Feverpitched

I come from a family of real estate entrepreneurs and investors.

As a result, I have been in real estate literally my entire life and so when it came time to invest, it felt natural to buy a rental property.

I bought my first one at the age of 18 and I still remember the numbers.

It was a condo in Germany. It was for sale at around €38k, I managed to negotiate it down to about €33k, and its expected rent was about €400 per month. I also had access to cheap debt to boost the returns on equity.

On the surface, this was a no-brainer.

The returns on equity were 20%+ per year and that was before even accounting for any future appreciation.

I thought that even with conservative estimates the returns would be much more attractive than what I could earn in the stock market.

But I was wrong!

Later, I went on to work in private equity real estate and I quickly realized that my calculations were way off.

And I am not alone to make these mistakes.

In fact, I would argue that the majority of rental property investors vastly overstate their returns by miscalculating them. Once you properly account for all expenses, the returns may still be attractive, but most often, they are inferior to those of REITs (VNQ), and that’s on top of taking much greater risks.

Let me demonstrate that to you:

Calculating the returns of rental properties: 101

The simple math that everybody is doing is the following.

Rents + appreciation – interest expense / down payment = return on equity

With this calculation, you can often get 30%+ annual returns.

But even fairly new investors will understand that this is widely misleading.

Taking it a step further, investors will typically replace rental income with net operating income, which removes property expenses like utilities, taxes, insurance, etc.

Net operating income + appreciation – interest expense / downpayment = return on equity

Here already, the returns begin to decline drastically. The net operating income is typically just half of the rental income if you properly account for all property expenses.

So let’s say that the returns now drop to 20%+ annually.

Still pretty good, right?

Well, we still haven’t accounted for the most important expenses… which are often forgotten by investors.

Calculating the returns of rental properties: Continued

Some investors may include a renovation reserve expense in the calculation of their net operating income, but most likely, it won’t cover major repair expenses that occur rarely, or at least, it won’t properly account for them.

Once in a while, you will have a bad surprise. It is literally inevitable and it needs to be accounted for when calculating returns.

If you get back to my first rental property, a single repair bill could have drained years of rental income. To take an example, imagine that the apartment flooded and suffered significant water damage. Your insurance may cover some things if you are lucky, but most likely not everything. The repair bill could easily be a few years or rental income.

But you will also have other negative surprises. It is not just property repairs, but also other things like a tenant who refuses to pay the rent… or trashes your places… or even sues you.

To take another example: let’s assume that some mold had been growing in your rental property because of poor ventilation, and your tenant decides to sue you after he or she finds out that she developed asthma.

You will have to hire a lawyer to defend yourself and this could drag into the courts for months or even years, costing you a lot of money (and time… more on that later).

The point here is that bad surprises are inevitable, they are very costly, and they need to be accounted for in your return calculations.

So let’s revisit the previous calculation:

Net operating income + appreciation – interest expense – reserve for bad surprises / downpayment = return on equity

So now, your return drops to let’s say 15-20% annually.

But this is where things really get messy because we still haven’t accounted for the value of your own time and work.

Buying and managing a rental property is closer to running a business than making a passive investment. It is a lot of work and your time is not free. You could just as well work on another job and earn a salary so we need to account for this expense.

First, we need to estimate how many hours per month you will work on your property. This depends on many factors, but assuming you own a few properties that you manage yourself, it could be something like 15 hours per month. In this estimate, I include also all the time spent on acquiring properties. Some months, you will work 30 hours. Other months, you will only work 5. We are using 15 hours as an average.

Then, we need to figure out what’s the value of your time. This will also depend on one person to another. If you work a regular job, let’s say your value is $25 per hour.

So the cost of you working on your rental property (instead of your regular job) is $25 x 15 = $375 each month.

Net operating income + appreciation – interest expense – reserve for bad surprises – value of your work / downpayment = return on equity

Now your returns may drop somewhere near 10% per year.

Still, it’s not bad, but we are far from the 30%+ discussed early on, and our estimate is still quite conservative.

Now assume that you are a lawyer and your time is worth is $300 per hour.

Then the monthly cost of you putting hours into your rental property is $4,500.

Are your returns high enough to justify this expense?

No, it isn’t. Your time is much better spent working your main job and investing that money in passive investments like REITs than working on a rental property, which at the end of the day, is typically much less rewarding.

The higher your income potential, the worse your returns are going to be once you properly account for the value of your time.

Why REITs Earn Higher Returns Than Rental Properties In Most Cases

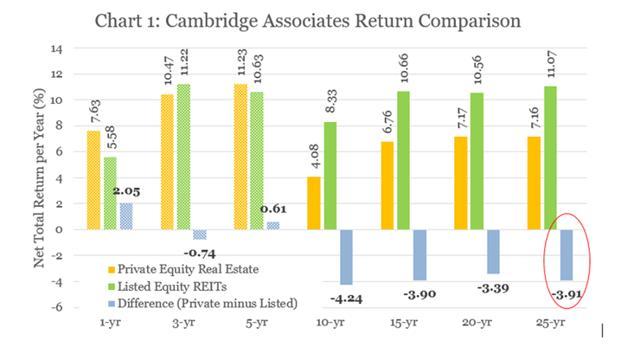

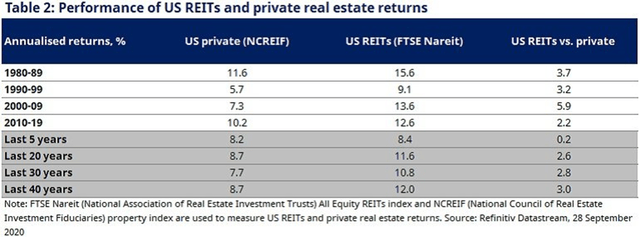

Several studies have shown that once you account for all expenses, publicly listed REITs earn higher returns than private real estate investments.

Here are three of those studies:

REITs outperform private real estate

REITs outperform private real estate (Cambridge)

REITs outperform private real estate (NAREIT)

How could this be?

We listed 10 reasons in a previous article that you can read by clicking here.

In short:

- 1) REITs Do Spread Investing to Compound Faster

- 2) REITs Can Enter Real Estate Related Businesses to Boost Returns

- 3) REITs Can Develop Their Own Properties

- 4) REITs Can Do Sale & Leaseback

- 5) REITs Enjoy Significant Economies of Scale

- 6) REITs Enjoy Stronger Bargaining Power With Tenants

- 7) REITs Employ The Best Talent in Real Estate

- 8) REITs Have a Total Return Approach

- 9) Most REIT Managers Are Well-Aligned With Shareholders

- 10) REIT Investors Pay No Transaction Costs

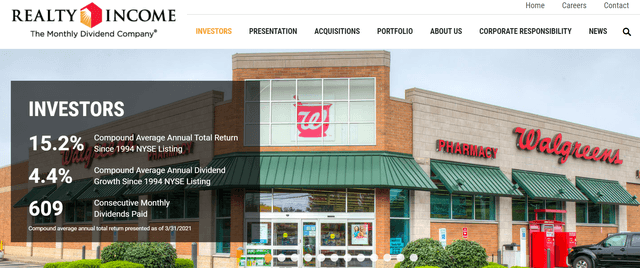

This explains how REITs like Realty Income (O) have managed to deliver 15%+ average annual returns since its IPO in 1994:

Realty Income generates 15%+ annual returns (Realty Income)

And Realty Income is not an exception. Many other REITs like American Tower (AMT), Prologis (PLD), Public Storage (PSA), etc. have achieved similar results over time…

And if you are an active REIT investor who can cherry-pick the best opportunities and may improve your returns even further.

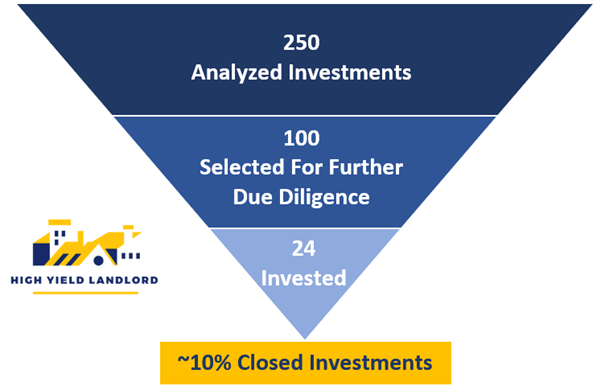

That’s what we aim to do at High Yield Landlord. We only invest in the best REIT opportunities to maximize returns:

High Yield Landlord selection (High Yield Landlord)

This has historically resulted in even stronger results for us. We have managed to compound returns at 15%+ per year and we also earn higher dividends with an average yield of 6%.

Ultimately, this is what led me to stop investing in rental properties to invest in REITs instead.

They allow me to earn comparable or better returns than rental properties, but importantly, I earn these returns with much lower risk and little effort.

I put a lot of work upfront to make the right selection, but beyond that, I simply monitor my investments, collect income, and wait patiently for long-term appreciation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment