matdesign24

Article Thesis

AGNC Investment (NASDAQ:AGNC) is a very high-yielding stock, offering a payout of 15% at current prices. For some, that is a reason to buy shares, even without taking a deeper look at how sustainable those dividends will be. I believe that it could be a wise idea to stay away from AGNC for now, despite its high yield, as there is a considerable dividend cut risk over the coming years.

The Most Recent Quarter: The Good And The Bad

AGNC’s most recent quarter was a complicated one. The report is available here on Seeking Alpha. On one hand, net spread and dollar roll income was better than expected, and easily covered the dividend for the quarter. In fact, results for this earnings metric came in at $0.84 per share for the quarter, while the dividend costs the company $0.36 per quarter — which makes for a coverage ratio of 2.3, or a payout ratio of just 43%.

That being said, there were also some pretty obvious negative things in the report, with a massive book value decline being the most obvious item. Net tangible book value stood at just $9.08 at the end of the third quarter, down from $11.43 one quarter earlier. In other words, net tangible book value declined by $2.35 in just one quarter — one more year like that, and net tangible book value would be negative. I do, for the record, not expect that the coming four quarters will be this bad, but this example shows how badly AGNC performed from a book value perspective during the most recent quarter.

Looking at the first three quarters of the current year, it is pretty clear that Q3 was not a one-off event. Instead, net tangible book value has declined from $15.75 to $9.08 in just three quarters, making for a $2.22 per quarter decline — the 2022 average is thus pretty close to the Q3 number, making Q3 a more or less average quarter in a very bad year for the mortgage REIT.

The fact that AGNC Investment was able to generate positive net spread and dollar roll income during the quarter despite seeing its book value get mauled can, at least partially, be described by the hedges the company had in place. That’s a good thing in general, but only a short-term solution when the macro environment remains problematic for AGNC — which could happen. As hedges roll off over time, the company has to re-hedge, sometimes at way higher costs, which, among others, holds true for its short Treasury position (which it uses as a hedge). The coming difficulties in remaining properly hedged without hurting profitability too much are not obvious in the reported Q3 number, where spread and dollar roll income still was compelling. But analysts agree that this level of profitability is not sustainable in the long run, showcased by the following table showing EPS estimates over the coming quarters:

Seeking Alpha

Analysts see EPS decline by around one-quarter in Q4, relative to Q3. But things don’t end there — according to the analyst community, earnings per share will decline on a sequential basis during each of the following quarters, up to early 2024, when EPS are forecasted at just half the level seen in 2022.

Readers and investors should note that these projections will not necessarily come true, of course. AGNC might be able to outperform expectations, but they also might underperform these forecasts. Still, the direction things will be moving in is pretty clear — profitability will come under pressure.

The fact that AGNC Investment has issued a substantial number of new shares towards the end of the third quarter — which was pretty bad timing, as they would have gotten way more dollars per share earlier in the year — will prove another headwind for earnings per share, as company-wide net profits will be distributed over a larger number of shares, decreasing each share’s portion of the total. Share issuance was, unfortunately, more or less necessary in order to keep leverage ratios from blowing out too much. Even with the share issuance during Q3, AGNC’s leverage ratio at the end of the quarter was pretty high, at almost 9, relative to its net tangible book value. High leverage can allow for juicy returns on equity if things go right, but high leverage also can be a major risk factor — without high leverage, the hits to book value over the last couple of quarters would have been way less pronounced. Warren Buffett once said that you don’t get in trouble when you’re not using leverage. While that is unrealistic advice for a mortgage REIT, less leverage would have meant less trouble for AGNC Investment for sure.

Book Value Decline Spells Trouble

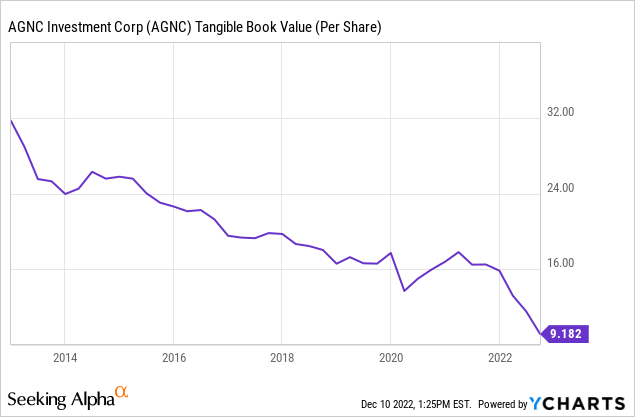

Some investors like to invest based on metrics such as dividend yield, but that isn’t a great idea, I believe, as it can make investors chase yield traps that might better be avoided. Investors can look at book value when valuing mortgage REITs. In AGNC’s case, the book value performance is far from encouraging:

Net tangible book value is down quite a lot this year, but even before that, AGNC’s book value performance was pretty bad. Over the last 10 years, tangible book value has declined by more than 70%. The trend has been a downward one even before 2022, as we can easily see in the above chart. Ultimately, book value and profits are connected, at least when we assume that the company’s return on equity will meander around a long-term average over time. Declining book value thus should result in declining profits in the long run, all else equal. This, in turn, has negative implications for AGNC’s dividend.

Not only has AGNC Investment’s dividend declined over the years, but this decline has more or less been tied to the decline in AGNC’s book value — due to the connection between book value and profits, that’s not surprising. Over the last decade, AGNC’s dividend has dropped by 90% — investors get just one-tenth of what they have gotten ten years ago on a similar number of shares. That’s a devastatingly bad performance for income investors, of course. I do not believe that dividends will drop this much over the next decade, but the declining book value, forecasted decline in earnings per share, and dilution do not bode well for AGNC’s dividend. I do believe that there is a pretty sizeable risk that the company will cut its dividend from the current $0.12 per share per month level.

Don’t Chase This Yield

With the company’s book value, its earnings per share, and possibly its dividend coming under pressure, I do believe that it’s not a great idea to chase AGNC’s yield. Shares are currently trading at a premium to book value, and book value could easily erode further, depending on Fed policy. With the PPI coming in hotter than expected a couple of days ago, Fed policy might be more hawkish than some have thought in recent weeks, which would likely lead to further pressures on AGNC and other mortgage REITs.

AGNC’s current dividend yield is very high, at 15% — but buying a yield this high while neglecting the dividend cut risk could be a bad idea. Those that have chased AGNC for its high yield in the past oftentimes regretted that decision: A decade ago, AGNC Investment’s dividend yield was deep in the double-digits as well — and yet, the total return, dividends included, over the last 10 years is just 7% or less than 1% per year. In other words, those that bought AGNC for its high yield a decade ago have seen their investment underperform the broad market massively, and AGNC hasn’t even managed to keep up with inflation — the stock was a money loser in real terms, despite a very high starting yield. The same may not hold true for the next decade, but I believe that it is a cautionary tale about what can happen when investors are buying for a high yield without looking at the sustainability of this dividend and a company’s earnings outlook.

There are high-yielding investments that have a way stronger track record, and where investors can assume that dividends will likely grow in the coming years. But AGNC is not one of those, I believe.

Takeaway

AGNC Investment has seen its book value drop massively this year. Depending on future Fed policy, more book value declines could happen. Add dilution, costlier hedges, and a declining earnings outlook, and AGNC does not look too strong from a fundamental basis.

The yield is very high right now, but history suggests that dividend cuts are to be expected from AGNC from time to time, and buying solely based on a high yield is risky. I thus think that being fearful about what might happen to AGNC’s dividend could be a wiser move than being greedy due to the stock’s very high current yield today.

Be the first to comment