MarsBars

It pays to buy cyclical stocks when they are at or near a bottom, and banks are no different. This includes a number of leading names that are now trading far closer to their 52-week lows than highs.

However, I’m willing to bet that the current downcycle won’t last forever, and am reminded by the Sir John Templeton saying that “bull markets are born out of pessimism, grow on skepticism, mature on optimism, and die on euphoria”

This brings me to JPMorgan Chase (NYSE:JPM), which has seen a material share price down turn since the start of the year. In this article, I highlight what makes an ideal quality bear market pick for an eventual economic recovery, so let’s get started.

Why JPM?

JPMorgan Chase is a bank has seen strong execution over the past decade plus, with an enviable investment bank, commercial and retail bank, credit cards, and wealth management franchises.

Its huge scale across the U.S. serves as a strong differentiator and competitive advantage. At present, it’s the largest credit card issuer in the U.S. and its investment bank is the leading global generator of fees. This has helped JPM to earn an A+ grade for profitability, driven by a sector leading net income margin of 34% (compared to the 29% sector median) and a return on equity of 16%, comparing favorably to the 12% sector median, over the trailing 12 months.

This trend continued with an ROTCE of 16% during the first quarter. This was driven by loan growth of 8% YoY, and net charge-offs declined to $582 million, down from $1.1 billion in the prior year period. JPM also maintains a strong A- rated balance sheet, with a common equity tier 1 capital ratio of 11.9% sitting comfortably above the 6% regulatory requirement.

JPM isn’t without its headwinds, however, as concerns around a slowing economy due to supply chain constraints, the war in Ukraine, and interest rate concerns have resulted in management building $902 million in credit loss reserves.

Moreover, lower home purchases and mortgage refinancing activity is driving JPM to lay off hundreds of employees in its home lending-unit and transferring hundreds more to other parts of the bank. All told, more than 1,000 employees are expected to be impacted by this action, with about 50% moving to other parts of the bank.

While the near-term outlook is gloomy for JPM’s mortgage business, its commercial and retail banking segments could benefit from higher rates due to higher net interest income. Additionally, management is prepared to strengthen its capital positioning with the expectation of a higher stress capital buffer requirement later this year, and expects to maintain a 17% ROTCE through the current cycle.

This also isn’t JPM’s first rodeo, as it’s weathered through troubling times before, and could come out of the current cycle stronger than before. This was noted by Morningstar during its recent analyst report:

JPMorgan has gone through several iterations of investments to generate share gains, and the bank is at the start of its next cycle of expansion. While this is causing pressure on expenses today, we expect the bank will continue to take incremental share across its different business lines for years to come, and we may even begin to see contributions from newer endeavors, such as international retail or new payments verticals.

Scale and multiple revenue sources allows the bank to increase customer switching costs, generate more revenue per risk-weighted asset than smaller peers, and also have a larger percentage of revenue come from fees. The bank also has a larger, more scalable tech budget, which should only increase in importance in the future.

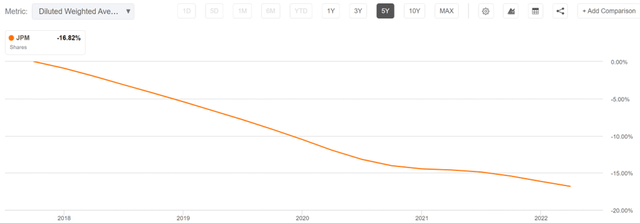

Meanwhile, JPM has been rather shareholder friendly with dividends and share repurchases. This includes $1.7 billion during the first quarter alone. While share repurchases may be muted in the near term, I would expect for it to kick back up when the economy starts to look up again. As shown below, JPM has repurchased an impressive 17% of its shares over the past 5 years.

JPM Shares Outstanding (Seeking Alpha)

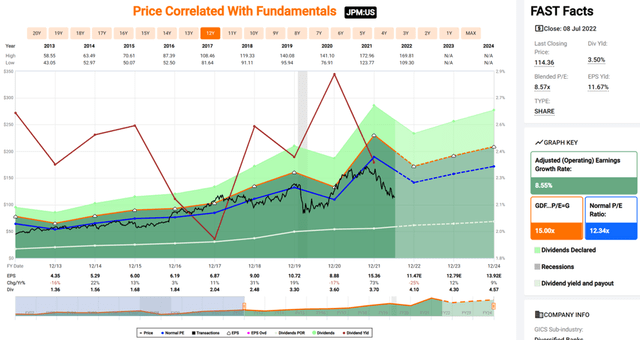

It also pays an attractive 3.5% dividend yield, which comes with a low 29% payout ratio, and a 5-year dividend CAGR of 15%. I see value in the stock at the current price of $114, with a forward PE of just 10.1, sitting well below its normal PE of 12.3 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $149, implying a potential one-year 34% total return including dividends.

Investor Takeaway

JPMorgan is a very high-quality bank whose stock price has materially fallen since the start of the year. While it has some near-term headwinds due to a slowing economy, it remains well-positioned to handle these challenges. It could come out of the current cycle in a strong position, and management has been shareholder friendly with aggressive capital returns. As such, I view JPM as “having it all”, with a high quality enterprise, a low valuation, and an attractive dividend yield.

Be the first to comment