setthaphat dodchai/iStock via Getty Images

Recent market volatility has created a number of bargains, but it’s important to be selective and not buy into value traps. This brings me to Medtronic (NYSE:MDT), which is a quality company whose stock continues to trade in the doldrums since hitting its 52-week high of $136 back in September of last year. This article highlights what makes MDT a quality name worth buying before the market gets the memo about this value pick, so let’s get started.

Why MDT Is Attractive While It’s Still Down

Medtronic is a diversified medical device company with operations in over 150 countries and a wide array of products ranging from pacemakers to stents to insulin pumps, treating 70 different health conditions. This gives the company a lot of pricing power and helps to insulate it from headwinds in any one particular product category or geography. MDT employs over 90K people across 150 countries.

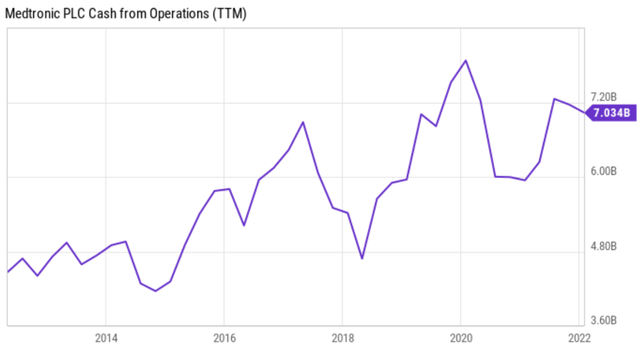

The company has a strong history of profitability and free cash flow generation, with an impressive 10-year track record. This is reflected by its A+ score for profitability, with a sector leading 30% EBITDA margin, far surpassing the 5% sector median. Additionally, as shown below, MDT has grown its cash flow from operations by 57% over the past decade, to $7.0B over the trailing twelve months.

It’s worth mentioning that revenue growth was rather muted in the fiscal third quarter of 2022 (ended January 28), with it being flat on a YoY basis (2% organic growth). This was driven by a challenging operating environment for healthcare providers amidst the Omicron-related surge as well as labor shortages, both of which led to lower medical device procedure volumes, mostly in the U.S.

I do see encouraging signs, however, as management, this month, noted that they anticipate an acceleration of patient procedures heading into the month of April. Additionally, the CFO also noted very limited impact to MDT from the Russia invasion of Ukraine, as it receives only 1% of its total revenues from these 2 countries.

Furthermore, MDT continues to invest heavily into its diabetes pipeline. This represents a substantial patient base, and management expects to return to market growth in this important market.

Looking out to fiscal Q4, the company expects to resume top-line growth with guidance for respectable organic revenue growth of 5.5%. Meanwhile, the company remains shareholder-friendly, as it spent $1.1 billion on share buybacks in the first nine months of fiscal year 2022.

Meanwhile, MDT maintains a strong A rated balance sheet, and is on its way to becoming a Dividend King, with 43 years of consecutive annual dividend raises under its belt. While the current yield of 2.3% isn’t considered high, it is far better than that of the S&P 500 (SPY). The dividend also well-protected by a 44% payout ratio and comes with an 8% 5-year CAGR.

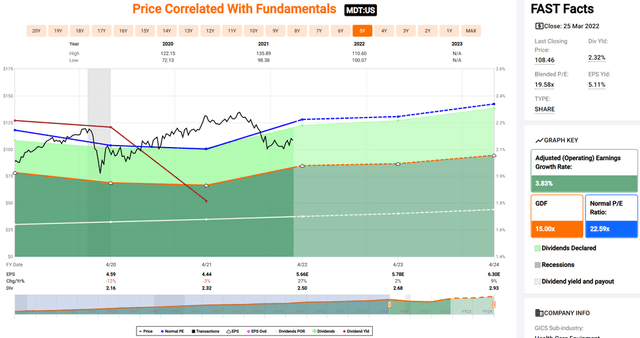

I see value in MDT at the current price of $108 with a forward PE of 19.2. This is considering the quality of MDT’s entrenched products and reputation with healthcare providers, and the 15% discount to the five-year average PE of 22.3. Sell side analysts have a consensus Buy rating with an average price target of $125. This translates into a potential one-year 18% total return including dividends.

Investor Takeaway

Medtronic is a quality company whose stock continues to trade at a discount to its historical valuation range. It has a diversified product portfolio and a strong history of profitability and free cash flow generation. The company is also shareholder-friendly, with a long history of annual dividend raises. Lastly, I believe the recent headwinds should resolve themselves. The current stock price presents an attractive entry point for long-term investors.

Be the first to comment