bymuratdeniz

The world is in the midst of a potential energy crisis as diesel and heating oil remain in short supply. There are about 40 LNG tankers in the Baltic Sea and English Channel waiting to help Europe when a cold front hits, since Europe does not have sufficient natural gas storage facilities. If this winter is severe, Germany and other European countries might be forced to close factories so they can heat homes.

Not only did Russia trigger an energy crisis, but the Biden Administration did too, by curtailing drilling permits on federal land and by cancelling the Keystone Pipeline. The truth of the matter is that the Biden Administration tried to mask its mistakes by releasing up to 1 million barrels per day from the Strategic Petroleum Reserve (SPR), but now that the SPR has been drawn down to 1980 levels, draining the SPR is not going to be possible much longer. Furthermore, OPEC+ is still planning to cut production by up to 2 million barrels per day, so higher crude oil prices are likely when seasonal demand rises in the spring.

I should add that Russia’s crude oil exports to Europe were largely unchanged in October. Interestingly, Russia’s worldwide crude oil exports in October rose by 165,000 barrels per day to 7.7 million barrels. Clearly, the existing sanctions, as well as impending G7 price caps on Russian crude oil, are ineffective.

I am baffled by the G7 price caps on Russian crude oil as well as Treasury Secretary Yellen allowing India to refine all the Russia crude oil it wants. Specifically, Treasury Secretary Janet Yellen recently told India that it could buy as much Russian oil over the G7 imposed price cap as it wants. India has been boosting its refinery capacity and increasingly exporting refined products, like gasoline and distillates (e.g., diesel, jet fuel, heating oil, etc.). In other words, India has helped Russia circumvent the restrictions that the G7 has imposed on Russian crude oil. The UAE and Saudi Arabia have also bought Russia crude.

I expect that food and energy inflation will persist in 2023. Food inflation is being exacerbated by the drought in the Mississippi River that is disrupting barge traffic, while crude oil prices are poised to soar in 2023 as supply remains tight and seasonal demand rises in the spring. Naturally, there is very little that the Fed can do to fight food and energy inflation, so core inflation will continue to be monitored carefully to determine the course of market rates and future Fed policy.

Excluding food and energy, the core CPI “cracked” in October, which triggered a big bond rally and raised hope that the December FOMC meeting would be the Fed’s last key interest rate hike. Overall, there is less uncertainty now than there was a couple of months ago, but the longer you look forward, the fuzzier it gets. As a result, it is imperative that we control our own destiny via superior stock picking.

The wild card remains Russian President Vladimir Putin, who was conspicuously absent at the recent G-20 meeting in Indonesia last week. Obviously, Ukraine has embarrassed Putin by causing the Russian army to retreat. Instead, Russia sent its foreign minister, Sergei Lavrov, to the G-20 meeting, and he left a day early, just before the G-20 issued a declaration to reject an “era of war.” A leadership change in Russia is very possible now, since some of Putin’s allies have become critical of the Ukrainian invasion.

President Xi Jinping said that the G-20 “must resolutely oppose the attempt to politicize food and energy issues or use them as tools and weapons.” The declaration specifically stated, “The use or threat of use of nuclear weapons is inadmissible. The peaceful resolution of conflicts, efforts to address crises, as well as diplomacy and dialog, are vital. Today’s era must not be one of war.”

Ukrainian President Zelenskyy also addressed the G-20 via a video feed, saying, “I want this aggressive Russian war to end justly and on the basis of the UN charter and international law.”

This joint declaration from the G-20 meeting is important, since there is little that the world agrees on regarding other subjects – like climate change or trade – but they all reject war. Many countries, like China, Germany, and the U.S., are all striving to protect their domestic industries. Also notable is the fact that President Joe Biden skipped the G-20’s gala closing dinner with world leaders on Tuesday night.

The other big news on Tuesday was that a missile landed in Poland and killed two farm workers, which triggered emergency NATO talks. President Joe Biden said that it was “unlikely” that the missile was fired from Russia. NATO on Wednesday said that this was not a “deliberate” Russian attack and that the missile that landed in Poland may have been from Ukraine’s missile defense system. Amidst all the chaos, Russia has been stepping up its barrage of missile attacks on Ukraine to destroy its power grid.

Overall, the world remains a complicated place and there are going to some surprises in the upcoming months, especially if Russia and Ukraine agree to a cease fire. The tight supply of crude oil is expected to send prices soaring in the spring as seasonal demand picks up. Currently, there is an acute shortage of diesel, and the fact that our Treasury Secretary told India that they could refine all of the Russian crude oil that it wants is frustrating, since India has become a big exporter of refined products.

The Fed Governors are Talking in Circles – and Some Conflicting Messages

Several Fed officials were in the news last week. Fed Vice Chairperson Lael Brainard confirmed last week that the Fed will slow its pace of key interest rates increases at its upcoming December Federal Open Market Committee (FOMC) meeting, so a 50-basis point increase is now widely expected. The fact that the 10-year Treasury bond yield has fallen 40 basis points in the wake of the October CPI report is also taking pressure off the Fed to make any further increases beyond mid-December.

