Sean Gallup/Getty Images News

Alphabet (NASDAQ:GOOG) and Meta Platforms (META) compete in the digital ad industry where they have cornered a bulk of the market share. The recent woes of Meta could lead to a major positive change for Google in its core advertising business. Meta has already announced that it could face over $10 billion revenue headwind due to the new privacy policy of Apple (AAPL). Google might not face similar issues as it has a licensing deal with Apple which is worth over $12 billion annually.

It is likely that the lost revenue from Meta can flow to Google as it is the main alternative for advertisers. In the last quarter, Meta announced that it was facing headwinds in the e-commerce ad segment while Google announced an unexpected uptick in search revenue in this business. Meta is also facing new regulatory headwinds in EU and other regions which can end up providing a boost to Google in these regions.

Meta has a number of growth levers over the long term like monetization of Reels, metaverse, hardware, and other initiatives. However, near-term challenges faced by Meta can help Google in the next few quarters. At the same time, Alphabet stock is trading at a modest valuation which should help the company show better returns if these positive factors materialize.

Meta’s pain is Google’s gain

Google and Meta have cornered most of the digital ad revenue over the last few years. Amazon (AMZN) is trying to increase its own ad business but it is still a small player compared to Google and Meta. In the previous quarterly earnings, Meta announced a number of headwinds for its business which led to a massive stock correction. One of the key points was that it is facing $10 billion revenue shortfall due to Apple’s new privacy policy. This is a massive amount and close to 10% of Meta’s trailing-twelve-month revenue base.

The new privacy features do not affect Google. It should also be noted that Google and Apple have a close licensing deal where Google pays over $12 billion to Apple for adding its apps to Apple devices. It is unlikely that Apple’s management would try to destabilize this highly lucrative revenue stream. Hence, future privacy policies by Apple would likely take into consideration the impact on Google.

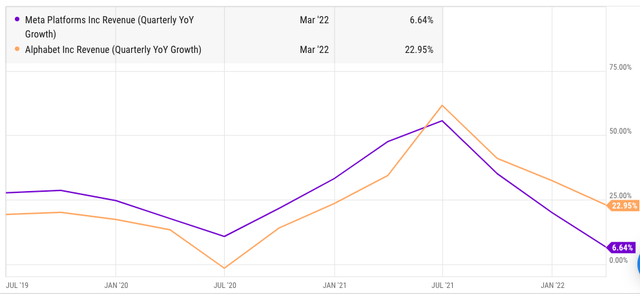

Figure 1: Despite a higher revenue base, Google is showing higher revenue growth rates compared to Meta. Source: Ycharts

Meta is also facing increasing headwinds in EU and has gone as far as saying that it will be forced to end its services of Meta and Instagram in EU if new policies are not announced. It is unlikely that Meta pursues such a dramatic step but the direct threat by Meta and EU shows the seriousness of these issues. Again, Google can gain a strong tailwind from these changes as most of the digital ad dollars could end up flowing towards it.

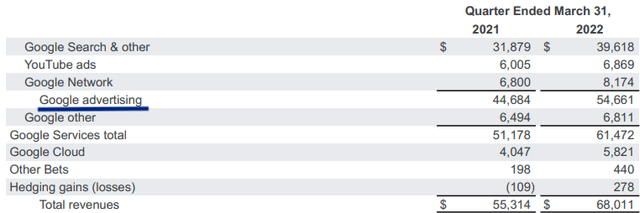

Importance of ad business

Despite efforts to diversify, Google receives over 80% of its revenue from digital ads and a higher percentage of its profits. Hence, any tailwind for Google’s search business can create strong revenue growth and expand the company’s margin. This is also important for other services where Google is growing. Google Cloud reported $24 billion in annualized revenue rate in the recent quarter but is still losing money. Massive investment in data centers is required to get economies of scale within the cloud business. This is possible only if Google continues to make good margins within the ad business.

Figure 2: Over 80% of the revenue base comes from advertising. Source: Company filings

Google also faces privacy issues similar to Meta. However, these are much smaller and the impact on revenue of new privacy rules is lower for Google. In the past few years, Google has been asked to pay several fines but the management has not mentioned any major headwinds to its search business due to new regulations.

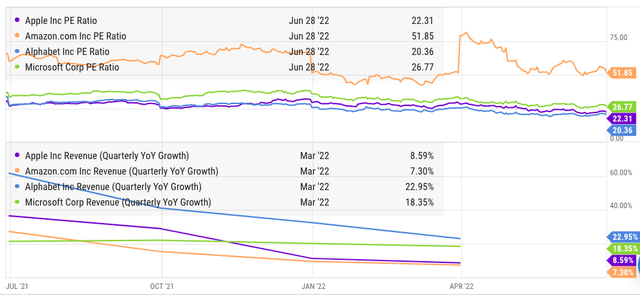

Not priced in

The tailwinds for Google due to Meta’s challenges have not been priced in by Wall Street. Alphabet stock still trades at a modest PE ratio of 20 which is less than Apple, Microsoft (MSFT), Amazon, and many other tech companies. Google’s search business is quite stable with a strong moat. We should see a better growth rate in this segment as the company takes advantage of Meta’s challenges and attracts more advertisers.

Figure 3: PE ratio and YoY revenue growth of Alphabet, Apple, Amazon and Microsoft. Source: Ycharts

Google receives a bulk of its revenue from the search business but it is investing in other segments. Segments like cloud, subscription and hardware can be one of the key drivers of future valuation growth. Hence, Google has a highly stable search business that is showing tailwinds due to lower competition and is growing rapidly in other lucrative segments. This should help the stock deliver better returns compared to other tech giants.

Investor Takeaway

Google stands to gain a lot from Meta’s short-term woes. Meta faces a headwind of $10 billion due to Apple’s new privacy rules and is also facing challenges in EU. It is likely that most of the ad dollars which do not go to Meta might end up in Google’s pocket as it is the main alternative for most advertisers. We have already seen this in the recent announcement when Google reported unexpected better results in some search categories.

Google needs its search business to fund other high-growth segments which are currently losing money but could be a major driver for future valuation growth. This can also help the company to diversify its revenue base. Alphabet stock is trading at a lower PE multiple compared to Apple, Microsoft, and Amazon despite having better YoY revenue growth. The tailwinds to Google’s search business are not completely factored in by the market and we could see strong bullish momentum in the stock as future earnings reports show this trend.

Be the first to comment