Eoneren/E+ via Getty Images

The Fed announced that it will begin reducing its balance sheet in June of 2022. This will drive real yields further toward 1.1% (the current expected long-term real per-capita productivity growth rate), with TIPS (Treasury Inflation-Protected Security) 5-year maturity used here as the real yield proxy.

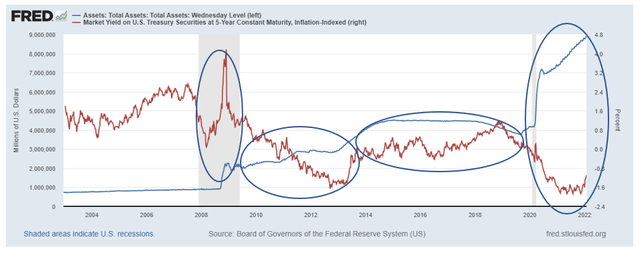

Chart 1: (St. Louis Fed) 5-Year TIPS yield vs. Fed Assets:

Fed Assets vs Real Yield (St. Louis Fed)

There is a clear inverse correlation between the change in Fed assets and the TIPS yield (real yield) in the three right-most circled periods. After a brief yield spike during the initial phases of the 2008 Financial Crisis, when expected inflation turned massively negative, and as the Fed bought trillions of impaired financial assets, the TIPS yield began a collapse into negative territory as the Fed increased its asset holdings (by buying distressed loans with created money going into capital markets which otherwise would have seen trillions in capital destruction). As asset holdings leveled off and began to fall as a ratio to real GDP, the real yield began to recover until the government and Fed’s actions in response to the COVID-19 crisis which resulted in many more trillions of created money pumped into the economy – but this time mainly to consumers; and thus in spendable form which caused the inflation spike we have seen. This is now largely over, and inventory to sales ratios indicate massive pending retail markdowns which are deflationary.

Bitcoin (BTC-USD) shares a key attribute with gold: limited supply (finite in the case of Bitcoin; supply increasing at the rate of population growth in the case of gold). These characteristics mean that real GDP growth is generally greater than the supply growth of both Bitcoin and gold; unlike fiat money where supply growth exceeds real GDP growth. Inherently, per unit of Bitcoin and gold, real GDP increases; which can be thought of as an inherent real yield. Holding fiat money is a negative real yield equal to the inflation rate.

I discuss the concept of inherent vs fiat money return in more detail in this paper and in my recent posts on Seeking Alpha.

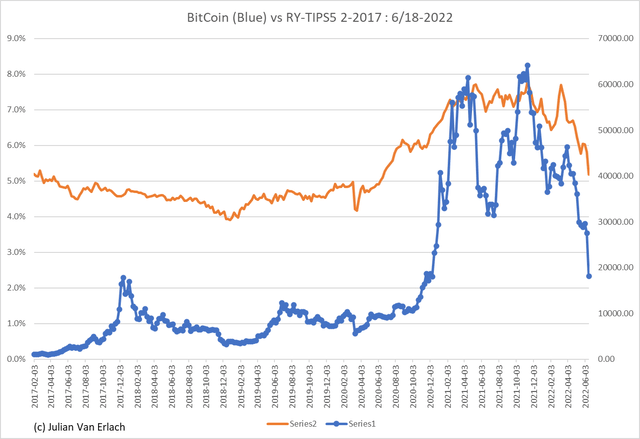

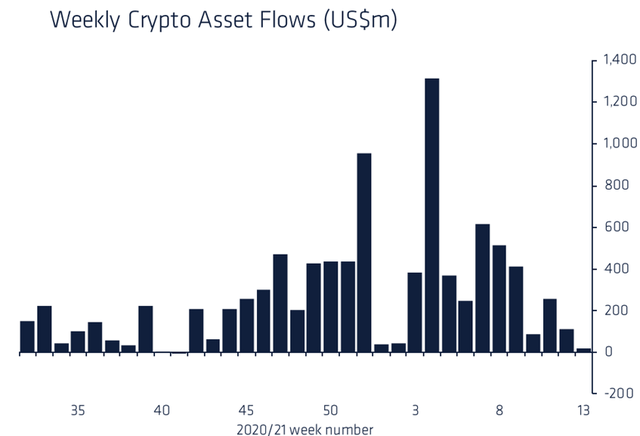

Bitcoin has been the subject of wild investment swings (Chart 3) and massive global government policy changes. Some corporations and investment funds have bought heavily. In a simple form, the model I use to value Bitcoin takes the resulting yield created from the formula: [(expected inflation + expected real long-term per capita productivity growth)/(1 – the expected effective tax rate on tax-deferred investment accounts)] – TIP 5-Year (“REAL”) yield. The real yield is subtracted, which if negative, adds to the yield in the formula. Thus, Bitcoin is expected to move up with an increasingly negative real yield as stated previously. This formula models the price movement of Bitcoin very well and is theoretically consistent with the valuation approach described in my posts.

The collapse of Bitcoin and crypto has largely been driven by this falling fiat yield measure; and magnified by the excessive investment inflows that caused its parabolic price spike in late 2020-21 which are now unwinding. Should the Fed continue on its announced asset reduction path, I believe the real yield (5-year TIPS) will approach and may surpass 1%, which coupled with the investment-driven price spike unwinding will easily push Bitcoin well below $10,000. Note that toward the end of 2018, the real yield was over 1% with Bitcoin trading well below $10,000 and before the huge corporate and institutional investment inflows. Panic selling could push its price even lower than the model predicts.

Chart 2: (Author) Bitcoin Value vs. Author’s Yield Model (RY-TIPS5)

Valuation of Bitcoin (Author)

Chart 3: (Coindesk.com): Investment Inflows Coincide with Valuation Jump of Bitcoin

Bitcoin Investment Flows (CoinDesk)

Bitcoin and gold both vary inversely with the real yield and expected inflation and their price changes can be predicted based on these expectations. Both face the same announced Fed policy headwinds.

The reason for this is that both earn an inherent real yield which is valued higher when either the yield on money falls via inflation, or the real yield on financial assets falls; since their inherent real yield is not affected. The reverse is true when inflation expectations fall and/or the real yield rises.

Be the first to comment