Unfortunately, multiple Fed district Presidents last week were also talking about future Fed policy. None of these district bank presidents want to say that the Federal Open Market Committee (FOMC) is done hiking key interest rates after the December FOMC meeting, and some hinted that they will continue, while others seemed to promise more increases. Market rates are changing fast, but due to the dramatic drop in the 10-year Treasury bond yields after the latest inflation numbers, I expect that the Fed will stop raising key interest rates after its December FOMC meeting, despite all these loose-talking Fed chiefs.

In Europe, inflation is running much hotter than in the U.S., since weak currencies are causing commodity prices and import costs to rise. The latest evidence came from Britain’s Office of National Statistics, which announced on Tuesday that consumer prices are now running at an 11.1% annual pace, up from a 10.1% annual pace in September. Consumer prices are also up at an 11.6% annual pace in Germany.

Higher energy costs continue to fuel rising inflation in Europe and may continue to rise if this winter is colder than normal. Britain’s GDP contracted at a 0.7% annual pace in the third quarter and the rest of Europe risks slipping into a recession, especially if factories have to close if their leaders choose heating homes versus running factories if an abnormally cold winter envelopes Europe.

Earnings Season Winds Down with One Prominent “Miss”

As I’ve often said, the good earnings come out early and the bad earnings later on. As the third-quarter earnings reporting season winds down, Target Corporation (TGT) announced last Tuesday that its third-quarter sales missed corporate guidance, which caused the company to state, “Clearly, it’s an environment where consumers have been stressed.” Interestingly, Target said that its customers are waiting for promotions on many items and are waiting until they spot a deal to buy. Target has been trying to clear a glut of many goods by discounting them, so it has apparently trained it customers to wait for special deals. I should add that Target is now expecting slower holiday sales, and so has lowered its fourth-quarter guidance.

Overall, due to inflation and higher prices, consumer spending is still rising, since same-store sales at Target are running at +2.7%, while Walmart’s (WMT) same-store sales are running at an 8.2% annual gain. There are clearly some problems impacting many retailers, since the most amazing statement from Target was that “organized retail crime” accounted for an astounding $400 million loss in profits this year, so “group shoplifting” in states that no longer prosecute thieves is negatively impacting its bottom line.

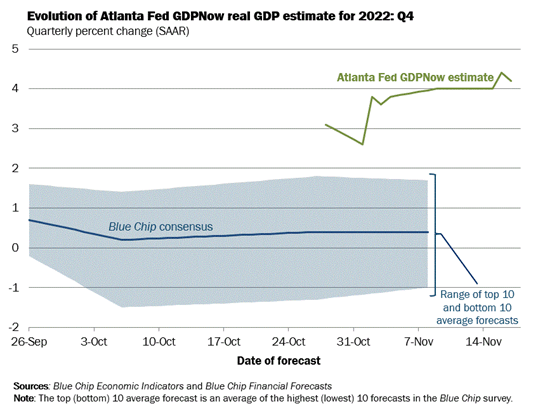

In the wake of the latest retail sales and housing reports, the Atlanta Fed raised its fourth-quarter GDP estimate to a +4.2% annual pace, which is well above the range of the Blue Chip economists. Those two ranges of numbers should begin to converge as we move deeper into the quarter – by mid-December.

Author

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Turning to retail sales in general, the Commerce Department announced that retail sales in October rose 1.3% (month-over-month), which was slightly better than the economists’ consensus expectation of a 1.2% rise. Sales at gasoline stations surged 4.1% in October and 17.8% in the past 12 months. Excluding gasoline stations, retail sales still rose by an impressive 0.9% in October. Especially encouraging is that sales at bars & restaurants rose 1.6% in October and 14.1% in the past 12 months, which is indicative that many consumers have disposable income. Vehicle sales rose 1.5% in October and are expected to remain strong, since many vehicles still have to be replaced from insurance claims due to Hurricane Ian. Overall, the October retail sales report was indicative that consumer spending remains surprisingly strong!

Higher mortgage rates are hindering housing starts and building permits. The Commerce Department on Thursday announced that housing starts decreased 4.2% in October to an annual pace of 1.425 million. Building permits in October declined 2.4% to an annual pace of 1.526 million. Three of five home builders are now offering incentives to sell homes, and 37% of builders cut home prices in October.

The National Association of Realtors on Friday announced that existing home sales declined 5.9% in October to an annual pace of 4.43 million for the ninth straight monthly decline. In the past 12 months, existing home sales declined 28.4%. The inventory of existing homes for sale declined by 0.8% to 1.22 million, so there is a 2.75-month inventory of homes for sale. Also, the most expensive regions, namely the Northeast and West, have had the biggest drop in existing home sales at 6.6% and 9.1%, respectively.

Navellier & Associates owns Walmart Stores Inc. (WMT) in managed accounts. We do not own Target Corp. (TGT). Louis Navellier does not own Walmart Stores Inc. (WMT) or Target Corp. (TGT) personally.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment