frantic00/iStock via Getty Images

Thesis

In my opinion, Modine Manufacturing Company (NYSE:MOD), a $1.12 billion company that is one of the Top Rated stocks here on Seeking Alpha, may still bring value to investors thanks to its cheap valuation, improving fundamentals, and expectations – three pillars for future outperformance.

Financials + Expectations + Valuation = Future Outperformance

According to the most recent 10-Q, MOD is designing, manufacturing, and testing heat transfer products for a wide variety of applications and markets. Its operating segments and their principal revenue-generating activities are as follows:

- Climate Solutions (43.68% of total sales) – selling heat transfer products, heating, ventilating, air conditioning, and refrigeration (“HVAC & refrigeration”) products, and data center cooling solutions;

- Performance Technologies (56.32%) – designs and manufactures air- and liquid-cooled technology for vehicular, stationary power, and industrial applications. In addition, this segment provides advanced solutions, which are designed to improve battery range and vehicle life, to zero-emission and hybrid commercial vehicle and automotive customers.

The coronavirus had a strong negative impact on the company’s business development, forcing management to look for ways out of loss-making business areas. On April 30, 2021, Modine Manufacturing sold its air-cooled automotive business in Austria to Schmid Metall GmbH. As a result of this transaction, the company recorded a loss of $6.6 million during the 1st quarter of fiscal 2022, but that transaction enabled MOD to avoid significant liabilities and future cash investments in the business.

Based on the dynamics of the company’s financial performance, MOD was lucky in some respects to reduce its presence in Europe – 2022 was far from the most outstanding for this region.

In Q2 FY2023 MOD reported a revenue growth of ~21% from the prior year despite a negative FX impact ($23.9 million impact compared to $8 million last year). Thanks to its sales mix with a focus on the Americas (58% of total sales) and a roughly even diversification by business segment, the company was able to compensate for the decline in sales in other regions, demonstrating a fairly good stability of the existing business model.

| Q2 FY2023, YoY change | USA | Europe | Asia | Total change |

| Climate Solutions | 32.57% | 1.22% | -8.42% | 17.82% |

| Performance Technologies | 26.51% | 13.70% | 21.52% | 21.86% |

Source: Author’s calculations

The 21%-growth in the top line led to significant growth in adjusted EBITDA (+73%, YoY) and EBITDA margin (from 6.2% in Q2 FY2022 vs. 8.8% in Q2 FY2023), well ahead of the transformation plan the management announced a few quarters ago.

As early as 2021, management refocused the company’s business model on developing segments that will depend heavily on the development of the EV sector in the future, as the automotive industry – the company’s most important end market – is moving in this direction with great strides.

We are making a significant commitment to the EV market to better serve customers who are leading the transition to alternative powertrains. We plan to name a dedicated leader to this group and will invest in the people and technology to support this dynamic and rapidly developing market. The future of transportation is EV, and we are gaining momentum with multiple program wins. This is the right time to stand up this organization as the transition is happening quickly.

Source: SA News citing MOD’s CEO Neil D. Brinker [Sept. 16, 2021]

Today, we see the EV sector-focused sub-businesses (“Liquid Cooled”, “Advanced Solutions”, “Data Center Cooling”) growing in their share of total sales due to above-average growth rates, making MOD more of an EV-focused company than an ICE-focused company over the years.

| Revenue, YoY change | Q2 2023 | % of total sales (Q2 2023) | % of total sales (Q2 2022) |

Growing/Declining share of sales |

| Heat transfer | 13.17% | 23.02% | 24.43% | declining |

| HVAC & Refrigeration | 11.30% | 15.29% | 16.50% | declining |

| Data center cooling | 80.92% | 5.34% | 3.55% | growing |

| Air-cooled | 24.21% | 28.90% | 27.91% | growing |

| Liquid-cooled | 22.55% | 20.31% | 19.90% | growing |

| Advanced Solutions | 31.82% | 5.92% | 5.86% | growing |

| Inter-segment sales | -21.98% | 1.21% | 1.86% | declining |

Source: Author’s calculations based on MOD’s 10-Q

If we look at the forecasts of different market research agencies and their reports for each sub-segment, we can see how important this business transformation is for MOD – what is growing today will most likely grow in the next 5-10 years:

Source: Author’s selection and calculations

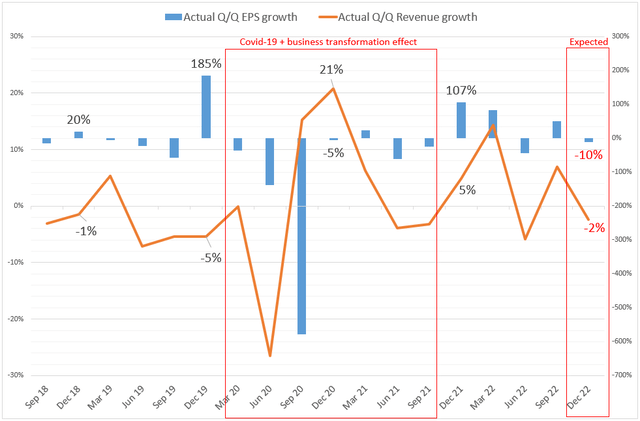

I could not see any clearly pronounced seasonality in the company’s revenue dynamics. Moreover, given the continued development of electric vehicle-focused submarkets, Modine should continue to grow at about the same rate as in FY2022 – so TradingView’s current EPS and revenue forecasts seem underestimated.

But even assuming that the electric vehicle production growth we saw in the 1st half of calendar 2022 (+62% YoY growth according to EV-volumes.com) slows in the 2nd half of 2022, why are analysts forecasting a drop in Modine’s Q3 FY2023 revenue and EPS by 10% and 2% QoQ, while this outcome was not seen in the company’s quiet (not so fast-growing) past years?

Author’s calculations, based on TradingView data

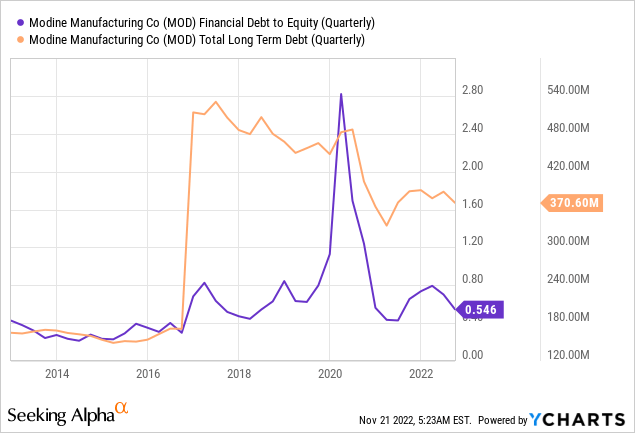

In Q2 FY2023, MOD managed to further reduce long-term debt and bring the debt-to-equity ratio to 2017-2018 levels – in the next quarters, this should have a positive impact on diluted EPS, so the 2% decline (the estimate for Q3 FY2023) the market is now pricing in is unfounded, in my opinion.

As for the quality of existing long-term debt, the company has to repay half of it in 2025, so the credit risk for MOD is minimal today (there is no need for urgent refinancing).

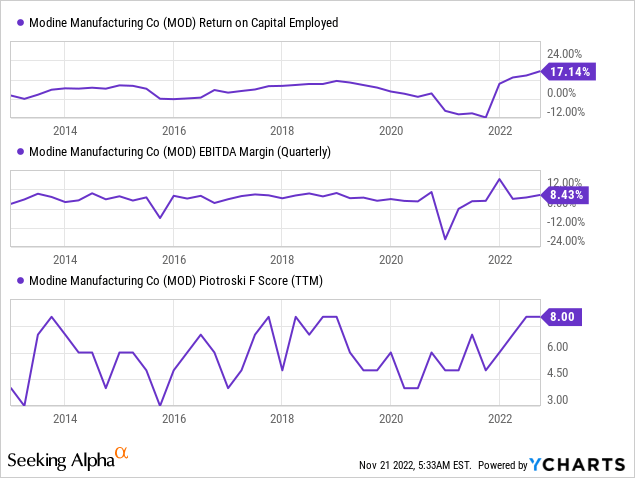

Thanks to the development of EV-focused sub-segments of the business, MOD still has plenty of room to expand margins, as they leave much to be desired today (despite an obvious improvement, as Piotroski’s F-Score shows):

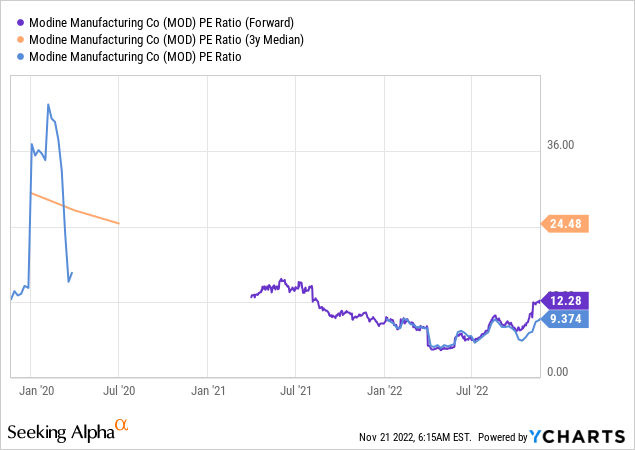

All of this – margin expansion, strong end-market growth, and debt reduction – is not yet priced in, according to the data points I look at. The company’s market capitalization is only $1.12 billion – few institutional investors are thinking about the company’s existence, which may theoretically explain the current injustice.

Now let us assume that the company’s earnings structure will not change over the next 8 years (which is doubtful) and that the current margins will remain at the current level. If we then use a weighted average (of the sub-segment CAGRs) EPS growth rate of 8.81% (8 years ahead) and a very conservative WACC of 12% (that’s my assumption, taking all risks into account, probably above market), we get a margin of safety of ~25% using GuruFocus’ DCF model template. For the current stock price to be “fair”, the EPS of MOD would have to grow by 3.53%, which is completely unrealistic.

But what if the company’s revenue mix shifts to the higher-growth sub-segments over time (as is the case today)?

In this case, I would think it reasonable to assume a 15% increase in EPS over the next 8 years, with a 4% increase in the terminal period (10 years). Let us increase the discount rate to 14% to offset the risks of our key assumptions. In this case, the undervaluation would be approximately 38% with a “fair” value per share of $34.7.

Bottom Line

Modine Manufacturing Company is, in my opinion, a pretty safe bet on EV company performance. An investor does not have to bet on the right horse if he/she can bet on a company whose performance depends on the average growth of the whole sector. It’s hard to overpay at today’s prices when MOD is trading at only 12.6 times forward earnings:

Moreover, EV is far from the only promising end market for MOD. Even the older end-markets continue to grow, as the company’s products continue to be in high demand, given the actual growth of even the “lagging” sub-segments.

I am bullish on this stock, having a price target in mind of $25.87-28 per share for the next 12 months.

Thank you for reading!

Be the first to comment