john_99/iStock via Getty Images

Introduction

Hudson Technologies (NASDAQ:HDSN), the leading refrigerant reclaimer in North America, delivered yet another exceptional quarter, crushing expectations. In this article, I would like to go over the recent quarterly report to see if the company is delivering results up to my expectations or not.

There are several factors that made me interested in the company. The company operates in a well defined niche, it has a strong moat thanks to its patented machines, it plays a double role in its supply chain, and the environmental regulations will give strong tailwinds for the years to come. This is why I believe the company is a very interesting buy.

Summary of previous coverage

I wrote an article (Hudson Technologies: Green Ratings For A Green Play) and these are the main points I dealt with

- The company operates in the HVACR industry (Heating, Ventilation, Air Conditioning and Refrigeration) and focuses on supplying and/or reclaiming refrigerants. It has a 35% market share in the refrigerant reclaiming business in North America.

- Hudson Technologies owns a chemical and technological know-how that makes it able to reclaim old refrigerants, clean and recycle them to resell them. This is particularly important as new regulations are banning and phasing out old kinds of refrigerants such as CFCs, HCFCs and, now HFCs. The company invented a highly performing machine, called the ZugiBeast after Kevin Zugibe (the founder) that gives the company a moat in its operations. The machine was inspired by kidney dialysis and enables building chillers to operate while the cleaning process is being carried out.

- Hudson Technologies has a double role in the supply chain: it is a reclaimer and a supplier at the same time, thus it holds a strategic position both at the beginning and at the end of the cycle. Actually, the end of the refrigerant cycle is the beginning of Hudson Technologies’ activity as it reclaims it and recycles them by removing moisture, oils and other contaminants.

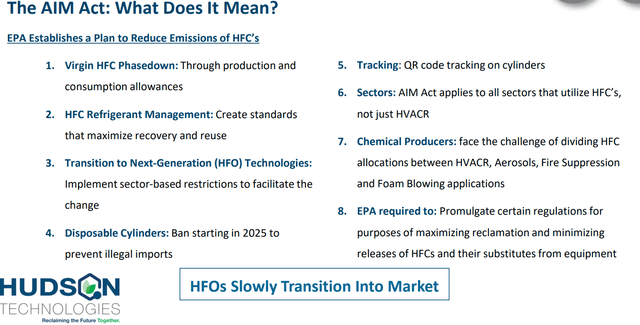

- The AIM act mandates a 10% step-down in production and consumption allowances for virgin HFCs in both 2022 and ’23 and a 40% baseline reduction in 2024. Additionally, the Act mandates an aggressive phasedown with the R-22 phaseout and promotes the use of reclaimed refrigerants to meet demand as virgin production steps down. This provides Hudson Technologies with strong tailwinds as it will be asked to fill the gap left by the absence of virgin refrigerants. The slide below explains well the implications of this law.

I also pointed out two risks:

- The company faced in 2017 a debt crisis, but it managed to refinance its debt and, thanks to its strong results, it is reducing it at a fast pace, as we will see.

- The bigger risk for the company is linked to reclaimed refrigerant prices. If the company builds up an inventory at high prices and then there is a sudden drop in refrigerant prices, the company ends up with a big loss. This happened in 2017 as the market saw many companies dump their virgin refrigerants before they were ruled out.

Three months ago, when the company published its Q2 release, I wrote a second article that showed how the company was performing above expectations on every metric.

Now, Hudson Technologies just published its Q3 results and this article aims at looking at the results to check if the bull-case is still playing or not.

Q3 Results

Let’s take a quick look at the results published by the company before we take some time to discuss them.

- In Q3, Hudson’s revenues were $89.5 million, an increase of 48% compared to revenues of $60.6 million in Q3 2021. As the company stated, the revenue growth was driven by increased selling prices for certain refrigerants during the period.

- Gross margin in the Q3 2022 increased to 49%, compared to 39% in the prior year Q3. This was due to the increase in selling price without a material appreciation in the cost basis of certain refrigerants sold.

- Operating income of $36.3 million in the Q3 2022, versus $16.9 million last year. This is a 114.8% increase, which is much more than the revenue increase and shows that the cost of sales as a percentage of total revenues has improved significantly with a well-managed inventory.

- Net income was $29.4 million versus $15.9 million in Q3 2021, which is equal to a 84.9% increase YoY. Just to be transparent, the company informed us that “net income during the third quarter of 2022 included an incremental non-cash tax benefit of $2.8 million associated with the release of an income tax valuation allowance as a result of increased profitability”.

- The net income result can be translated into a $0.65 EPS for the quarter, which is an 80% increase YoY compared to $0.36 EPS of Q3 2021.

I think these results speak for themselves: the company exceeded expectations and it now on track to breach the barrier of $300 million in revenues for this year. Just like I did in my previous article, let’s look at this table to compare the results achieved in the first nine months of this year versus 2021.

| In $ million except per share | 9M 2022 | 9M 2021 | % change YOY |

| Revenues | 277.8 | 188.3 | 79% |

| Gross margin | 53% | 35% | 1800 bps |

| Operating income | 124.4 | 33.0 | 277% |

|

Net income |

98.7 | 26.1 | 278% |

| EPS (diluted) | 2.10 | 0.56 | 275% |

Well, even if we see that when we compared the first half of this year to the first half of 2021 we had a revenue increase of 100% and a net income increase of 580%, the company, though slowing a bit as it starts to overlap higher comparables, is still performing extremely well thanks to strong tailwinds at play.

Now, let’s talk a bit about margins and let’s recap briefly the results achieved in the past two quarters to understand the trajectory of the business regarding its margins. Hudson Technologies saw an outstanding Q1 with a +149% revenue growth YoY, and a +72% revenue growth in Q2. Gross margins were well above 50%. The company had warned investors not to get used to these margins, as its guidance targets a 35% gross margin.

It is known that the real threat to margins is simple: if the difference between the cost basis of the reclaimed refrigerants and the reselling price shrinks, then Hudson could have a problem. Investors monitor this closely and it was the first thing I looked at in the report.

In the press release Hudson, as we have already seen, reported for Q3 a 49% gross margin, compared to the 39% reached in the Q3 of the prior year. The reason was what I expected: the increase in selling price without a material appreciation in the cost basis of certain refrigerants sold. I think it is fair to interpret this in the following way: Hudson had built a big enough inventory at low prices and this year it has taken advantage of the big rise in commodities.

However, is this something that can last? In fact, we see that, though high, margins are reverting back to the mean, coming down from a +149% increase YoY in Q1 to “just” +49% YoY in the past quarter.

We can see that the company has improved its cost of sales/revenues ratio, as already seen above. Meanwhile, inventories grew as follows:

| in USD million | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| Inventories | 58,789 | 94,144 | 101,314 | 118,664 | 120,158 |

In just a year the inventories on the balance sheet doubled. However, this is not due to higher volumes, but rather to higher inventory cost, as Brian Coleman, Hudson President and CEO, said during the earnings call:

We made a decision […] that we weren’t going to carry as much inventory volumes and we’re sticking to that plan. We certainly don’t know what next year’s economy could bring. As you know, the thing that we really care about most as a headwind is cool weather. You don’t know if you’ll have a cool spring. So we just always are trying to be a little bit cautious with the amount of inventory we carry. Now the dollars have been increasing in inventory mainly because cost per unit has gone up, not so much the overall volume of product.

So, given the fact the gap between inventory cost and selling price is a bit narrowing, we can expect future margins to stabilize around 35%-40% which is a bit above what the company has kept on stating. I think it is fair to assume that margins may come a bit higher because the company has a track record of understimating and overdelivering.

Furthermore, there are several political tailwinds like the Aim act and the recent the Kigali Amendment to the Montreal Protocol that will lead to increasing demand for reclaimed refrigerants when virgin supply will be phased out.

Lastly, let’s look at the balance sheet. To my pleasure, I saw that the company is being true to its commitment towards reducing its debt. During Q3, Hudson paid down $31 million of term loan debt, thus reducing its leverage ratio to 0.41:1 for the TTM ended September 30, 2022. This is a significant decline from a leverage ratio of 2.35:1 for the TTM ended September 30, 2021. This was possible because, in the first three quarters of the year, Hudson generated $60 million of cash flow from operations. In addition, Hudson didn’t need to borrow any money against its revolver loan and has $87 million in available liquidity between its cash and the loan.

Hudson has three goals to achieve thanks to its additional cash flow: de-leveragin the balance sheet; ensure adequate inventory on hand compared to demand; consider other opportunities (i.e. M&As).

Valuation and conclusion

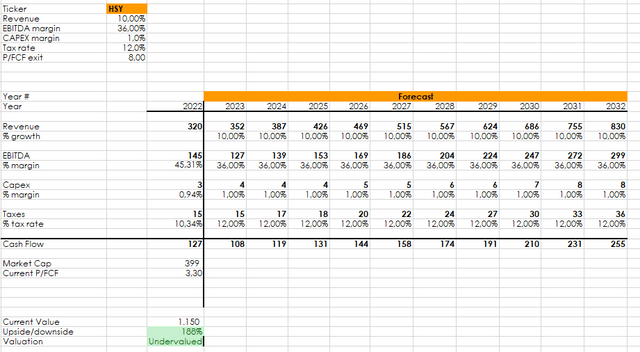

In my past article, I shared two discounted cash flow models according to which I judged the stock undervalued. I just plugged in the new numbers we can expect from full year 2022 and I forecasted an average growth in revenue of 10% assuming. Though it may be generous, I don’t think it is too way off what we could see as reclaimed refrigerants become the solution as virgin ones become more and more scarce. As we can see, we are before a stock whose revenue is almost equal to its market cap and whose EBITDA is just a bit over 2x compared to its market cap. With increasingly good cash flows, the stock is undervalued and could still be a 2 or 3 bagger.

We have one problem: there is a technical resistance just below $11 which seems, for the moment, to hold. But if Hudson keeps on posting just decent results, I do expect the fundamentals to cause the resistance to break, opening new territories for the stock. This is why I chose not to sell after the report. I am not expecting from Hudson just a 20-30% return, but rather, I want to see if this whole story plays true and leads to a multi-bagger.

Be the first to comment