trait. Others may see this as an unwelcome strategy as it holds back being able to announce attractive net profit figures for markets to welcome. This helps to explain the difference in stock price between BYD and Tesla. It also makes it unlikely that BYD will become a generous dividend provider anytime soon.

* Long-term Worldwide Recession.

This is quite possible. It is not though an argument against investing in BYD but an argument perhaps against stock investment in general.

* Rail Transit Division.

Large sums have been invested in this division. So far the returns appear to have been somewhat disappointing. I covered this in detail in an article in May.

Pictured below from Getty Images is a system in operation in China:

getty images

This division could though be a hidden gem which analysts have under-rated.

Conclusion

A market leader in secular growth areas of the world economy with sound financing and good management would seem to be one that would be approved by the mainstream of investors and analysts. However BYD remains a somewhat contrarian play, for the time being.

Illustrated below is a 5 year stock chart as provided by Charles Schwab Inc:

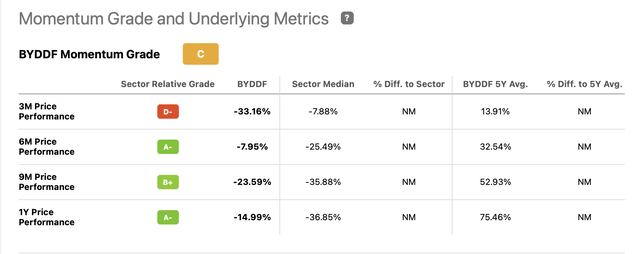

SA Quant Ratings illustrate the picture in regards to momentum in the chart below:

These show that a return to the pre market collapse norm would produce immediate gains for stock holders. The company’s sales position has improved markedly in the past 9 months. That would indicate that when the world economy improves, BYD’s stock price should exceed its previous growth momentum.

Investors should get in before BYD’s integrated growth model becomes fashionable again. When investors understand its strong position in secular growth markets which are true long-term growth markets, then I think one can expect a return to sparkling stock returns.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment