Stephen Chernin/Getty Images News

United Natural Foods, Inc. (NYSE:UNFI) is the largest publicly traded grocery wholesale distributor, delivering healthier food options to people throughout the United States and Canada. UNFI distributes over 250,000 natural, organic and conventional products to more than 30,000 customers including natural product superstores, independent retailers, conventional supermarket chains, ecommerce retailers, and food service industry.

Among their customers include Whole Foods (AMZN), Harris Teeter, Publix, Sprouts (NASDAQ:SFM) and Wegmans. Known for their Wild Harvest consumer brand, UNFI capitalizes on private label products, which carry high profit margins and have become increasingly popular. In fact, one-third of consumers say that most of their grocery shopping includes private brands. This helps the company increase their margins amidst a low margin industry.

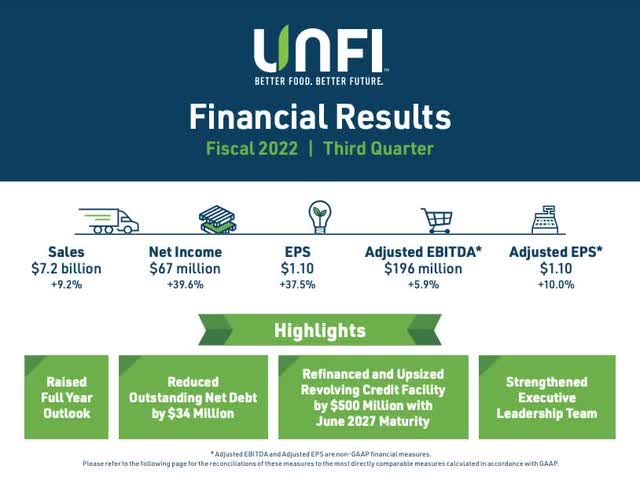

In their latest quarterly report, United Natural Foods reported sales increased by 9% from a year earlier. Net income rose 39.6% to $67 million, EPS grew 37.5%, and the company reduced its outstanding net debt by $34 million. Overall, it was a magnificent quarter for this small cap growth company, which should now be on every analysts’ radar.

Best-In-Class Distribution

One of the things that make this company stand out in this highly competitive and low margin industry is its best-in-class food distribution supply chain. Having over 30,000 institutional customers requires a very efficient operational system to produce consistent profits and growth. United Natural Foods’ distribution system is one of the best in its class.

UNFI

As an example, earlier this year the company instituted a one-truck, one-invoice system to streamline its accounts receivables. This ensures that every customer has one ordering system where products will be delivered on one truck and billed on one invoice for more accurate and timely orders. This is especially critical knowing that the company makes 5,000 deliveries a day across the U.S. and Canada.

Growing Market Opportunity

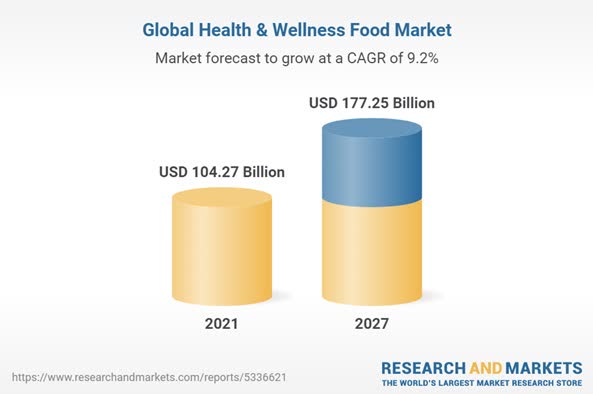

With Americans being more health conscious in what they eat, the health and wellness food market is estimated to grow by an annual compound rate of 9% over the next five years. This gives United Natural Foods the wind at its back to continue to grow as its market grows.

Research and Markets

However, the company’s growth opportunities do not only come from its expanding universe, but it can also come from growing vertically. UNFI’s diverse customer base paired with its expansive portfolio of products positions the company favorably to serve consumers of all types as their buying habits change due to inflation.

The ability for the company to provide more premium offerings or more value offerings on short notice is a competitive advantage that keeps the company tuned in to consumer’s shifting preferences. This can be seen in how the company handles as many as 275,000 SKUs (stock keeping unit) that differentiate one product from another and helps to track inventory levels.

Having multiple avenues to growth increases the company’s ability to meet its own sales targets amid a potential slowdown in the economy stemming from rising inflation.

Analysis

Buy Rating: I have a Buy rating for United Natural Food’s stock with a five-year target price of $112 per share.

In my analysis of UNFI’s stock, I believe the company can continue to grow their net margin over the next 5 years to 1.2%, which is more than double its 0.55% net margin in 2021. I anticipate the company’s revenue growth to be 9.5%, which is in line with the growth of its market. Finally, I anticipate that the stock’s price-to-earnings ratio (P/E) will contract slightly to 14 due to the rate of growth of its earnings outpacing the rise in its share price.

Below is a table contrasting the company’s current metrics and stock price to the 5-year estimate:

| United Natural Foods |

Current* (as of 9/2/22) |

5-Year Estimate |

|

Revenue (in millions) |

$26,950 |

$38,745 |

|

Net Margin (%) |

0.55% |

1.2% |

|

Net Income (in millions) |

$149 |

$465 |

|

# Outstanding Shares |

60,000,000 |

58,000,000 |

|

Net Income per Share |

$2.48 |

$7.98 |

|

Price/Earnings (PE) Ratio |

17.14 |

14 |

|

Stock Price |

$42.50 |

$112 |

Source of company metrics: Morningstar, UNFI

*Current metrics based on fiscal year end 2021

To better understand how to read the table above, read my previous article Meta: Attractive Valuation.

Two Years of Guidance

One of the benefits that the company provides its investors is a two year guidance. In the latest quarterly report, the company raised its full year revenue guidance for 2023 by 7%, and EPS to grow to around $4.78 per share, which is an increase of 93% from the previous year.

For 2024, the company is estimating net income per share to be no less than $6 per share, which would be another 25% increase from 2023. Having this far of a line of sight into a company’s future earnings is a rare benefit to investors. Offering this degree of guidance shows the level of confidence management has on their ability to compete and execute.

Be the first to comment