EvilWata/iStock via Getty Images

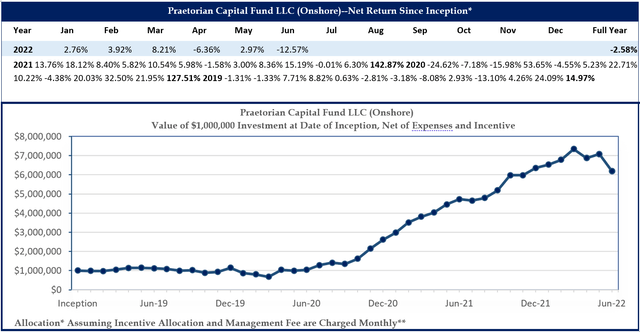

During the second quarter of 2022, the fund declined by 15.69% net of fees. For 2022, the fund’s performance for the first half of the year, net of fees, was -2.58%. Given the fund’s concentrated portfolio structure and focus on asymmetric opportunities, I anticipate that the fund will be rather volatile from quarter to quarter.

During the second quarter, the majority of our core portfolio positions declined after multiple consecutive quarters of appreciation. This decline represents a long-overdue pullback within a portfolio that I believe remains on-trend and undervalued.

Offsetting this decline in our core portfolio, our Event-Driven Book produced a small positive return. This subpar return from the Event-Driven book is mostly a reflection of a decision on my part to keep overall Event-Driven exposure at a reduced level, leading us to take fewer positions than normal in the Event-Driven book. In my experience, the Event-Driven strategies tend to perform better in a volatile or rising market, as they are primarily long-biased.

While the markets have mostly trended lower since the beginning of the year, the overall volatility has remained surprisingly tame, with the VIX mostly capped at 35, which has hampered the returns from the Event-Driven book. I am hopeful that the remainder of 2022 will lead to a recovery in our Event-Driven performance but intend to keep exposure rather reduced until the market evolves from a down-trending one, to one with more volatility or preferably an up-trending one.

|

Praetorian Capital Fund LLC |

||

|

Gross Return |

Net Return* |

|

|

Q1 2022 |

19.79% |

15.55% |

|

Q2 2022 |

-18.16% |

-15.69% |

|

YTD 2022 |

-1.96% |

-2.58% |

|

2021 |

181.80% |

142.87% |

|

2020 |

159.39% |

127.51% |

|

2019 |

18.27% |

14.97% |

|

Since Inception (1/1/19) |

747.57% |

518.89% |

*Unaudited net return data is estimated, net of all fees and expenses (using the expense structure in place at the time, which was: a maximum of 2% expenses from Inception through December 2020, and a 1.25% Management fee since January 2021).

During 2020 and 2021, this fund relied strongly on the Event-Driven book to produce returns and help to offset pullbacks in our core book. The lack of Event-Driven returns over the past two quarters clearly has been a hinderance to the fund’s overall returns. Like many things in markets, Event-Driven returns tend to be cyclical, and after several anemic quarters, I’d anticipate a recovery at some point.

As noted over the past few quarters, I would like to caution you that our portfolio has become somewhat lopsided in terms of exposure to inflation assets, particularly with a focus on energy assets.

Partly this is due to disproportionate appreciation of those assets as a percentage of the portfolio and partly this is a result of what I see as the most attractive opportunity set in the current market. As commodities tend to be more volatile than the overall market, it bears mentioning that I believe this increased exposure is likely to increase the overall volatility of our fund—particularly as the Federal Reserve has embarked on a rate cycle that is specifically targeting inflation assets.

The negative performance during the second quarter, particularly in June, was the result of a sizable pullback in a number of energy related securities that we own. I believe that this overweighted exposure may weigh on returns until the Fed signals that they are ready to pause the rate hikes. Fortunately, I believe that the pause may be much sooner than many market participants expect.

Market Views

I believe strongly that the Federal Reserve has little heart for their campaign to quash inflation, especially as much of the inflation is coming from energy products that are becoming scarce as various global leaders, including our own, embark on campaigns to hinder the production of energy and threaten producers with excess profits taxes, carbon taxes and outright nationalization. These policies are directly contradictory to the market’s normal supply response in reaction to higher prices.

Additionally, my view is that higher prices will continue to be met with subsidies, so that lower-income consumers can continue to consume at a similar or increased pace, despite higher prices. All of this leads to a feedback loop of higher energy prices and the Fed will eventually conclude that energy prices are impossible to restrain.

Outside of energy, many of the causes of the recent inflation are moderating with the slowdown in the economy. As a result, I believe that the Fed will soon take a pause. Especially as they’ll determine that it is foolish to destroy the economy while chasing oil higher. When that pause happens, inflation assets will once again scream higher. I want to be long before that happens, even if it involves a bit of pain as we wait for the Fed to hit pause.

Thoughts on the Fund’s Q2 Pullback

My style of inflection investing tends to produce substantial volatility. While I get plenty of investment themes wrong, I feel my disciplined approach to valuation means that my mistakes often produce a slight gain or loss and the effect on portfolio performance from mistakes tends to be negligible. Instead, most of the portfolio’s volatility tends to be caused by securities that appreciate dramatically before experiencing a pullback. That was the case during the second quarter.

I like to point out that a stock that appreciates from $10 to $30 has appreciated by 200%. Then when it experiences an inevitable pullback and declines to $20, that event hits our performance for a third. While frustrating on a shorter-term horizon, that security is still trading for twice what we paid, which is a victory. While you are likely looking at your account statement and wondering about the negative results this quarter, you’re mainly looking at the above situation where securities have pulled back after many quarters of appreciation.

My job in this situation is to analyze the pullback and ensure that nothing has changed to imperil the thesis. If all is going well, my decision process comes down to determining the price at which we should add more. While I have been slow to add on this pullback, I don’t see many theses that have changed— if anything, our core themes seem to be going better than originally anticipated—the beneficiaries of unexpected tailwinds that improve the potential magnitude of the ultimate returns.

Russian Securities

During last quarter’s letter, I gave an update on our Russian securities positions and noted that we had moved them into a side-pocket and marked them all at zero. Nothing has changed regarding the side-pocket or the mark on the positions. However, we did succeed in removing the GDR wrapper from our Sberbank position and now own local Russian Sberbank shares. We intend to do that for our other 3 Russian positions when our broker allows us to.

While it may require some time until we can liquidate these positions, we now have quite substantial unrealized gains on our Russian positions— though it is difficult to quantify the magnitude of the gain as our position in the VanEck Russia ETF (RSX) is not traded in Russia and the composition of the basket of securities that it owns is difficult to mark. However, even if our RSX position were marked at zero, our other four Russian securities positions would set our Russia basket at almost break-even based on current prices on the MOEX.

Naturally, the current MOEX pricing is subject to unique market conditions, and the situation may change in the future.

Position Review (top 5 position weightings at quarter end from largest to smallest)

Uranium Basket (Entities holding physical uranium along with production and exploration companies)

It may take some time still, but I believe that society will eventually settle on nuclear power as a compromise solution for baseload power generation. This will come at a time when there is a deficit of uranium production, compared with growing demand. As aboveground stocks are consumed, uranium prices should appreciate towards the marginal cost of production. Additionally, there is currently an entity named Sprott Physical Uranium Trust (OTCPK:SRUUF) that is aggressively issuing shares through an At-The-Market offering, or ATM, in order to purchase uranium (we are long this entity).

I believe that these uranium purchases will accelerate the price realization function by sequestering much of the available above-ground stockpile at a time when utilities have run down their inventories and need substantial purchases to re-stock. The combination of these factors ought to lead to a dramatic increase in the price of uranium as it will take at least two years for incremental supply to come online—even if the re-start decision were made today.

While most of our exposure to physical uranium is within the Sprott trust, because it allows us to express this view with reduced risk, we also own shares of Kazatomprom (KAP – UK) along with a few select junior miners. I am well aware that mining is one of the riskiest businesses out there, but Kazatomprom is one of the lowest-cost producers globally, with incredible scale in what is a highly consolidated industry.

At the same time, I recognize that we take on certain risks when owning a company engaged in mineral extraction, especially in a country like Kazakhstan that can be politically unstable at times. That said, I believe that the recent change in government will do little to impact the operating environment in Kazakhstan, though the tax rate may expand moderately.

Ironically, uranium will be a prime beneficiary of sanctions on Russia as Russia is one of the world’s largest enrichers of uranium. As the West is forced to enrich more of the uranium that ultimately goes into reactors, underfeeding of tails will flip to an overfeeding of tails. The net effect could be anywhere between 10% and 30% of the global supply of uranium disappearing—which may dramatically accelerate the timing of my thesis while increasing the ultimate magnitude of the upward swing in uranium prices.

Oil Futures, Futures and ETF Options and Call Spreads

I believe that years of reduced capital expenditures, along with ESG restricting capital access, combined with western governments that are openly hostile to fossil fuels, have created an environment for dramatically higher oil prices. While we could purchase oil producers, I feel it is far more conservative to simply own the physical commodity itself. We own December 2025 oil futures, along with various futures and ETF call options and call spreads. I believe that this leveraged play on oil gives us the most upside to oil and ultimately inflation, while exposing us to reduced risk when compared to producers.

Building Materials (Positions Not Currently Disclosed)

We own shares of two companies that produce and distribute building materials, primarily for the home building industry. Both companies trade at mid-single digit cash flow multiples and are using the cash flow to rapidly repurchase shares. One could say that the low multiples are due to peak cyclical earnings. I take a different view and believe that we’re in the early stages of a long-term housing boom caused by migration to low tax states along with a catch-up phase as home construction rates were below trendline over the past decade.

I believe that the US needs in excess of 1 million new single-family homes each year, just to provide for population growth, ignoring the other factors. As a result, these businesses do not appear to be at peak earnings; instead, I believe we are seeing a new baseline for earnings.

Energy Services Basket (Positions Not Currently Disclosed)

In 2020 when oil traded below zero, drilling activity ground to a halt and many energy service providers declared bankruptcy. Many of these businesses had teetered on the verge of bankruptcy for years due to reduced demand and over-leveraged balance sheets. The bankruptcies led to consolidation and reduced future industry capacity, removing future competition in the recovery.

With oil prices now at multi-year highs, I believe that demand for drilling and other services will recover. While producers have been slow to increase spending on exploration, despite dramatic recoveries in energy prices, I believe that this only extends the timing on the thesis. In the end, the only way to reduce energy prices is to see a dramatic increase in global oilfield services spending. Any postponement of this spending only leads to higher prices and more wealth transfer from the global economy to the producers, which will likely end up resulting in spend on exploration and production.

We purchased many of these positions at fractions of the equipment’s replacement cost, despite restored balance sheets and positive operating cash flow. As spending in the sector recovers, I believe that the potential for cash flow will become more apparent and this equipment will trade up to valuations closer to replacement cost.

St. Joe (JOE)

St. Joe owns approximately 175,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE will grow revenue at 30% to 50% each year for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at a single-digit multiple on Adjusted Funds from Operations (AFFO) looking out to 2024, while substantial asset value is tossed in for free.

Besides the valuation, growth, and high Return on Invested Capital (ROIC) of the business, why else do I like JOE? For starters, land tends to appreciate rapidly during periods of high inflation— particularly an inflationary period where interest rates are likely to remain suppressed by the Federal Reserve. More importantly, I believe we are about to witness a massive population migration as people with means choose to flee big cities for somewhere peaceful.

I suspect that every convulsion of urban chaos and/or tax-the-rich scheming will launch JOE shares higher, and it will ultimately be seen as the way to “play” the stream of very wealthy refugees fleeing for somewhere better.

In summary, during the second quarter of 2022, the fund experienced a pullback in many of its core positions. I have used this pullback to moderately increase a number of our positions, which has increased our overall exposure. Our exposure is a bit more concentrated in inflation, particularly in energy, than I’d normally expect it to be, but those are also my favorite themes. We’ve expressed this view through instruments like physical uranium, long-dated oil futures and futures options, energy equipment services companies, and land plays, which I believe should have a reduced risk of permanent impairment.

I also believe we are in the early stages of this inflationary boom and while there will be sizable volatility going forward, we are positioned well.

On a final note, I intend to visit mainland Europe for the first time since Covid started. I’ll likely be in Switzerland, Spain and Denmark during July and August. If you are interested in meeting up, please let me know by clicking here.

Sincerely,

Harris Kupperman

|

Praetorian Capital Fund LLC – Quarterly Returns |

||

|

Gross Return |

Net Return* |

|

|

Q1 2022 |

19.79% |

15.55% |

|

Q2 2022 |

-18.16% |

-15.69% |

|

YTD 2022 |

-1.96% |

-2.58% |

|

Q1 2021 |

57.50% |

45.66% |

|

Q2 2021 |

28.14% |

23.96% |

|

Q3 2021 |

11.42% |

9.85% |

|

Q4 2021 |

25.32% |

22.44% |

|

YTD 2021 |

181.80% |

142.87% |

|

Q1 2020 |

-41.22% |

-41.22% |

|

Q2 2020 |

54.32% |

54.32% |

|

Q3 2020 |

34.09% |

29.32% |

|

Q4 2020 |

113.25% |

93.94% |

|

2020 |

159.39% |

127.51% |

|

Q1 2019 |

6.10% |

4.88% |

|

Q2 2019 |

7.99% |

6.44% |

|

Q3 2019 |

-10.51% |

-8.40% |

|

Q4 2019 |

15.34% |

12.42% |

|

2019 |

18.27% |

14.97% |

* Unaudited net return data is estimated, net of all fees and expenses (using the expense structure in place at the time, which was: a maximum of 2% expenses from Inception through December 2020, and a 1.25% Management fee since January 2021).

*Unaudited net return data is estimated, net of all fees and expenses (using the expense structure in place at the time, which was: a maximum of 2% expenses from Inception of PCF LLC on January 1, 2019 through December 2020, and a 1.25% Management fee since January 2021). For PCO Ltd., the fee has been a 1.25% Management fee since its inception date of October 1, 2021.

** No investor has achieved these precise results. Chart is for illustrative purposes and is intended to provide a basis for further discussion.

Praetorian Capital Offshore Ltd. is a “feeder fund“ into the Master Fund (Praetorian Capital Fund LLC) and will have slight return discrepancies due to differences in inception dates and expenses.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment