Liz Truss Resigns As Prime Minister Of The United Kingdom Leon Neal/Getty Images News

Investment Thesis

The most recent British government under Prime Minister Liz Truss announced a mini-budget on September 23rd that caused a massive turmoil in the financial markets. The British pound dropped to all time lows vs. the USD, UK interest rates skyrocketed and continued selling of UK government bonds eventually lead the Bank of England to intervene in the market to break a vicious circle of self reinforcing fire sales and prevent a market meltdown.

The government was quickly forced into a U-turn regarding its fiscal policy and the first victim was the Chancellor who handed in his resignation. This lead the British tabloid Daily Star to wonder if a lettuce might stay fresh longer than Truss could hold on to her job as a Prime Minister. The lettuce won. Truss announced her decision to resign as PM on October 20th. UK government bond markets immediately started a relief rally.

While the turmoil in the market after the budget announcement was the start of the end of the Truss government it might have also lead to a great investment opportunity in Legal & General (OTCPK:LGGNF), a leading British insurance company. Not only is L&G still down nearly ten percent since then but it is also uniquely positioned to benefit from the market turmoil that the Truss government caused via its most important division.

This might finally be the catalyst that leads to a re-rating of L&G which currently trades at a depressed valuation. But even without an immediate re-rating L&G pays the patient investor a rich 8% dividend while he waits for the market to acknowledge that L&G trades just too cheaply.

I will first give a short introduction to Legal & General. Then I will explain what has happened in the UK that necessitated the Bank of England to intervene to avoid a market meltdown and how that might benefit L&G. Finally I will look at L&G as an investment and analyze its valuation, expected returns and associated risks. All data will be presented in British Pound (GBP) unless otherwise specified and refers to the UK listed share. An ADR (OTCPK:LGGNY) is available for US based investors.

Legal & General Introduction

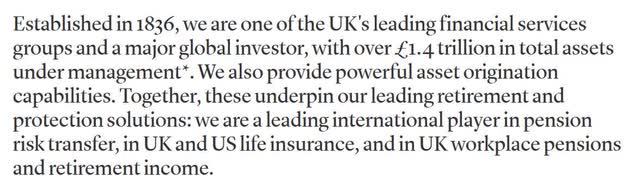

L&G is a leading UK based insurance company. This is how they describe themselves:

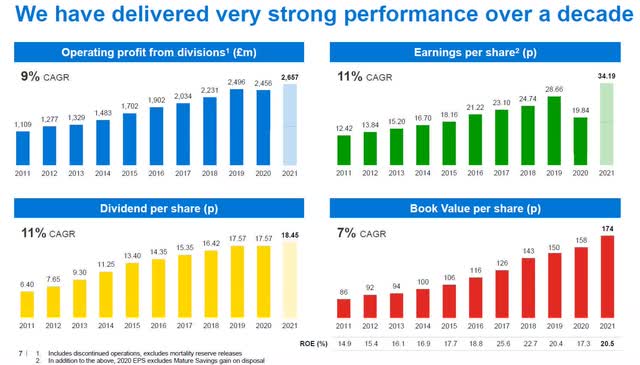

L&G’s historical performance

L&G also managed to show good growth during the last ten years.

ten year performance (L&G 2021 annual results presentation)

That said the numbers here seem somewhat questionable. Take for example the operating profit one. It states operating profit from divisions. This excludes the group’s financing costs as well as its other central expenses.

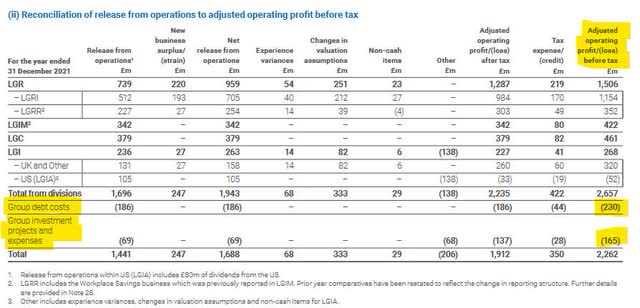

In 2021 the reconciliation looked like this:

2021 adj operating profit reconciliation (L&G 2021 annual Report p.143)

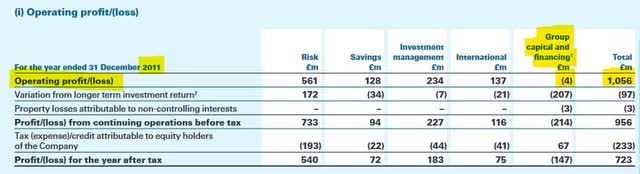

However, in 2011 divisions where different and the group centre was not really making losses. I would assume they charged the divisions the respective financing and operating costs back then but I don’t know. The overall number is also a touch lower than the number on the investor presentation slide but that might just be due to changes in mortality reserves that are excluded on the slide.

2011 operating profit reconciliation (L&G 2011 Annual Report p.107)

If we want to figure out the real CAGR we should then compare not the 2657 for 2021 from the slide but the 2262 which includes the central costs that were probably also included in the 2011 number. This unfortunately reduces the CAGR to only 7.4% from the stated 9%. Given that diluted share count also increased by over 6% in the period we find out that they grew operating profit only by 6.8% per share. And looking at adjusted operating figures including central costs it looks like there is hardly any progress in recent years:

recent L&G adjusted operating profits (L&G Annual report 2021 p.2)

This is also in line with the slides that show a general slowdown of growth in recent years. Which probably explains the lackluster share price performance. Let’s take a closer look at the underlying drivers of operating profit at L&G.

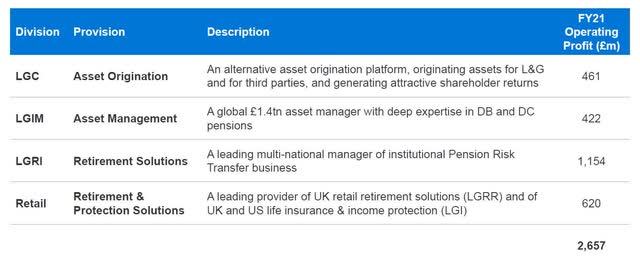

L&G business units

L&G has evolved from a traditional insurance company to a financial services group that specializes on managing risk and assets. As such L&G operates the following business units:

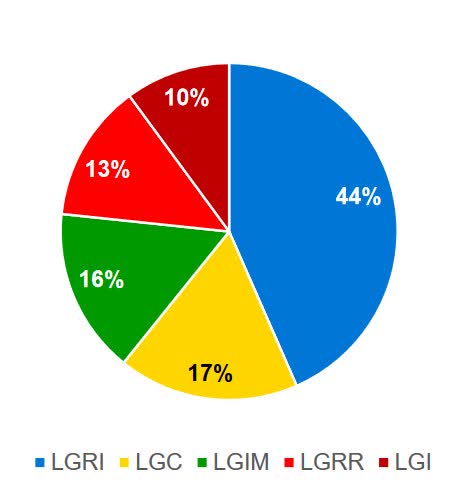

L&G business units operating profit contribution (L&G 2021 annual result presentation)

Here is their respective contribution to operating profit in a pie chart:

L&G business units operating profit contribution (L&G 2021 annual results presentation)

Retail now combines the former LGI (L&G Insurance) and LGRR (L&G Retail Retirement Solutions). LGI is the classical life insurance business sold to individuals. Their insurance business is highly cash generative but only low single digit growth in terms of operating profit. LGRR on the other hand encompasses retirement solutions like individual annuities or lifetime mortgages. This segment grew very strongly historically (25% operating profit CAGR 2015-2019) but has seemingly stalled in recent years as people delayed annuity and retirement decisions during the pandemic. Longer term this segment should dominate L&G’s retail business due to superior growth prospects.

LGIM (L&G Investment Management) is also a pretty standard asset management business with GBP 1.4 trn AuM by year end 2021. L&G has a specific expertise with index fund based solutions (about 1/3 of AuM) as well as with regards to liability driven investing (about half of AuM) for pensions. Unfortunately, both index based solutions as well as institutional business are low margin. It has decent net inflows over time but overall operating profit growth is only low-mid single digit. They target 3-6% operating profit growth going forward. Growth opportunities include their recent expansion into Asia.

LGC (L&G Capital) is their alternative asset platform. Here they manage and originate alternative assets for their own use (and risk), for their LGRI division and for third party investors. Pension liabilities are very long term and often also have an inflation component. They are very hard to match properly with standard assets. This was especially true in the last couple of years with record low interest rates. LGC has been growing operational profit by 12% annually in recent years and overtook LGIM in terms of profit contribution. L&G expects this division to have an operating profit of GBP 600-700m by 2025 which means high single to low double digit growth going forward. This profit growth comes partly from an increase in external AuM but also from investing parts of their own balance sheet in alternative assets which exposes L&G to sizable risk and income volatility.

Therefore, while it is a strongly growing income stream I would personally like them to not invest as much of their own balance sheet but rather focus on the opportunity to manage external funds rather than their own.

And finally there is LGRI, their bulk purchase annuity (BPA) business. This is the main focus of this article. It is also the biggest contributor to operating profits. What do they do in this segment? Simply put, they get paid to take on pension liabilities from e.g. companies with defined benefit (DB) schemes. L&G estimated in October last year, that there are 2 trillion GBP of DB in the UK alone, with only 12% being transacted so far.

From 2015-2019 LGRI had been growing operating profit with a CAGR of 21%. This has come to a drastic end with 2021 operating profit at LGRI only 3% higher than 2019’s. In H1/22 we already saw an uptick in growth with a 7% increase in operating profit. The main thesis of this article is, that LGRI, the biggest segment of L&G, could return to double digit growth over the next years and thereby led to a re-rating of the company and a recovery of the share price.

Enter Liz Truss and the mini-budget crisis

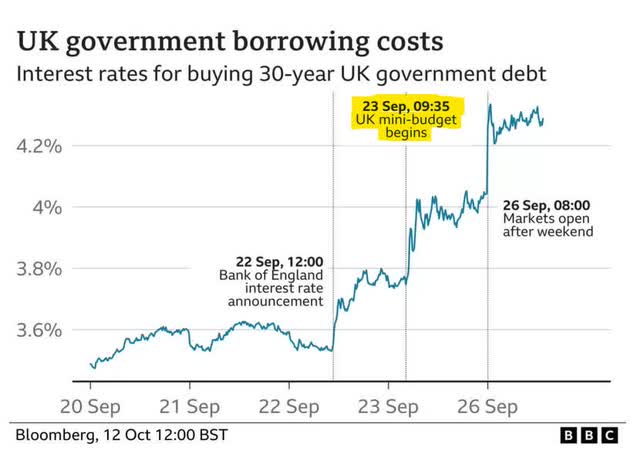

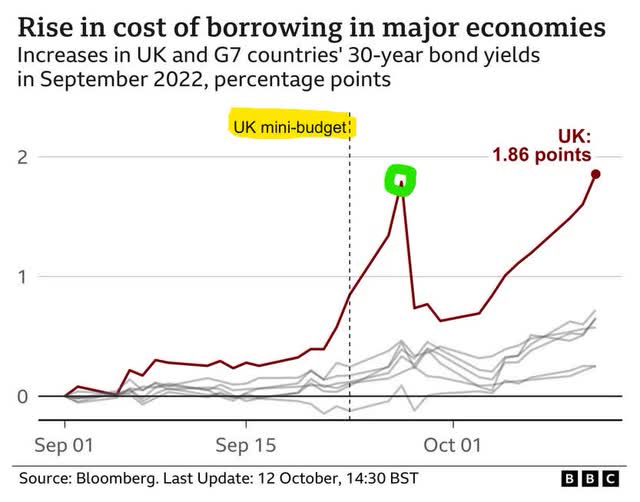

As mentioned in the introduction, the mini-budget of the Truss government caused a dramatic market turmoil in recent weeks. The budget contained massive tax cuts leading to expectations of high future indebtedness driving up interest rates in the UK government bond market (aka “gilts”).

dramatic move in interest rates after mini-budget (BBC article)

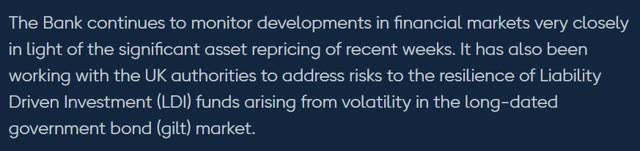

These moves were so strong and sudden that they caused calls for additional collateral from pensions funds that used derivative overlays on their assets to manage their liability exposures. To fund those calls they sold government bonds and therefore driving prices down further and interest rates ever higher leading to a self-reinforcing vicious cycle. This forced the Bank of England (BoE) to intervene (green circle).

mini-budget and BoE intervention (BBC article)

BoE’s chief economist Huw Pill gave a speech on the 29th of September in which he also shortly touched on the issue:

…the Bank is preventing a self-sustaining vicious spiral of collateral calls, forced sales and disappearing liquidity from emerging in a core segment of the financial markets.

… yesterday’s intervention is intended to prevent painful, adverse self-fulfilling market dynamics emerging.

To prevent a meltdown the BoE embarked in an emergency gilt purchase activity which it then expanded by mid October to index-linked gilts which are strongly used by pension funds.

L&G also offers these kinds of services to its clients. In their SFRC 2021 they state this:

L&G on LDI and derivative overlays (L&G SRFC 2021)

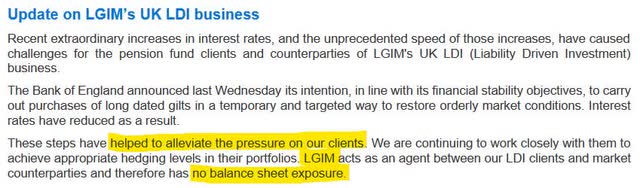

How did that specific turmoil impact L&G? L&G released a press release:

LGIM no balance sheet exposure to mini-budget (L&G press release)

Basically, their LDI clients at LGIM were impacted but L&G itself had no balance sheet exposure in that division. In their LGRI division however, they do have a balance sheet exposure.

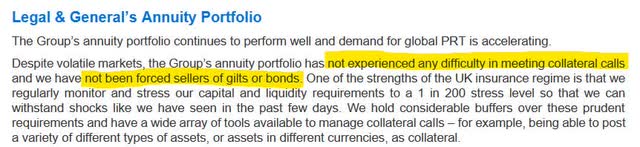

LGRI no forced seller (L&G press release)

Thanks to L&G being a highly regulated insurance company they were prepared for such events and did not experience any difficulty in meeting collateral calls and neither were they forced sellers.

What is the consequence of that mini-budget turmoil? I believe it was a net positive for L&G. Firstly, they proved that their internal system worked. Secondly, many DB managers might have realized that they are still exposed to major risks well out of their control. Thirdly, the higher rate environment leads to shrinking values of pension liabilities. Therefore it is cheaper for DB schemes to offload their liabilities to third parties like L&G. I believe the turmoil will further strengthen the case for many pension schemes to sell out to the likes of L&G in the next years. This is in line with L&G’s comments:

BPA demand increasing (L&G press release)

Therefore, while Liz Truss might have lost her job over the mini-budget crisis it should lead to increased growth for L&G in their most important division. And with the new Prime Minister, Rishi Sunak, being a former banker and hedge fund manager it can be expected that the new government will follow a more traditional fiscal policy for the time being.

to ADR, or not to ADR – that is the question

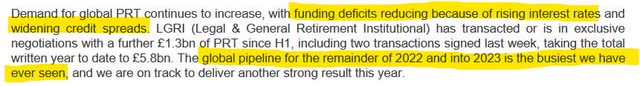

One can either buy L&G directly (OTCPK:LGGNF) or via an ADR (American Deposit Right) (OTCPK:LGGNY). An ADR represents 5 shares of L&G. They are quoted in USD and for US based investors they are generally easier and cheaper to buy vs. buying the shares directly. ADRs also pay the dividend in USD which might reduce costs from conversion of the GBP dividend payments. They sometimes trade at a minor premium or discount.

L&G discount/premium ADR (Deutsche Bank)

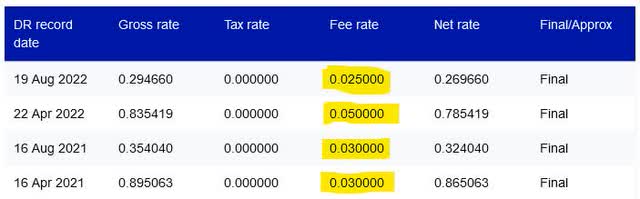

However, ADRs come at a price which is that they charge an annual fee that gets deducted from the dividend payment. It seems that fee has just been increased to $0.075/ADR from $0.06.

At the current price this is a drag of nearly 0.6% on annual returns from holding the ADR. For very long term investors this adds up over time. If one intends to invest more shorter term this aspect does not matter as much.

Is the British Pound a severe drag on expected performance?

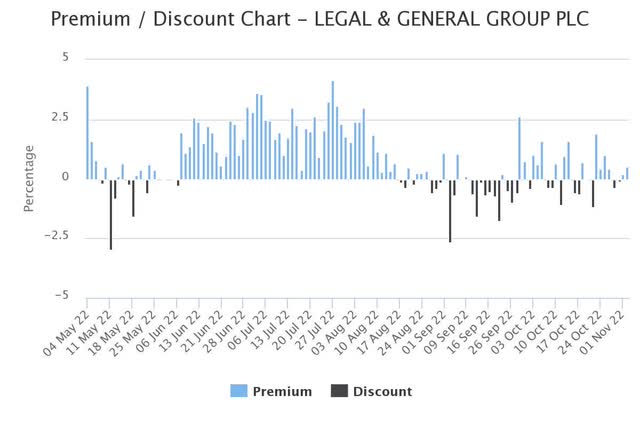

One of the risks of investing in foreign stocks is FX risk. In case of L&G they still get most of their profits from the UK and of course the dividend is also paid in GBP.

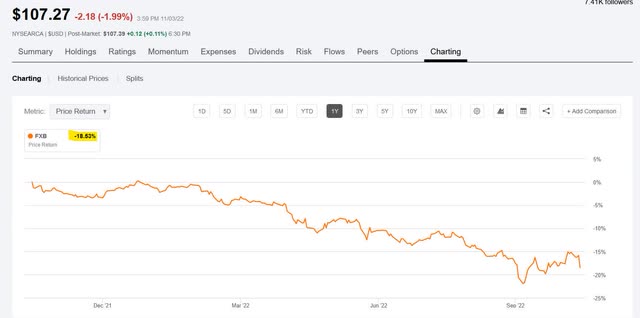

The pound just recovers from all-time lows vs. the dollar after the Truss debacle. Additionally, there is clearly a longer term trend of the GBP losing out vs. USD. This year alone the GBP has lost over 18%!

Such moves can clearly strongly impact investor returns. That said, this is a very strong move which is most likely related to the general USD strength due to the Fed’s strong action taken which is certainly an abnormal situation. Given the dire situation in the UK and based on recent BoE comments pundits have been recently very cautious on the pound. Further weakness throughout the current crisis could very well be on the cards. Longer term the picture is less dramatic:

GBP vs. USD (pound sterling live)

While it had been relatively stable over decades during the last ten years the pound started to decline sizably. Ten years ago a pound was worth $1.60. Now it is worth just $1.07. That equates to a loss of over 33% or nearly a 4% annual drop. However, most of that drop occurred during the last year. In the 9 years beforehand it just dropped by about 14% or roughly 1.6% p.a. Right now it looks very similar to first half of the 80s under Volcker. The USD also gained ground dramatically and even ended up at the same level that we are now at. During the second half of the 80s this trend reversed. Whether this repeats again is anyone’s guess but I believe the 4% annual loss is too high a long term assumption as it reflects the strong moves of the last twelve months. I believe taking the last 30 years when the pound traded around 1.70-1.80 in the early 90s to now gives a good idea of what to expect. It includes both the famous Black Wednesday of the early 90s as well as the current weakness but stretches it over a 30 year period. This gives me a roughly 1.6% annual depreciation vs. the USD. I believe it is prudent to deduct this from any return expectations for a US based investor. If one wants to be compensated for the extra FX risk one could also add say another 0.9% margin of safety on top of it for an extra 2.5% hurdle to invest in L&G as a US based investor.

As an aside: due to the recent massive drop of the GBP vs. the USD the yield information on financial pages is distorted and too high. They use the USD value that investors got paid but by now that USD value would be lower as the Pound devalued. Those sites unfortunately do not reflect this. While the share price gets converted into USD at the current exchange rate the dividend stays converted at the historic higher rate. This then leads to a reported yield of 9% for LGGNF vs. the true 8%. Therefore it is always advised to check the yield in the original currency.

L&G valuation and return expectations

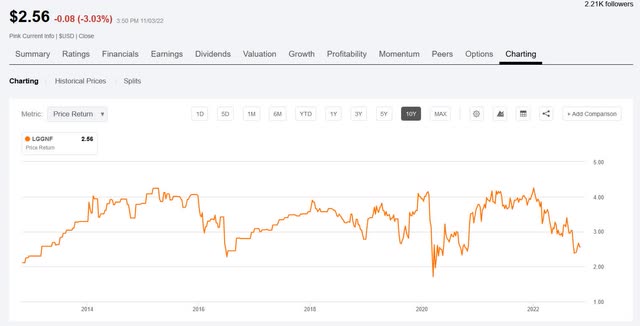

L&G has had a lacklustre share price performance over the last years.

L&G share price stagnating (L&G investor relations page)

In USD it was even worse:

even worse in USD (Seeking Alpha)

As explained above, in recent years growth has been minimal. The main reward came from the dividend. This is hopefully about to change now. For 2022 L&G already points to an 8% growth in operating profit. Capital generation should be about GBP 1.8bn compared to a market cap of not even GBP 14bn. Therefore L&G trades at less than 8x its capital generation. L&G intends to grow its dividend a bit slower (3-6%) than earnings to have funds available to take advantage of growth opportunities. Assuming a 5% growth for FY 22 the forward dividend should be around 19.37 pence or a roughly 8.4% yield.

Taking the 3-6% dividend growth target I would get to an annual return expectation of 11.4-14.4% which by itself is already a good value. I expect growth to be rather on the upper end and would therefore expect a 13-14% annual return in GBP over the long term. For US investors they should deduct 0.6% from that if they use the ADR and another 1.6-2.5% for the GBP drag for a total return expectation of 10-12%.

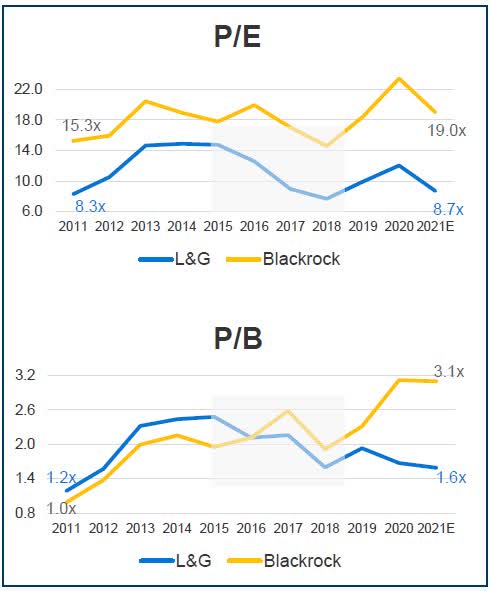

Medium term I could also see a multiple expansion once growth picks up and it is clear that L&G sails well through the upcoming economic turmoils. L&G targets an RoE of 20% and I feel a 1.6-1.8x book multiple seems not unreasonable.

L&G Book multiple (L&G investor presentation)

As we can see L&G has traded at higher book multiples in the past when its growth outlook was better. Current BV is GBP 1.86 at H1/22. That means L&G is nearly back to the 1.2x multiple from ten years ago. If it were to re-rate to a 1.7x multiple that would imply an additional 35-40% upside from the rerating.

What are the risks?

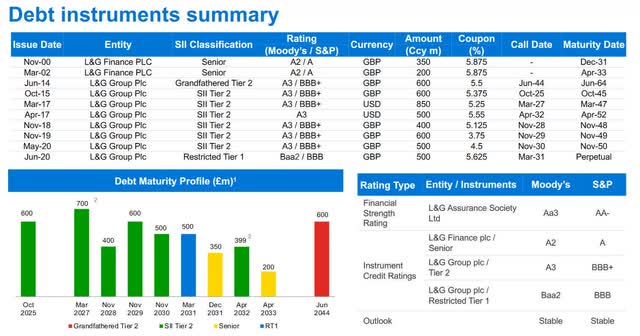

For insurance companies the risks tend to be buried within the balance sheet. Here rating agencies often give a first idea about how risky a company is:

L&G debt ratings (L&G debt investor presentation 2022)

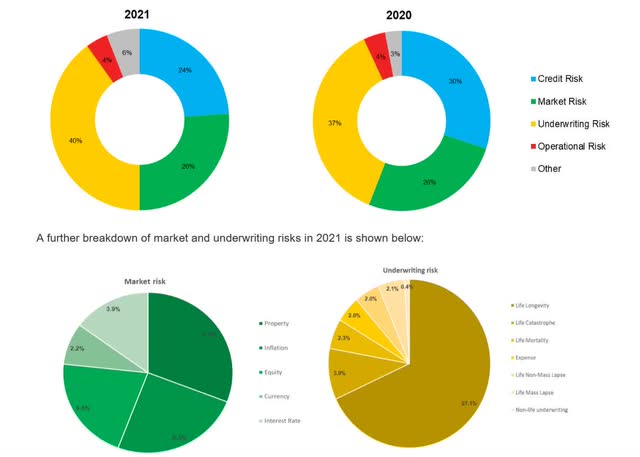

With an A-rating for senior bonds and a BBB-rating for subordinated paper L&G is of good credit quality. Equity is obviously more risky. In their Solvency and Financial Condition Report 2021 they point to their main risks:

SCR risk exposure by type (L&G SFCR 2021)

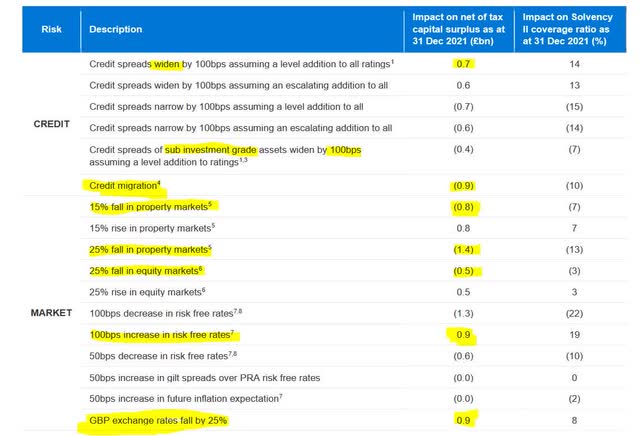

The biggest risks are underwriting risks – which in the case of L&G is the longevity risk for their annuity business. Basically, if people live longer than L&G assumes they will have to pay out pensions longer. Market risks involves property or equity prices falling. Luckily, L&G also provides some data on how sensitive they are to movements in asset markets:

L&G exposure to macro trends (L&G SFCR 2021)

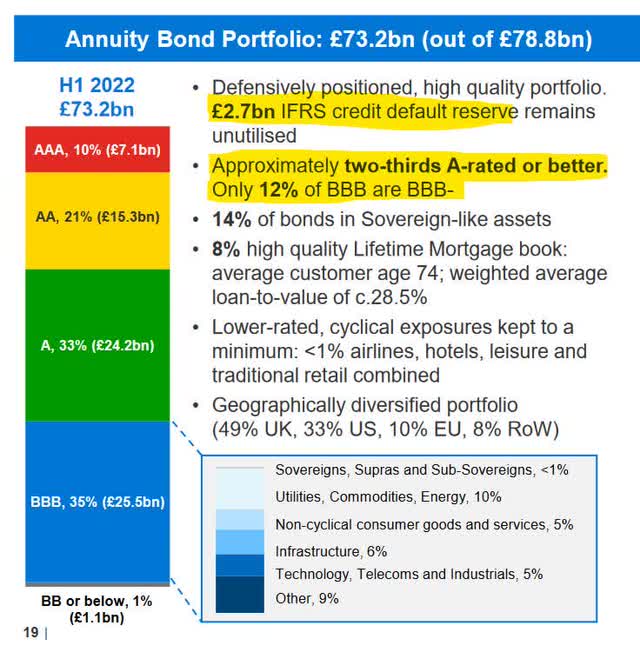

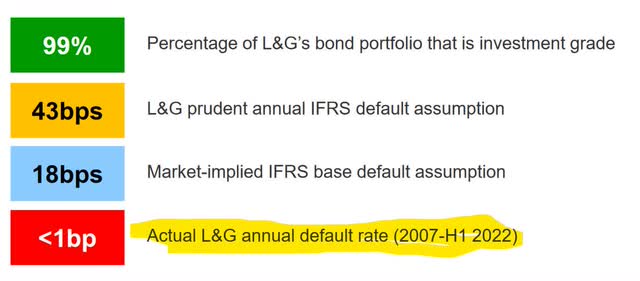

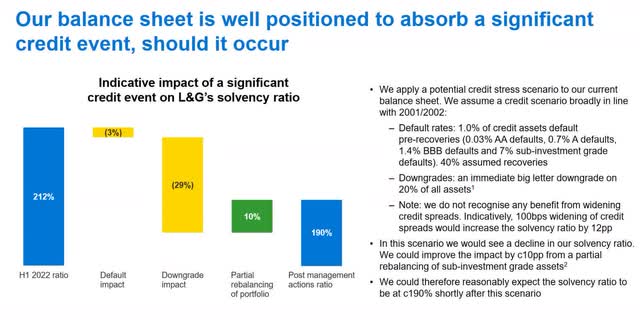

The impact of falls from property or equity markets are sizeable but L&G should be able to handle them with 1.8bn of annual capital generation and a generous solvency surplus. What one can also see is that the current environment is actually favourable to them. Rising rates and widening spreads reduce the value of their liabilities more than on their asset side. This does not include the impact of actual defaults. Their annuity book is of high quality and with minimal historical defaults:

L&G Annuity Portfolio (L&G investor presentation H1-22) default rate assumptions vs. real default experience (L&G investor presentation H1-22) L&G default stress test (L&G investor presentation H1-22)

Overall, it seems L&G is conservatively positioned to weather negative economic conditions. As for the dividend safety they did cut their dividend during 2008/9 by a third but by 2011 it was already 7% higher than 2007. During the pandemic they defied calls by the regulator to cut/omit their dividend and held it stable. They currently pay out about 2/3 of the capital they generate which should give them enough cover under normal circumstances. That said, forecasts for the UK are dire and I am personally also somewhat worried that there might be some surprise negative exposures coming from LGC. There they target returns of 10-12% and that involves activities like house builders or venture capital. I am just not sure I like my insurance company to own and operate a house building company in the current environment.

Is now a good time to buy?

Hopefully, I have established that L&G is fundamentally an attractive buy based on expected returns. I am normally not much of a fan of market timing. But from my experience there are some exceptions: irrespective of what pundits tend to tell you it is generally not a smart idea to buy REITs into a strongly rising rate environment as many have experienced by now and similarly also not so smart to buy into financials when you expect a severe recession to unfold.

L&G share price stagnating (L&G investor relations page)

The yellow downward spikes are the Brexit vote in 2016, the Covid pandemic in 2020 and the Truss budget just now. One might take comfort that L&G’s share price regularly recovered after those external shocks. But I would not be surprised if we revisited the 180-200 level in the course of the upcoming UK recession. Inflation is currently at 10% and the BoE forecasts that the recession could very well last into 2024, which would be the longest recession since the 1920s.

Financials like banks and insurance companies often do operate on slim margins. To get to RoEs like the 20% L&G touts they employ leverage. Massive leverage! In the case of L&G they have GBP 130bn of assets with shareholder’s equity of only GBP 11bn at risk (ignore unit linked as a pass through). This means, if assets decline by 1% then everything else equal equity declines by 12%! Because of this leverage financials often do poorly in a recession as there is a lot of uncertainty about how much damage will be done. Once you are in the recession however, financials tend to be a very rewarding investment if you correctly identify those that have been unfairly punished. As I believe L&G is an overall conservatively managed company I expect it to be one of those. What worries me a bit is their LGC division that might see some write-downs in their investments.

Timing is always tricky. Personally, I did just establish a foothold position in L&G but am far from a full position as I hope to be able to buy more as the negative environment I expect unfolds. With a “winter of discontent” looming, massive political and economic uncertainty I would not be surprised if we revisit the GBP 1.80 area again. I would also not rule out further GBP weakness.

Summary:

L&G shares have not been doing much in the past years besides paying their dividend. This can be explained by lackluster operating performances since 2018. However, last year the company started picking up growth again and also in H1 this year it showed good growth. Unfortunately the current market environment is not favourable and the stock has sold off strongly. L&G has shown operating resilience during the Truss mini-budget crisis in UK and this might even lead to better growth in the highly important LGRI division which is the main growth driver for L&G. Therefore, we might now be at an inflection point where L&G finally returns to better growth but is still valued as a stagnant company with high economic sensitivity. I believe for a long term holder this is fundamentally a buy now to secure a good quality income stream.

That said, I feel we are entering turbulent times in the market and the economy. I fear we might see better entry points in financials including L&G. I therefore decided to not go all in yet but establish an initial position with the intent to eventually buy more at hopefully better prices. I do not see the need to chase it right now as I expect the ride to be rocky over the next months or maybe even years.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment