Mario Tama

Shares of Altria Group, Inc. (NYSE:MO) revalued sharply lower in 2022, in part because JUUL Lab’s e-cigarettes were subject to an FDA ban earlier this year. Altria, which owns a 35% share in JUUL Labs, has written down the investment value to just $350M as of September 30, 2022, after paying $12.8B for the company in 2018.

Altria covers its dividend with adjusted earnings and returns a lot of cash to shareholders every year. Those capital returns could stabilize the stock price and even result in a higher dividend going forward. Since the stock is cheap based off of earnings, I believe Altria convinces regarding income, yield and valuation!

Altria: Headwinds are real

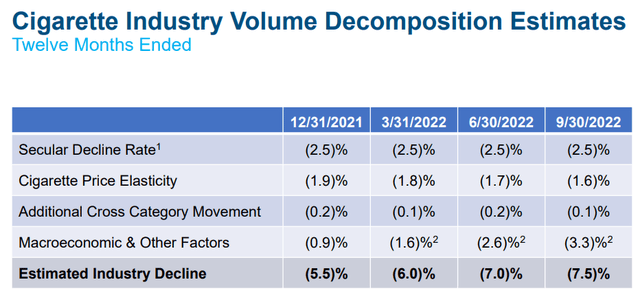

Altria is currently experiencing headwinds in its business due to three distinct factors: (1) The long-term share of smokers is declining, which is leading to successive decreases in shipment volumes. In the first nine months of FY 2022, adjusted industry cigarette volumes were down 7.5% year over year; (2) The strong USD is a challenge for corporations that generate sales in regions that use other currencies than the USD (non-USD profits become less valuable for U.S. companies when the USD appreciates); and (3) Higher prices are pressuring consumers who in turn make less cigarette trips and spend less money on tobacco products. Macroeconomic factors — which include higher gas prices — were the largest contributor in the third-quarter that explained the 7.5% industry decline.

The question is how transitory those factors are. The secular decline rate — which shows the decline of smokers — is unlikely to change going forward. However, the macroeconomic factor, which explains the majority of the contraction in the cigarette industry in FY 2022, is set to become less of an issue for Altria and its investors once inflation eases. Going forward, I expect a normalization in the industry decline rate to 4-5% which is still high, but not as high as it is currently.

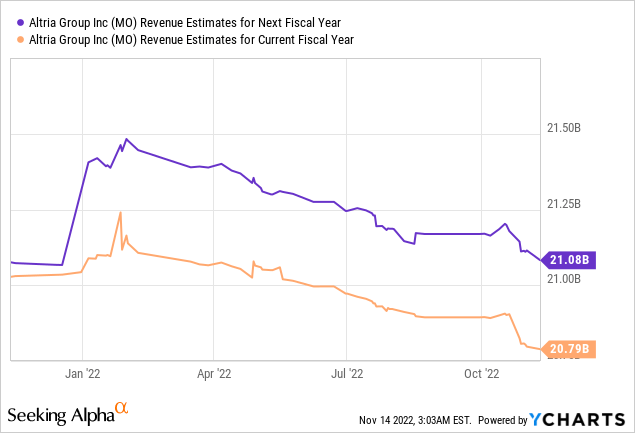

Due to the factors described above, Altria’s top line contracted 3.5% year over year to $6.6B in Q3 ’22. Estimates for Altria’s top line show continual pressure: Altria’s revenues are expected to decline 1.5% in FY 2022 and increase only 1.4% in FY 2023.

Altria’s bright spot: Capital Returns

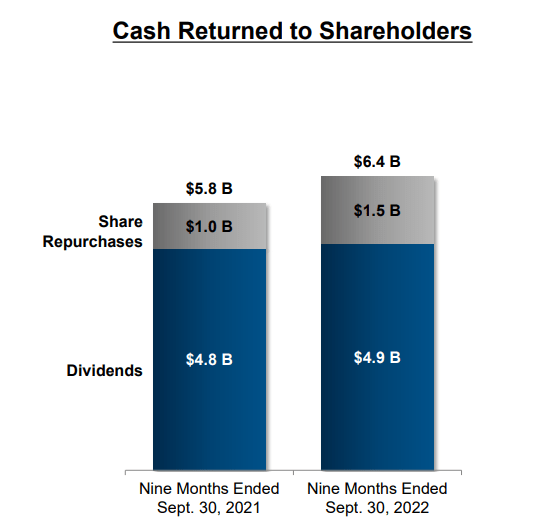

Altria is returning a lot of cash to shareholders, and so far in FY 2022, the cigarette company has paid $4.9B in dividends, showing an increase of 2% year-over-year, while the amount of stock buybacks in the first nine months of the year increased by 50% year-over-year to $6.4B. Going forward, I expect Altria to continue to buy back more shares, although the majority of capital returns will likely be paid as dividends.

Source: Altria

EPS guidance and valuation

Altria narrowed its guidance for FY 2022 adjusted earnings from $4.79 to $4.93 per-share to $4.81 to $4.89 per-share, which would show a year-over-year growth rate of 4.5-6.0%. The narrowed EPS guidance for FY 2022 implies a payout ratio of 76%. Altria has said that it targets a long-term payout ratio of about 80%, so the tobacco company is doing even better than its projected payout target. Altria also recently increased its dividend payout from $0.90 per-share to $0.94 per-share, which represented a dividend growth rate of 4.4%.

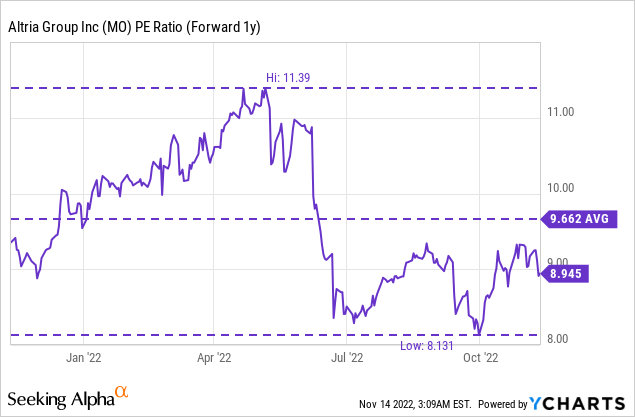

Based off of guidance, shares of Altria are valued at 9.1 X estimated earnings. Based off of consensus predictions for FY 2023, Altria is valued at a P/E ratio of 8.9 X. Shares of Altria is also still trading below the 1-year average P/E ratio of 9.7 X.

Risks with Altria

The biggest commercial risk for Altria, as I see it, is a continual decline in the top line. There are a couple of factors that are driving Altria’s top line challenges right now. While inflation is likely going to continue to ease going forward, the secular decline rate is not: the share of smokers is likely set to dwindle further. This will likely continue to put pressure on Altria’s top line and may result in a lower valuation factor for the tobacco company.

Final thoughts

Despite Altria’s challenges in the tobacco industry and the unfortunate development with JUUL Labs which forced the company to dramatically write down the JUUL Labs investment value, Altria remains interesting for investors as a steady dividend payer. Altria is also set to return a considerable amount of cash to shareholders going forward, as the company not only pays a generous dividend but also buys back a ton of its shares in the market. Since shares of Altria are also really cheap based off of earnings, I believe Altria Group, Inc. is top income bet for investors!

Be the first to comment