bombermoon

Thesis: Energy Transition + Falling Interest Rates Provide Massive Boost

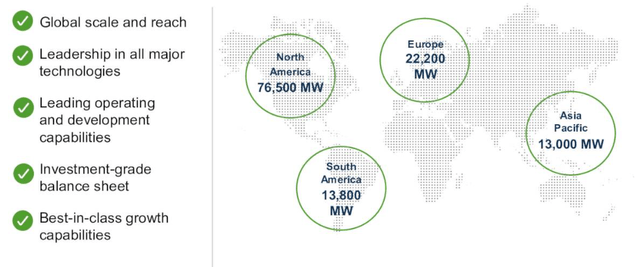

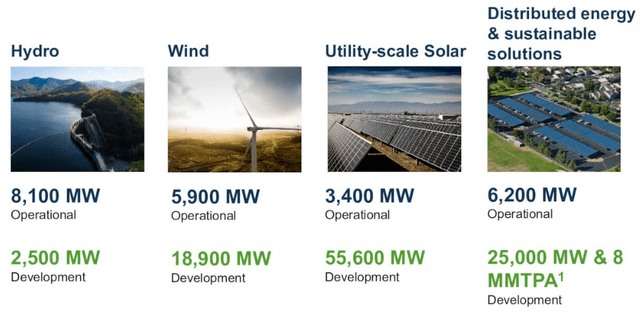

Brookfield Renewable (NYSE:BEP, NYSE:BEPC) is a global leader in the ownership and development of renewable energy assets such as wind, solar, and hydropower with around $70 billion in assets under management spread across 20 countries.

With a huge and globally/technologically diversified renewable energy portfolio with electricity generation capacity of almost 25 gigawatts, BEP is effectively a “green energy supermajor,” a whale among minnows with ample room for consolidation through M&A.

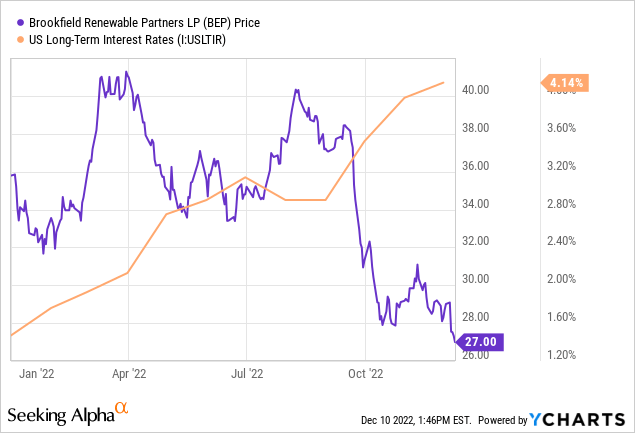

Green energy has enjoyed a spate of good news recently, most notably the signing into law of the “Inflation Reduction Act” with its decade-long runway of tax credits for renewable energy assets. And yet, BEP has shed ~25% of its value year-to-date. Why?

It’s useful to remember that, regardless of the popularity of green energy, BEP’s core business model is to invest in assets that have cash yields greater than its cost of capital. The narrower the investment spread, the less profitable each incremental investment is.

Considering BEP’s extensive (though not excessive) use of leverage, it is not surprising that the stock has sold off this year as interest rates have surged higher.

Now, at $27, BEP trades at a price to funds from operations (“FFO”) of 17.4x and a price to normalized FFO of about 15.5x.

I would argue that this is a cheap entry point for this green energy supermajor. In fact, I believe the company has two major catalysts that should strengthen its fundamentals and reinvigorate the stock’s rally. These two catalysts are:

- The exponential acceleration in the global energy transition

- Lower interest rates that should come as a result of the widely expected 2023 recession

If these two catalysts play out as expected, BEP could easily double in price in the years ahead as investors flock to it as a blue-chip play on this multi-decade, multi-trillion-dollar growth trend.

Overview of Brookfield Renewable

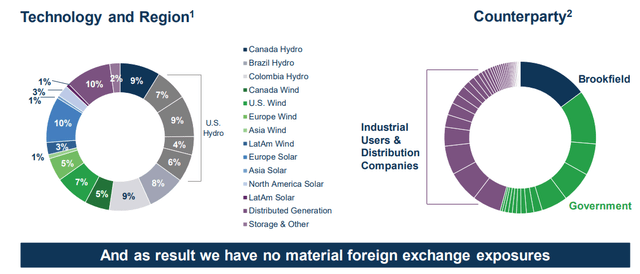

BEP is a well-established expert in this field, with over two decades of experience investing in and operating renewable energy assets around the world. Around 75% of assets are located developed markets, with the balance in emerging/developing economies.

This scale and expertise makes BEP the go-to provider of green energy for many of the world’s largest government agencies and corporations, such as Amazon (AMZN), which recently signed a 600-megawatt power purchase agreement with BEP to power its Amazon Web Services (“AWS”) operations.

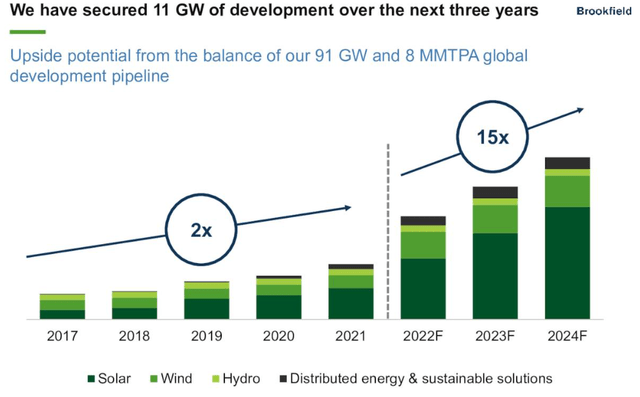

Unsurprisingly, BEP boasts both the largest operational portfolio of around 24 gigawatts and the largest development pipeline of around 102 GW of its closest peers.

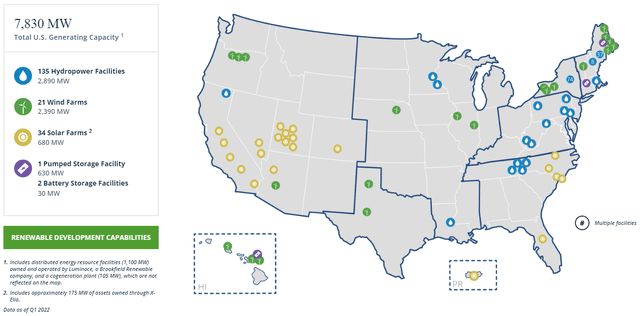

Hydropower dams make up around half of BEP’s current electricity generation capacity. Some worry that this creates vulnerability as droughts and low water levels in many lakes and rivers may result in lower generation capacity going forward, but the locations of BEP’s hydropower dams are largely in the wetter parts of the world with the least drought problems.

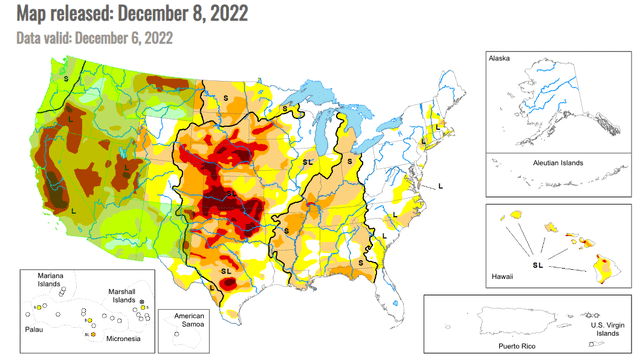

Compare, for example, the areas of worst drought in the United States…

…to the locations of BEP’s US hydropower dams:

BEP owns only one dam in California, and it is not in the worst affected part of the state as far as the water shortage is concerned. Most of the company’s dams are located on the East Coast, where there is little to no water problem.

Admittedly, though, this isn’t the case for all of BEP’s dams. For instance, some of its dams in Brazil are located in the areas of worst drought. (Although in the first nine months of 2022, BEP’s Brazilian dams generated 54% more electricity than last year.) This sort of diversification makes the portfolio as a whole safer and more valuable, as weakness in one area can be mitigated by strength in another.

Diversification characterizes BEP’s portfolio in more than one way, as the company owns multiple asset types in many different regions, and those assets are contracted to hundreds of credit-worthy counterparties.

Around 94% of revenues derive from power purchase agreements (“PPAs”) with a weighted average remaining contract term of 14 years.

What’s more, 70% of its contracts have inflation-linked fee escalations, giving revenue generation at least partial protection from purchasing power degradation.

Not only is BEP the industry leader in its space in terms of balance sheet strength, illustrated by the company’s BBB+ credit rating. That’s the highest credit rating in BEP’s peer group.

Consider these balance sheet metrics:

- 92% non-recourse, project-level debt

- 38% consolidated debt to total capitalization

- 97% fixed interest rate debt

- 12-year weighted average debt maturity

- Weighted average interest rate on non-recourse debt: 5.1%

That last metric represents the primary headwind to BEP right now. In Q3 2021, BEP’s weighted average interest rate on non-recourse debt was 4.0%. Now it’s up to 5.1%. As more loans are rolled over, that number will likely trend even higher, squeezing the spread between cost of capital and effective asset yields.

BEP currently enjoys $3.5 billion in total liquidity, which will go a long way in funding the $6-7 billion in capital deployment planned over the next five years. Most of that capital deployment is unsurprisingly slated for various solar assets.

Most of that solar deployment will be in utility-scale arrays contracted to various municipal and investor-owned utilities, but a growing portion of it will also be distributed generation assets (e.g. rooftop solar) primarily with commercial and industrial end users.

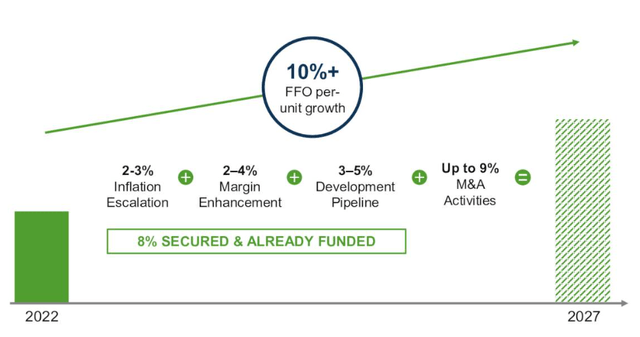

Historically, BEP has generated FFO per unit growth around 10% annually. But considering the depth and consistency of BEP’s development pipeline, I would estimate BEP’s FFO per unit growth to be at least 10% without any M&A activity. With M&A, such as its recently announced purchases of Urban Grid, Scout Clean Energy, and Origin Energy, I think BEP’s FFO per unit growth should average closer to 15% going forward.

In the third quarter of 2022, that is exactly the year-over-year FFO per unit growth rate that BEP achieved: 15%.

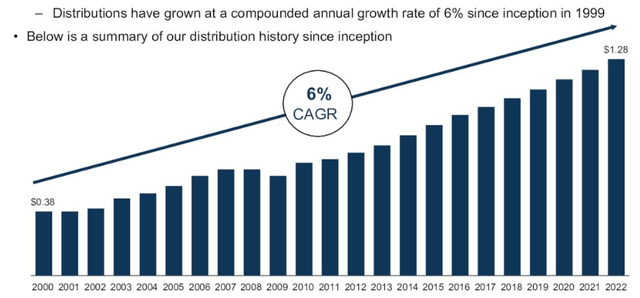

This level of FFO growth should put the company’s distribution payout on increasingly solid ground, setting it up for many more years of raises to continue its long distribution growth record.

With a 77% payout ratio based on FFO, BEP’s distribution/dividend looks to be on solid ground and more than capable of extending its growth record.

That said, annual raises should continue to come in on the lower end of BEP’s 5-9% target distribution growth range as the company prioritizes funding investments rather than returning cash to shareholders.

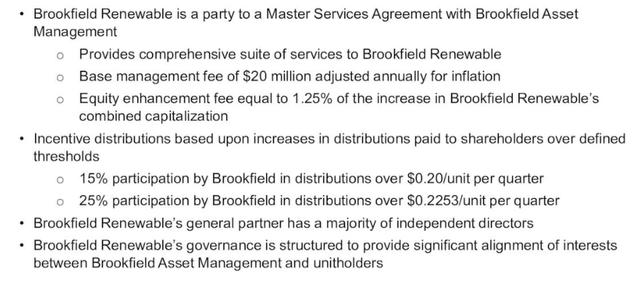

As a last point to mention, it should be noted that BEP enjoys a beneficial relationship with its sponsor, Brookfield Asset Management (BAM), which owns a considerable portion of BEP and maintains a significant alignment of interests with BEP unitholders.

One thing I like about this management agreement is that, in exchange for access to BAM’s deep resources and expertise, BAM is rewarded with higher incentive distributions based on increases in BEP’s distribution to shareholders. This results in an overlap in interests between BAM and shareholders who want to see long-term growth in the distribution.

It’s also worth noting that BEP is a publicly traded LP and generates a K-1 form for tax purposes, while BEPC is a Canadian corporation that avoids the K-1 form for shareholders. Both have identical economic ownership and pay the same distribution/dividend.

Now that we have a better grasp of BEP, let’s discuss its two major catalysts for outperformance.

Major Catalyst #1: The Global, Multi-Decade Energy Transition

Partially in response to the Russian invasion of Ukraine and the European energy crisis that it has spurred, the governments of major countries around the world have recently implemented policies that heavily incentivize their power production sectors to transition away from fossil fuels and toward renewable energy sources.

Primary examples include the US “Inflation Reduction Act,” the European Union’s “REPowerEU,” and China’s 14th 5-Year Plan.

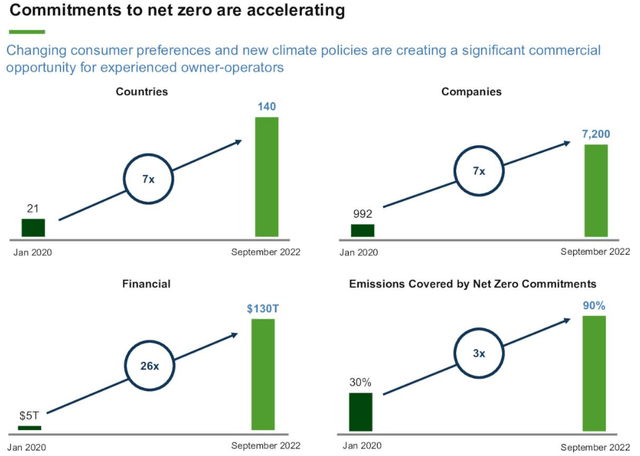

We can also see momentum building in the sheer number of countries and companies that have committed to “net zero” emissions by certain future dates in just the last few years.

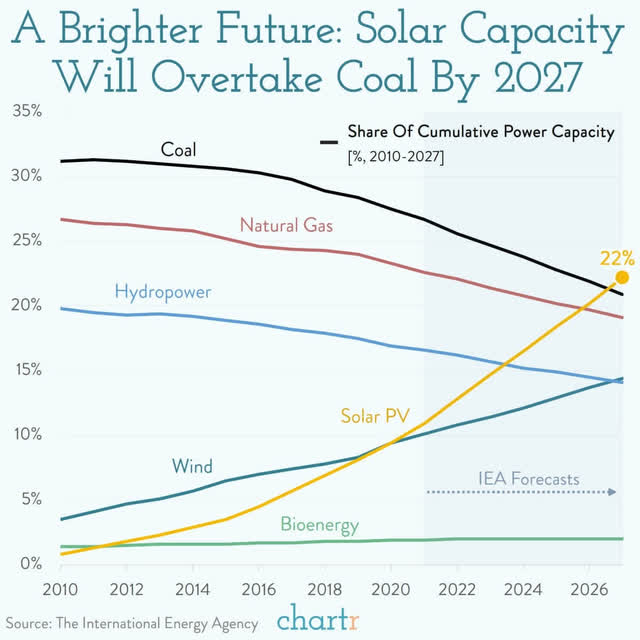

The International Energy Agency recently released its 5-year forecast for renewable energy, incorporating these government policy plans, and it projects renewables and especially solar power to dramatically increase its share of global electricity generation in the years ahead.

The growth in power generation from solar PV sources has already been impressive, but the IEA projects that solar should become the single largest source of global electricity by 2027. That is remarkable, given that it was the smallest source in 2010.

In other words, the IEA forecasts that in the span of 17 years, solar is projected to go from the smallest power source to the largest in the world.

The IEA forecasts that renewables will become the largest source of electricity production across the world by early 2025, surpassing coal. Quoting from the IEA report:

Electricity from wind and solar PV more than doubles in the next five years, providing almost 20% of global power generation in 2027.

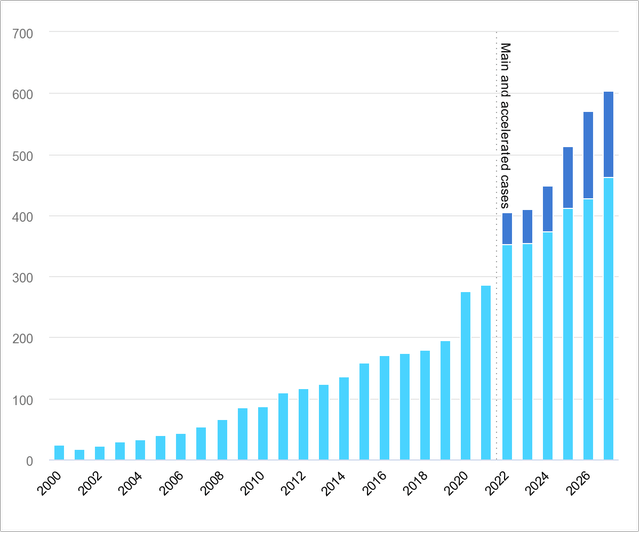

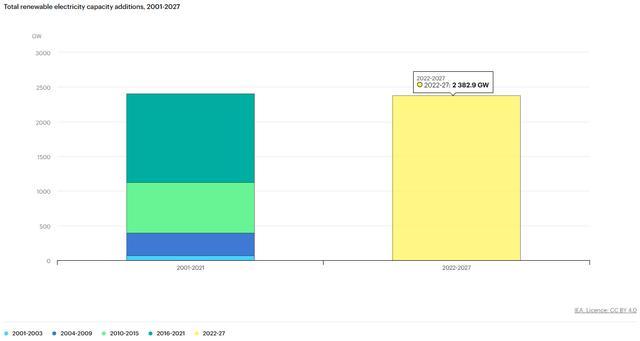

Net Additions of Renewable Power Capacity (Actual and Projected), by GW:

Correspondingly, coal’s share of power generation is expected to shrink from about 36% in 2021 to 30% by 2027, while natural gas’s share edges down from 23% to 21% during that period.

That forward estimate is ~30% higher than the equivalent forecast in last year’s report, marking it as the IEA’s largest upward revision ever.

The ~2,400 GW expected to be installed in the next five years is roughly equivalent to the entire installed power capacity of China today, according to the IEA.

In short, BEP’s growth runway is long and deep. As a global leader in the development and operation of renewable energy assets, it should capture a significant share of this growing market.

Major Catalyst #2: Falling Interest Rates

A recent survey conducted by The Conference Board finds that 98% of corporate CEOs are preparing for a recession in the US in the next 12-18 months. Meanwhile, 99% said they expect a recession in Europe during that time. CEO confidence has slumped to its lowest level since the Great Recession.

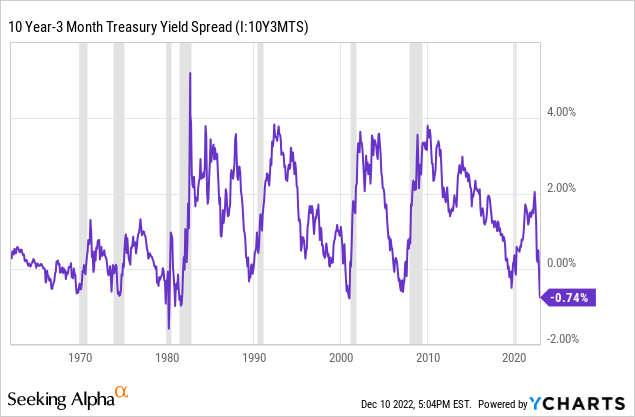

Another predictor of an oncoming recession is the inverted yield curve, specifically the 10-year minus 3-month spread. An inversion in this spread has accurately predicted every recession over the last 50 years (and in the late 1960s, it did precede a significant slowdown in GDP growth).

The yield curve is virtually screaming that a recession is coming, as it has sunken to its deepest inversion since late 2000.

Why would a recession paradoxically be a good thing for BEP? Because:

- BEP’s assets, contracts, and customers are largely recession-proof and should scarcely suffer from a recession, especially with such meaningful government support.

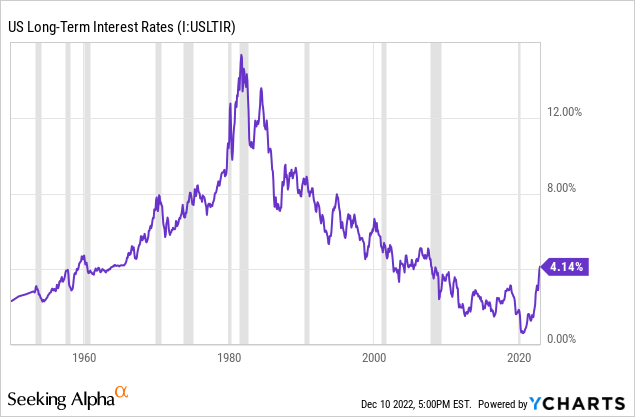

- Recessions have an unbroken track record of causing interest rates to drop, at least temporarily.

Going back to 1950, whether interest rates are in a long-term uptrend (because of rising inflation) or downtrend (because of falling inflation), recessions have always caused interest rates to drop during and/or immediately after their occurrence.

At the very least, this will give BEP a period of time in which to fix more of its loans at lower rates for long periods of time.

At best, interest rates will remain fairly low and won’t rebound to their current levels after a recessionary dip. This will indefinitely widen BEP’s investment spread while increasing the value of its existing portfolio.

Personally, I do not believe the economy has entered a long-term uptrend in interest rates, and thus the drop in BEP’s stock price due to (temporarily) elevated interest rates is an excellent buying opportunity.

Bottom Line

Neither the long and deep growth runway from the global energy transition nor the high probability of lower interest rates in the next year or so are priced in to BEP today. This gives investors the opportunity to accumulate shares/units of this blue-chip green energy supermajor while they are temporarily undervalued.

Between a nearly 5% yield and 10-15% annual growth, BEP should easily deliver total returns of 15-20%, considering no valuation upside. However, if investors flock to this name in the years ahead, as I suspect they will, to gain high-quality exposure to renewables, then BEP could easily double in price in the years ahead.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment