imaginima

Dear readers,

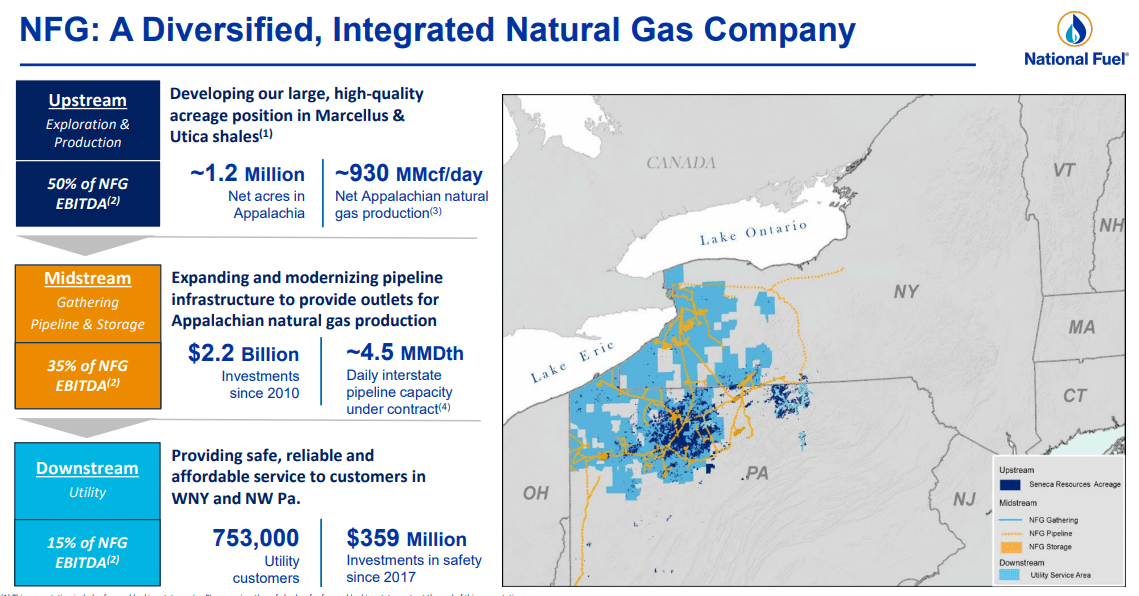

National Fuel Gas (NYSE:NYSE:NFG) is a well-diversified company in the energy space, selling natgas through its utility segments and providing transportation through pipeline and storage. It also has upstream operations, through its Texas-based segment.

In my earlier article on the company, I outlined some of the main issues with this company, which after all is one of the earliest available companies in the space.

Let’s recap and see where the appeal is today.

Revisiting National Fuel Gas

From a high level, this company looks like the perfect sort of investment.

NFG IR (NFG IR)

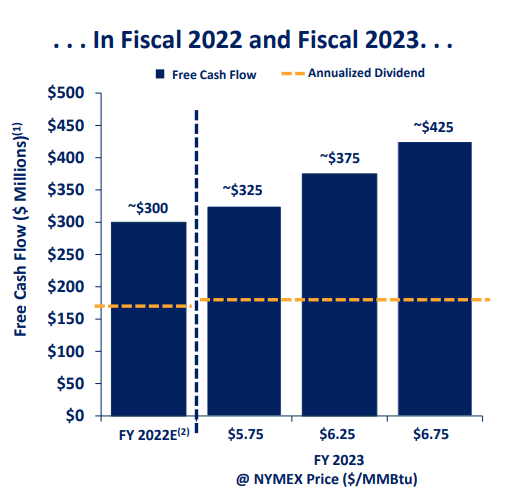

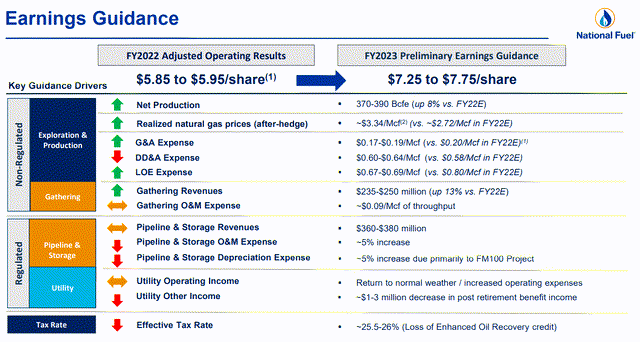

With a fully-integrated operating model enhancing shareholder value, and the current energy market being the way it is, it’s hard to see a situation where NFG doesn’t generate impressive overall cash flows for both 2022 and potentially for 2023E.

The company has a long history of returning attractive capital to shareholders, and the integrated structure means that investors, such as myself (and perhaps you as well), have the advantages that:

- The company can quickly adjust to shifting commodity pricing environments.

- It’s more efficient in CapEx

- It generally yields higher returns on investments

- Its cost of capital is generally lower than firms that lack the full integration

- It has lower operating costs

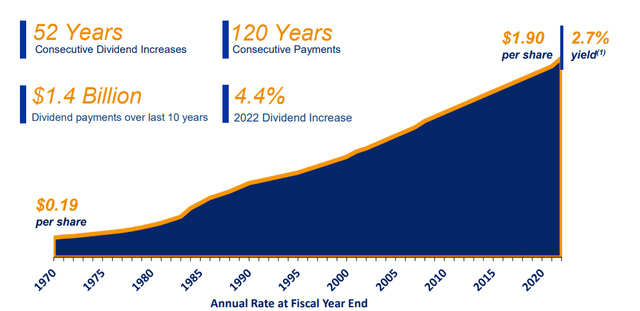

- It can play on fields with more competitive infrastructure projects

The company’s fundamentals aren’t the best in the business, but they’re still solid. Its main strength is that it doesn’t overextend its payouts, which means it can go through pressured periods without having to cut its dividend. The flip side is that the company’s dividend is no higher than 2.8% here, meaning there aren’t many companies in the segment that have a lower overall valuation. The dividend history this company has is no joke. National Fuel Gas has paid dividends for 119 years. It has 51 years of consecutive increases, making it a storied dividend king, and it has paid out $3.4B in dividends since 1970.

The company is expecting to drive that OCF/FCF up through CapEx optimization, continued stable returns from its regulated businesses, hedging the upstream commodity risks while maintaining that upside to rising pricing (as we’re seeing now), and improving that BBB- to a BBB or even higher through consistent FCF.

3Q22 was a good quarter – as expected, based on the current pricing for energy. Expectations for 2023E are positive, with ever increasing FCF and a slightly higher dividend.

NFG IR (NFG IR)

Improvements here are based on the aforementioned CapEx optimization, modernizing infrastructure and storage and distribution infrastructure. The regulated business is expected to continue to generate positive FCF, the company’s upstream operations meanwhile are hedged.

If you want a safe and reliable payer, there’s very little that NFG doesn’t offer.

Operating results in Exploration/production more than doubled in 3Q22 on a YoY basis – in fact, every sub-segment the company has increased for the quarter except utilities, which have been stable. All of this is supported by increased Natgas prices and improved energy trends, which has caused the following earnings guidance.

The company has several new projects ongoing, with growing production of the company’s capacity. NFG has plenty of wells left untapped across most of its geography. As we mentioned in the last article, the company’s Californian oil production is a risk. As you might have expected from Cali as a state, the company’s operations here face extensive state-level regulation which hampers profit and growth – and judging by Cali overall, this might be increasing going forward.

But the main issue with NFG remains its earnings exposure to its exploration/production, which usually sees around half of the company’s FCF/EBITDA.

Also, inflation.

This will affect the company both in terms of boosting commodity prices, but it will also increase costs, which also include financing costs. NFG has a relatively high amount of liabilities in terms of its assets. With a $6.5B market cap, the company has over $2.5B in collective overall debt. More conservative investors should consider limits and regulations on Cali oil drilling as well as market expectations for the company’s various operations in this very volatile climate.

This restrictive state-level situation isn’t just in Cali, but it’s found in New York as well – and it’s not unrealistic that this could limit NFG’s future potential. These are risks to NFG, but in the end, none of them should be enough to completely offset the conservative upside to this business.

National Fuel Gas – Valuation Update

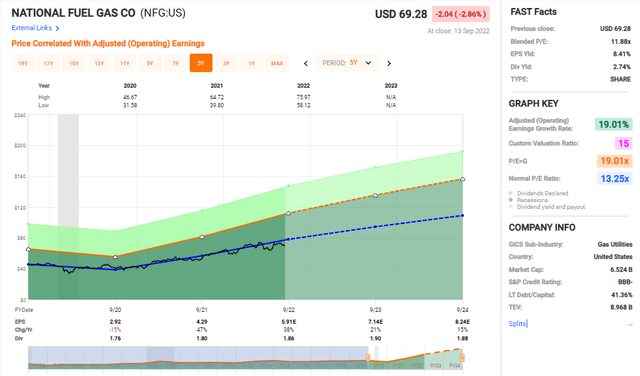

In the last article, I went “HOLD” on the company due to the valuation risk related to the prospect of ever-increasing commodity prices. Such a concept is risky in itself – but we’ve now adjusted our growth targets somewhat, and the overall appeal of the company is still very much there. Even based on a lower, 10-15% EPS growth, NFG is able to produce double-digit RoR annually in this market.

Even with a relatively low yield and a BBB- rating in terms of credit, this is no longer an unappealing prospect in this market – especially given the instability we’re currently seeming to be facing.

NFG’s role in your portfolio should be one of energy stability – and that isn’t easy to find. That NFG has provided relative stability over the past few years isn’t a hard sell. And that crystallizes the potential upside to the company’s normalized P/E-ratio. I don’t see much reason why NFG should trade far outside of this range.

Forecast accuracy here is high, relatively speaking. Only a 15% miss ratio with a 10-20% MoE gives this company a higher-than-usual forecast safety. The potential upside ranges we’re looking at for NFG are, therefore, between 15% at the lowest, indicating a 10.75x normalized P/E under the current forecast, all the way up to a 36.2% annualized RoR based on around 15x normalized P/E.

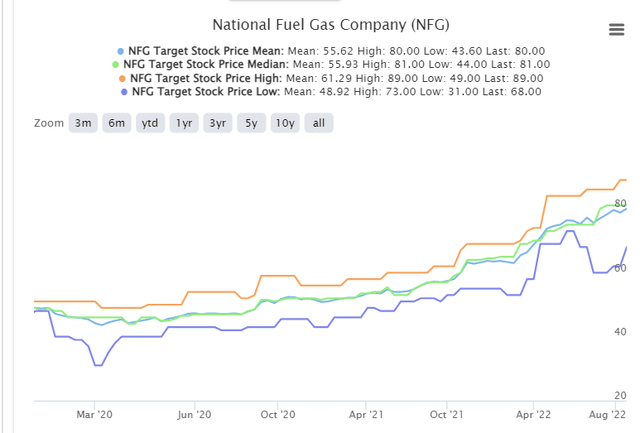

S&P Global would generally agree with the upside that’s available here. The current price targets come to between $68 on the low side and $89 on the high side, with an average of around $80/share. 3 out of 5 analysts consider this company a “BUY” or equivalent at this time.

I will point out that there has been a tendency towards valuing this company higher. As with all analyst targets, I would watch this carefully, because these targets have been increasing markedly. It’s not strange, because the way we’ve been valuing oil/gas has evolved in time with the current market. However, an inflection point is possible, and those ignoring conservative approaches might be getting the short end of that stick in case things turn down again, which is something we want to avoid.

NFG Analyst targets (TIKR.com/S&P Global)

What we need to remember that energy is a cyclical sector. Despite current appearances, it hasn’t stopped being cyclical, and there will be a point when things turn “down to brown-town”. When it does, we want to be certain that we’re invested at a good valuation.

For the time being, it’s my stance that this can be done with National Fuel Gas.

The current energy situation, macro situation, and market have made me re-evaluate NFG as an investment possibility in the energy space. In accordance with this, I’ve established and expanded my existing LONG position in the company, and I’m ready to give a price target, albeit a more conservative one than you might be expecting.

I would accept a 13-14x P/E normalized, which puts me at about $70/share at this time, lower than analysts are on the company.

So, take this as me shifting my thesis – and carefully advocating a “BUY” here.

Thesis

My thesis for NFG is as follows:

- NFG is a fundamentally appealing, integrated commodities business and utility with an attractive operational profile. At the right price and conservative upside, this company constitutes an absolute “BUY”.

- However, recent risks including debt, inflation, operations in states traditionally opposed to hydrocarbons, and a rich valuation based on continued commodity pricing upside add to the risk here.

- I come in at a “HOLD” – my target is $70/share, no higher.

Remember, I’m all about :

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them. (Italicized)

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment